Ethereum wertet weiter gegen Bitcoin ab. Das Wachstum ist schwach, Wale bleiben dominant. Doch was bietet Ethereum für 2025?

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Ethereum wertet weiter gegen Bitcoin ab. Das Wachstum ist schwach, Wale bleiben dominant. Doch was bietet Ethereum für 2025?

MoonPay, a crypto payments platform, has acquired Helio, a blockchain-based platform built on Solana, for a reported $175 million.

Ivan Soto-Wright, co-founder and CEO of MoonPay, posted the announcement on X, adding that “2025 is going to be [an] even bigger [year], and we’re kicking it off with a bang [with] the acquisition is HelioPay.”

Fox Business reported the acquisition was for $175 million.

breaking news: we’ve acquired @helio_pay pic.twitter.com/k3Nw9XfvOo

— MoonPay 🟣 (@moonpay) January 13, 2025

According to a press release, the acquisition of Helio brings its technology, team, and ecosystem into MoonPay’s portfolio.

“This acquisition is an important step in advancing our vision for the future of payments,” said Soto-Wright. “Helio’s technology and expertise strengthen our ability to deliver efficient, secure, and scalable solutions for crypto commerce, trading infrastructure, and marketplaces. With MoonPay and Helio combined, we now offer the most comprehensive product for on-chain payments.”

Helio has already handled more than $1.5 billion in transactions, integrates with platforms such as Discord, Shopify, and WooCommerce, and supports over 6,000 merchants.

In December, MoonPay secured its Markets in Crypto Assets (MiCA) license in the Netherlands. By doing so, MoonPay can offer its services and products across Europe.

The granting of the MiCA license is a massive milestone for MoonPay as the approval means expansion across a large market where more people are tapping into crypto payments.

In June, MoonPay integrated with PayPal for on-ramp crypto purchases in the UK and the US. MoonPay also partnered with Ledger last April to bring instant crypto purchases to its Ledger Live users.

The post MoonPay kicks off 2025 with acquisition of Helio to advance the future of crypto payments appeared first on CoinJournal.

Tether is on its way to establishing new headquarters in El Salvador, the USDT issuer announced on Jan. 13, 2025.

According to details shared in a blog post, the relocation of services follows the acquisition of a Digital Asset Service Provider (DASP) registration in the crypto-friendly country. Tether’s entities have been incorporated in the British Virgin Islands.

The stablecoin giant recently acquired the Digital Asset Service Provider licence in El Salvador, the first country to adopt bitcoin as a legal tender in 2021.

Tether ♥️ 🇸🇻

Very excited for Tether group relocating in El Salvador.

El Salvador is the beacon of freedom and @nayibbukele is an inspiring leader driving the country with love, passion and intelligence.Seguimos 🦾 https://t.co/42Y83ryEaE

— Paolo Ardoino 🤖🍐 (@paoloardoino) January 13, 2025

Tether seeks to establish networks in digital assets in El Salvador which has Bitcoin friendly policies. The company further seeks to leverage bitcoin as a legal tender and spearhead the adoption of stablecoin on emerging markets.

The country opens up to business in the digital finance space by providing digital assets friendly policies as well as growing a digital asset liberated community. To enhance bitcoin adoption, the country seeks to formulate a policy requiring businesses to accept bitcoin as a legal tender.

Tether, the issuer of the global stablecoin with a market cap of $137 billion, said its plans to relocate to El Salvador aligns with the company’s goal to support financial inclusion by leveraging bitcoin adoption. By establishing networks in the digital assets friendly country, the company aims to align with the country’s regulatory policies while focusing on emerging markets.

“El Salvador represents a beacon of innovation in the digital assets space. By rooting ourselves here, we are not only aligning with a country that shares our vision in terms of financial freedom, innovation, and resilience but is also reinforcing our commitment to empowering people worldwide through decentralized technologies,” Tether chief executive officer Paolo Ardoino said.

Tether joins Bitfinex Derivatives which also announced moving its operation headquarters to El Salvador after it acquired its Digital Asset Service Provider licence. El Salvador has increasingly become a digital assets business destination for global bitcoin businesses, exchanges, and companies.

The post Tether to relocate operations to El Salvador appeared first on CoinJournal.

Donald Trumps Amtseinführung ist nur noch eine Woche entfernt, aber wichtige Krypto-Gesetze könnten einige Zeit brauchen, um in Kraft zu treten, wie die NYDIG warnt.

