- Microsoft shareholders have voted against the proposal that sought to have the tech giant add Bitcoin to its balance sheet.

- The vote on Tuesday, December 10, 2024, followed the proposal by the National Center for Public Policy Research, and came after MicroStrategy founder and Chairman Michael Saylor added to the call for Microsoft to adopt a Bitcoin treasury via a presentation.

On Dec. 10, details on the vote indicated Microsoft shareholders had rejected the proposal – meaning one of the world’s most valuable companies is not primed to add BTC to its treasury any time soon. Microsoft will not now take time to study the option of having the world’s largest cryptocurrency by market cap as part of its diversified portfolio.

Saylor, whose company is the largest corporate holder of Bitcoin after a buying spree that started in 2020, said last week that Microsoft had the potential to add trillions of dollars to its market cap if it invested in the flagship digital asset.

MicroStrategy acquired an additional 21,550 BTC worth $2.1 billion on Dec. 9, bringing its total haul 423,650 BTC bought for approximately $25.6 billion.

Microsoft board urged shareholders to vote down proposal

The “Assessment of Investing in Bitcoin” proposal by the National Center for Public Policy Research advocated for a 1% outlay of Microsoft’s assets into BTC. According to the proposal, the company should have weighed whether diversifying with Bitcoin to hedge against inflation was in the best interests of shareholders.

Saylor offered a 3-minute presentation to Microsoft’s Board of Directors and the chairman and CEO Satya Nadella. The Bitcoin bull explained why taking this approach would have been the right thing for the company.

The preliminary results of the shareholders’ vote means Microsoft could adopt this strategy at a time when BTC price will be much higher than the current $97k. The company’s board had last month asked shareholders to reject the proposal.

Despite the outcome of the vote, some in the crypto industry are bullish on what it means to have such a proposal in place.

Notably, the National Center for Public Policy Research has also submitted a similar proposal to Amazon.

