- Trump is now considering Kevin Warsh and Marc Rowan for the US Treasury Secretary position

- Howard Lutnick is reportedly frustrating Trump by spending too much time with him to get himself appointed

- A person familiar with the situation between Lutnick and Scott Bessent as a “knife fight”

President-elect Donald Trump is allegedly reconsidering his options for US Treasury Secretary, pivoting away from pro-crypto choices.

Trump is now considering former Federal Reserve governor Kevin Warsh and Wall Street billionaire Marc Rowan, according to a report from the The New York Times. Trump is expected to invite the two to Mar-a-Lago, Trump’s Florida residence, this week following internal conflict over the role.

President-elect Trump is having second thoughts about his options for Treasury Secretary and is expected to invite the top candidates to interview with him at Mar-a-Lago. Here are the latest updates. https://t.co/0fHtpa82wN

— The New York Times (@nytimes) November 18, 2024

Trump had been expected to pick either pro-crypto candidates Howard Lutnick, the CEO of Cantor Fitzgerald or Scott Bessent, the founder of Key Square Capital Management, an investment firm, and a former money manager for George Soros.

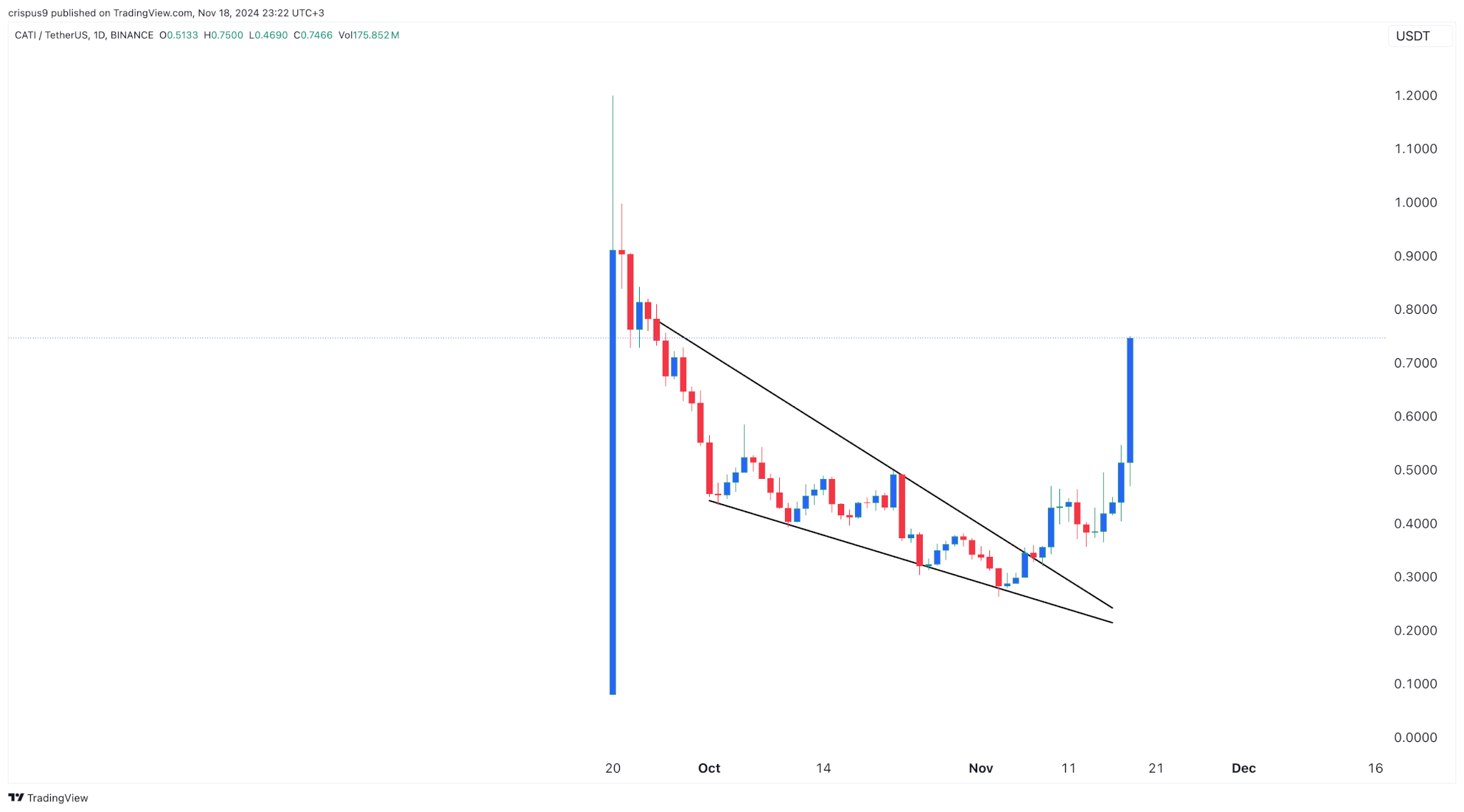

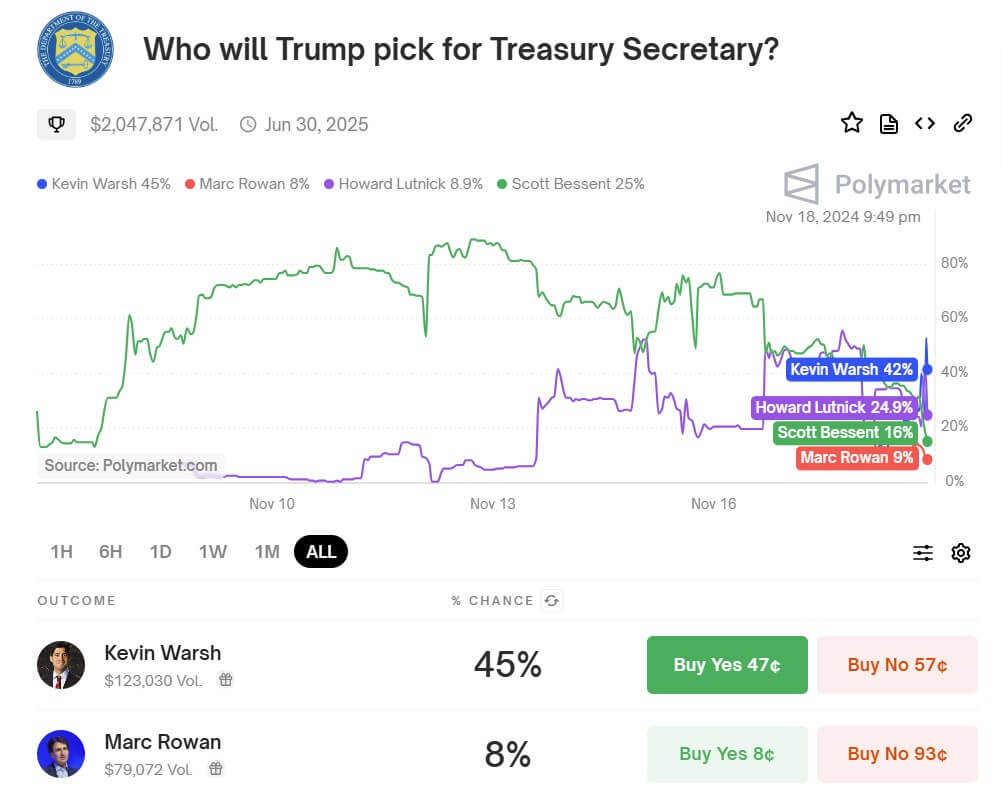

Up until yesterday morning, Polymarket, a prediction market platform, had put Bessent at an 87% chance of getting the job. However, he’s now down to 16% with Warsh taking the lead at 44%.

Getting frustrated

