Der offizielle X-Account von ChatGPT verwendete dasselbe Schema wie US-Präsident Joe Biden in einem Post und machte sich über die allgemeine Intelligenz lustig.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der offizielle X-Account von ChatGPT verwendete dasselbe Schema wie US-Präsident Joe Biden in einem Post und machte sich über die allgemeine Intelligenz lustig.

The price of Avalanche (AVAX) continues to hover above $30 as the altcoin holds onto gains despite a broader crypto market dip in the past 24 hours.

On Monday, AVAX price traded around $31.93 at 10.30 am CET. The price remained double-digits up in 24 hours with bulls looking to hold above the key threshold following the spike from $26.73 on July 19.

On Sunday, US President Joe Biden announced his exit from the 2024 US election presidential race, endorsing his VP Kamala Harris. The immediate market reaction following the news was a slight dip in crypto prices as some panic hit.

Bitcoin, which had traded above $68k on the day, dropped to below $67,500 and Ethereum, Solana and other top altcoins pared gains.

Crypto market intelligence platform Santiment noted that the pattern seen late Sunday and early Monday morning mirrored the crypto market reaction in the hours after last week’s assassination attempt of former president Donald Trump.

“Though wildly different circumstances, the news of the Trump attempted assassination from 2 weeks ago caused a similar price pattern. Throughout the closing hours of Sunday, prices quickly bounced after an initial drop, and are now quite volatile to start the week,” Santiment wrote.

Given Biden has endorsed his VP and other top democrats have followed suit, its likely news related to Kamala Harris will be another trending topic that impacts crypto prices. A similar outlook will also continue to emerge around Trump, who is expected to speak at the Bitcoin 2024 conference in Nashville, Tennessee this weekend.

In this case, Santiment expects US politics to “continue to prove fragile correlations with speculation-driven cryptocurrency prices”.

Like many altcoins, Avalanche price has surged or dipped in tandem with market sentiment, news and Bitcoin’s performance.

Over the past four months, the cryptocurrency has benefited from positive network developments, particularly partnerships. However, price has also declined sharply on negative news, including the 10% dive that followed the recent incident involving Turkish crypto exchange BtcTurk.

The price of Avalanche dipped as the exchange reportedly lost AVAX tokens worth over $54 million from its hot wallets.

However, integration with Stripe and an announcement from MapleStory Universe had seen AVAX price surge significantly.

While gaming has picked up momentum on Avalanche, there’s new traction in the liquid staking space and the Avalanche blockchain could be set for take-off. The upcoming Avalanche Summit LATAM in Buenos Aires is also a big event in the horizon for Avalanche.

The post Avalanche holds above $30 despite politics-driven crypto dip appeared first on CoinJournal.

HKX cryptocurrency exchange, hi5 (Hong Kong) Limited, has announced its decision to cease operations in Hong Kong. This decision follows challenges in meeting the region’s stringent regulatory requirements.

The announcement was made on July 18, with the HKX management advising users to withdraw their assets promptly.

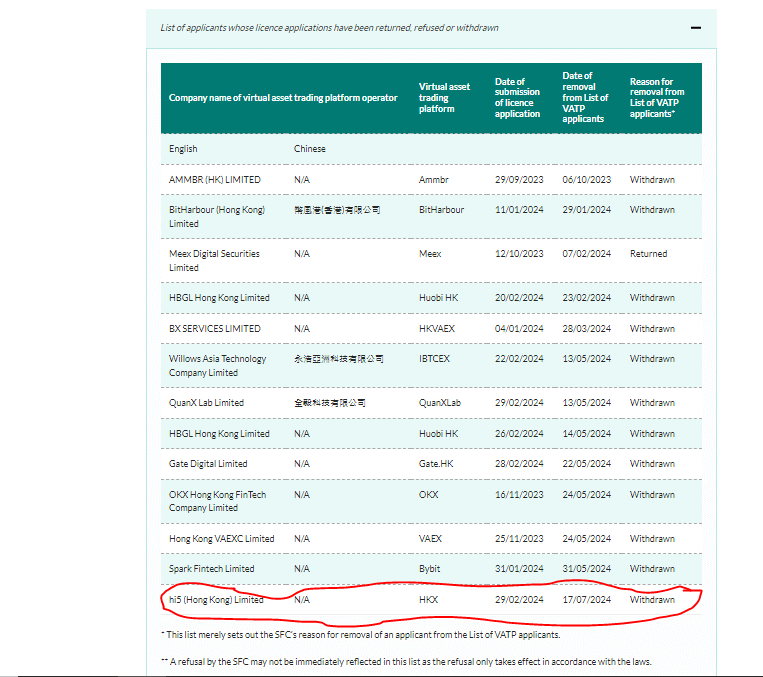

The Securities and Futures Commission (SFC) of Hong Kong has added HKX to its list of cryptocurrency exchanges that have withdrawn their license applications.

HKX had initially applied for the necessary licenses in February, seeking compliance with both the Securities and Futures Ordinance (Cap. 571) and the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615).

However, despite these efforts, HKX struggled to meet the regulatory standards set by Hong Kong authorities.

In a statement published on their official website, the HKX management elaborated on their decision stating: “We would like to inform you that our management team has, after careful consideration, decided to withdraw our application for the Type 1 and Type 7 licenses under the Securities and Futures Ordinance and the virtual asset service provider license under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance.”

