Der Tesla-CEO hat seine Plattform X genutzt, um darauf hinzuweisen, dass brasilianische Einwohner die richterliche Anordnung durch die Nutzung von VPNs umgehen können.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der Tesla-CEO hat seine Plattform X genutzt, um darauf hinzuweisen, dass brasilianische Einwohner die richterliche Anordnung durch die Nutzung von VPNs umgehen können.

Recent trends in the cryptocurrency exchange-traded funds (ETF) market have highlighted a significant divergence in the performance of Bitcoin and Ether ETFs.

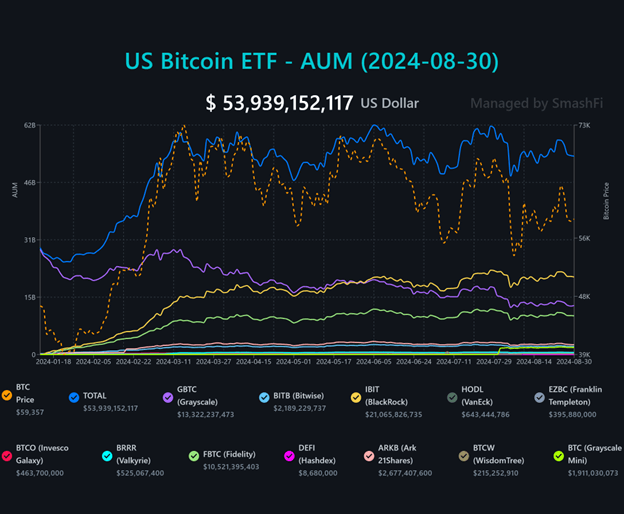

Comparing Bitcoin ETF Flow data to Ethereum ETF Flow data on Farside Investors, Ether spot ETFs have underwhelmed compared to their Bitcoin counterparts. Since their launch, Ether ETFs have experienced net outflows of approximately $500 million, a stark contrast to the $5 billion net inflows recorded by BTC ETFs during a similar period following their debut.

Several factors contribute to this disparity. To start with, Bitcoin’s “first mover advantage,” higher liquidity, and lack of staking opportunities in Ether ETFs have made Bitcoin more appealing to institutional investors.

Additionally, unexpected outflows from Grayscale’s Ethereum Trust (ETHE), amounting to $2.5 billion, far exceeding the bank’s initial $1 billion estimate, have further dampened Ether ETF performance. To counter these outflows, Grayscale introduced a mini-Ether ETF, but it has only managed to attract $200 million in inflows.

In contrast, BTC ETFs have shown resilience and robust performance with US-based BTC ETFs recording an impressive eight-day winning streak, with net inflows totalling $202 million led by BlackRock’s iShares Bitcoin Trust (IBIT).

On August 26 alone, IBIT attracted over $224 million in net inflows bringing its total Bitcoin holdings to over 350,000 BTC, solidifying its dominance in the market.

Competing funds such as those managed by Franklin Templeton and WisdomTree also saw positive inflows, while others, including Fidelity, Bitwise, and VanEck, reported negative flows. Notably, Grayscale’s Bitcoin Trust (GBTC) saw a decline in redemptions over the past two weeks, indicating stabilization in the market.

As investor confidence in Bitcoin ETFs grows, asset managers are increasingly exploring combined ETFs that offer exposure to both Bitcoin and Ethereum, reflecting the evolving dynamics of the cryptocurrency investment landscape.

The post Bitcoin ETFs outperform Ether ETFs as BlackRock’s IBIT leads peers appeared first on CoinJournal.

Der Kryptowährungsmarkt ist angesichts der jüngsten Entwicklungen in Aufruhr, während der native Token von Bitcoin Dogs, 0DOG, einen dramatischen Anstieg inmitten der steigenden Bitcoin-Nachfrage in den USA erlebt. Dieser bemerkenswerte Wertanstieg von 0DOG kommt nach dem Start des Liquiditätspools und einem Anstieg des Bitcoin-Interesses nach den Kommentaren des Vorsitzenden der Federal Reserve Jerome Powell.

Während die Bitcoin-Nachfrage auf dem breiten Markt weiterhin negativ ist, führt das Engagement des US-Sektors zu bedeutenden Verschiebungen sowohl bei Bitcoin Dogs als auch bei Bitcoin selbst.