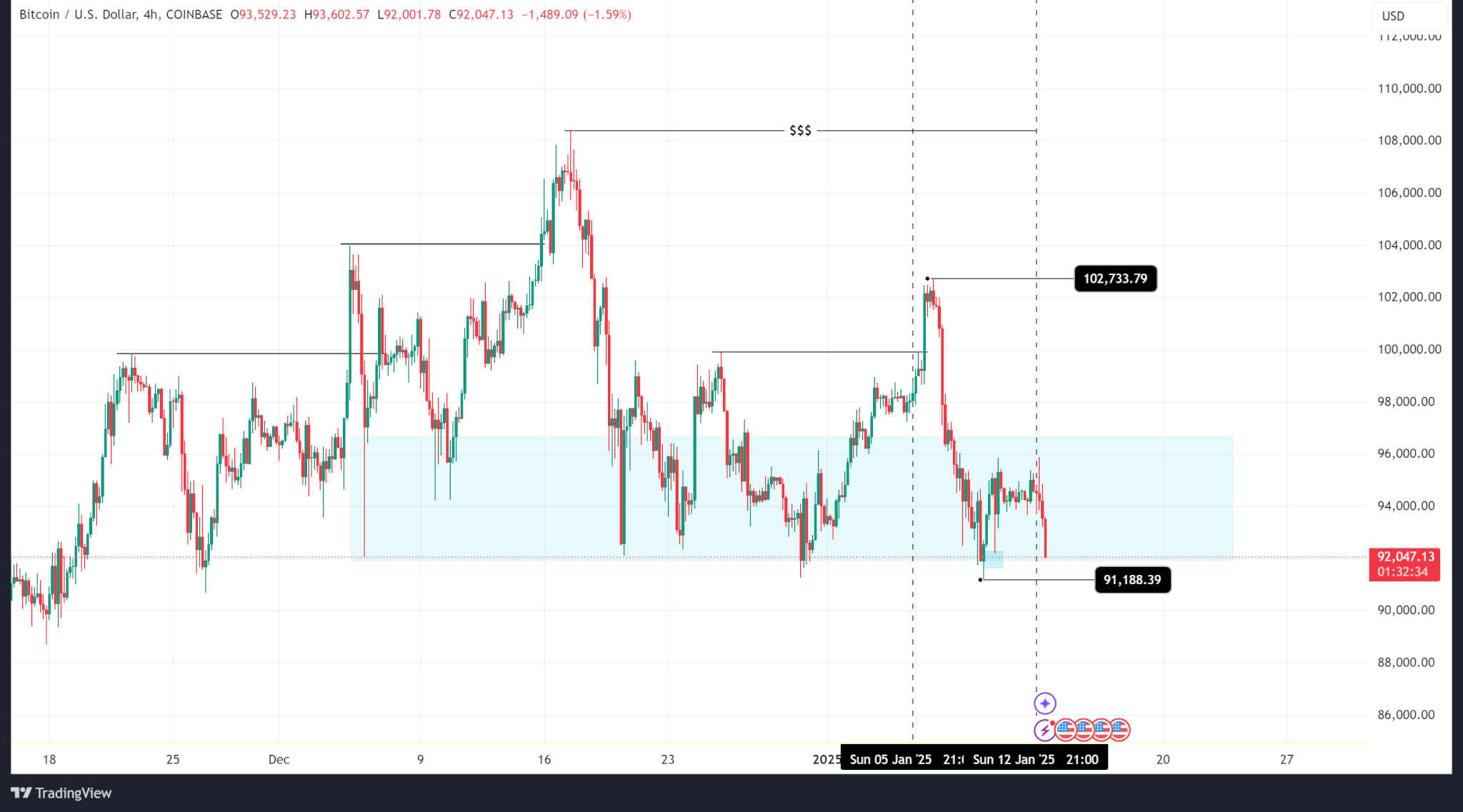

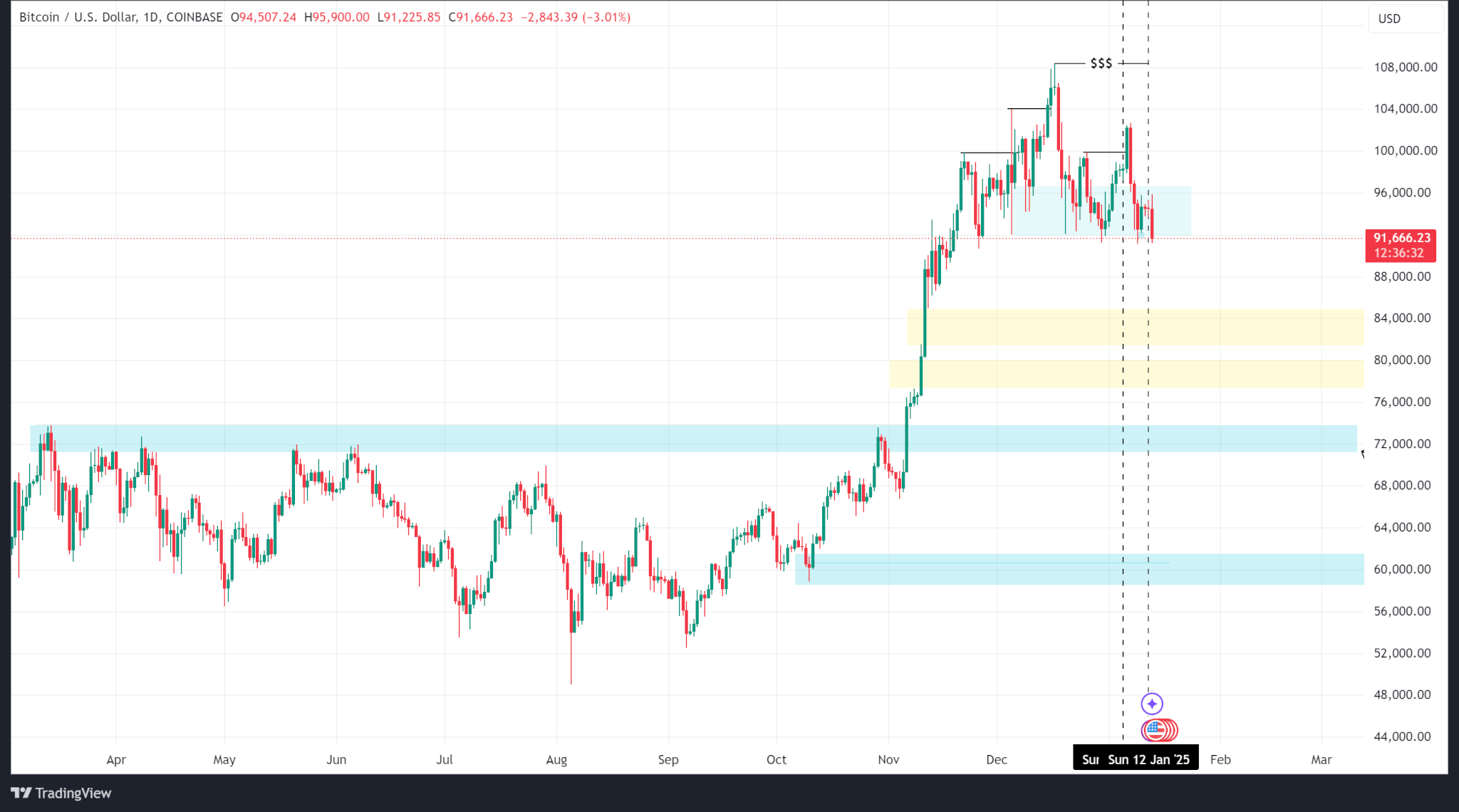

Bitcoin’s price logged a negative week falling from a high of $102,733 to a low of $91,188 before eventually closing at $94,547.

