Ripple wehrt sich gegen die Berufung der SEC und fordert Neuprüfung des vorherigen Urteils im Hinblick auf XRP-Verkäufe an institutionelle Investoren.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Ripple wehrt sich gegen die Berufung der SEC und fordert Neuprüfung des vorherigen Urteils im Hinblick auf XRP-Verkäufe an institutionelle Investoren.

The Dutch government has asked for public input on a new draft regulation for crypto tax monitoring and reporting, with a focus on aligning local tax laws with broader crypto regulation within the European Union.

The Netherlands’ Ministry of Finance announced the public feedback program in a press release published on Oct. 24. The draft bill, if adopted into law, would mandate cryptocurrency exchanges and other digital asset service providers to submit customer data to the Dutch Tax Administration.

Per the announcement, the new law aims to create a more transparent environment in terms of crypto ownership to reign in potential tax avoidance or evasion.

As such, the public have Nov. 21 to submit their opinion, advice and comment. Thereafter, the government will look to bring the bill to the Dutch House of Representatives at the start of Q2, 2025. If adopted, the new law will take effect on January 1, 2026.

The Netherlands’ proposed bill is part of the country’s effort to bring local crypto regulation in line with broader laws in the European Union. This effort is being implemented across the EU member states. In October 2023, the EU released the DAC8 directive, which provides that crypto exchanges adopt tax reporting measures in the countries they hold regulatory licenses.

Accordingly, the DAC8 eases the administrative burden on exchanges as reporting is only mandated in that one country and applies across the EU.

The Netherlands’ move sees it join Denmark, which this week outlined crypto tax standards for unrealized gains. The proposal also aligns with the DAC8 and is part of the broader effort to support EU’s Markets in Crypto-Assets (MiCA) regulation.

MiCA is a comprehensive regulatory framework that the European Parliament passed into law in June last year. The regulation provisions on stablecoins came into effect on June 30, 2024, while the full law takes effect as of December 30, 2024.

The post Netherlands seeks public feedback on crypto tax reporting rules appeared first on CoinJournal.

