Roni Cohen-Pavon, der ehemalige Finanzchef von Celsius, hat sich 2023 in den USA schuldig bekannt und durfte gegen Kaution nach Israel reisen.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Roni Cohen-Pavon, der ehemalige Finanzchef von Celsius, hat sich 2023 in den USA schuldig bekannt und durfte gegen Kaution nach Israel reisen.

Now ranked third among all cryptocurrencies globally, Ripple has lately tapered its activities. It is not only a wonderful day for the leaders of XRP but a momentous occasion for the Chief Technology Officer at Ripple, who has just marked twelve years of service with the company. XRP is gaining notable traction within the market due to its rapid 83.57% price increase in the last few days. The token is valued at $2.6 at the time of this writing.

This remarkable surge has driven XRP beyond stablecoin behemoth Tether (USDT) and the well-known “Ethereum killer” Solana (SOL), cementing its position as a top-tier digital asset. However, although XRP revels in its newfound success, the competitive landscape is changing. Solana and a new challenger, Rexas Finance (RXS), are making substantial progress, and both could pose challenges to XRP’s dominance.

XRP’s explosive climb to the top 3 can be ascribed to rising institutional acceptance and an increasingly favorable legal environment.

Ripple’s ability to negotiate legal issues has raised investor confidence and generated notable inflows. In a recent comment, David Schwartz expressed satisfaction with XRP’s expansion and attributed its success to Ripple’s strong community and innovative attitude. Considering his 12-year career, Schwartz remarked, “This road has been quite remarkable.”

The basis of XRP’s success is its resiliency and the constant support of the community. XRP is also widening its use cases as it rides this wave of momentum, especially in decentralized finance (DeFi) and cross-border payments and this helps to place the cryptocurrency as a major actor in the upcoming stage of blockchain development.

Celebrated for scalability and rapid transactions, Solana has evolved into the chosen platform for decentralized apps (dApps) and non-fungible tokens (NFTs). Solana is still a strong rival, even though XRP takes third place. Solana has stayed at the forefront thanks to recent changes, such as improvements to its basic infrastructure and alliances with well-known companies. Solana’s emphasis on interoperability and environmental growth, according to analysts, might help it to recover ground lost.

Despite the competition between XRP and Solana, Rexas Finance (RXS) has emerged as a strong alternative, gaining traction with its novel platform and aggressive presale success. Rexas Finance is currently in its ninth presale round at $0.125 per token, having raised over $22.4 million and selling over 303.5 million tokens.

Rexas Finance stands out for its real-world applications, particularly in real estate tokenization and decentralized finance. By solving inefficiencies in traditional financial systems, Rexas Finance hopes to establish itself as a major player in the blockchain arena.

By establishing fractional ownership of actual objects and thereby enabling users to tokenize real-world assets, Rexas Finance’s creative platform opens high-value investments beyond the reach of only wealthy individuals. Through its Rexas Launchpad, the platform also helps entrepreneurs and inventors generate money quickly, enabling new token introductions in a user-friendly manner.

Rexas Finance has already clocked up a number of important achievements. Listing on sites like CoinMarketCap and CoinGecko increases the token’s reputation and visibility. Furthermore, an assessment by CertiK underlines the project’s dedication to openness and security.

The ongoing $1 million giveaway by Rexas Finance, which will award 20 winners, each with $50,000 worth of RXS tokens, adds to the buzz. Along with encouraging community involvement, this project has shown the token’s possible high growth investment potential. Using its presale success and original value propositions, Rexas Finance is creating a clear identity. With its listing almost ready and significant community support, RXS is positioned to upend major players like XRP and Solana and upset the market.

XRP’s rise to the third-largest cryptocurrency ranking demonstrates its stability and usability. Still, the fast-changing crypto market calls for investors to be alert. Investors seeking substantial returns may find Solana’s innovative approach and Rexas Finance’s aggressive expansion strategy appealing. The decision among these tokens for investors will rely on personal risk tolerance and investment objectives. Solana offers speed and scalability, XRP offers stability with proven use cases, and Rexas Finance holds out the promise of exponential growth as a burgeoning cryptocurrency. In the coming months, there could be a shift in the cryptocurrency hierarchy, and each of these coins has a compelling case to lead this change.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

The post Ripple CTO Reacts to Ripple (XRP) Becoming 3rd Biggest Crypto, But Solana (SOL) and a New Fierce Rival Are Closing In appeared first on CoinJournal.

Ripple will soon launch its stablecoin RLUSD after it received the final approval from the New York Department of Financial Services.

Brad Garlinghouse, the CEO of Ripple, confirmed this via a post on X on Tuesday, December 10, 2024.

