- Roman Storm will face trial on December 2 for alleged money laundering via Tornado Cash

- The judge rejected Storm’s defence that his code was protected under the First Amendment

- The prosecution must, however, prove Storm knew he dealt with the proceeds of any crime, not specifics

Roman Storm, co-founder of the cryptocurrency mixing service Tornado Cash, is set to face trial after a US federal judge rejected his motion to dismiss money laundering charges.

The trial will occur on December 2, 2024, in New York.

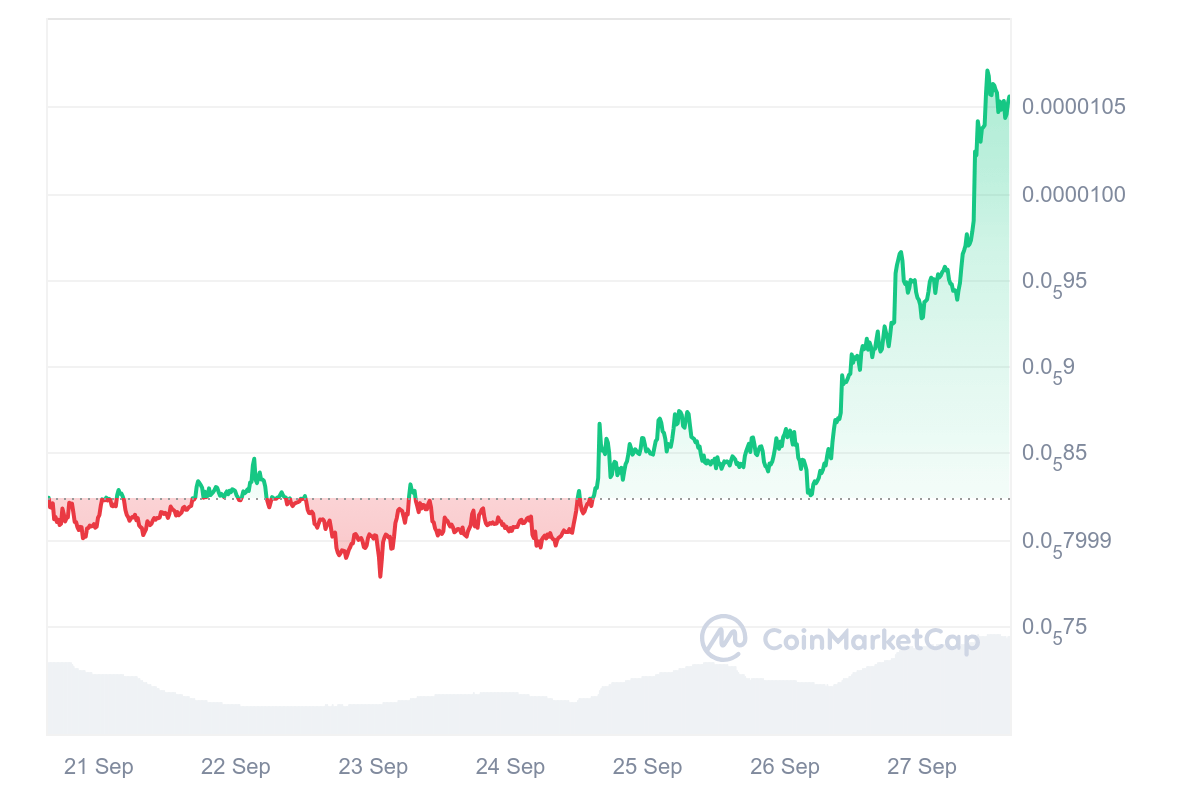

District Judge Katherine Polk Failla of the Southern District of New York denied the dismissal during a telephonic conference on September 26, pushing the case to trial.

Tornado Cash founders face multiple charges

Storm, alongside co-founder Roman Semenov, face multiple charges, including conspiracy to commit money laundering, conspiracy to violate the International Economic Emergency Powers Act (IEEPA), and conspiracy to operate an unlicensed money-transmitting business.

The charges stem from allegations that Tornado Cash facilitated the laundering of over $1 billion in criminal proceeds, some of which were linked to North Korea-backed cybercrime group Lazarus.

In a motion to dismiss the charges, Storm’s legal team argued that his role in developing the Tornado Cash software was protected under the First Amendment.

However, Judge Failla rejected this claim, asserting that the “functional capability” of the code did not equate to free speech as defined under the First Amendment. She emphasized that the government’s efforts to combat money laundering and sanction evasion were “wholly unrelated” to suppressing free speech.

The court also ruled that control was not a necessary element for the charges under the 1960 statute and rejected the argument that Storm had to be aware of specific criminal activities. Instead, the prosecution must only prove that Storm knew he was dealing with proceeds from a crime.

The judge dismissed arguments about due process, stating that Storm’s state of mind and intent were matters for the jury to decide.

Judge Failla further noted that Tornado Cash was not “meaningfully different” from traditional financial services and money-transmitting firms, thereby holding Storm accountable under existing laws.

The trial, expected to last two weeks, could set a precedent for how software developers are treated under US law when their technology is used for illicit purposes.

Semenov remains at large.

The post Judge rules Tornado Cash co-founder will face trial for money laundering appeared first on CoinJournal.