Chris Larsen, der rund 12 Millionen US-Dollar an PACs zur Unterstützung von Kamala Harris beigesteuert hat, sagte, er hoffe auf „parteiübergreifende Unterstützung“ für Krypto in der Regierung ab 2025.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Chris Larsen, der rund 12 Millionen US-Dollar an PACs zur Unterstützung von Kamala Harris beigesteuert hat, sagte, er hoffe auf „parteiübergreifende Unterstützung“ für Krypto in der Regierung ab 2025.

In einem offenen Brief an Donald Trump und Kamala Harris hob Charles Cascarilla die Rolle von Stablecoins bei der Aufrechterhaltung der globalen Dominanz des US-Dollars und der Verbesserung der Bankeneffizienz hervor.

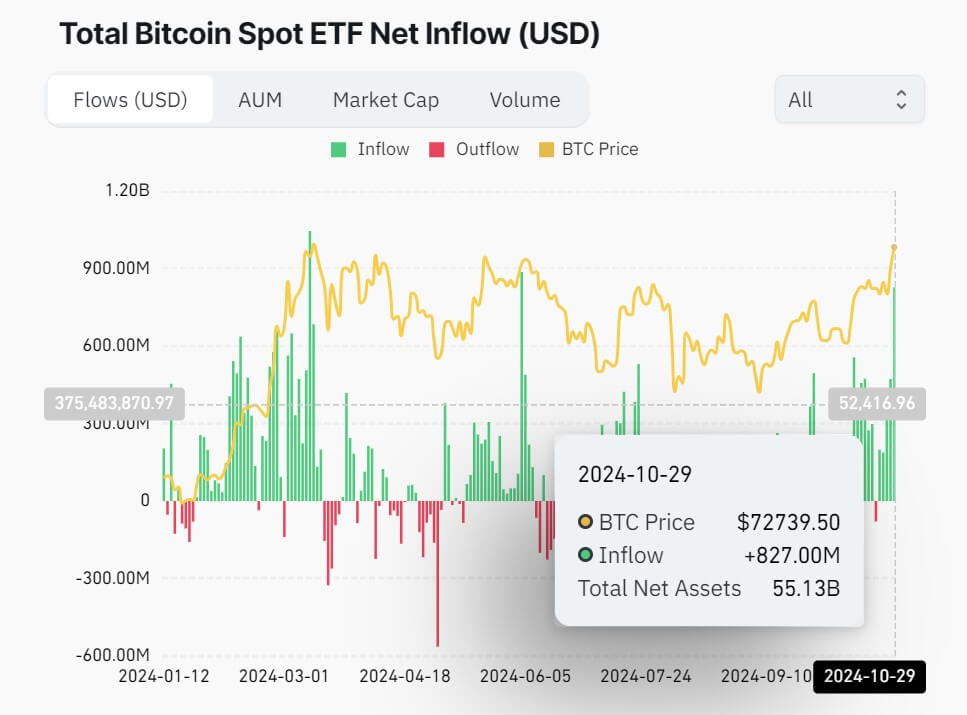

Bitcoin steht kurz vor einem neuen Allzeithoch, da der Markt für Bitcoin-ETFs große Kapitalzuflüsse verzeichnet. Mit einem Zufluss von 870 Millionen Dollar am 29. Oktober führen ETFs wie der iShares Bitcoin Trust und Fidelity’s FBTC die Nachfrage an.

Coinbase and Visa are teaming up to deliver real-time account funding for customers providing more flexibility in the crypto space.

Available to customers in the US and Europe, the announcement from Visa comes as Bitcoin’s price nearly touched its March all-time high of $73,700 on Tuesday. At the time of publishing, data from CoinMarketCap shows Bitcoin is trading at $72,500.

Through the integration with Visa Direct, Coinbase customers can deposit funds into their Coinbase account using eligible Visa debit cards. According to Visa, the integration gives Coinbase users more flexibility in a “dynamic crypto environment.”

“Providing real-time account funding using Visa Direct and an eligible Visa debit card means that those Coinbase users with an eligible Visa debit card know that they can take advantage of trading opportunities day and night,” said Yanilsa Gonzalez Ore, Head of Visa Direct, North America for Visa.

On top of the real-time deposits, Coinbase users can cash out money from their Coinbase accounts in real-time with their Visa debit cards.

The addition of the real-time deposits adds to Coinbase’s Visa debit card it offers its US-based customers.

In October 2020, the crypto platform announced it was launching its Visa debit card, enabling users to make purchases online and in-store. In addition, users would be able to withdraw ATM cash withdrawals.

The launch of its US Coinbase card followed that of its Coinbase Visa debit card to UK and EU customers in 2019.

The real-time deposit comes as spot Bitcoin exchange-traded funds (ETFs) saw inflows reaching $827 million yesterday, according to data from CoinGlass.

In a post on X, Bloomberg ETF analyst Eric Balchunas said “FOMO confirmed,” citing data showing BlockRocks IBIT brought in daily Bitcoin inflows reaching nearly $600 million.

FOMO Confirmed (and this is just from Mondays activity. Todays don’t show up in flows till tmrw night) https://t.co/jc0kyHJuqc

— Eric Balchunas (@EricBalchunas) October 30, 2024

Balchunas added, “IBIT not alone – altho by far the most – as all the main BTC ETFs saw elevated volume past two days.”

The post Coinbase and Visa Direct deliver instant funding for EU, US customers appeared first on CoinJournal.

Brian Armstrong, CEO von Coinbase, sagte, dass man sich bei den Amerikanern für den Schaden entschuldigen müsse, den die SEC dem Krypto-Markt zugefügt habe.