Die täglichen Einnahmen von Bitcoin-Minern sind auf ein neues Jahrestief von 2,5 Millionen US-Dollar gefallen.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die täglichen Einnahmen von Bitcoin-Minern sind auf ein neues Jahrestief von 2,5 Millionen US-Dollar gefallen.

SUI’s bullish momentum has has boosted it to the day’s top gainer among cryptos as Bitcoin struggles to break the crucial zone of $60,000. Meanwhile, Poodlana has meme coin traders at the edge of their chairs with less than 100 hours to go before it hits the public shelves.

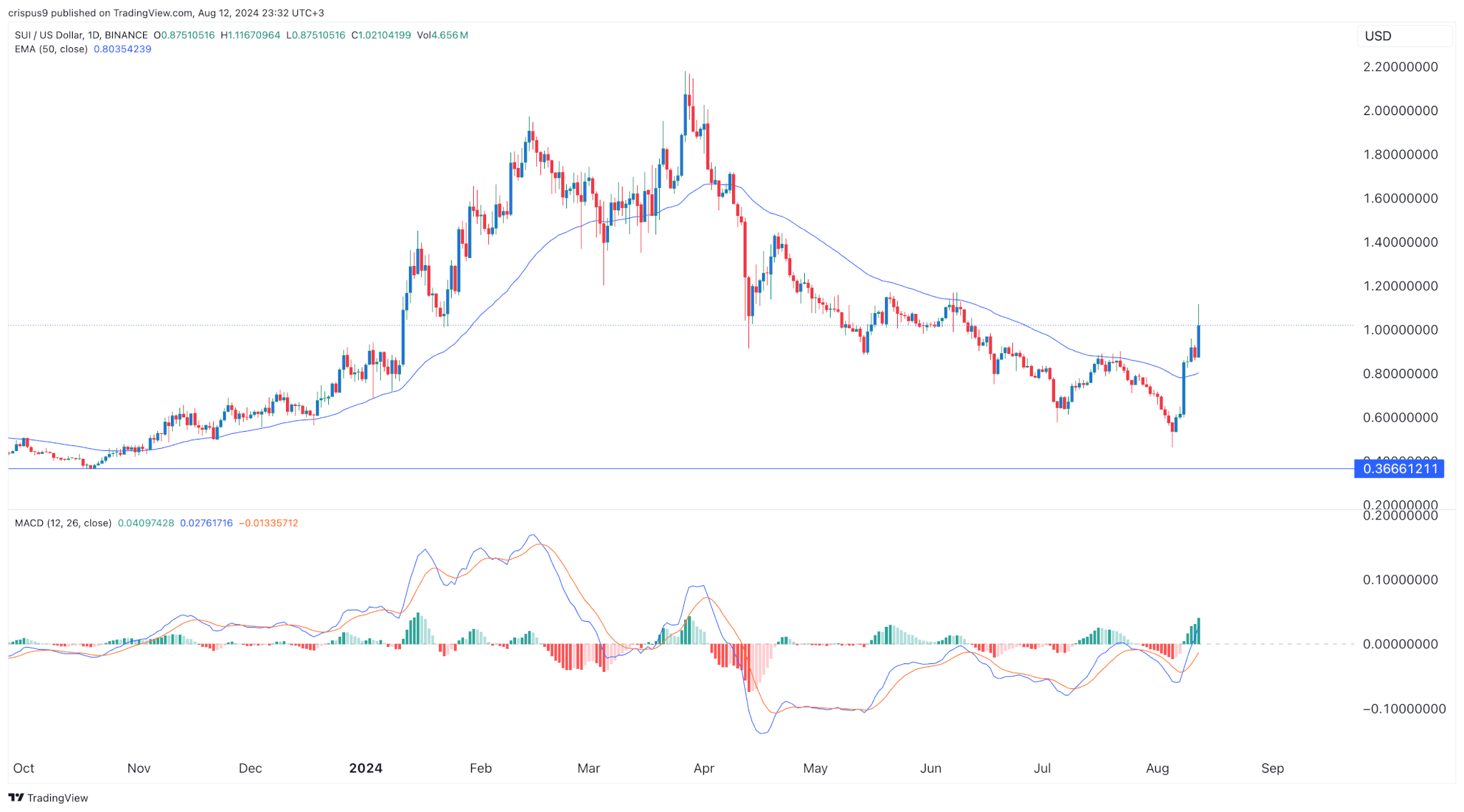

Among the trending cryptocurrencies in the new week is SUI. As at the time of writing, it was the top gainer among cryptocurrencies with its price up by 20.52% in the past 24 hours as indicated by CoinMarketCap. Notably, it has maintained this impressive momentum for days; having risen by 118.82% in the past 7 days.