“This just in…we have final approval from NYDFS for $RLUSD! Exchange and partner listings will be live soon – and reminder: when RLUSD is live, you’ll hear it from Ripple first,” Garlinghouse posted.

The official Ripple X account also shared the upcoming launch of the stablecoin, with the news coming as the XRP token looked to recover above $2. Losses for the altcoin came as Bitcoin pared gains to below $95k and most coins traded lower.

Earlier this month, Ripple dismissed reports the US dollar-pegged stablecoin was launching. Rather, it confirmed that the official launch awaited regulatory approval from the NYDFS.

Despite some speculation, $RLUSD isn’t launching today. We’re in lockstep with the NYDFS on final approval and will share updates as soon as possible.

We are fully committed to launching under the supervision of NYDFS and upholding the highest regulatory standards. Stay tuned…

— Ripple (@Ripple) December 4, 2024

in an earlier announcement regarding exchange and platform partners, Ripple named the likes of Bitstamp, Uphold, CoinMENA and Bullish.

Meanwhile, the company said RLUSD will be pegged 1:1 to USD and be 100% backed by USD deposits, short-term US government treasuries and other cash equivalents. The stablecoin went live in private beta in August, with the launch on both the XRP Ledger and the Ethereum mainnet.

While the company expects RLUSD to launch imminently, it has cautioned its users and the broader market to be wary of impersonations or scams.

$RLUSD is launching soon!

Stay vigilant and report any impersonations or scams. https://t.co/yqnAdBQSfW

— Ripple (@Ripple) December 10, 2024

Ripple announced plans to launch its stablecoin in April.

Entry into the market will see RLUSD compete with top USD-pegged stablecoins. The market leader in this segment is Tether’s USDT, which has a market cap of over $138 billion. USDC, the second largest, has a market cap of over $40 billion.

The post Ripple secures final NYDFS approval for RLUSD appeared first on CoinJournal.

