Die Familie des ehemaligen FTX-Chefs Sam Bankman-Fried will eine Begnadigung durch Donald Trump erreichen, doch die Chancen dafür standen unter Biden vermutlich besser.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Familie des ehemaligen FTX-Chefs Sam Bankman-Fried will eine Begnadigung durch Donald Trump erreichen, doch die Chancen dafür standen unter Biden vermutlich besser.

Nach Gerüchten über eine mögliche Aufnahme von Bitcoin durch die tschechische Zentralbank gibt sich EZB-Präsidentin Lagarde nun sicher, dass dieser Schritt nicht erfolgen wird.

The Musk It (MUSKIT) token has seen an astronomical rise, soaring by 544% within the last 24 hours to hit an all-time high of $0.07278.

This surge comes hot on the heels of an announcement by Errol Musk, the father of tech mogul Elon Musk, who revealed his ambition to raise $200 million through this memecoin for a new venture called the Musk Institute.

The Musk It token, which was initially launched in December 2024 by a Middle Eastern cryptocurrency company, had previously struggled to capture the market’s attention, shedding over 50% of its value since its inception.

However, the recent news of Errol Musk’s fundraising plan has dramatically reversed its fortunes, pushing the token’s price to $0.07278 from a low of $0.0107 in a day.

This price movement has been accompanied by a trading volume of $87,495,901, signalling significant investor interest.

The Musk Institute, as envisioned by Errol Musk, aims to be a for-profit think tank focused on engineering projects, particularly those that could go “beyond rockets.”

Errol Musk’s ambitious goal with the Musk It memecoin has evidently struck a chord with investors, despite the token’s lack of intrinsic utility, a common trait among memecoins.

The surge in MUSKIT’s price and trading volume indicates that the market is not just responding to the Musk name but also to the potential for what the raised funds could achieve.

However, this dramatic rise in Musk It’s valuation comes with a caveat. The token’s success appears to be closely tied to the Musk family name, yet there’s a clear distinction: Elon Musk has no involvement in this project.

This lack of endorsement from Elon, whose influence in the crypto world is significant, especially with his history of impacting Dogecoin’s price, casts a shadow over the token’s long-term sustainability.

Anndy Lian, an intergovernmental blockchain expert, has expressed scepticism about Musk It reaching the same heights as other celebrity-backed memecoins without Elon’s direct stamp of approval.

The memecoin market, notorious for its volatility, often sees such dramatic swings based on hype rather than fundamental value.

The excitement around Musk It mirrors the recent interest in other high-profile memecoins like those associated with the Trump family, which have also seen significant, albeit fluctuating, gains.

This trend suggests that investors are on a constant lookout for the next big hit in crypto, hoping to capitalize on the speculative nature of these tokens.

While the immediate future for Musk It looks promising with its newfound momentum, the long-term outlook remains uncertain. The market cap has now reached $63,922,516, but without detailed tokenomics or a clear roadmap, the project’s transparency is under scrutiny.

While Errol Musk has distanced the project from being a “pump-and-dump” scheme, the market’s history is rife with such examples where initial excitement quickly dissipates.

The post Musk It price explodes 544%, Errol Musk aims to raise $200M with it appeared first on CoinJournal.

Im Namen der Anleger der Krypto-Token von Pump.fun wurde eine Sammelklage gegen die Memecoin-Plattform eingereicht.

