Tether verlagert seine Geschäftstätigkeit von den Britischen Jungferninseln nach El Salvador, nachdem es eine Lizenz als Anbieter von digitalen Vermögenswerten erhalten hat.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Tether verlagert seine Geschäftstätigkeit von den Britischen Jungferninseln nach El Salvador, nachdem es eine Lizenz als Anbieter von digitalen Vermögenswerten erhalten hat.

Globale Krypto-Hedge-Fonds haben den Rückgang ebenfalls aufgekauft, was auf einen möglichen Bitcoin-„Angebotsschock“ hindeutet, da die BTC-Börsenreserven stark zurückgegangen sind.

Der Rückgang von Bitcoin unter 90.000 US-Dollar ist ein negatives Zeichen, aber es wird erwartet, dass die Bullen die Marke von 85.000 US-Dollar heftig verteidigen werden.

The U.S. Court of Appeals for the Third Circuit on Monday demanded that the SEC explain itself for refusing to set clear crypto regulations when Coinbase requested they do so after the regulator issued the exchange with a Wells Notice in March 2023.

According to one of the Judges, “Rather than force the agency to make a rule, we order it to explain its decision not to.” Another cautioned the SEC against rendering a poor explanation like it has been doing.

The SEC vs Coinbase

The SEC’s case against Coinbase began in March 2023 when it issued the exchange with a Wells Notice for violating securities regulation through its staking services and asset listings.

Coinbase responded with confidence in the legality of its operations and attempted to engage with the regulator to clarify the basis of its Wells Notice and set clear regulations.

The SEC however maintained that current securities regulations were sufficient to regulate cryptos and filed a lawsuit in June 2023.

Recent developments

Coinbase won against the regulator following a ruling to freeze the case on the grounds of novelty as various courts across the country are reaching different conclusions on cryptos being securities.

The SEC’s case will now go to an appeals court where it will be decided whether it should be tried in a district court.

This new development from the panel from the U.S. Court of Appeals for the Third Circuit deals another blow to the SEC one week to the end of Gary Gensler’s term as SEC Chair.

Meanwhile, Coinbase Legal Head, Paul Grewal, counts this as a victory for Coinbase

https://twitter.com/SECGov?ref_src=twsrc%5Etfw

https://twitter.com/iampaulgrewal/status/1878860619895685283?ref_src=twsrc%5Etfw

The post US Judges Demand Explanation from SEC for its Refusal to Set Clear Crypto Rules appeared first on CoinJournal.