Technical analysis shows a break above the last lower high and a push back down into the H4 demand zone, which means that although the price took a bearish turn, it is still in overall bullish territory.

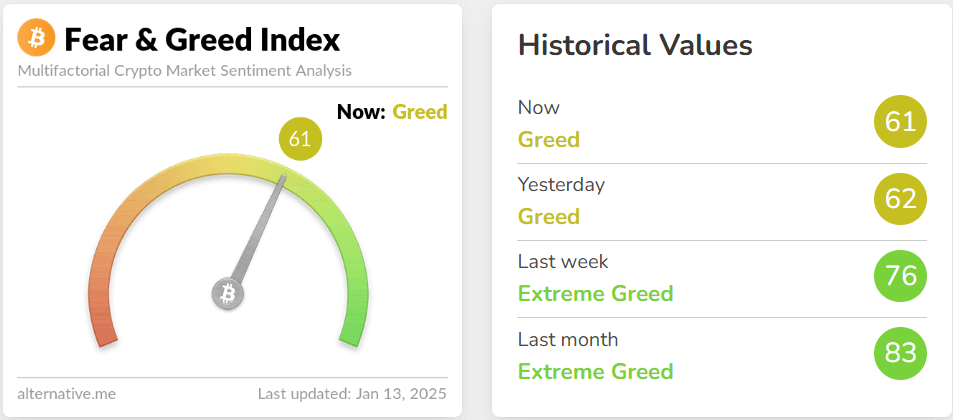

Much of this bearish sentiment is driven by bleak economic expectations. The Fed meeting minutes, released on Jan. 8, showed that the reserve bank is cautious about inflation it expects will follow Trump’s policies.

As such, the likelihood of continued rate cuts has dwindled, with some analysts seeing an end to cuts early this year. The market’s reaction reflects this updated risk-off sentiment.

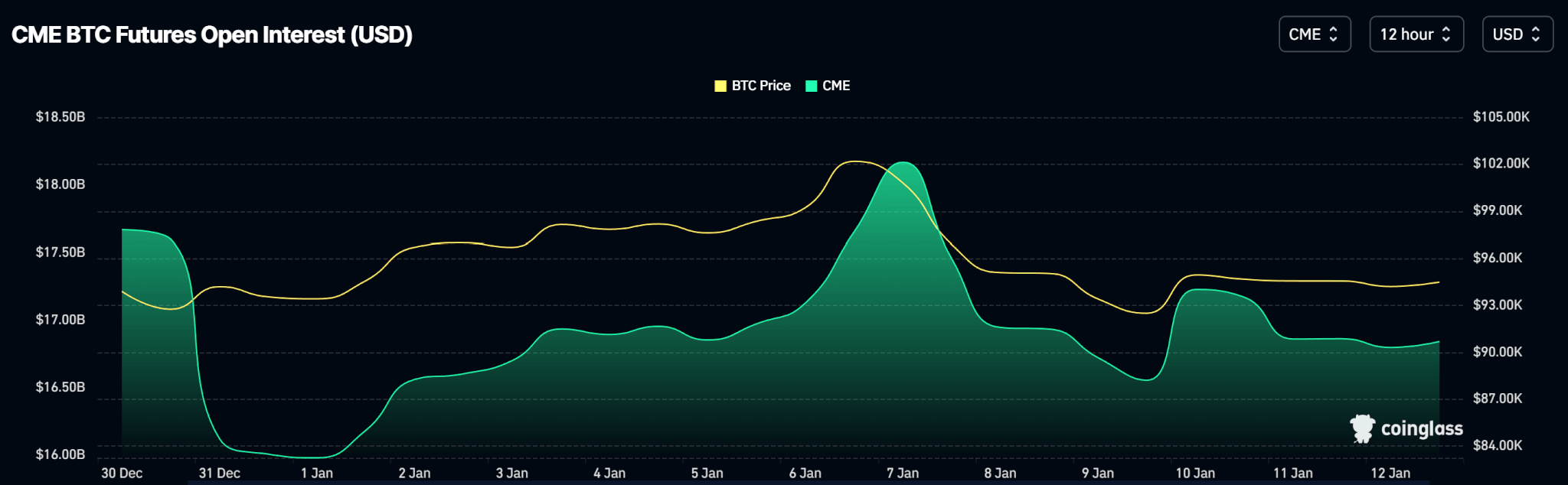

Bitcoin’s open interest chart shows a decline in open contracts between Wednesday and now. Open interest hit a weekly high on Tuesday at $18.16Bn on the CME, fell to a low on Thursday ($16.55Bn), and mellowed out the rest of the week.

Meanwhile, spot Bitcoin ETFs logged outflows after the release of the Fed’s meeting minutes on Wednesday. Outflows totalled $718.20Mn while inflows totalled $1.03Bn.

Outlook

Bitcoin’s price currently hovers around the bottom of the demand zone. If it breaks below, price could be pushed down to $85,100 where a fair value gap could act as support.

BTC trades at $91,622 as of publishing.