Bull traders’ optimism has continued to boost the altcoin following Grayscale Investments’ announcement on 7th August. While launching two new investment trusts for Sui (SUI) and Bittensor (TAO) tokens, the firm’s head of product & research, Rayhaneh Sharif-Askary stated, “We are excited to add Bittensor and Sui to our product suite, and believe Bittensor is at the center of the growth of decentralized AI, while Sui is redefining the smart contract blockchain”.

A look at its daily price chart shows SUI above the 50-day EMA and an RSI of 68. Besides, it has risen past the descending channel; aspects that point to a strong bullish trend. In the short term, it will likely be range-bound between 1.1360 and 0.9710 as bulls gather enough momentum to retest June’s high at 1.1785. On the flipside, a pullback past the aforementioned support level may have it drop to 0.8858 before rallying further.

While SUI has been one of the trending cryptos in recent sessions, a greater hype lies in one of the newest projects – Poodlana. Indeed, with all the facts and excitement around it, it may end up being the biggest Solana listing of 2024; possibly even outperfoming Dogecoin.

With less than 100 hours to go before the presale ends, the project has already raised $6.76 million. In addition to the popularity of meme coins, POODL’s status has largely been boosted by its association with luxury. It is named after the Poodle; a dog breed associated with luxury fashion especially in Asia. Besides, it has packaged itself as The Hermes of Crypto.

Notably, Poodlana buyers are optimistic that it will continue on an uptrend once it starts trading an hour after the end of its presale. Granted, those buying at its current price of $0.0499 already have gains locked with the next stage price set for $0.0539. This means that with a modest investment of $150, you get 3,006 tokens. In the next 20 hours, that will equate to 2,782 tokens; a significant difference, right? You can learn more about Poodlana token here.