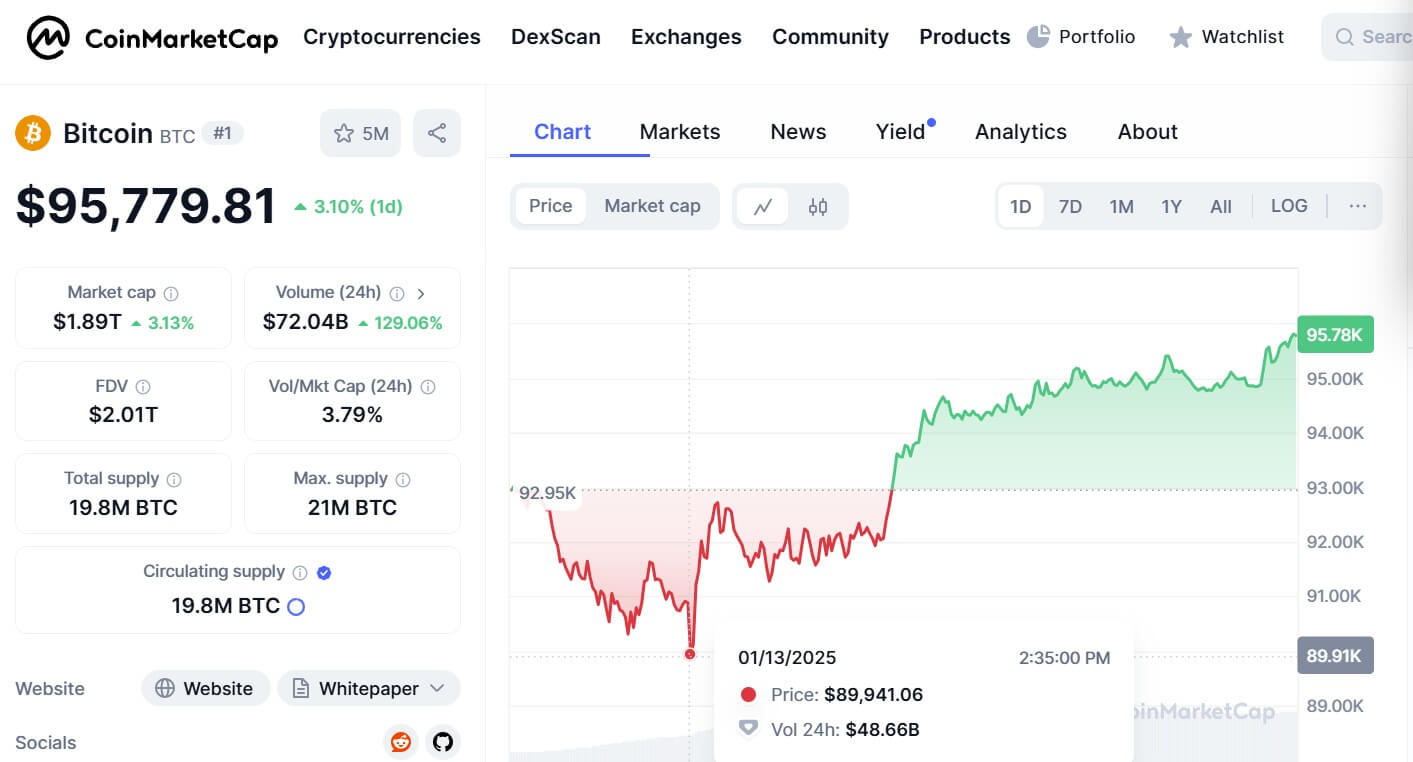

Bitcoin fell below $90,000 for the first time in two months, dropping 3.6% in 24 hours as the market experienced selling pressure.

Data from CoinMarketCap shows that Bitcoin’s price dropped to around $89,900 on January 13. However, at the time of publication, it’s trading over $95,000.

According to James Toledano, COO at Unity Wallet, there are several reasons why Bitcoin’s price fell.

“The first is profit-taking, after hitting a peak of around $108,300 in mid-December, the market has seen a massive amount of it, particularly following the election of pro-crypto President-elect Donald Trump,” he said to CoinJournal, adding:

“Secondly, while institutional buying has continued contributing to Bitcoin reserves on exchanges hitting a seven-year low, trading volume remains subdued and this could simply be down to a seasonal slow-down.”

Recent analysis suggests that bleak economic expectations drive this bearish sentiment. This includes Trump’s tariff plans, the US Federal Reserve’s cautious approach to interest rate cuts, and a strong dollar.

Zach Pandl, head of research at Grayscale Investments, said to CNBC that:

“I would attribute the drawdown in the last two days largely to the market starting to appreciate that not every aspect of the Trump policy agenda is going to be positive for Bitcoin – and tariffs do introduce some new uncertainty.”

As questions surround Trump’s forthcoming policies, it may have dampened enthusiasm, which can “lead to short-term volatility for an already highly volatile asset,” said Toledano.

Some analysts believe Bitcoin can reach between $140,000 and $200,000 by mid-2025, so the current price action may appear concerning. Yet, it doesn’t necessarily signal the end of the bull run.

“The inauguration of President-elect Trump is just seven days away and could be a pivotal moment, with markets anticipating announcements of pro-crypto policies that might spark renewed buying interest,” said Toledano. “Institutional accumulation, as reflected in falling exchange reserves also supports the view that demand remains strong despite low trading volumes.”

The post Bitcoin price drop caused by profit-taking and macroeconomic conditions appeared first on CoinJournal.