Die Gesamt-Marktkapitalisierung der Memecoins lässt im Dezember um satte 40 Mrd. US-Dollar nach, wobei sich die Entwicklung der Scherz-Kryptowährungen an Marktführer Pepe zeigt.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Gesamt-Marktkapitalisierung der Memecoins lässt im Dezember um satte 40 Mrd. US-Dollar nach, wobei sich die Entwicklung der Scherz-Kryptowährungen an Marktführer Pepe zeigt.

MicroStrategy founder Michael Saylor has posted the company’s Bitcoin (BTC) tracker chart on X again.

In recent months, every such post has been followed by an announcement that the world’s largest corporate holder of the flagship digital asset had acquired another haul.

Industry experts and observers have been quick to point out that MicroStrategy is about to announce another major BTC purchase.

NEW: Michael Saylor posted his BTC purchase tracker again, which means MicroStrategy will announce another HUGE #Bitcoin purchase tomorrow.

SAYLOR IS THE GOAT 🐐 pic.twitter.com/48RTgEE1ud

— Nikolaus Hoffman (@NikolausHoff) December 29, 2024

Noticeably, MicroStrategy has acquired additional BTC for billions of dollars in recent months, with these following such hints. The company announced it bought 27,200 BTC worth $2.03 billion on Nov. 10; another 51,780 BTC worth $4.5 billion on Nov. 17 and $5.32 billion for 55,500 BTC on Nov. 24. The company’s buying spree also saw it add 15,350 bitcoins in mid-December.

Most recently, MicroStrategy acquired 5,262 BTC for $561 million, with the acquisition announced on Dec. 23 indicating the company bought at the average purchase price of $106,662 per bitcoin. This brought the total BTC holdings as of Dec. 22, 2024 to 444,262 BTC, which MicroStrategy has cumulatively acquired for roughly $27.7 billion since 2020.

The average purchase price of this entire haul, its dollar cost averaging, stood at $62,257 per bitcoin at the time of writing. Per Saylor portfolio tracker, the company’s holdings stand at $42.16 billion with Bitcoin price hovering near $94,780. Overall profit is over $14.5 billion.

Here’s Saylor’s latest post on X:

Disconcerting blue lines on https://t.co/Bx3917zMqi. pic.twitter.com/xPl4GTKU3E

— Michael Saylor⚡️ (@saylor) December 29, 2024

Bitcoin traded above $94k on Dec. 29, holding above the level after bears rejected bulls’ advances near the $100k level. Earlier this month, bulls recovered from lows of $92k – having suffered the massive slump from above the all-time high of $108k.

While BTC price has not skyrocketed amid recent MicroStrategy buys, the market is extremely bullish amid the combination of the buy pressure, spot ETFs demand and other positive catalysts. Analysts say it could rally to $150k-$200k in 2025.

The post Saylor posts MicroStrategy’s BTC tracker: Another Buy? appeared first on CoinJournal.

Nach dem Ausbau des staatlichen Bitcoin-Vermögens auf über 6.000 BTC rutscht El Salvador hinter den USA, China, Großbritannien, Ukraine und Bhutan auf den sechsten Platz der Staaten mit den größten BTC-Vermögen.

Data from CoinGecko shows the native Theta Network (THETA) token has surged by more than 10% in the past 24 hours at the time of writing.

Theta‘s price gains on the day come as the broader AI sector records upward momentum. In the past day, several AI-powered projects and meme coins have increased in value as bulls target new forays ahead of a potentially defining few months.

NEAR Protocol (NEAR), Internet Computer (ICP), RENDER (RENDER), Artificial Superintelligence (FET) and Virtuals Protocol (VIRTUAL) were all in the green over the past 24 hours and week. These gains have also seen tokens such as ai16z, aixbt and Fartcoin rally, with the AI meme sector recording even higher returns in the same period as the AI agent market heats up.

THETA reached highs of $2.41, retesting the resistance level seen on Dec. 24 and 25. However, the chart pattern formation to watch out for is an ascending triangle. A breakout could see Theta Network price rally nearly 50%, Rose Premium Signals recently shared via X.

If price flips negative, key support levels would be around $2.16 and below that, $1.8. Notably, THETA broke to lows of $1.76 on Dec. 20.

Theta Token ( $THETA/USDT) is trading at $2.419, showing bullish potential after rebounding from the Fibonacci 0.618 retracement zone. The price is targeting $2.941 (T1) as the first resistance, followed by $3.337 (T2) and $3.759 (T3). The Fibo Zone at $1.800 remains a critical… pic.twitter.com/AvvPVoC90S

— Rose Premium Signals 🌹 (@VipRoseTr) December 25, 2024

Decentralized cloud AI project Theta is seeing buying pressure amid this overall positive sentiment.Theta Network’s key partnerships and integrations, including recent deals with the University of Oregon’s Distopia Lab and esports platform FlyQuest, are likely catalysts.

Theta EdgeCloud is trusted by the leading academic institutions & enterprises – learn all about who’s using the Decentralized Cloud for AI, Media & Entertainment at https://t.co/Dgn0dzE1g4 pic.twitter.com/KakezYFG49

— Theta Network (@Theta_Network) December 20, 2024

In October this year, Dystopia Lab announced it would leverage Theta EdgeCloud in its AI research, specifically in its AI model training. Meanwhile, FlyQuest said it was teaming up with Theta to unveil an AI esports chatbot.

The post THETA surges 10% as AI tokens rally appeared first on CoinJournal.