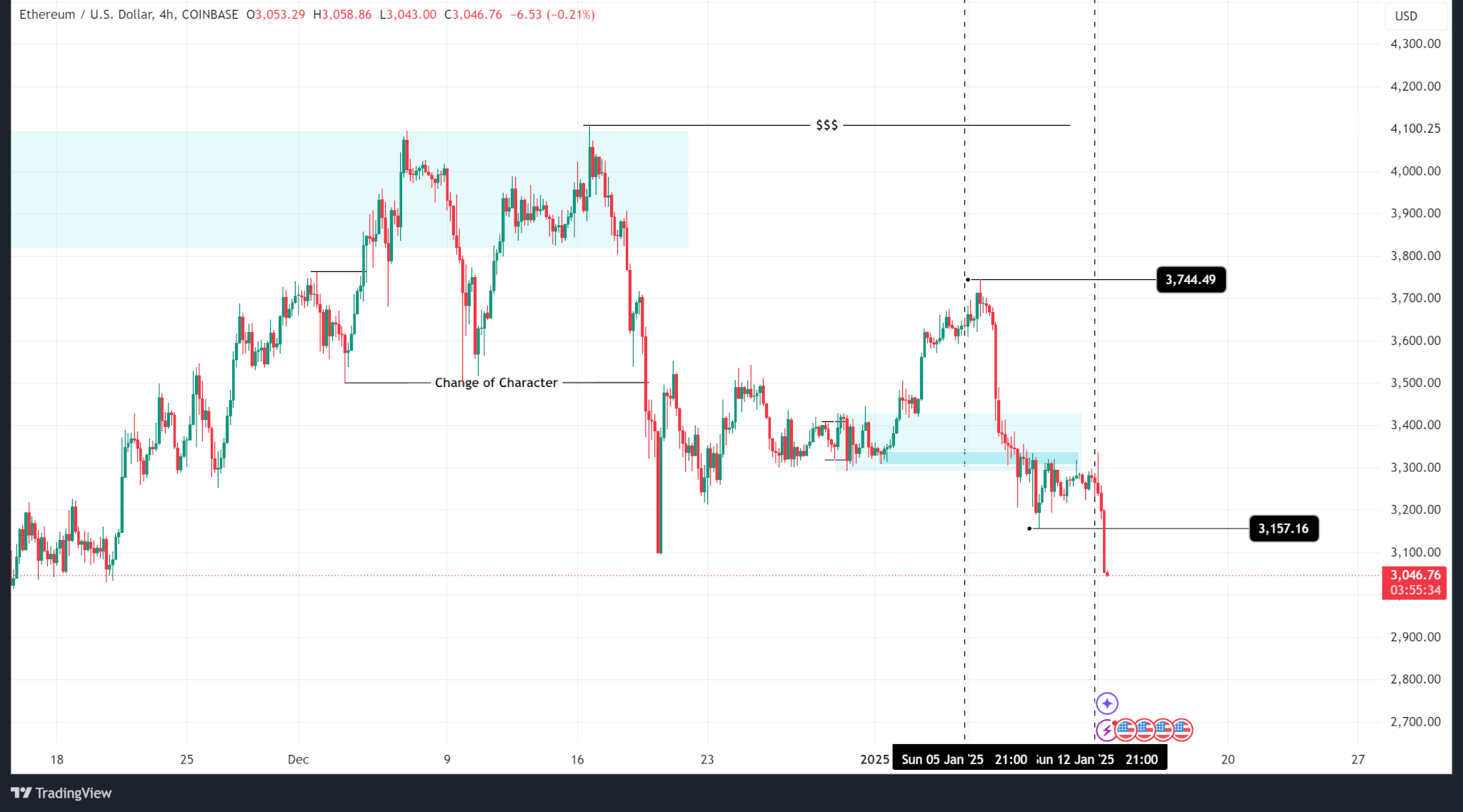

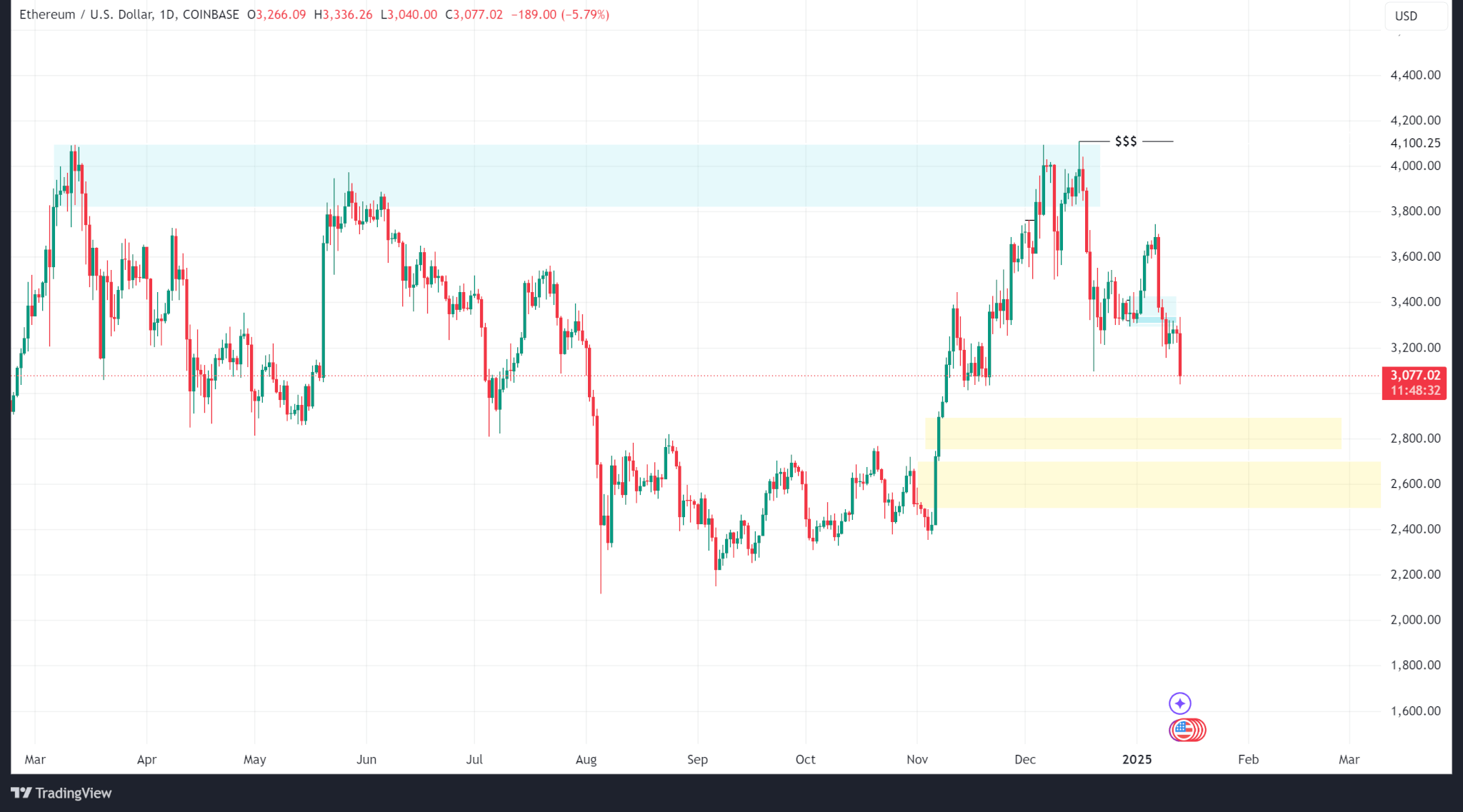

Ethereum’s price also logged a negative week, falling from a high of $3,744 to a low of $3,157 before closing at $3,236. ETH price action tested March 2024’s high of $4,089 in early Dec 2024 but failed to break above and has been logging lower lows since.

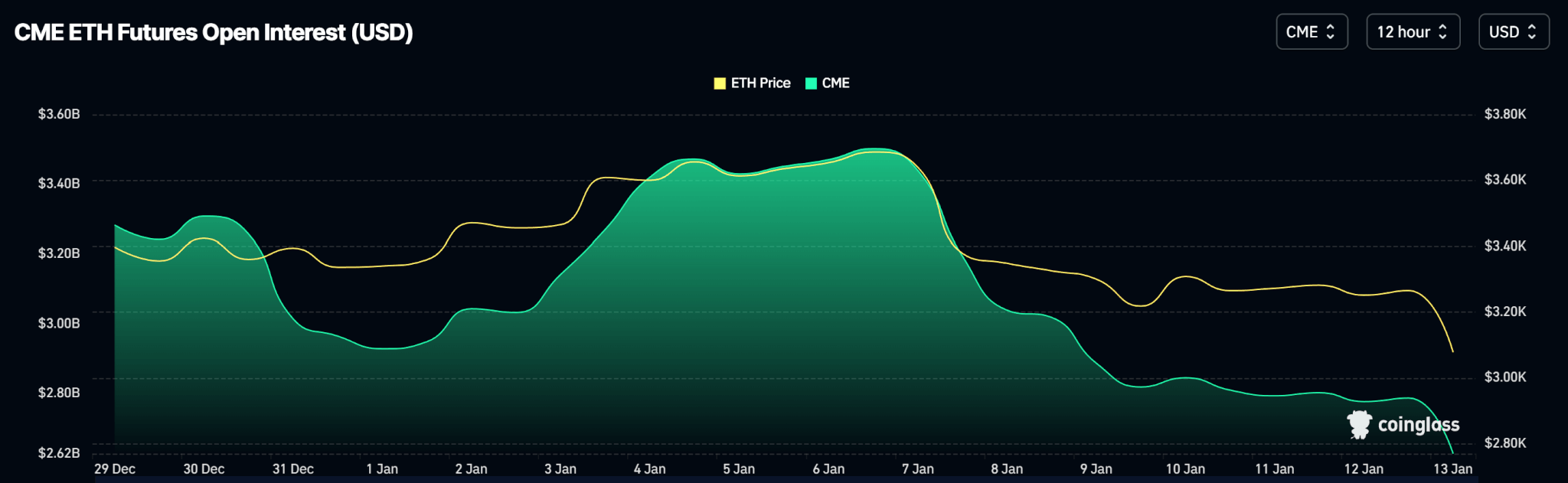

Open interest dropped from a Jan. 7 high of $3.50Bn and continued to decline until it was $2.63Bn as of this publication.

Meanwhile, Ethereum spot ETFs logged a weekly net outflow of $186.00Mn following risk-off sentiments in the market.

Outlook

As Ethereum’s price continues to trend lower, the next technical level that could provide support is the fair value gap at the $2,893 price level.

ETH trades at $3,071 as of publishing.

