Frankreich bereitet die Umstellung auf MiCA vor und nimmt ab sofort die dafür nötigen Anträge von Krypto-Dienstleistern an.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Frankreich bereitet die Umstellung auf MiCA vor und nimmt ab sofort die dafür nötigen Anträge von Krypto-Dienstleistern an.

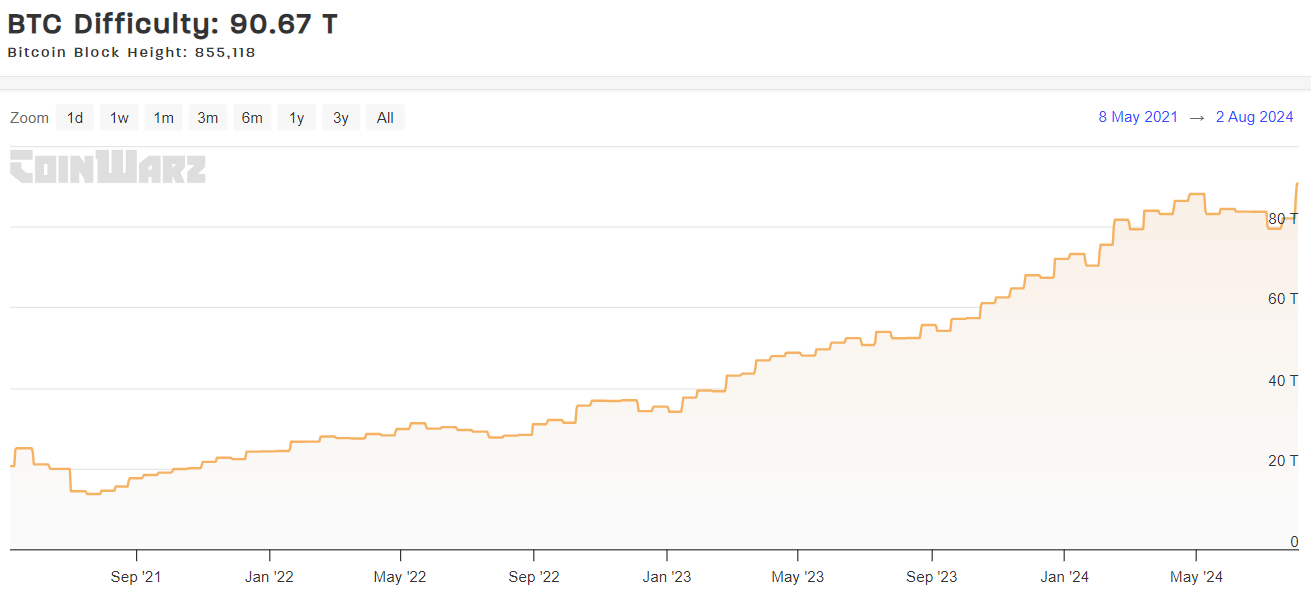

Bitcoin has set a new record for network difficulty, reaching 90.67 trillion on August 2, 2024 according to data on CoinWarz.

This milestone represents a significant rebound following three months of declining difficulty, signalling renewed confidence among miners in the cryptocurrency’s network.

The increased difficulty implies that mining new Bitcoin blocks now requires more computational power, potentially driving up operational costs and influencing Bitcoin’s future supply and pricing dynamics.

On July 27th, Bitcoin’s hashrate surged to a record 677 EH/s, reflecting a robust and secure network infrastructure. This peak suggests intensified competition among miners and strengthens the network’s resilience against potential security threats.

A high hashrate not only indicates increased mining activity but also has the potential to positively impact Bitcoin’s price by boosting investor confidence.

Currently, Bitcoin is trading at $63,103.42, showing a 0.17% increase over the past 24 hours. The cryptocurrency has been fluctuating between $62,248 and $65,593, suggesting a mild recovery trajectory despite recent volatility.

If this trend continues, Bitcoin may avoid the $62,000 resistance level, potentially paving the way for new highs.

However, the Relative Strength Index (RSI) for Bitcoin is at 44.64, indicating that the cryptocurrency is approaching oversold conditions.

A declining RSI points to diminishing bullish momentum, and if bearish forces intensify, Bitcoin might test its next support level at $58,000. Further declines could follow if market pressure persists.