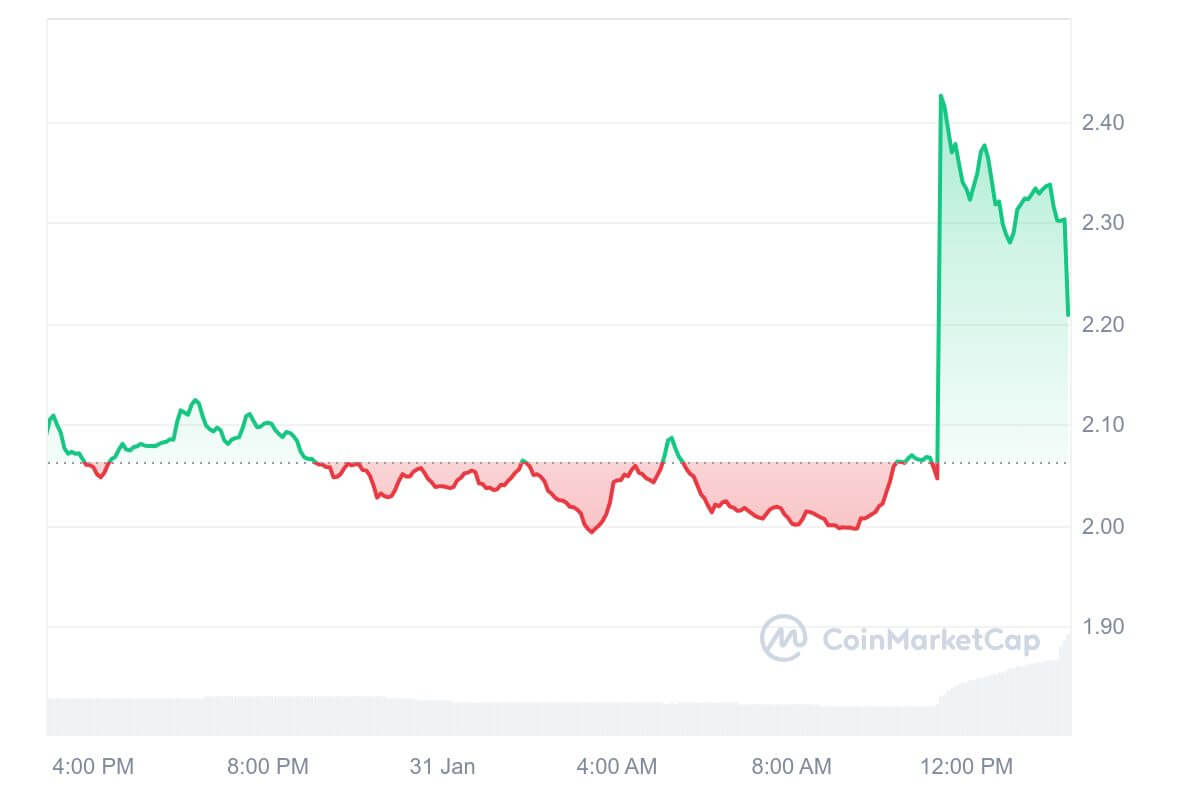

VIRTUAL, the native token of the AI agents platform Virtuals Protocol, has surged to highs of $2.45 and recorded a 24-hour trading volume of over $485 million.

Market data shows the token’s daily volume has shot up by more than 186%, indicating a massive increase in interest and trading activity.

VIRTUAL price spiked in early trading on Jan. 31 after Upbit, the largest cryptocurrency exchange in South Korea, announced its support for the token.

In an update on X, Upbit said it would be listing VIRTUAL with support for three major trading pairs. The exchange planned to add pairs against the Korean Won, Bitcoin (BTC), and Tether (USDT).

Market reaction to the news has helped the artificial intelligence protocol’s native token reclaim price levels seen early this week.

While VIRTUAL has pared some of these gains amid profit taking deals, it trades 6% in the green. Bulls have cut weekly losses to about 16%.

Overall AI sentiment is one reason this token is up today.

Notably, the latest bounce for the Virtuals Protocol price came as Injective Labs announced the AI agent token will be part of the newly-launched AI index AIX.

This tokenized product combines some of the world’s best AI tokens andstocks. Other than INJ, the index comprises top AI tokens Bittensor as well as trending agentic tokens ai16z and Virtuals Protocol. Injective’s AIX also has Nvidia and Taiwan Semiconductor stocks.

Virtuals’ price has also traded higher amid a partnership with Allora, a Polychain-backed decentralized AI platform. The collaboration allows developers on G.A.M.E to leverage Allora’s technology to create smarter AI agents.

Virtuals’ recent surge also followed the project’s expansion to Solana, with LayerZero powering the integration. The move brought co-ownership of AI Agents to two chains – Base and Solana.

The post VIRTUAL surges as Korea’s largest crypto exchange lists token appeared first on CoinJournal.