Es gibt jetzt 85.400 Bitcoin-Millionäre und damit mehr als doppelt so viele wie im Jahr 2023.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Es gibt jetzt 85.400 Bitcoin-Millionäre und damit mehr als doppelt so viele wie im Jahr 2023.

As the broader cryptocurrency market experiences a downturn, Bitcoin Dogs (0DOG) is not immune to the pullback. Despite an initial surge in price following its debut, 0DOG has seen its value drop by nearly 50%.

However, beneath the surface of this decline lies a narrative of resilience and potential, driven by strong trading volumes and a series of upcoming developments that could reignite investor interest.

The global cryptocurrency market has recently witnessed a decrease in overall value, with the total market cap now standing at $2.21 trillion, marking a 1.27% decrease over the last day.

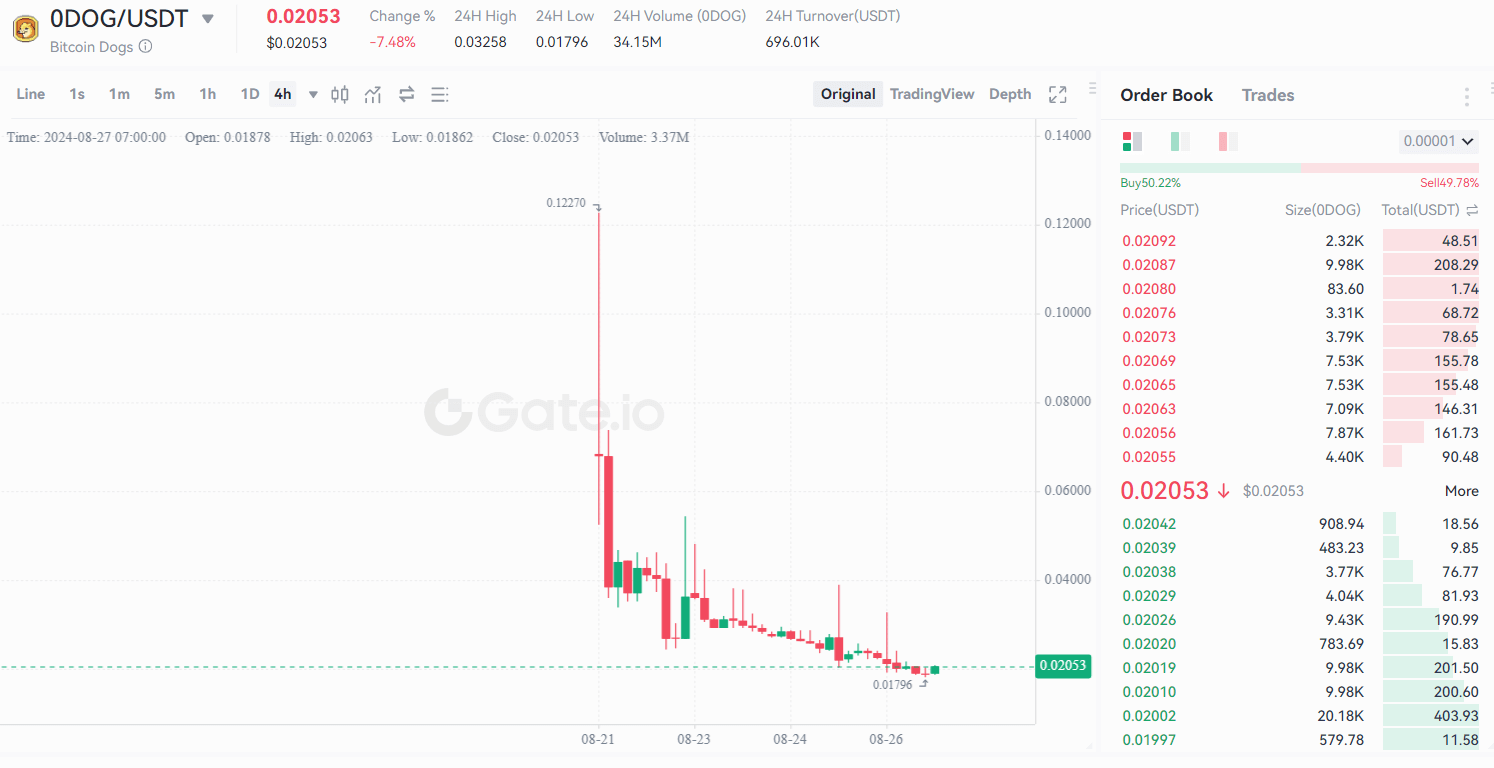

Major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB) have all seen their prices drop, reflecting a broader bearish sentiment. In this context, Bitcoin Dogs (0DOG) has also experienced a significant pullback, with its price dropping by approximately 49.24% from its listing price of $0.0404 to around $0.02053.

Despite this decline, 0DOG has shown some signs of strength. The token’s trading volume remains relatively high, standing at around $3.37 million, indicating that investor interest has not waned entirely. This level of trading activity suggests that there is still a strong base of holders who believe in the token’s long-term potential.

The initial surge in 0DOG’s price, where it climbed almost 3x to reach $0.12270, demonstrated the robust demand and technical support backing the token. While the price has cooled off, the resilience in trading volume points to a potential for recovery, especially as the broader market stabilizes.