According to the New York Times, Trump has expressed frustration with Lutnick, claiming he’s been hanging around the president-elect too much to get himself appointed. A person familiar with the matter described the situation between Lutnick and Bessent as a “knife fight” with Lutnick as the “primary aggressor.”

Despite this, Elon Musk, CEO of Tesla, and an influential figure in Trump’s inner circle, took to X to endorse Lutnick, adding that “Bessent is a business-as-usual choice.”

“Business-as-usual is driving America bankrupt, so we need change one way or another,” Musk said. He added that Lutnick will “actually enact change.”

Would be interesting to hear more people weigh in on this for @realDonaldTrump to consider feedback.

My view fwiw is that Bessent is a business-as-usual choice, whereas @howardlutnick will actually enact change.

Business-as-usual is driving America bankrupt, so we need change… https://t.co/igGLZOJ8wz

— Elon Musk (@elonmusk) November 16, 2024

As a result of Trump’s second thoughts, he’s slowed down the selection process even though Bessent is still under consideration. Both Lutnick and Bessent are considerably more pro-crypto compared to Warsh and Rowan.

In an essay for the American Enterprise Institute, Warsh advocated for an American central bank digital currency (CBDC) despite concerns over consumer privacy. Rowan, on the other hand, said in a March interview he didn’t see the “value of an alternative currency” when discussing crypto.

The post NYT: Trump reconsiders pro-crypto choices for Treasury Secretary, slows down his selection process appeared first on CoinJournal.