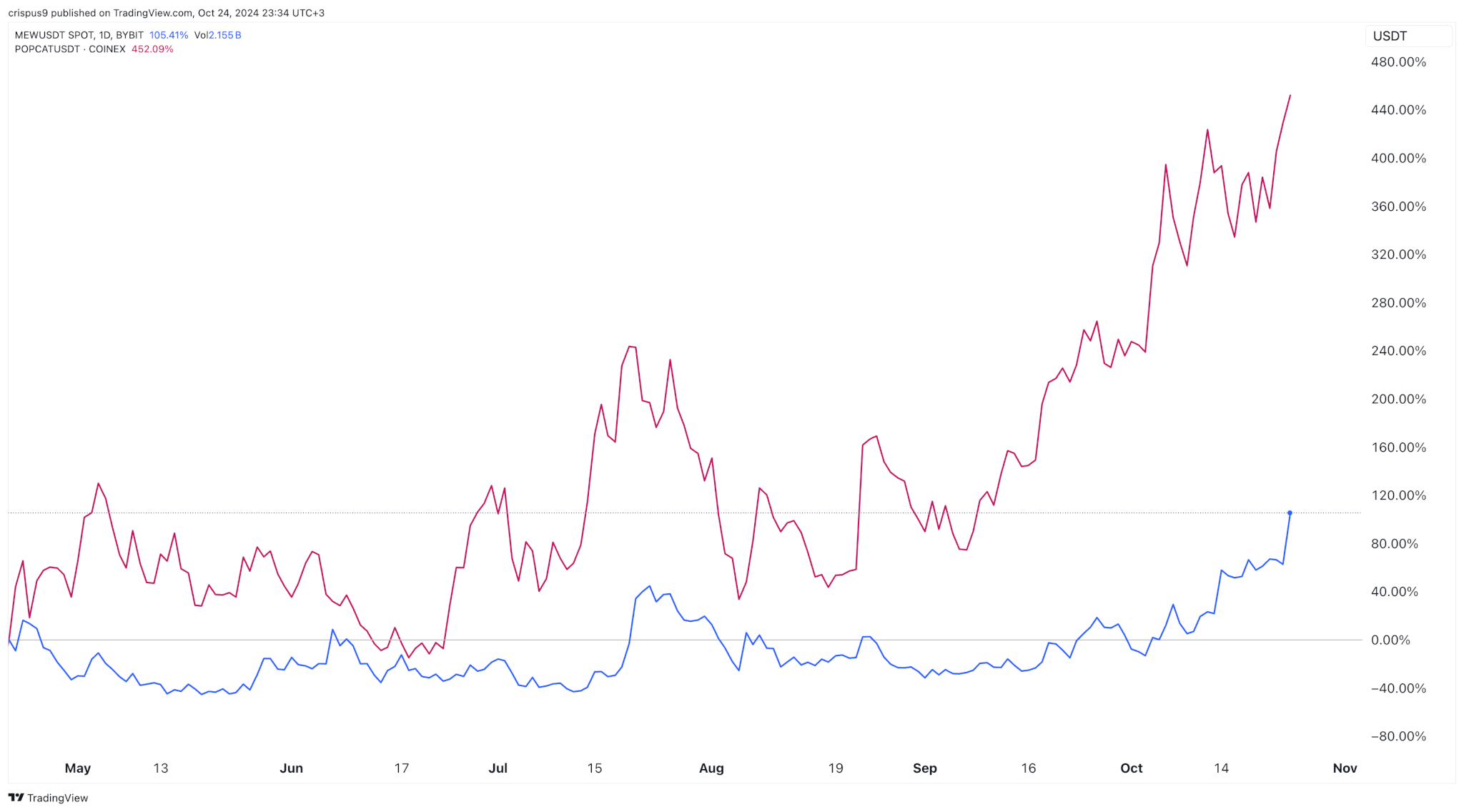

Cryptocurrency prices are doing well this year, with most of them outperforming traditional assets like the S&P 500, Nasdaq 100, and the Dow Jones. These indices have all jumped by over 15%, while Bitcoin has risen by almost 60%, and is hovering near its all-time high.

Cat in a dogs world (MEW) and Popcat (POPCAT) have soared by over 1,000% this year, giving them a market cap of over $1 billion. Analysts believe that these tokens have more upside in the coming months because of their deep liquidity, fear of missing out (FOMO), and their substantial volumes in the spot and futures market.

MEW and Popcat also have positive technicals, with the two of them rising above their short-term and medium-term moving averages. On top of this, there are signs that Bitcoin may be about to have a bullish breakout, which could see it jump to a record high.

It has remained below the key resistance level at $70,000 this week, meaning that it only needs one catalyst to have this breakout. Many experts believe that this rally is possible. For example, analysts at Bernstein have predicted that it will rise above $200,000 in 2025. John Paulson, a billionaire investor, has also expressed optimism in Bitcoin.

A strong Bitcoin breakout would be a positive thing for meme coins like Cat in a dogs world and Popcat. Historically, as we saw earlier this year, meme coins do better than Bitcoin when it makes a bullish breakout.

Crypto analysts and investors are now betting on Vantard, an upcoming meme coin inspired by the success of Vanguard, the second-biggest asset manager in the world with over $7 trillion in assets under management.

Vantard started its pre-sale event this week and has raised $163,000 from global investors in its first stage. The initial price was $0.00010, and will increase across the ten stages, with the next price being $0.00011, a 10% increase.

According to its white paper, 75% of the dedicated treasury funds will be allocated to fundraising. 5 billion tokens went to the pre-seed round, while the ongoing seed fund will have a limit of 40 billion tokens, equivalent to 55.56% of the total. The other 40 billion tokens will go to series A and series B.

Vantard’s key to success is what it calls the first-ever Meme Index Fund (MIF), which aims to give investors access to the best-performing meme coins in a single asset.

The fund will be fully decentralized, with its profits being distributed to holders through the $VTARD token. This fund is inspired by popular Vanguard exchange-traded funds (ETF) like the one tracking the S&P 500 index, which has added over $60 billion in assets this year.

Vatard’s MIF fund will also have a surge pricing model, where investors will pay a 0% fee during periods of low activity and up to 50% during high-peak demand periods. The goal of this fee is to discourage mass redemptions.

The other top benefit is that it will give investors access to the best meme coins in the industry. As such, instead of buying tens tokens hoping to catch the next big thing, an investor in the fund will have access to the best of them. You can learn more about Vantard here.

The post Why experts are backing cryptos like Vantard, MEW, and Popcat appeared first on CoinJournal.

Die Niederlande wollen ihre Regulierungsvorschriften zur Einholung von Informationen über Krypto-Vermögen mit den Vorgaben der EU in Einklang bringen und bitten deshalb um Feedback für entsprechende Pläne.

Pennsylvania has passed “The Bitcoin Rights Bill”, a new legislation that seeks regulatory clarity to the crypto industry.

While the US continues to lag other countries and regions in terms of regulatory clarity for digital assets, the state of Pennsylvania has taken a huge step towards this with the passage of House Bill 2481.

According to FOX Business, the new bill received bipartisan support in the Pennsylvania House of Representatives and passed on Wednesday, October 23, 2024, with 176 votes to 26. The bill outlines protections for Bitcoin and crypto holders, including the right to self-custody and use for payments. ‘Bitcoin Rights’ also provides guidelines on the taxation of Bitcoin transactions.

76 Democrats joined their Republican counterparts to pass the bill, FOX Business wrote.

The next stage will see the new bill come up for debate and voting at the Pennsylvania Senate, which is Republican-led. If it passes, the final stage will be forwarded to Gov. Josh Shapiro. These two steps commence after the November 2024 US election.

Crypto stands out as one of the topics candidates in the upcoming US election have sought votes on, including at the presidential level.

With Donald Trump taking a crypto-friendly stance, it’s been up to Kamala Harris to win the crypto holder’s vote. Despite crypto roundtables and positive policy plans, Harris isn’t connecting with the crypto vote.

That’s also despite her campaign receiving major donations from some wealthy crypto owners. The most recent is Ripple co-founder Chris Larsen’s $10 million XRP contribution. Larsen called for the Democrats to take a “new approach” to the issue of cryptocurrencies.

Meanwhile, with less than two weeks to go, forecasts put the majority of crypto holders down as Trump votes. JD Vance, Trump’s VP pick, is also pro-crypto.

Notably, Pennsylvania is a battleground state and one that could help decide the Trump vs. Harris race to the White House.

The post Pennsylvania House passes bipartisan Bitcoin bill appeared first on CoinJournal.