While the current price drop might deter some investors, those looking at the bigger picture will find reasons for optimism. Bitcoin Dogs (0DOG) is not just another meme coin; it’s part of a broader crypto-gaming and social ecosystem that integrates with Bitcoin’s blockchain.

The token’s initial success can be attributed to its strong presale, which raised $13.5 million, and its listing on major exchanges like MEXC, Gate, and UniSat.

The tokenomics of 0DOG, with a supply of 900 million tokens, has been designed to benefit long-term holders, particularly with the planned developments on the horizon.

The upcoming months are crucial for 0DOG’s trajectory. The token is expected to benefit from anticipated bullish trends in Bitcoin’s price action, particularly in Q4 2024, when Bitcoin’s price is predicted to surge.

Additionally, the integration of Bitcoin Dogs into the Telegram gaming sector, coupled with unique features like Tamagotchi-style gameplay, PvP battles, staking opportunities, and NFT collections, is set to attract a significant user base.

These developments are likely to drive additional interest and investment in 0DOG, potentially pushing its price beyond its recent highs.

Moreover, the token claim process, which began on August 21, 2024, is set to run for ten months, with 10% of the total claimable tokens available each month. This gradual release of tokens is expected to create a controlled supply, potentially limiting excessive sell pressure and supporting the price.

If intrigued by Bitcoin Dogs (0DOG), you can visit the official Bitcoin Dogs website to learn more about the cryptocurrency. 0DOG is currently tradable on MEXC, Gate, and UniSat for those looking for where to trade the token.

The post Bitcoin Dogs (0DOG) pulls back as market loses steam, but there is a catch appeared first on CoinJournal.

Crypto exchange Bitpanda and trading platform CoinMENA have announced a strategic alliance aimed at bolstering the latter’s efficiency.

CoinMENA has operational licenses from the Central Bank of Bahrain and the Dubai Virtual Asset Regulatory Authority (VARA). The platform’s strategic partnership with Bitpanda also seeks to boost the Middle East & North Africa focused crypto entity’s suite of available digital assets products and services.

In a comment, CoinMENA co-founders Dina Sam’an and Talal Tabbaa note:

“We are excited to partner with Bitpanda Technology Solutions, an industry leader that shares our commitment to providing top-tier crypto asset trading services. This collaboration will not only enhance trading efficiency but also fulfill one of the most requested features from our users, enabling us to add new crypto assets more rapidly to meet market demands.”

Sam’an also commented on the partnership via a post on X on Aug. 26.

Thrilled to announce our strategic partnership with @Bitpanda_global! Together, we are enhancing trading efficiency and expanding our crypto asset offerings at @CoinMENA. This collaboration marks a significant step forward in our mission to provide users with the most reliable… pic.twitter.com/7nq2YwkFHM

— Dina Sam’an | دينا سمعان (@DinaSaman_) August 26, 2024

Bitpanda will act as a liquidity provider for CoinMENA, enhancing the exchange’s trading efficiency and user experience.

“The MENA region is one of the most ambitious and innovative regions in the world when it comes to crypto assets,” Bitpanda global head Nadeem Ladki, noted. “Bitpanda Technology Solutions provides institutions in the region access to one of the broadest ranges of crypto assets available, in a fully modular way, all with a highly regulated and trusted partner,” Ladki added.

Bitpanda recently partnered with UAE’s RAKBANK to expand the digital assets space in the UAE. The exchange has also joined forces with Coinmotion and struck a major deal with Serie A giants AC Milan.

The post Bitpanda partners with CoinMENA to boost crypto adoption appeared first on CoinJournal.

The US Securities and Exchange Commission has charged crypto platform Abra with the offer and sale of unregistered securities.

SEC’s charges filed against Plutus Lending LLC allege that Abra’s retail crypto lending product Abra Earn was offered to US investors. The platform began offering the product in July 2020 and at its peak had nearly $500 million of its $600 million in assets from investors in the US.

According to the SEC, Abra marketed its Earn product promising interest to investors and that the platform used investor funds on various income-generating activities. The effort also helped the company fund interest payments.

The SEC alleges therefore that Abra offered the Earn program as a security, violating the law by operating as an unregistered investment company for two years. Per SEC’s complaint, Abra initiated a halt of its Earn program in the US in June 2023.

“To settle the Commission’s charges, Abra, without admitting or denying the SEC’s allegations, has consented to an injunction prohibiting it from violating the registration provisions of the Securities Act and the Investment Company Act and requiring it to pay civil penalties in amounts to be determined by the court,” the SEC said in a press release.

Abra recently settled with 25 US states for operating in those jurisdictions with licenses. Notably also, the charges relating to Abra Earn are similar to those filed against Genesis and Gemini over the Gemini Earn program in January 2023. Genesis settled with the SEC earlier this year.

Meanwhile, news of SEC’s charges against Abra also come just days after a US judge ruled that the regulator’s lawsuit against Kraken can proceed. The SEC has cases against Binance, Coinbase and Consensys.

The post SEC charges Abra for offering unregistered crypto securities appeared first on CoinJournal.

Während zahlreiche Persönlichkeiten die Verhaftung kritisieren, betont Präsident Macron die Unabhängigkeit der Justiz und die Notwendigkeit, das Gesetz einzuhalten.