Bitstamp und Stripe gehen eine Zusammenarbeit ein, um die On-Ramp-Lösung des Krypto-Zahlungsdienstes in Europa ausbauen zu können.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Bitstamp und Stripe gehen eine Zusammenarbeit ein, um die On-Ramp-Lösung des Krypto-Zahlungsdienstes in Europa ausbauen zu können.

Avraham Eisenberg, der vermeintliche Betrüger im Fall Mango Markets, beharrt darauf, dass seine damaligen Handlungen völlig legal wären.

Die britische Finanzaufsicht will der heimischen Kryptobranche dabei helfen, besser ihre neuen Vorgaben für die Bewerbung von Krypto-Investitionen einhalten zu können.

As the markets stabilize, Solana has emerged as one of the top crypto gainers in Tuesday’s session. Meanwhile, one of the meme coins under the Solana network, Poodlana, has already raised over $5 million – 10 days ahead of its presale end. With its viral traction, it gives a one-of-a-kind opportunity for lovers of meme coins to earn heftily from modest investments.

Solana, the fifth largest cryptocurrency, extended its gains on Tuesday after the huge bearish wave that swept across markets at the beginning of the week. After dropping to a five-month low at $110.47 on Sunday, it rose back above the $150 mark on Tuesday.

As at the time of writing, it was trading at $152.12; equating to a 9.15% increase over a span of 24 hours. At the same time, its market cap and volume was at $70.9 billion and $ 5.5 billion respectively.

The close to 40% gain recorded over the past two days comes amid the heightened discussions regarding SOL ETF(exchange-traded fund). Granted, the natural recovery phenomenon across markets has also contributed to the rally.

With regards to the SOL ETF, there is heightened optimism that it will likely be the 3rd spot token availed to investors after BTC and ETH.

