The cryptocurrency market is buzzing with excitement, and much of the focus is on three notable tokens: Solana (SOL), Dogecoin (DOGE), and the fast-emerging Rexus Finance (RXS). Whether you’re a seasoned investor or just starting out, these cryptocurrencies are worth watching as each shows potential to shape the next market cycle in its own way.

Solana’s Potential Breakout: Building Bullish Momentum

Solana (SOL) has been making waves with recent price movements that suggest a bullish trend is building. Currently trading at $151.06, Solana saw a retracement to $128, but the price has since bounced back, gaining 19.61% in the last 24 hours. This recovery is in line with market optimism and may signal an impending breakout. Analysts believe that as Solana respects its current support levels, it has the potential to break beyond the $151 mark and continue upward.

The combination of Solana’s low transaction costs, high speed, and growing developer ecosystem positions it as a strong contender for further growth in the crypto space.

Dogecoin’s Resurgence: A Meme Coin with Staying Power?

Dogecoin (DOGE), one of the most popular meme coins, appears to be making a comeback after a series of ups and downs. After hitting a resistance level of $0.10 in early 2024, DOGE reached a swing high of $0.22 before retracing back to $0.10. Now retesting this previous resistance as support, Dogecoin is showing signs of stability. If this support holds, DOGE may have the potential to recover from its recent 53.41% drop and initiate a more sustained rally.

While Dogecoin is often driven by social media hype, it continues to have a loyal following, and its ability to bounce back makes it a meme coin with staying power in the market.

Rexus Finance (RXS): The Rising Star with Real-World Utility

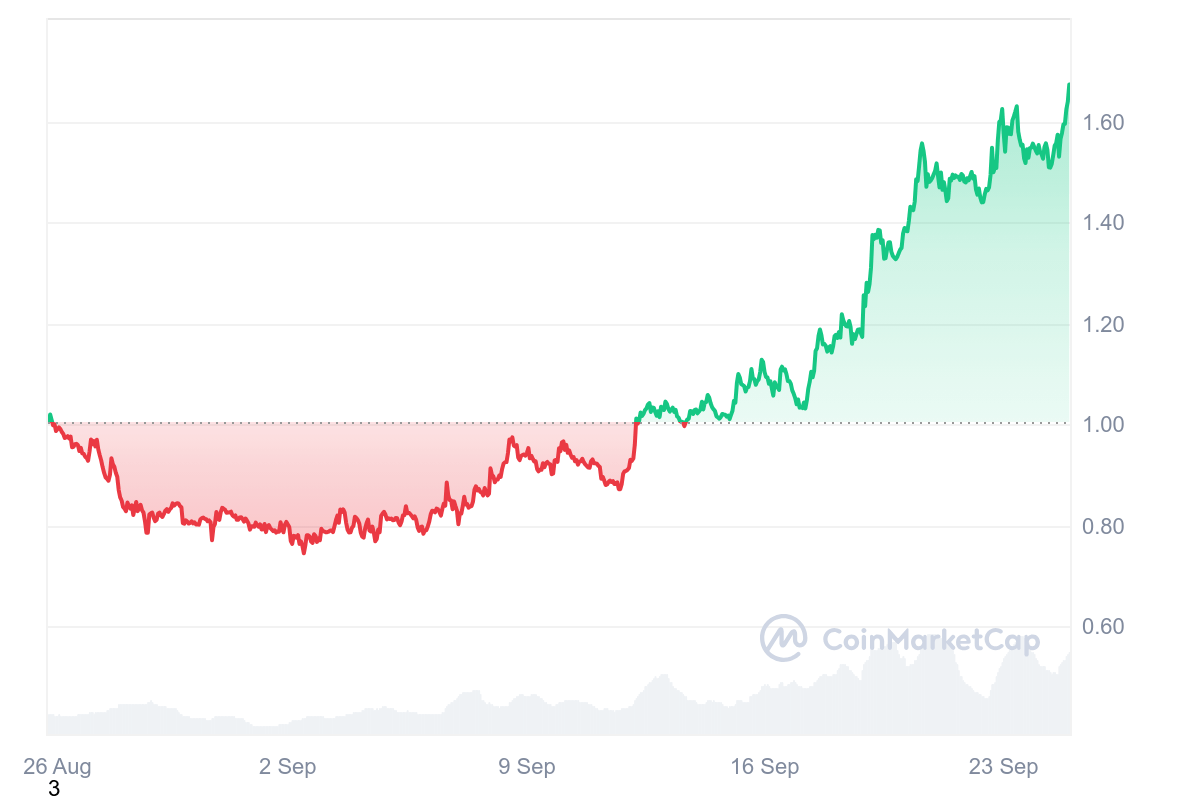

Rexus Finance (RXS) is quickly becoming the talk of the crypto community, and for good reason. Currently in Stage 2 of its presale, each RXS token is priced at just $0.05, but analysts believe that this token could see significant price growth, with projections as high as $10 in the future. This would represent a staggering 24,900% increase for early investors.

What sets Rexus Finance apart from other cryptocurrencies is its focus on real-world asset (RWA) tokenization. Through RXS, investors can purchase fractional ownership of assets such as real estate, making traditionally illiquid assets more accessible and tradable. Whether investing in a whole property or just a portion, Rexus Finance opens up opportunities for all types of investors to participate in a global market.

With over $1.39 million already raised in its presale, early investors are seeing returns of up to 40%, and the excitement continues to grow.

How to Participate in the Rexus Finance $1 Million Giveaway

To add to the excitement, Rexus Finance has launched a $1 million giveaway aimed at rewarding its early supporters. To participate, you simply need to:

- Buy RXS tokens during the presale.

- Engage on social media: Participate in Rexus Finance’s social platforms, such as Twitter, Telegram, and Discord, to increase your chances.

- Hold your tokens: Those who hold onto their RXS tokens during the presale period will be eligible for the giveaway.

With 20 lucky winners each receiving $50,000 USDT, this giveaway adds even more incentive to get involved with Rexus Finance early.

Conclusion: Three Cryptos, Many Opportunities

As Solana builds momentum for a potential breakout, Dogecoin attempts a resurgence, and Rexus Finance gains viral traction, the cryptocurrency landscape is full of opportunity. Each of these tokens has its own unique strengths: Solana’s scalability and speed, Dogecoin’s community-driven power, and Rexus Finance’s innovative real-world asset tokenization.

For those looking to maximize potential gains in the crypto market, Rexus Finance’s low entry price and focus on real-world utility make it a standout option. But whether you are a fan of Solana, a Dogecoin supporter, or intrigued by Rexus Finance, now may be the time to take note of these rising stars as the crypto world continues to evolve rapidly.

The post Crypto Market Updates: Solana’s Breakout, Dogecoin’s Comeback, & the Token That Could Soar to $10 appeared first on CoinJournal.