HKX’s decision to exit the Hong Kong market is part of a broader trend. According to the information on the SFC website, a total of 13 cryptocurrency exchanges had either withdrawn their license applications or had their applications refused and returned by the SFC by July 22.

The increasing regulatory scrutiny and the high standards required for compliance have posed significant challenges for crypto exchanges operating in the region.

Gate.HK, another Hong Kong-based cryptocurrency exchange, had previously faced similar challenges. OKX also withdrew its VASP license application in May.

After failing to meet the local licensing requirements, Gate.HK withdrew its application but announced plans to overhaul its platform to align with regulatory standards. The exchange is currently focused on allowing withdrawals for its customers and aims to resume operations in the future, contributing to the virtual asset ecosystem once the necessary licenses are obtained.

In preparation for its shutdown, HKX had already halted new user registrations and suspended trading and deposit services on May 29. The company emphasized its commitment to assisting users with the safe withdrawal of their assets, ensuring a smooth transition during the winddown process.

However, there are no immediate plans for HKX to restart services or reapply for a license.

This wave of exits underscores the complex regulatory landscape in Hong Kong for cryptocurrency exchanges.

As the HKSFC continues to enforce stringent compliance measures, the future of cryptocurrency trading in the region remains uncertain, with only those able to meet these rigorous standards likely to continue operations.

The post HKX joins growing list of crypto exchanges exiting Hong Kong appeared first on CoinJournal.

US-Präsident Joe Biden hat seine Kandidatur um die US-Präsidentschaft zurückgezogen.

The unexpected withdrawal of US President Joe Biden from the 2024 presidential race has led to a significant crypto market volatility. Within 30 minutes of the announcement, $67 million in leveraged long positions were liquidated.

However, amidst this chaos, Poodlana, a new entrant in the meme coin market, has captured investor attention with its high-fashion branding and successful presale, raising nearly $2 million.

Joe Biden’s sudden exit from the 2024 presidential race sent shockwaves through the cryptocurrency market.

Between 5:30 pm and 6:00 pm UTC on July 21, the market saw $67 million worth of leveraged long positions liquidated, triggered by a 2.3% drop in Bitcoin’s price to $65,880.

This rapid decline was part of a broader 12-hour period that witnessed a total of $81.1 million and $53.4 million in long and short positions, respectively, being wiped out according to CoinGlass data.

Bitcoin and Ether were the most affected, with Bitcoin experiencing $43.8 million in liquidations and Ether $31.1 million.

The market reaction can be attributed to the uncertainty Biden’s withdrawal introduced. Markus Thielen, founder of cryptocurrency firm 10x Research, noted that Biden was seen as a weak candidate against Trump, and his exit left no credible alternative, leading to increased market volatility.

Interestingly, a massive buy order during this period helped Bitcoin recover swiftly, reaching a 24-hour high of $68,480 and causing traders with short positions to incur $34 million in losses.

Amid the market turmoil, Poodlana (POODL), branded as “The Hermès of Crypto,” has managed to attract substantial investor interest.

Launched at a price of $0.02, Poodlana’s token price has quickly risen to $0.023. The presale price is rising every 72 hours, raising the stakes for investors to invest early before the price rises.

At press time, Poodlana had raised an impressive $1,918,665.37 in less than a week since the launch of the presale.

The presale, scheduled to run for 30 days from July 17, has drawn attention due to its strategic positioning and high-fashion branding.

Unlike typical presales, Poodlana offers immediate token availability post-presale, aligning with its commitment to transparency and fairness.

The presale’s success is also fueled by the broader resurgence of meme coins. Investors have shown renewed interest in meme-based digital assets, with established tokens like Dogecoin (DOGE), Bonk (BONK), Pepe (PEPE), and dogwifhat (WIF) experiencing significant gains.

Over the past week, Dogecoin has seen a 16% increase, Bonk has seen a 25% increase, Pepe has seen a 25% increase, and dogwifhat has seen a 49% increase.

This trend underscores a growing appetite for meme coins, positioning Poodlana as a promising investment.

Poodlana plans to list on decentralized exchanges (DEX) like Raydium within 60 minutes of the presale’s conclusion on August 16, ensuring immediate visibility and liquidity.

The project also aims to launch a chic staking platform, offering attractive rewards for token holders.

Additionally, Poodlana has planned surprise airdrops and bonuses to celebrate key milestones, enhancing its appeal to investors.

The project emphasizes global outreach, particularly targeting Asia and international markets. Collaborations with top influencers, high-end fashion brands, and lifestyle platforms are in the pipeline to amplify its presence.

Poodlana’s strategic focus on creating an exclusive, high-fashion brand in the crypto space sets it apart from typical meme coins, attracting trendsetters and high-profile investors.

Notably Poodlana’s entrance into the crypto market coincides with an increased interest in meme coins as Solana based meme coins like Pooodlana carry the day.

Amidst the exacerbated crypto volatility following the withdrawal of by Joe Biden from the presidential race, Poodlana emerges as a beacon of opportunity for investors. Its successful presale, coupled with strategic branding and future plans, positions it well in the evolving meme coin market.

As Poodlana gears up for its first exchange listing and broader market integration, it represents compelling investment opportunity for fashion and crypto lovers.

If interested in purchasing Poodlana (POODL), visit the official website.

The post Market volatility post Joe Biden withdrawal wipes out $113M as investors flock to Poodlana appeared first on CoinJournal.