Mit Optionen könnten institutionelle Anleger Risiken reduzieren und Händler ihre Kaufkraft stärken.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Mit Optionen könnten institutionelle Anleger Risiken reduzieren und Händler ihre Kaufkraft stärken.

The Robinhood Wallet, a self-custody wallet app available on iOS and Android, has added support for Solana (SOL).

Robinhood announced the big news on August 27, providing a positive flip in Solana sentiment as prices hovered near $155. SOL price rose slightly on the news before retreating as the broader market struggled.

With support for SOL and Solana-based tokens, the wallet has added a new gateway to web3 for cryptocurrency’s fifth-largest asset by market cap. It’s also a huge boost for an ecosystem that has over $9.8 billion in total value locked and more than 1.99 million active addresses (24-hour count).

Robinhood Crypto general manager Johann Kerbrat commented on the wallet’s support for SOL and SLP tokens:

“Super excited to announce that the Solana network is now live on Robinhood Wallet! Starting today, you can self-custody Solana tokens and send + receive over the Solana blockchain.”

Robinhood 🤝 Solana

Just in: Robinhood Wallet has added support for Solana! https://t.co/Qxsu8mrVTE pic.twitter.com/7VumKVvCgT

— Solana (@solana) August 27, 2024

Robinhood’s self-custody wallet that allows users to hold their private keys and have full control over their assets, also supports many of the top cryptocurrencies. These include Bitcoin, Ethereum, Dogecoin, Arbitrum, and Polygon. The wallet also supports Optimism and Base tokens.

Several wallets – both browser-based and mobile app-based, support SOL and its ecosystem tokens.

Key integrations or features for these wallets include dApp connectivity, native staking and native swaps. Popular wallets are Phantom, Solflare and Torus, while hardware wallets such as Ledger and SafePal also support SOL.

The post Robinhood Wallet has added support for Solana appeared first on CoinJournal.

On August 27, 2024, Ethereum co-founder Vitalik Buterin sent 199.9 ETH worth over $517,000 to a multi-signature wallet. Details suggest a donation to ethos, a project that says its building an Ethereum mobile operating system.

While notable, this transfer pales in comparison to some of the largest whale movements seen in the past 24 hours.

Earlier in the day, Lookonchain pointed out a potential $49 million dump by a whale who had moved 19,000 ETH to Coinbase. The whale initially requested to transfer over 30,000 stETH – the staked ETH token, with this withdrawals amounting to over $78.67 million at the time.

A whale is selling 19,000 $ETH($49.17M)!

This whale requested a withdrawal of 30,007 $stETH($78.67M) 4 days ago and claimed 19,000 $ETH($49.17M) 30 minutes ago.

And the whale is depositing the 19,000 $ETH($49.17M) to #Coinbase to sell!https://t.co/bujNxac1Kf pic.twitter.com/ndB9Ow5hxM

— Lookonchain (@lookonchain) August 27, 2024

Lookonchain has also highlighted another whale who has exchanged more than 4,591 stETH for 4,589 ETH, taking a 2.3 ETH loss just to have the tokens available immediately for sale. On-chain data shows the whale address has deposited 5,145 ETH tokens to Binance. This deposit and potential sale was worth over $13.3 million at the time of the transfer.

But that’s not all. Two whales also sold 8,208 ETH worth over $21.5 million as the Ethereum price hovered at $2,630. According to on-chain analysis, the whales moved to dump their Ether for funds to repay debts on decentralized lending protocol Aave. The whales sold to “avoid being liquidated”, Lookonchain noted.

Whale dumping has also happened at a loss in the past 24 hours, with one large holder selling 5,088 ETH for $13.58 million. The whale made a loss of $3.66 million after having moved the coins off Binance in March and April this year, with the value of the holdings at around $17.24 million.

In total, whales have dumped over $96 million worth of ETH in the past 24 hours.

The price of Ethereum rose to highs of $2,808 on August 24, riding a bullish flip that also saw Bitcoin (BTC) break above $64,900.