Overall, Bitcoin’s rising network difficulty and hashrate highlight a strengthened and competitive mining environment. These factors are essential for evaluating the network’s health and security as Bitcoin navigates through ongoing price volatility.

The post Bitcoin network difficulty reaches record high amid price volatility appeared first on CoinJournal.

Over the past three days, Genesis Trading has moved approximately 32,256 BTC, valued at around $2.12 billion, and 256,775 ETH, worth about $838 million, to various addresses.

This substantial transfer of assets is seen as part of the company’s efforts to manage creditor repayments under its ongoing financial restructuring plan.

Genesis Trading has transferred 32,256 $BTC($2.12B) and 256,775 $ETH($838M) to multiple addresses in the past 3 days and may be undergoing bankruptcy proceedings to repay debts.

And #GenesisTrading transferred 13,291 $BTC($830.7M) to #Coinbase between Jun 12 and Jul 15, during… pic.twitter.com/EpLdn5PUJn

— Lookonchain (@lookonchain) August 2, 2024

The turmoil for Genesis began in November 2022 with the collapse of the FTX crypto exchange, which severely impacted the firm’s derivatives business.

Genesis halted withdrawals and filed for Chapter 11 bankruptcy protection in January 2023 due to substantial losses linked to the FTX debacle and the failure of Three Arrows Capital.

At that time, the company owed over $3.5 billion to its top creditors.

Amidst this challenging backdrop, Genesis has recently reached a court-approved settlement plan, aimed at returning $3 billion to its customers. This plan will cover approximately 77% of the total value of customer claims.

In the immediate aftermath of Genesis’s bankruptcy filing, claims were trading at only 35% of their value on claim trading platforms. However, current trading prices for claims are significantly higher, with claims over $10 million trading between 97-110% of their value and smaller claims trading between 74-94%.

Digital Currency Group (DCG), the parent company of Genesis, will not benefit from this settlement. The court has ruled that there is insufficient value in Genesis’s estate to provide DCG any recovery as an equity holder.

This decision was influenced by DCG’s failed attempt to cap customer claims at January 2023 cryptocurrency values, which would have allowed for full repayment to customers and potentially a recovery for DCG.

Additionally, DCG had assumed $1.1 billion of Genesis’s debt from the Three Arrows Capital collapse, but this obligation did not cover the losses.

The post Genesis Trading prepares to return $3B to customers, transfers 32,256 BTC appeared first on CoinJournal.

Futu Securities International, Hong Kong’s largest online broker, has introduced retail cryptocurrency trading in the city, marking a significant advancement in its financial services.

The brokerage firm, known for its extensive reach and innovative offerings, now allows residents to trade Bitcoin and Ethereum on its platform. This initiative comes after a partnership with HashKey Exchange, one of only two licensed cryptocurrency exchanges in Hong Kong.

The launch comes with enticing bonuses. New account holders who deposit HK$10,000 (approximately $1,280) for 60 days can receive either HK$600 worth of Bitcoin, a HK$400 supermarket voucher, or a share of Alibaba.

Those who deposit HK$80,000 are eligible for HK$1,000 in Bitcoin or a share of Nvidia, whose stock has surged by about 130% this year.

Additionally, Futu has waived commission fees for crypto trading starting August 1st, enhancing the appeal of their new service.

Futu is also pursuing a cryptocurrency exchange license for its new platform, PantherTrade, which currently operates under a ‘deemed to be licensed’ status.

PantherTrade is among 11 platforms in Hong Kong awaiting full approval from the Securities and Futures Commission (SFC).

Despite these advancements, Hong Kong’s aspiration to become a global crypto hub faces hurdles. The city has experienced the exit of major global trading platforms and low trading volumes for crypto ETFs.

Increased fraudulent activities, such as a recent scam involving counterfeit currency, have further complicated the situation.

In response, Hong Kong authorities are enhancing their regulatory measures and law enforcement capabilities to address these issues and boost investor confidence.

As Futu Securities deepens its presence in the cryptocurrency market, the success of its initiative will depend on balancing innovation with stringent oversight to ensure a secure trading environment.

The post Hong Kong’s largest online broker Futu Securities launches Bitcoin and Ethereum trading appeared first on CoinJournal.

Die ESMA gibt zu bedenken, dass globale Krypto-Unternehmen wegen der MiCA vermehrt auf Offshore-Dienstleister zurückgreifen und damit Regulierungsvorgaben umgehen könnten.