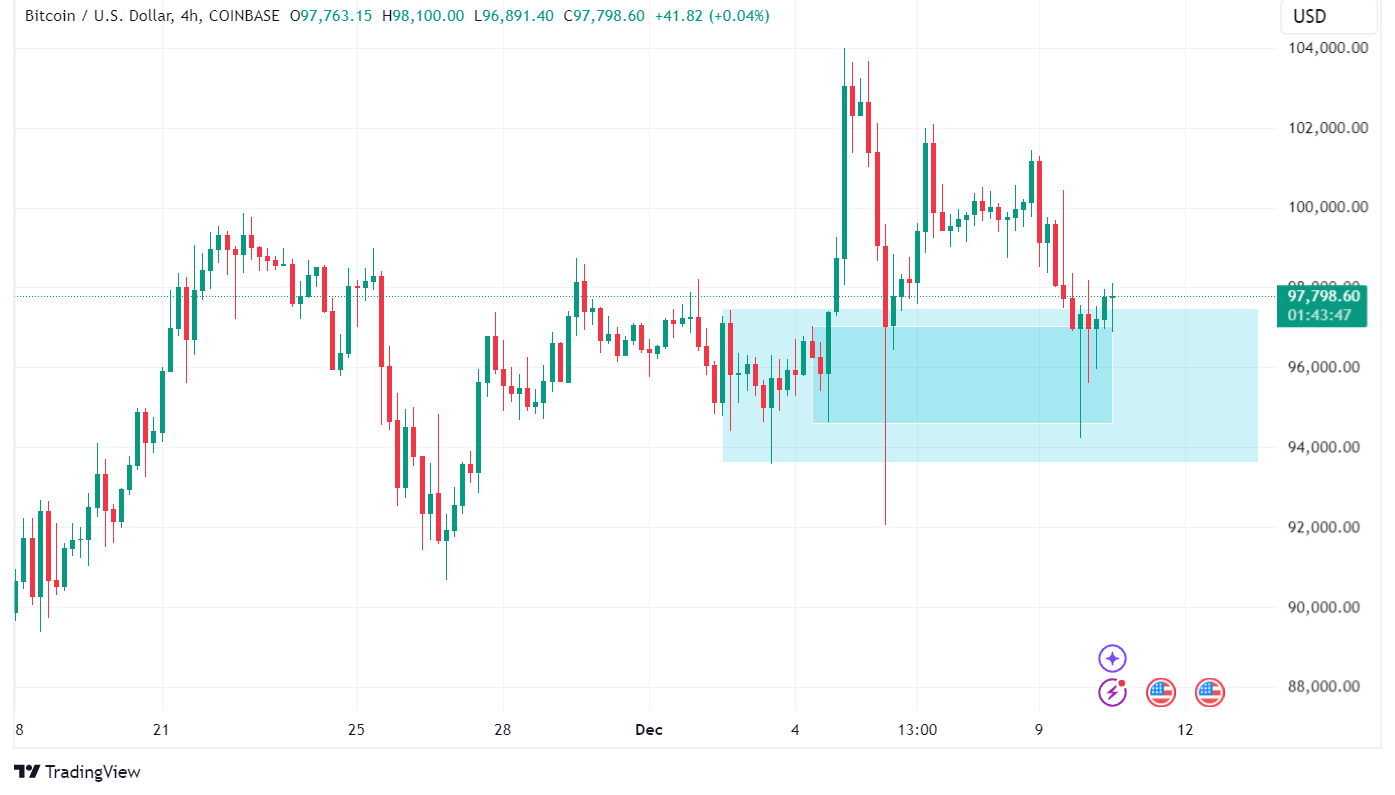

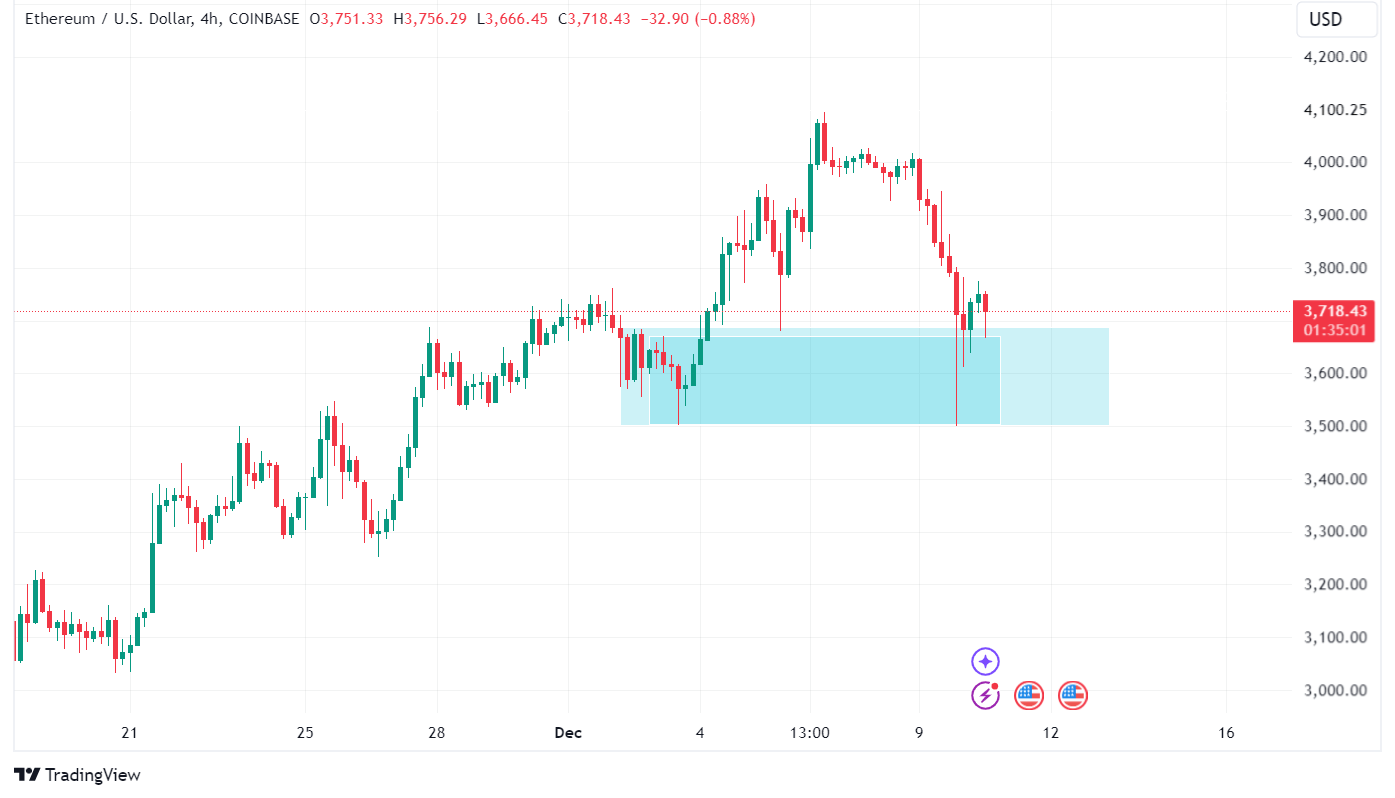

MSFT shares traded around $446.98 at the time of writing, with the performance largely flat on the day. Bitcoin price fell below $95,000 on the news, reaching lows of $94,550. However, BTC was back above $95k at the time of writing as bulls target a retest of the psychological $100k level.

The post Microsoft shareholders reject Bitcoin treasury proposal appeared first on CoinJournal.