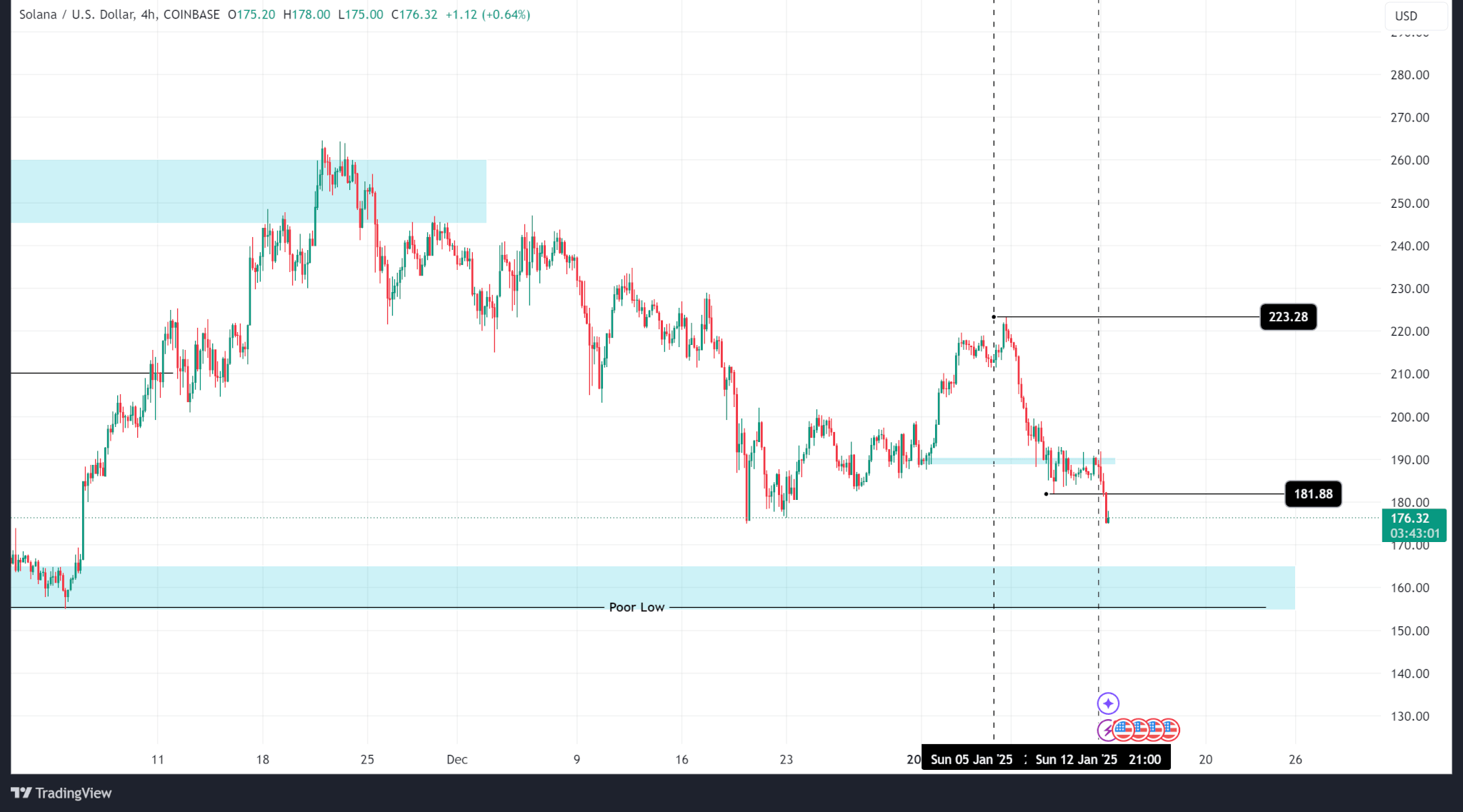

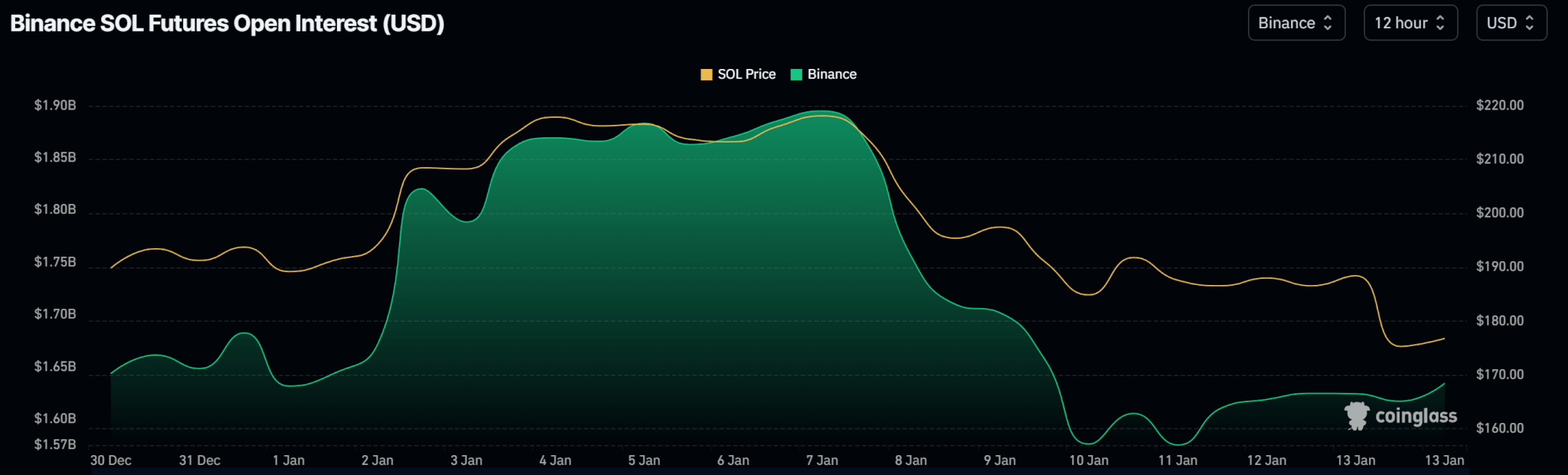

Solana’s price fell from a weekly high of $223 to a weekly low of $181 before eventually closing at $188, logging a total loss of 12.53%. SOL continues to trend lower after failing to close above its all-time high of $260.