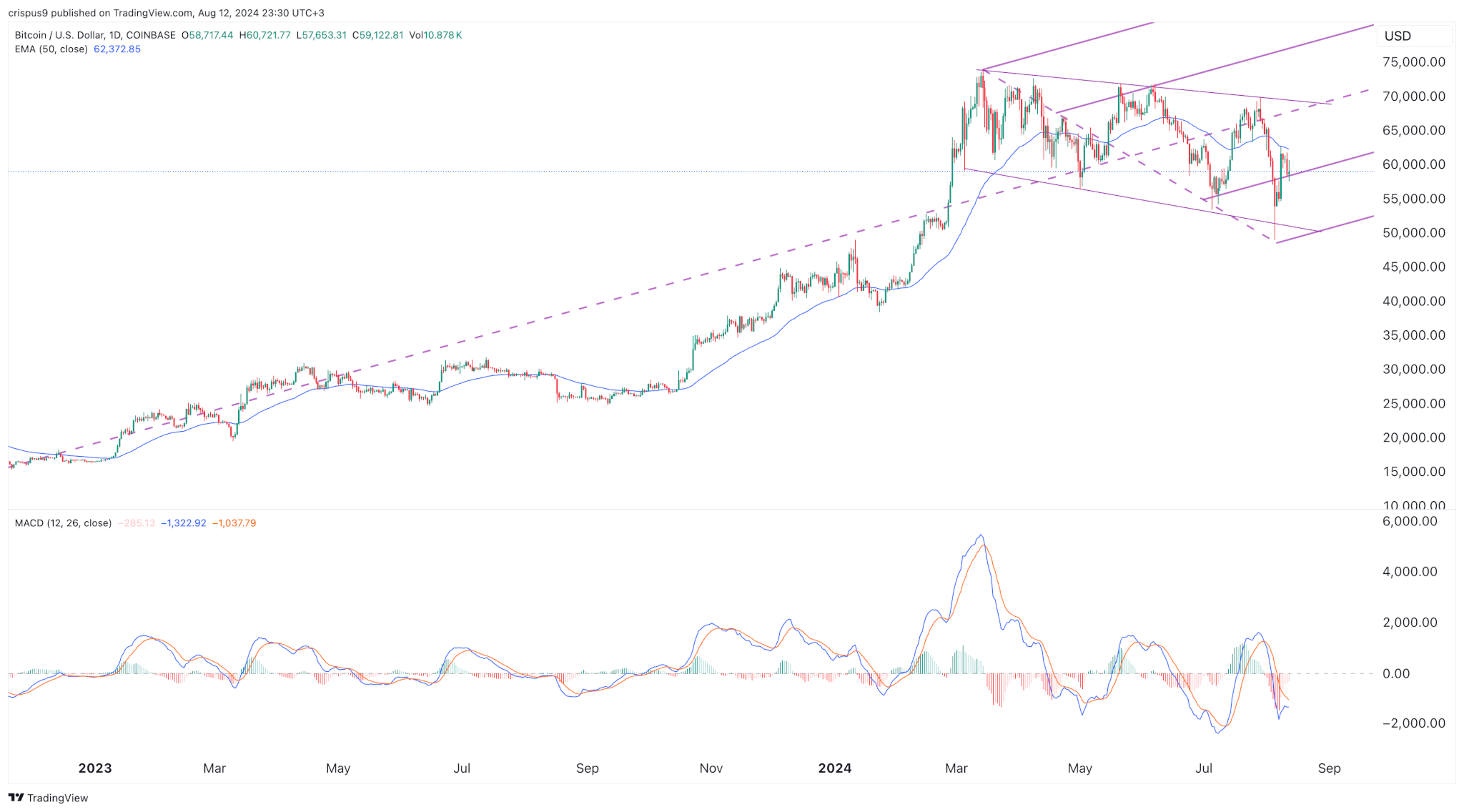

While the extreme fear experienced a week ago appears to have eased, the hesitance is still pulpable. As such, Bitcoin is struggling to break past the $60,000 zone in this week’s first trade session.

On a daily chart, it continues to trade below the 25 and 50-day EMAs. This substantiates last week’s outlook of a dead cat bounce. In the short term, the range between 57,121 and 61,925 is worth watching.

The post Crypto price prediction: Sui, Bitcoin, Poodlana appeared first on CoinJournal.

The world of gaming is no longer confined to traditional platforms and payment methods. The advent of cryptocurrencies has introduced a new dimension to gaming, particularly online betting, offering a range of benefits and challenges that are reshaping the industry.

As the integration of crypto into gaming platforms becomes more prevalent, whether its impact has been fully realised is a complex question, especially in regions like South Africa where online gambling is evolving but remains legally ambiguous.

Cryptocurrencies have made significant inroads into the gaming industry, offering both operators and players a range of benefits.

One of the primary advantages is speed. Transactions using cryptocurrencies are often processed within minutes, compared to traditional payment methods like bank transfers or PayPal, which can take several days. This immediacy enhances the gaming experience, particularly for online sports betting and casino games where quick access to funds is crucial.

Another notable advantage is privacy. Crypto transactions do not require users to disclose sensitive personal information, unlike conventional banking methods. This feature appeals to gamers who value anonymity and wish to avoid the scrutiny that can come with traditional financial transactions.

Additionally, the decentralized nature of cryptocurrencies eliminates the need for intermediaries, which can reduce transaction fees and costs.

Moreover, the volatility of cryptocurrencies presents both risks and opportunities. While price fluctuations can lead to significant gains or losses, savvy gamers might leverage these dynamics to their advantage. This element of investment adds an extra layer of excitement for those who understand the market.

In South Africa, the legal status of online betting and cryptocurrency usage is complex and somewhat ambiguous.

The National Gambling Act of 2004 regulates gambling activities in the country but does not explicitly address online betting on games in South Africa. This gap in legislation has led to a situation where online sports betting is legal, but online casinos and other forms of interactive gambling are technically illegal.

Despite the legal uncertainties, South Africa’s online sports betting industry has experienced significant growth.

In 2020, the market was valued at R3.27 billion, with nearly 50% of South Africans placing sports bets in the previous year. Rugby, cricket, and soccer are among the most popular sports for betting in the country.

By the end of 2024, South Africa’s online sports betting market is projected to hit a market volume of $394.80 million (R7.290 billion) according to data from Statista.

Cryptocurrency betting, however, remains a contentious issue. While it offers numerous benefits, including sizable welcome bonuses and enhanced privacy, it is currently prohibited under South African law.

The legal framework does not specifically address cryptocurrency gambling, leaving it in a grey area. South African punters are restricted from using digital currencies for betting, despite the growing global trend toward crypto adoption.

Globally, the integration of cryptocurrencies into online gaming and betting platforms is more advanced. Many international platforms accept Bitcoin, Ethereum, Litecoin, and other popular cryptocurrencies.

These platforms offer attractive incentives such as large welcome bonuses and fast transaction speeds, further driving the adoption of digital currencies in gaming.

However, the adoption of crypto in gaming is not without its challenges. Fees associated with cryptocurrency transactions, while generally lower than traditional methods, can still be a concern.

Additionally, the volatility of digital currencies can result in significant financial risk, making it essential for players to manage their investments carefully.

