- Spiko has introduced tokenized T-Bills on Arbitrum.

- iDEGEN presale has raised over $18.6M with 21K+ holders.

- As the iDEGEN presale gathers steam, the iDEGEN AI is learning from community interaction on X.

In a groundbreaking move, Spiko, a French fintech company, has introduced tokenized US and EU Treasury Bill Money Market Funds to the Arbitrum One blockchain, marking a significant step towards integrating traditional finance with decentralized finance (DeFi).

Notably, the launch of Spiko’s Tokenized T-Bills coincides with the iDEGEN project raising an impressive $18.624 million in its presale, showcasing the growing interest in AI-driven, community-engaged crypto projects.

Together, these developments reflect a dynamic shift in the financial landscape, where real-world assets (RWAs) and community-driven AI projects are gaining traction.

Spiko’s tokenized T-Bills bridge traditional finance with DeFi

Spiko’s initiative to deploy its tokenized Money Market Funds on Arbitrum One is not just an expansion of its service offering but a pioneering effort to bring institutional-grade investment assets into the blockchain ecosystem.

These funds, regulated under the European Commission’s Undertakings for Collective Investment in Transferable Securities (UCITS), provide a compliant framework for mutual funds, thereby adding layers of trust and security for investors.

The US T-Bills fund has shown robust growth, with net assets increasing by 8% over the past month to exceed $50 million, offering an annual percentage yield (APY) of 4.37%. This performance is indicative of the appetite for yield-generating blockchain assets.

On the other hand, the EU fund has amassed $95.1 million, growing by 10.9% within the same period.

The tokenization of Treasury Bills on Arbitrum isn’t just about bringing traditional financial products into the crypto space; it’s about democratizing access to investments that were previously the domain of larger institutional investors.

By leveraging blockchain technology, these funds offer unprecedented liquidity and the ability to trade regulated financial instruments in a decentralized environment.

This fusion of traditional finance with DeFi is seen as a critical step towards mainstream adoption, where even smaller investors can participate in markets traditionally inaccessible due to high entry barriers.

The broader market for tokenized Treasury assets is also on the rise, with other players like Ondo Finance contributing to an ecosystem now valued at $3.43 billion.

This growing market underscores the increasing acceptance of blockchain as a viable platform for traditional financial instruments, potentially reshaping how investments are managed and traded.

iDEGEN presale and the community-driven AI evolution

Parallel to Spiko’s advancements, the iDEGEN (IDGN) project has captured the crypto community’s imagination with its unique approach to AI development.

iDEGEN’s AI, which learns directly from unmoderated X (formerly Twitter) interactions, represents a novel experiment in AI-driven community engagement.

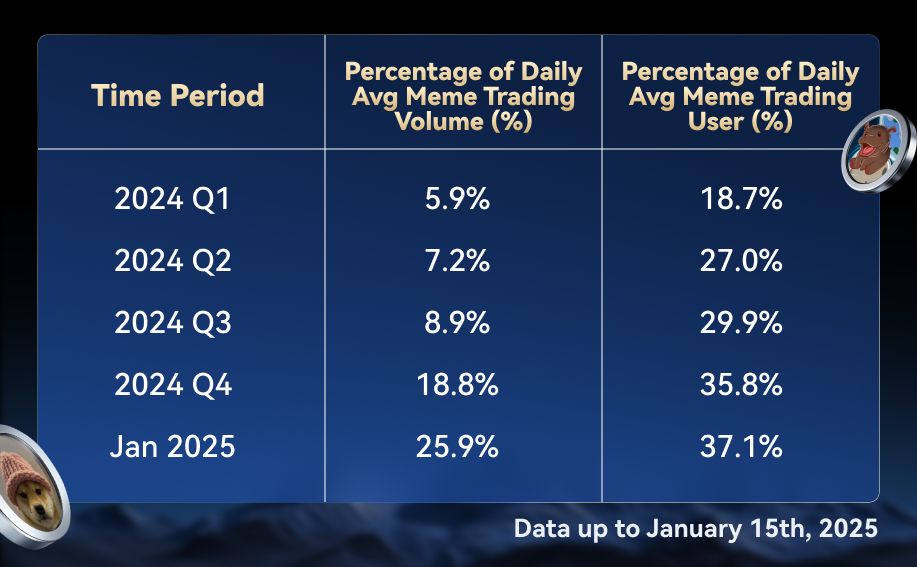

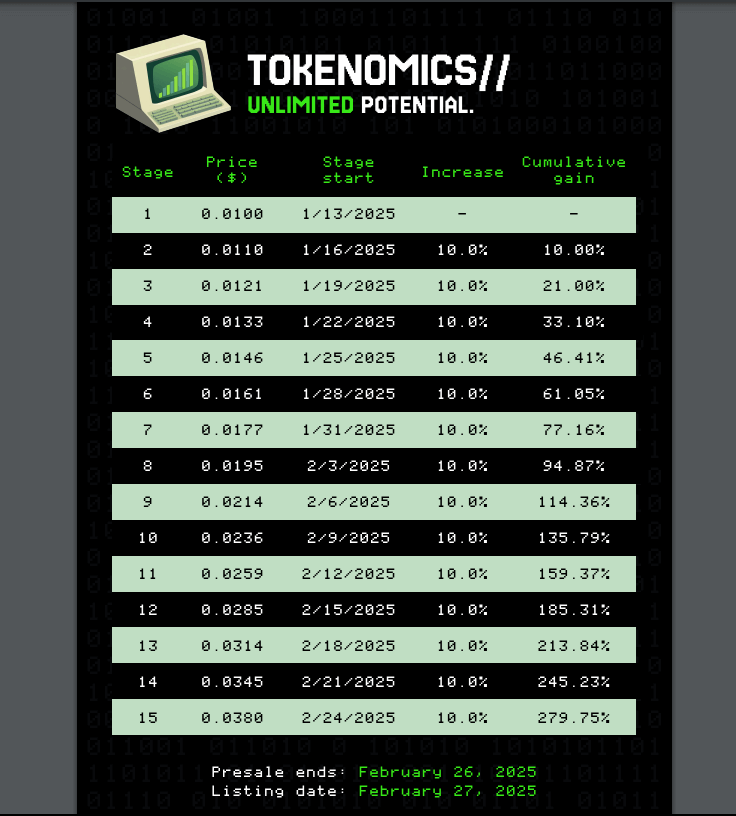

iDEGEN initially employed a dynamic auction model but has since transitioned to a more predictable pricing strategy for its presale, aiming to balance excitement with investor stability. Currently, the token price stands at $0.0161 in its sixth presale stage out of fifteen stages.

In the next presale stage, the price is expected to rise to $0.0177, with the final presale price set at $0.038 by the end of its 15-stage presale.

The presale has not only been a financial success, raising $18.624 million with over 21,759 holders and 1.578 billion tokens sold but has also generated significant community engagement, achieving 1.44 million impressions.

This success story illustrates how community involvement can be leveraged to evolve an AI’s intelligence, creating a symbiotic relationship where each tweet or interaction contributes to the AI’s learning process.

As iDEGEN prepares for its exchange listing on February 27, the project stands as a testament to the potential of community-led initiatives in the crypto space, where participants are not just investors but active contributors to the project’s direction and growth.

The post Spiko launches Tokenized T-Bills on Arbitrum, iDEGEN presale nets $18.6M in funds appeared first on CoinJournal.