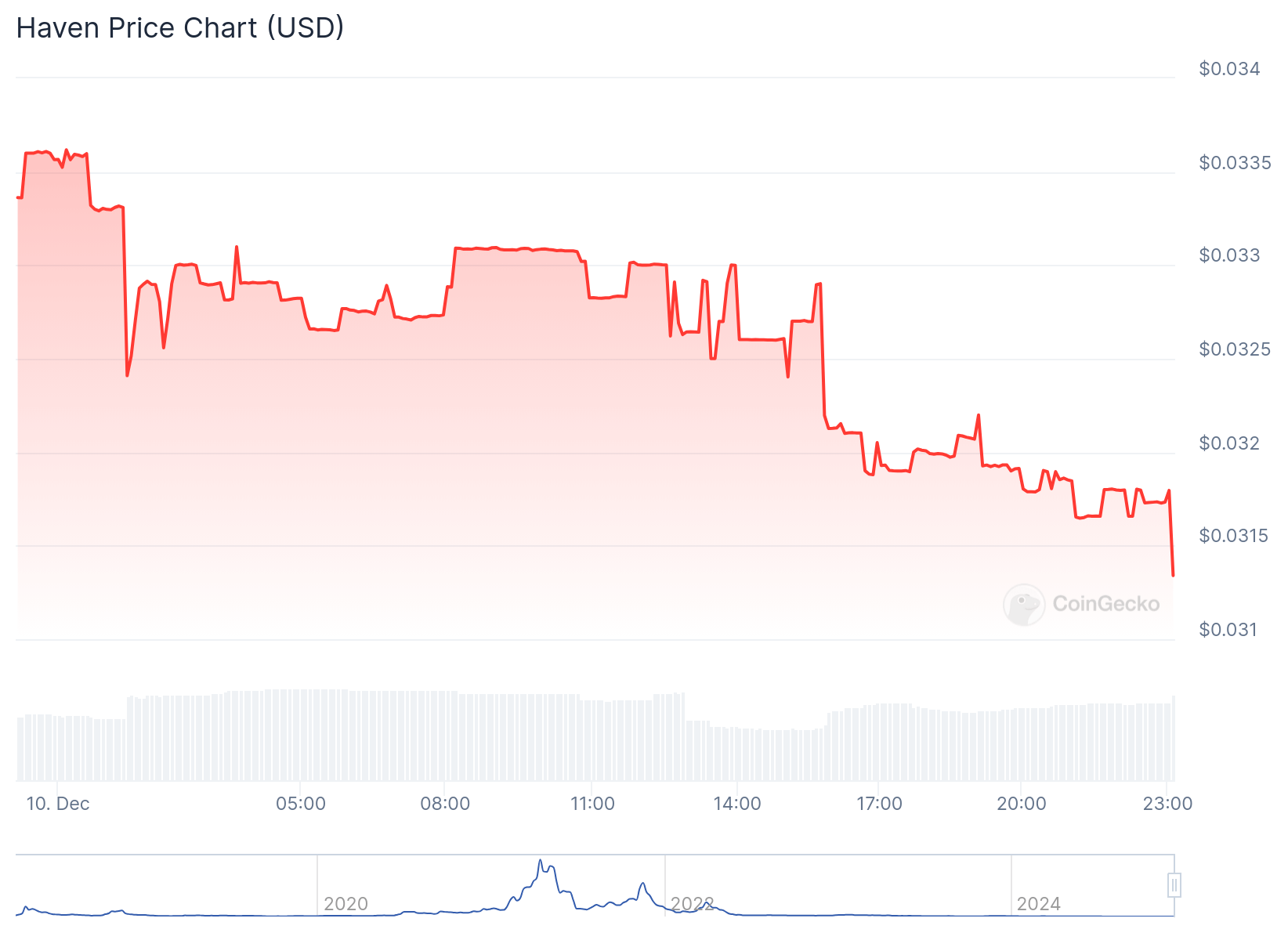

Haven Protocol, a blockchain project known for its mint-and-burn mechanism, has suffered a mint exploit, leading to a dramatic plunge in its token price.

The exploit allowed a hacker to mint a vast number of XHV tokens, driving the supply to unmanageable levels. Following the hack, the price of the Haven token (XHV) nosedived by over 60%, falling from $0.0003594 to $0.0001341.

The Haven Protocol team disclosed the exploit via their social media account, revealing that over 500 million XHV tokens were illicitly created.

⚠️ Haven Mint Exploit ⚠️

Unfortunately we’ve been hit by an exploit.

This was identified when querying the amount of XHV on exchanges.

The number reported to us is in excess of 500 million XHV.$XHV

🧵👇🏼— Haven Protocol (@HavenXHV) December 10, 2024

This discrepancy was detected during an exchange supply query, contrasting sharply with the audited supply of 263 million tokens. Developers attributed the breach to a vulnerability in the “range proof validation” code, introduced during the Haven 3.2 rebase to Monero.

This flaw enabled the creation of XHV tokens without detection, as the minting occurred after auditing processes.

Notably, the surplus tokens were not accounted for in the audited supply figures, exposing a critical gap in the protocol’s security measures.

The exploit has significantly impacted the market standing of XHV, a project that once saw its token peak at $28.99 in April 2021. The incident has compounded its decline, with the current price reflecting the erosion of trust in the protocol.

In response, Haven Protocol urged its community to avoid purchasing XHV on exchanges, citing ongoing efforts to assess the situation. The team acknowledged the gravity of the breach, expressing regret and promising further updates as discussions within their Haven Operations Committee (HOC) progress.

The post Haven Protocol Token (XHV) crashes after mint exploit appeared first on CoinJournal.

Italy has decided to abandon a controversial proposal to raise the tax on cryptocurrency capital gains from 26% to 42%, following significant industry opposition and political disagreements.

The initial plan, introduced by Economy Minister Giancarlo Giorgetti, aimed to increase government revenues to fund socio-economic programs. However, it met resistance from lawmakers, industry stakeholders, and members of the ruling League party, prompting a reassessment of the measure.

According to sources familiar with the development, instead of the sharp hike, Italian lawmakers have proposed a more moderate increase, capping the tax rate at 28%. Others suggest maintaining the current 26% rate to avoid disrupting the growing crypto sector.

The revised tax plans form part of the 2025 budget, which must gain parliamentary approval by the end of December.

League lawmaker Giulio Centemero and Treasury Junior Minister Federico Freni were among those pushing for a softer approach. Both argued that an excessive tax increase could drive cryptocurrency trading underground, harming both investors and the broader economy. “No more prejudice about cryptocurrencies,” the lawmakers emphasized, highlighting the importance of fostering a supportive environment for the digital asset industry.

To further encourage innovation while addressing fiscal concerns, lawmakers have also proposed implementing progressive taxation and raising exemption thresholds to protect smaller investors. These measures aim to create a balanced regulatory framework that promotes investment in digital assets without stifling economic growth.

The tax debate in Italy mirrors broader global trends as nations seek to regulate and tax cryptocurrencies. For instance, Russia imposes a 13%-15% income tax on crypto sales, while exempting mining operations from VAT.

The Czech Republic has also introduced reforms exempting long-term crypto holdings from capital gains tax, encouraging digital asset investments.

Italy’s recalibrated approach signals an intent to align with these international practices while mitigating risks to its domestic economy. By rethinking its stance, Italy seeks to strike a balance between fiscal responsibility and fostering a competitive digital economy.

The post Italy will drop plans to increase tax on crypto capital gains appeared first on CoinJournal.