Der Solana-Kurs schießt 11 % nach oben und knackt damit sein vroheriges Rekordhoch.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der Solana-Kurs schießt 11 % nach oben und knackt damit sein vroheriges Rekordhoch.

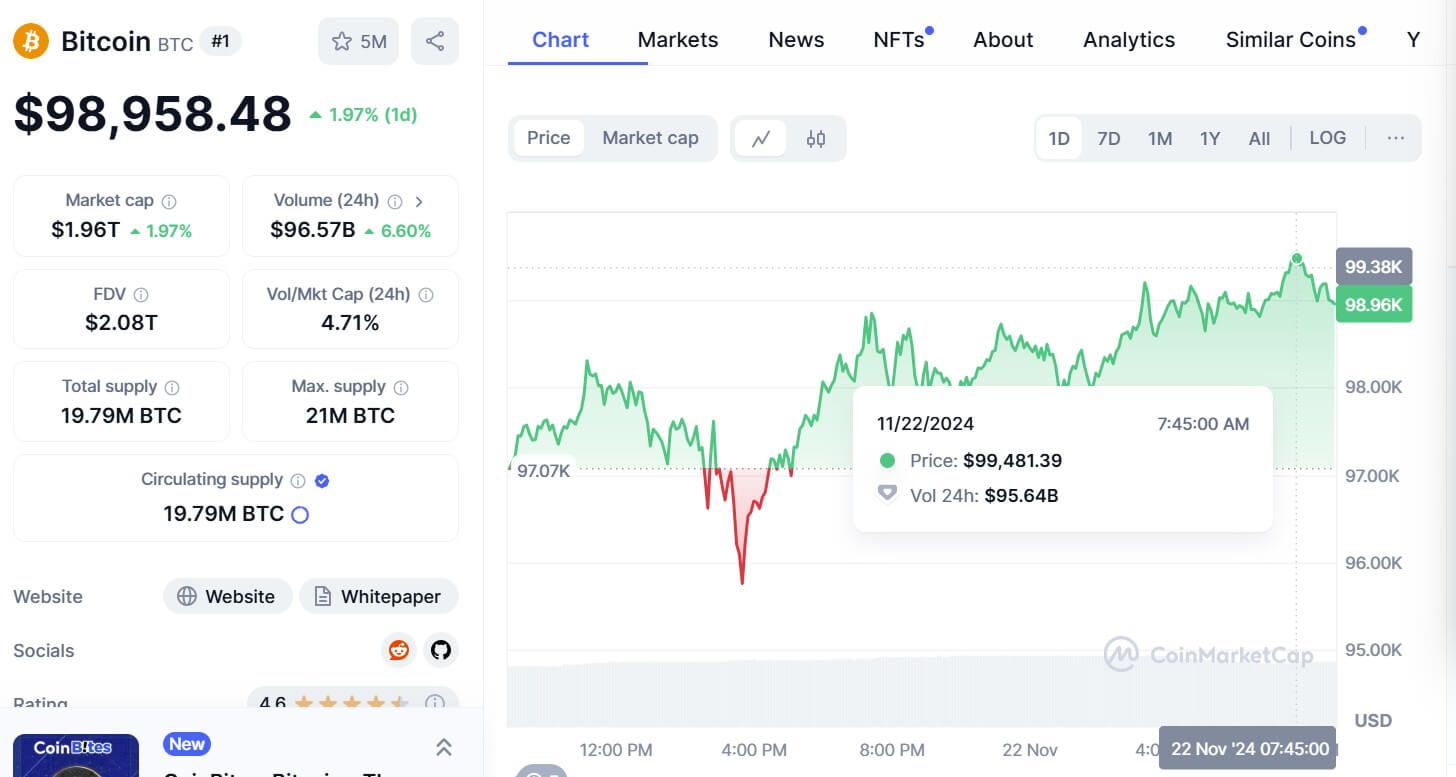

Bitcoin came within touching distance of $100,000 on November 22 as the asset continues its bull run since the beginning of November.

Data from CoinMarketCap shows Bitcoin hit a high of $99,500. The record comes after Bitcoin topped $98,000 yesterday, pushed along by the launch of ETF options earlier this week.

The rally follows after Bitcoin dipped to $95,000 yesterday afternoon before rallying into the green.

Taking to X, analyst Skew said: “Price did see a brief LTF dip before higher thereafter. Still seeing limit bids moving higher with underlying spot buyers ~ positive market signal,” adding:

“A lot of aggregate spot supply around $100k. Price currently is chewing away at this supply, before this has preceded a pretty violent breakout.”