Bitcoin Dogs (0DOG) hat kürzlich mit einem beeindruckenden Preisanstieg nach der Einführung seines mit Spannung erwarteten Liquiditätspools die Aufmerksamkeit auf sich gezogen.

Zunächst sah sich 0DOG einem Abwärtstrend gegenüber und fiel nach einem anfänglichen Anstieg am ersten Handelstag auf einen Tiefstand von 0,00603 $. Allerdings hat sich das Schicksal des Tokens mit dem Debüt des Liquiditätspools stark gewendet. Bei Redaktionsschluss wurde 0DOG bei 0,01646 $ gehandelt, nach einem Anstieg über 0,029 $ am 30. August 2024.

Der neu eingeführte Liquiditätspool, der einen anfänglichen APY von 405,56 % bietet, war ein wichtiger Katalysator für den Preisanstieg und weckte erhebliches Interesse der Anleger.

Die dynamische APY-Struktur des Liquiditätspools soll eine frühzeitige Teilnahme fördern und ihn zu einer lukrativen Gelegenheit für Anleger machen.

Bei einer anfänglichen Poolgröße von 50.000 $ wird der APY mit dem Wachstum des Pools sinken, was einen frühen Einstieg fördert, um die Rendite zu maximieren. Diese Struktur, kombiniert mit dem innovativen Ansatz von Bitcoin Dogs als weltweit erstem ICO auf dem Bitcoin BRC20-Token, sorgt für erhöhte Begeisterung bei den Anlegern.

Die Integration von 0DOG in den Telegram-Gaming-Sektor und die bevorstehende NFT-Sammlung stärken die Wachstumsaussichten weiter.

Diese strategischen Entwicklungen dürften eine bedeutende Nutzerbasis anziehen und durch den In-Game-Nutzen von NFTs einen Mehrwert bieten.

Während Bitcoin Dogs wieder Tritt fasst, hat die Nachfrage nach Bitcoin in den USA nach den Bemerkungen des Vorsitzenden der US-Notenbank Jerome Powell auf dem Symposium in Jackson Hole deutlich zugenommen.

Dieses gestiegene Interesse von US-Investoren wird durch den Anstieg der Coinbase Premium auf 0,11 % deutlich, was auf eine höhere lokale Nachfrage im Vergleich zu internationalen Börsen hindeutet. Der Indikator Inter-Exchange Flow Pulse (IFP) hat ebenfalls einen Aufschwung erlebt, was darauf hindeutet, dass BTC als Reaktion auf den Preisaufschlag und die gestiegene Nachfrage in US-Plattformen fließt.

Trotz dieses lokalen Aufschwungs bleibt das Wachstum der Bitcoin-Nachfrage insgesamt schleppend. Der Bitcoin-Preis kämpft damit, sich über 60.000 $ zu halten, was dazu führt, dass das Engagement der Anleger nicht von erheblichen Gewinnmitnahmen geprägt ist.

Die realisierten Gewinne von 536 Millionen $ sind bescheiden im Vergleich zu den Milliardenbeträgen, die bei früheren Marktspitzen erzielt wurden. Darüber hinaus ist das scheinbare 30-Tage-Wachstum der Bitcoin-Nachfrage von positiven 496.000 BTC im April auf negative 36.000 BTC gesunken, was einen allgemeinen Nachfragerückgang widerspiegelt.

Während Bitcoin Dogs (0DOG) von der kürzlichen Einführung des Liquiditätspools profitiert, ist das Interesse an Bitcoin in den USA gestiegen, während der breitere Markt ein gemischtes Bild aufweist.

Weitere Informationen über das relativ neue Projekt Bitcoin Dogs, dessen nativer Token derzeit auf MEXC, Gate.io und Unisat gehandelt werden kann, finden Sie auf der offiziellen Website des Projekts.

The post Bitcoin Dogs (0DOG) steigt; die Nachfrage nach Bitcoin (BTC) in den USA nimmt zu appeared first on BitcoinMag.de.

Das Upgrade wird die Cardano-Governance in den kommenden Monaten verändern und es ADA-Inhabern ermöglichen, sich an Abstimmungen zu beteiligen.

Die Bitcoin-Wale waren in letzter Zeit zunehmend aktiv und kauften immer mehr Krypto auf. Kleinere Händler verkaufen hingegen eher.