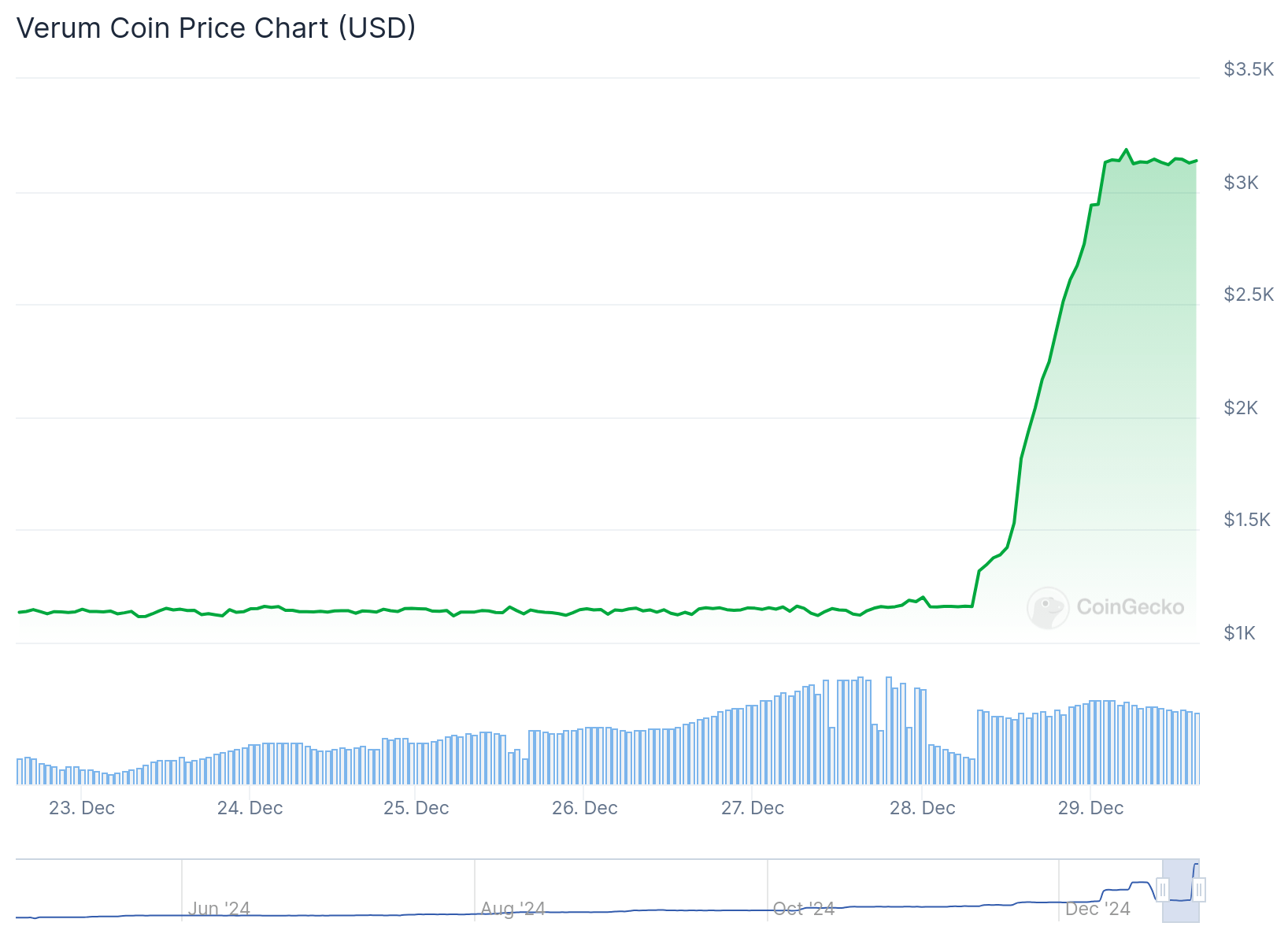

Verum Coin (VERUM) outperformed the top 500 cryptocurrencies by market cap in the past 24 hours as its price jumped 70% to hit a new all-time high.

The altcoin’s price rose as the broader market experienced a slow Christmas week, with Bitcoin remaining ranged below $95k and Ethereum, XRP and Solana all retesting key levels.

On Dec. 29, VERUM price hit a new all-time high above $3,163 – a new ATH that meant the token’s value traded at levels over 2,200% higher than its all-time low of $131 reached in June 2024.

Verum Coin had initially plummeted from highs above $2,200 early this month and stagnated around $1,150 over the past week as BTC retraced further after paring gains from the parabolic surge to above $108k.

With the latest moves, VERUM has surged more than 179% in the past week. The current price is $1,723% up over the coin’s value at the same time in the past year.

Verum Coin has gained amid two major wallet support integrations – likely fueling the upside momentum.

The cryptocurrency revealed Binance Wallet had added support for the token in late November. The Halo Wallet also added Verum Coin (VERUM) this month, with users getting another option to securely store and manage their coins as they explore the crypto space.

Within the Verum Coin ecosystem, the native token serves various purposes.

This includes payments for premium features, tips, private transactions, and in-game purchases. Users also benefit from rewards, with players of the Verum Runner game able to earn V coins and convert them to VERUM and fiat currency.

The coin has a market cap of over $292 million and has recorded a daily trading volume of over $224k in the past 24 hours.

The post VERUM hits new all-time high amid 70% spike appeared first on CoinJournal.