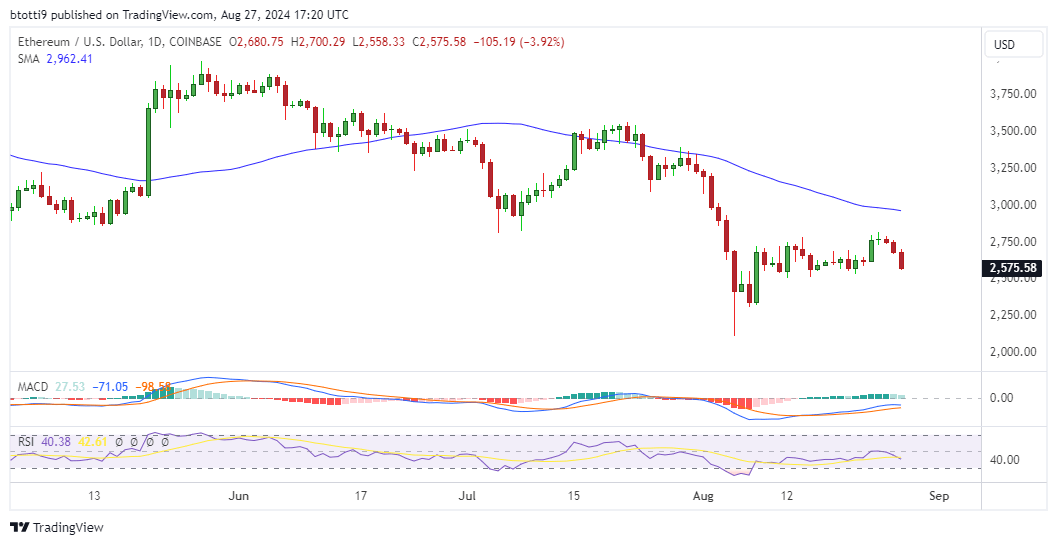

However, ETH has seen a downturn that currently has price hovering below $2,600. Indeed, the leading cryptocurrency fell to lows of $2,558 on Coinbase, with the RSI and MACD on the daily chart suggesting bears have the upper hand.

The post Ethereum falls below $2.6k as whales dump ETH appeared first on CoinJournal.

Große Investoren haben in den letzten Tagen massive Mengen an XRP verkauft. Diese Abverkäufe haben den Kurs deutlich nach unten gedrückt.

Ondo Finance has launched its market-leading permissionless yieldcoin, USDY, on the Arbitrum blockchain, marking a significant expansion of real-world assets (RWAs) within the decentralized finance (DeFi) ecosystem.

USDY, a tokenized US Treasuries product, is now accessible on Arbitrum, one of the largest and most vibrant DeFi platforms, further cementing Ondo’s role in bridging traditional finance with blockchain technology.

USDY offers a compelling 5.35% annual percentage yield (APY) and is specifically designed for non-US individual and institutional investors. It provides the stability of a dollar-denominated asset, combined with the yield potential of US Treasury Bills.

Following the integration, the USDY is now integrated into key Arbitrum DeFi protocols, including Camelot and Dolomite, enabling users to trade, lend, and earn yields in a secure, decentralized environment.

Arbitrum has quickly risen to prominence as a leading Layer 2 scaling solution for Ethereum, boasting over $15.5 billion in total value locked (TVL) and $4.5 billion in stablecoins. The integration of USDY into this ecosystem follows the Arbitrum DAO’s strategic decision to allocate 6 million ARB from its treasury into Ondo’s yieldcoin, making USDY a substantial 17% of the DAO’s total investment. It also comes on the heels of Arbitrum DAO’s approval of a proposal to boost ARB performance and treasury security.

USDY holders on Arbitrum can benefit from trading on Camelot, the platform’s largest decentralized exchange, and lending on Dolomite, a major money market protocol. The token’s price is supported by primary and secondary market feeds from Pyth, enhancing its usability across various DeFi applications.

With USDY’s launch, Ondo Finance continues to drive the adoption of RWAs on-chain, offering global investors a robust, compliant, and yield-generating asset within Arbitrum’s rapidly growing DeFi landscape.

The post Ondo Finance launches its permissionless yieldcoin USDY on Arbitrum appeared first on CoinJournal.