Poodlana is among the cryptocurrencies to record a flip in price direction as the ecosystem recorded $2.2 billion in digital assets investment inflows. While Bitcoin, Ethereum, and Solana eye key support levels, its likely the positive sentiment pushes other alts higher.

What this means is that Poodlana price could go parabolic amid highly anticipated US election?

Digital assets hit $2.2 billion inflows

According to CoinShares, total inflows into the crypto investment products market reached $2.2 billion last week, the largest mark since July 2024. Total assets under management has jumped to near $100 billion, the digital assets investment firm said in a weekly report published on Oct. 21.

Key to the surge in interest in cryptocurrencies is the increased bet on a possible Donald Trump victory in the US elections set for Nov. 5.

“We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets. This, in turn, has led to positive price momentum,” CoinShares wrote in a blog post.

With the Republican candidate viewed as crypto-friendly, Bitcoin has surged to near $70k and could explode higher. Optimism helped pull over $2.1 billion into Bitcoin exchange-traded products amid a 30% spike in trading volumes.

Altcoins gain amid ETP inflows

As CoinShares data shows, there were also notable inflows into altcoins. Ethereum, whose price touched $2,763 on Monday, recorded $58 million in inflows into Ether ETPs last week.

Solana’s price, on the other hand, jumped to near $170 and saw $2.4 million in inflows. Meanwhile, Litecoin attracted $1.7 million and XRP $0.7 million as respective prices also rose.

With the price outlook for these alts positive, its likely continued bullish sentiment will pull other altcoins higher. In this category could be leading meme coins within the Solana ecosystem, one of which is recently launched Poodlana (POODL).

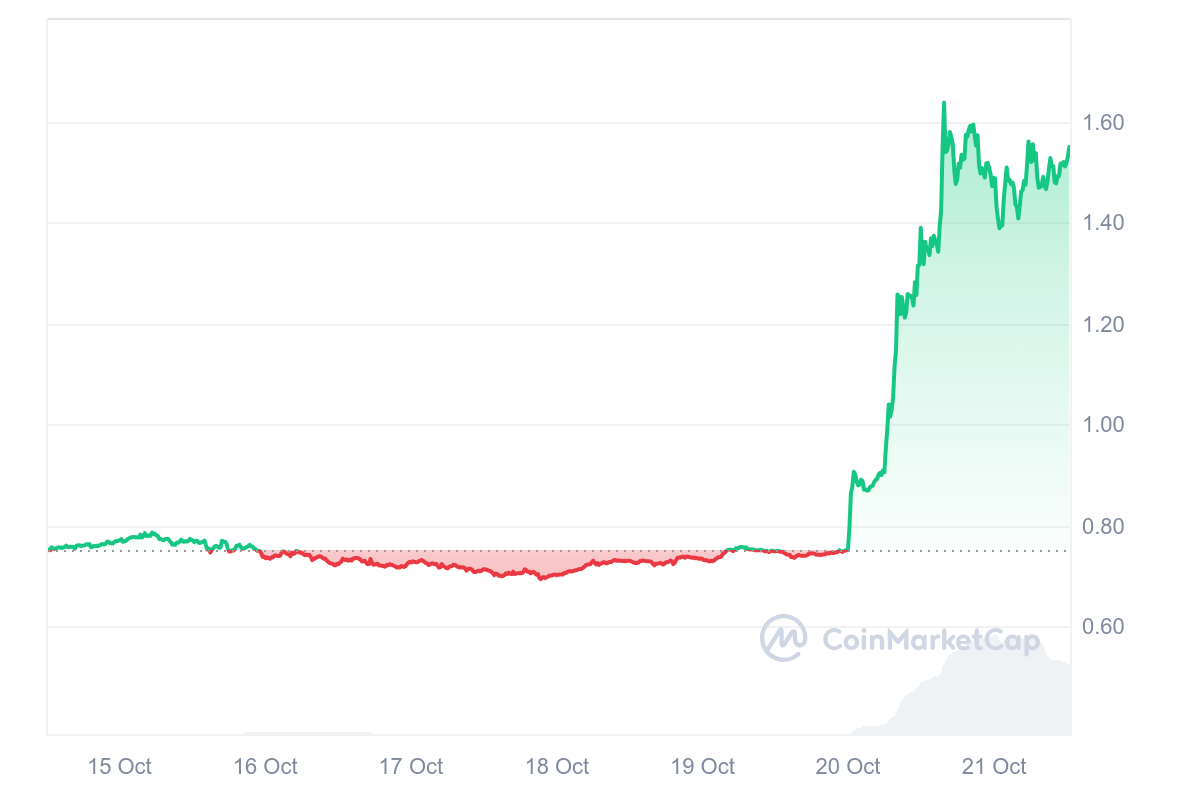

Poodlana price holds key level

Poodlana is a luxury-fashion and poodle dog inspired meme coin that went live on exchanges on Aug. 16 after a quickfire 30-day presale. Gate.io, MEXC and Raydium all list POODL, while the community wish list includes the world’s largest crypto exchange Binance.

The POODL price has struggled for upside momentum since its trading debut. However, bulls have managed to hold above $0.00. It suggests that a flip in overall trajectory for cryptocurrencies could offer Poodlana the tailwinds it needs to skyrocket.

Similar trends were observed with coins such as Popcat, Pepe and dogwifhat – an initial dip followed major gains before prices exploded again.

POODL looks set for its own surge.

Likely to play a huge role is the Poodlana community that’s expanded rapidly since the token’s viral entry in the market. Asia, where the poodle is a top dog breed, leads this growth metric.

For more about Poodlana, check out the official website.

The post Poodlana rises as digital assets see $2.2 billion inflows appeared first on CoinJournal.