Open interest data shows a steep fall from $1.89Bn on Binance on Jan. 7 to $1.58Bn on Jan. 10. As of this publication, OI levels have improved to $1.63Bn.

Outlook

The next technical support zone is at the $164 price level. However, although the order block is a support, it is a poor low that could be taken out even if price reverses from that zone.

SOL trades at $176 as of publishing.

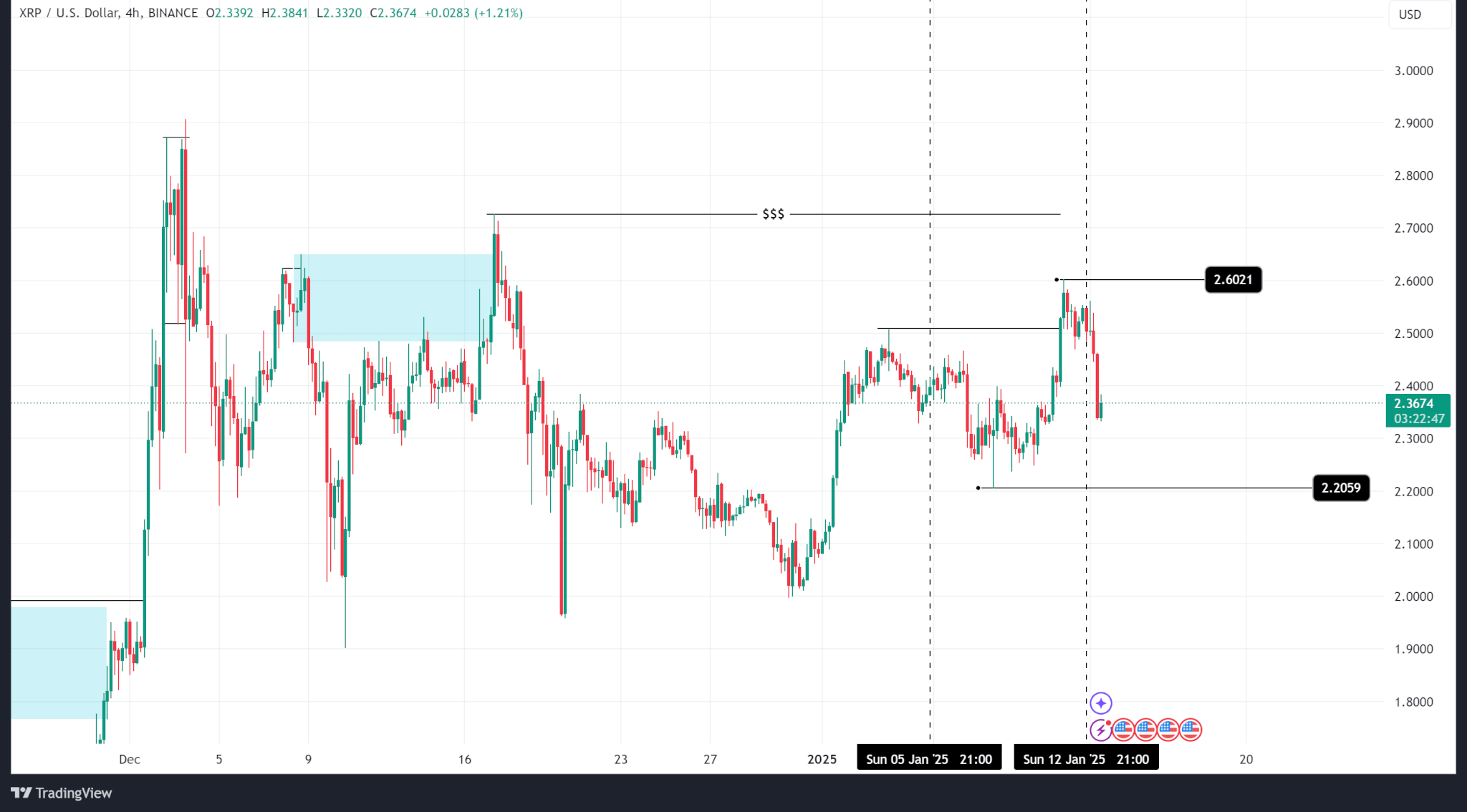

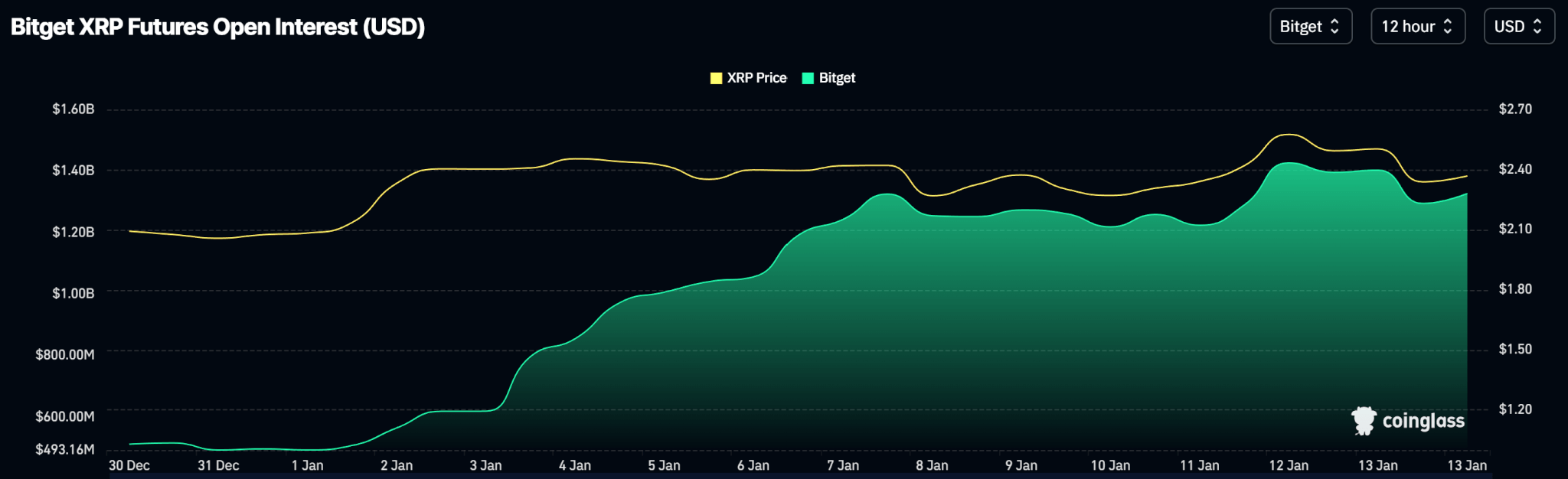

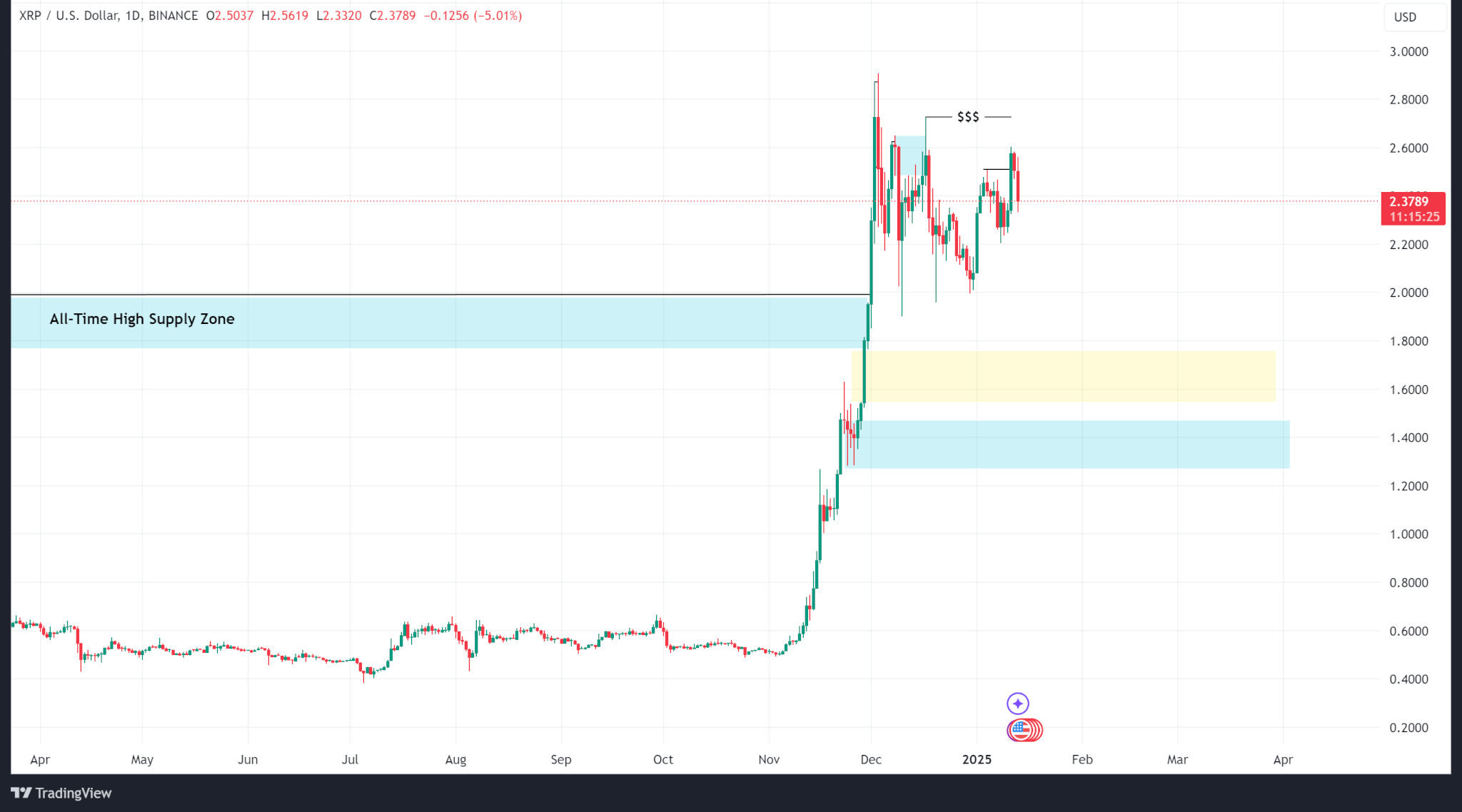

Ripple’s price fared better last week, closing higher at $2.55 from $2.38 at the start of the week as price continued to log higher highs. Zooming out, the price continues to range between $1.90 and $2.90 as the market cools.

Open interest rose on Bitget, the exchange with the highest XRP derivative trading volume, over the last week, supporting upward price movement as positive news around Ripple’s case with the SEC boosted sentiments.

Outlook

Ripple’s price is buoyed by news around the SEC’s lawsuit against its parent company, a case which could be thrown out with the outgoing administration.

However, technical analysis shows that XRP trades at a premium and a pullback is expected. The most likely levels are the fair value gap at $1.75 and the order block at $1.46.

XRP trades at $2.37 as of publishing.

The post Weekly Price Analysis: Prices Decline on Risk-Off Sentiments appeared first on CoinJournal.