$BTC Binance Spot

Update since previous post

Price did see a brief LTF dip before higher thereafterStill seeing limit bids moving higher with underlying spot buyers

~ Positive market signalA lot of aggregate spot supply around $100K

Price currently is chewing away at this… https://t.co/TruZVGXwTM pic.twitter.com/nGtekY6Y0F

— Skew Δ (@52kskew) November 22, 2024

Joe Constori, head of growth at Theya and institutional lead at the Bitcoin Layer, said on X that Bitcoin at $100,000 is going to happen.

“Its properties have always destined it to be a multi-trillion dollar base layer monetary asset. It just took the price 15 years to catch up.”

Market analyst Ali mentioned that “the TD Sequential presents a sell signal on the #Bitcoin $BTC 4-hour chart, anticipating a brief correction to $97,085,” adding:

“A candlestick close above $100,470 will invalidate the bearish formation and potentially push #BTC to $102,656 or $104,343.”

The TD Sequential presents a sell signal on the #Bitcoin $BTC 4-hour chart, anticipating a brief correction to $97,085!

A candlestick close above $100,470 will invalidate the bearish formation and potentially push #BTC to $102,656 or $104,343. pic.twitter.com/WiKQTGYNmJ

— Ali (@ali_charts) November 22, 2024

The continued surge follows since Donald Trump won his re-election into the White House on November 5.

Trump, now considered pro-crypto, made several promises regarding the crypto market during his election campaign, one of which is to make the US the “crypto capital of the world.”

Earlier this week, it was reported that Trump’s transition team was considering its first-ever White House crypto office.

If established, this position would serve as a liaison between the digital assets sector, Congress, and key regulatory agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

At the time of publishing, Bitcoin is trading at $98,600.

The post Bitcoin gets within touching distance of $100K as rally continues appeared first on CoinJournal.

Der amtierende SEC-Chef Gary Gensler wird mit dem Amtsantritt von Donald Trump zurücktreten, was den Weg für einen offenen Umgang der Börsenaufsicht mit Kryptowährungen frei machen könnte.

Ethereum zeigt sich mit einem starken bullischen Momentum und steht kurz vor einem Kursziel von $4.000. Technische Signale wie das bevorstehende Golden Cross, verstärkte Whale-Aktivitäten und Erfolge von Layer-2-Lösungen treiben die Entwicklung voran.

The United Kingdom is set to introduce a comprehensive regulatory framework for cryptocurrencies, stablecoins, and crypto staking services in early 2025, marking a pivotal shift in its approach to digital assets.

The announcement was made by the Economic Secretary to the Treasury Tulip Siddiq at City & Financial Global’s Tokenisation Summit in London on November 21.

Initially slated for December 2024, the regulatory rollout was delayed due to the change in government following the election of Prime Minister Keir Starmer’s Labour administration in July 2024.

The upcoming framework consolidates regulations for crypto assets into a single, overarching regime, a decision Siddiq described as “simpler and more logical.”

The framework aims to provide clarity in a rapidly growing sector that has faced uncertainty in the UK.

Stablecoins will receive distinct treatment under these regulations, as their functionality does not align with existing payment services rules.

Siddiq highlighted that staking services would also avoid being designated as “collective investment schemes,” a classification that could impose burdensome restrictions.

The UK government’s renewed focus on digital asset regulation comes as it seeks to align with global developments. The European Union’s Markets in Crypto-Assets (MiCA) regulations will be fully enforced by the end of 2024, offering regulatory certainty that has positioned Europe as an attractive market for the crypto industry.

Meanwhile, the US, under President Donald Trump’s administration, has adopted a markedly pro-crypto stance, including the establishment of a White House “crypto czar” and SEC Chair Gary Gensler’s planned departure in January 2024.

The Labour government has shown its intent to catch up with international competition. In September 2024, it introduced a bill recognizing NFTs, cryptocurrencies, and carbon credits as property.

The new regulatory push reflects the UK’s ambition to regain credibility as a crypto hub while addressing criticisms of the Financial Conduct Authority’s perceived stringent oversight.

By delivering a robust, streamlined framework, the Labour government aims to bolster the UK’s standing in the multibillion-dollar crypto industry.

The post UK to unveil crypto and stablecoin regulatory framework early next year appeared first on CoinJournal.