The lack of comprehensive regulatory frameworks in many regions also poses a challenge. In South Africa, the proposed Remote Gambling Bill aims to address some of these issues by potentially legalizing and regulating online gambling for real money.

However, as of now, this bill has not been enacted, leaving a gap in the regulation of crypto betting.

The impact of cryptocurrency on the gaming industry is evident, with numerous benefits driving its adoption. However, the full potential of crypto’s impact has yet to be realized, particularly in regions like South Africa where legal and regulatory uncertainties persist.

As global trends continue to evolve, we will likely see more jurisdictions embracing the integration of cryptocurrencies into online gaming.

For now, the intersection of crypto and gaming remains a dynamic and evolving landscape, with significant potential for future development.

The post Has crypto’s impact on gaming been truly realised yet? appeared first on CoinJournal.

In a landmark decision, the Lido Finance community has voted to integrate its stETH (Staked Ethereum) into the BNB Chain. This move, finalized on August 9 through an on-chain vote by the Lido decentralized autonomous organization (DAO), marks the first time Lido has connected to a layer-1 blockchain outside of the Ethereum ecosystem.

The approved integration will utilize Axelar and Wormhole as the canonical solutions to bridge stETH to the BNB Chain.

This significant development allows Lido’s total value locked (TVL) to interact with one of the top five chains by TVL, expanding its reach and utility in the decentralized finance (DeFi) sector.

Lido Finance remains a dominant player in the Ethereum staking market, holding a substantial 28.2% share of net ETH deposits.

Despite a slight dip earlier in the year, Lido’s position as a leading staking platform is reinforced by its extensive validator network, which reached one million in April 2024. This growth underscores the platform’s vital role in the DeFi ecosystem and its impact on staking services.

The DeFi landscape has seen significant contributions from liquid staking protocols like Lido. Unlike traditional staking, which locks funds for a set period, liquid staking enables users to earn yields while retaining the flexibility to move or trade their staked assets.

For Lido, this process involves depositing ETH to receive stETH, a token that accrues interest and can be redeemed at an approximate 1:1 ratio with the underlying asset.

According to DefiLlama data, Lido’s liquid staking protocol commands a remarkable $26.227 billion of the total $83.782 billion in the DeFi ecosystem, solidifying its position as the largest DeFi protocol. This integration into the BNB Chain is expected to further enhance Lido’s influence and operational scope within the DeFi space.

The post Lido Finance votes to integrate stETH into BNB Chain appeared first on CoinJournal.

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has announced the extension of its strategic partnership with the Dubai Multi Commodities Centre (DMCC). The collaboration has already seen significant achievements over the past year and its extension marks a new phase as Bybit transitions from a key ecosystem partner to an advisory role.

We are excited to announce the renewal of @dmcccrypto’s partnership with @Bybit_Official, a key ecosystem partner accelerating the development and mass adoption of the #crypto and #Web3 industries. This partnership will see major events and educational initiatives bringing… pic.twitter.com/AjCJ6DTWY7

— DMCC (@DMCCAuthority) July 31, 2024

The extended partnership will run from August 2024 to July 2025 and aims to further strengthen Dubai’s position as a global hub for cryptocurrency and Web3 innovation.

In its new capacity as a DMCC Ecosystem and Advisory Partner, Bybit will provide strategic guidance to the DMCC Crypto Center and its members.

Acknowledging the new advisory role, Chief Operating Officer at Bybit, Helen Liu, said that the company is honoured to be the first organization appointed to this advisory role by DMCC and that they are excited to leverage their expertise to drive innovation and support the growth of the industry in Dubai.

This shift underscores Bybit’s commitment to fostering the growth and development of the region’s crypto industry.

By leveraging its deep industry expertise, Bybit aims to shape the future of Dubai’s burgeoning Web3 sector.

To enhance Dubai’s standing as a leading global crypto hub, Bybit and DMCC have planned two major industry events this year.

A global hackathon will be organized to nurture innovation by supporting developers in building Web3 projects. Additionally, a flagship conference will bring together industry experts and key opinion leaders, positioning Dubai as a centre for thought leadership in the crypto space.

Over the past year, Bybit has played a crucial role in Dubai’s crypto ecosystem, actively supporting and advising over 20 startups.

Their initiatives included a $100,000 prize pool hackathon, a masterclass for aspiring entrepreneurs, and a high-profile side event at Token 2049. These efforts have helped numerous startups establish a foothold in Dubai’s dynamic crypto landscape.

The post Bybit and DMCC extend partnership to bolster Dubai’s crypto ecosystem appeared first on CoinJournal.