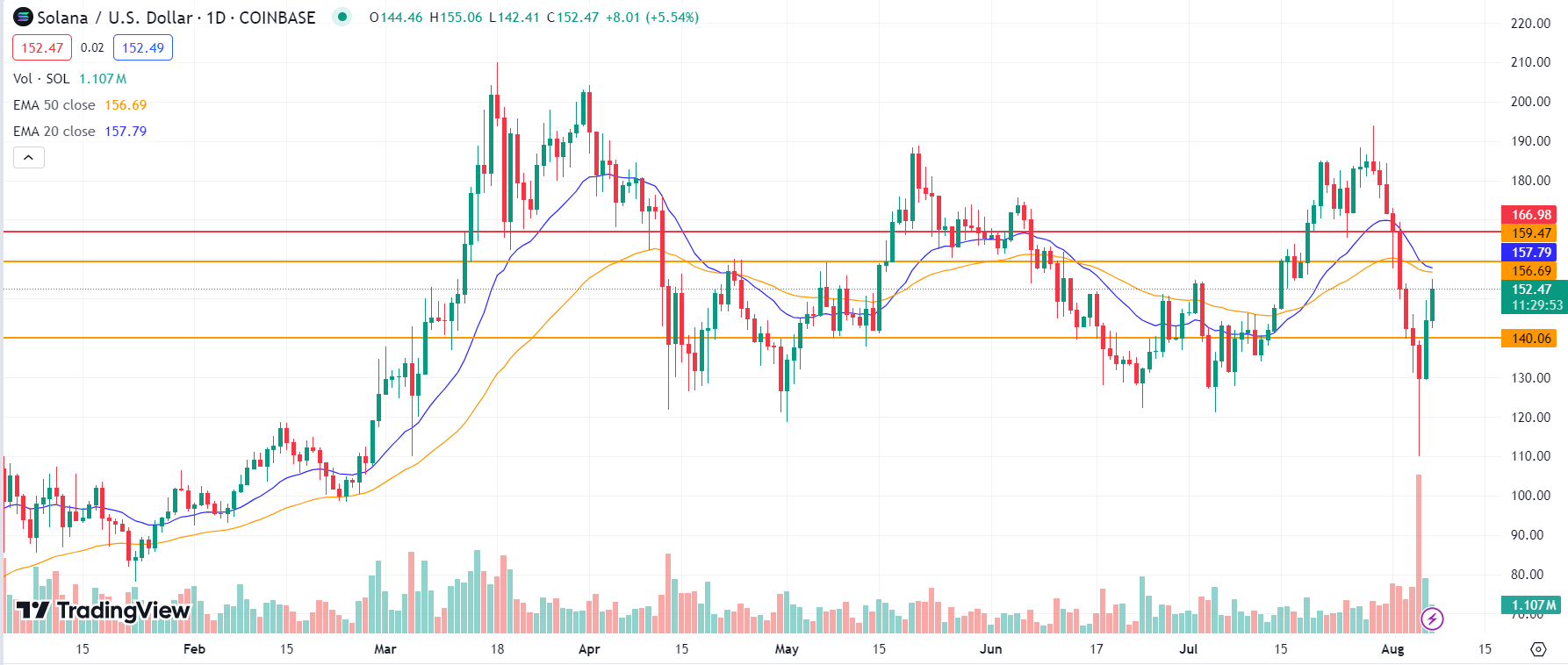

A look at the chart below shows SOL is not out of the woods yet. On the one hand, it formed a bullish hammer candlestick on Sunday. However, it is still trading below the 20 and 50-day EMAs.

As the markets stabilizes, the region of 140 will likely be a steady support level in the ensuing sessions. However, it will likely face substantial resistance around 159.47. As such, the crypto may remain within the aforementioned range in the short term. Success in breaking that barrier will then have the bulls eyeing the next resistance level of 170.05.

Increased interest in the SOL blockchain has seen meme coins within the network record substantial gains.In the past 24 hours, HahaYes, Ginnan The Cat, and YAWN have risen by 225.4%, 117.9%, and 170.2% respectively.

There are these meme coins, and then there is Poodlana, the “Hermes of Crypto”. POODL has captured the attention of the fashion-savvy populace and the constantly growing number of crypto enthusiasts. Seeing that the two industries are enormous sectors expected to continue growing, the poodle-themed meme coin might just be the biggest Solana listing yet.

At the moment, Shiba Inu and Dogecoin and the dominating dogs in the crypto market. However, the love for crypto and the fashion-centric poodle places POODL on the right path for dominance.

Since launching its presale on 17th July, this largely talked-about coin has raised $5.50 million. So heightened is the hype that in just 10 days after the launch of its presale, it raised over $3 million. The one-month presale is set to end on 16th August.

As indicated on the project’s website, the current price is $0.0458 and is expected to rise to $0.0499 in its next stage. At the set listing price of $0.060, there is a huge opportunity for investors to make big bucks before and once it goes live on the trading market.

Indeed, the meme coin market has a huge return potential despite the associated risks. Based on its viral traction, a modest investment on POODL can yield immense returns.

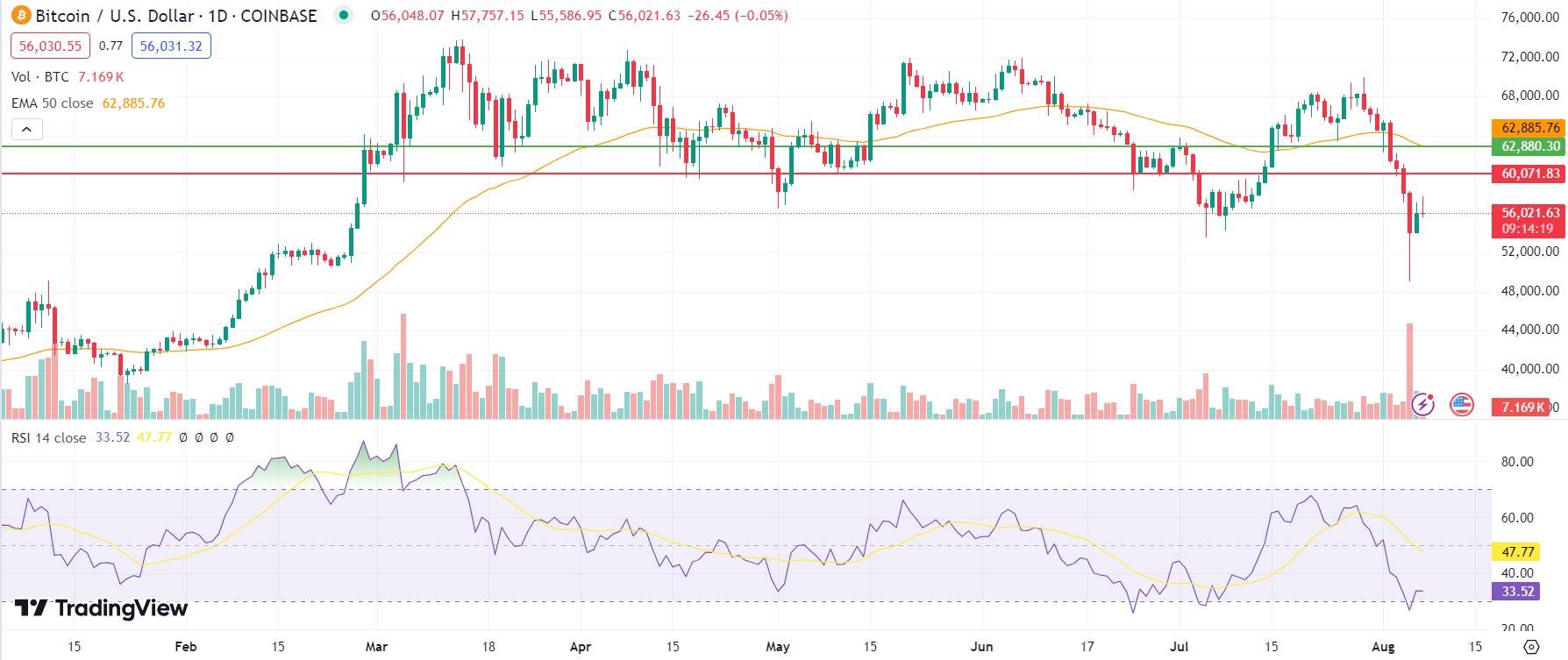

BTC dropped below the psychological level of $50,000 on 5th August for the first time since 14th February. While it has since recouped some of those losses, it lacks enough momentum to break the previously steady support zone of $57,500.

A look at the technicals shows the possibility of a dead cat bounce. With an RSI of 33, it will likely make temporary gains before embarking on a downtrend.

As the markets stabilize, it may gather enough momentum to push past the $60,000 mark. However, to reverse the current downtrend, it will need to move past the 50-day EMA at $62,880.

The post Crypto price prediction: Solana, Poodlana, Bitcoin appeared first on CoinJournal.

In a recent interview on Bloomberg Television, Michael Saylor, the Chairman of MicroStrategy, revealed he holds Bitcoin worth approximately $1 billion.

This makes him one of the most prominent BTC holders in the world, joining the ranks of figures such as Binance Founder Changpeng Zhao, the Winklevoss Twins, and Satoshi Nakamoto.

Saylor’s endorsement of Bitcoin as a capital investment asset is both passionate and unwavering. In his discussion with Bloomberg’s Sonali Basak on August 7, Saylor confirmed that he possesses a significant personal stack of Bitcoin, which he first disclosed four years ago.

At that time, he announced owning 17,732 BTC, a figure that has only grown since.

Some have asked how much #BTC I own. I personally #hodl 17,732 BTC which I bought at $9,882 each on average. I informed MicroStrategy of these holdings before the company decided to buy #bitcoin for itself.

— Michael Saylor⚡️ (@saylor) October 28, 2020

Despite the significant appreciation of Bitcoin’s value over the years, Saylor has not sold any of his holdings, continuously acquiring more of the cryptocurrency.

For Saylor, Bitcoin represents more than just a speculative investment. He describes it as a revolutionary financial tool, superior to both physical and traditional financial capital.

According to Saylor, Bitcoin is an unparalleled asset that offers generational wealth potential for individuals, families, corporations, and even countries. His commitment to Bitcoin is rooted in its perceived stability and security, as well as its ability to preserve value over time.

During the interview, Saylor emphasized his belief that “there is never a bad time to buy Bitcoin.” He likened Bitcoin to “cyber Manhattan,” suggesting that investing in it is akin to acquiring prime real estate in the most coveted location.

This analogy highlights his conviction that Bitcoin, as a scarce and desirable asset, will always hold significant value, regardless of market fluctuations.

Saylor’s investment philosophy extends beyond his personal holdings to his leadership of MicroStrategy. Under his guidance, the company has amassed a substantial Bitcoin reserve, totalling 226,500 BTC, valued at over $12 billion.

This massive investment represents a significant portion of the company’s balance sheet. MicroStrategy’s average cost per Bitcoin stands at approximately $37,000, and the company is set to execute a 10-to-1 stock split, which could further impact its financial structure and stock performance.

In addition to discussing his personal holdings, Saylor also addressed Bitcoin’s broader implications for corporate finance. He asserts that Bitcoin can “fix” corporate balance sheets by providing a secure and stable asset for long-term investment.

Saylor points to Bitcoin’s immense computational and electrical power, which he argues makes it “nation state resistant” and “nuclear-hardened.” He proudly notes that the Bitcoin network consumes more electricity than the United States Navy, a testament to its robust security and resilience.

However, Saylor’s enthusiasm for Bitcoin is not just limited to its investment potential. He views cryptocurrency as a groundbreaking technological advancement, with the power to reshape financial systems globally.

The post Michael Saylor’s bet on Bitcoin paying off, his BTC holdings now valued at $1B appeared first on CoinJournal.