Die Mehrheit der Nutzer auf X stimmte für eine solche Integration.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Mehrheit der Nutzer auf X stimmte für eine solche Integration.

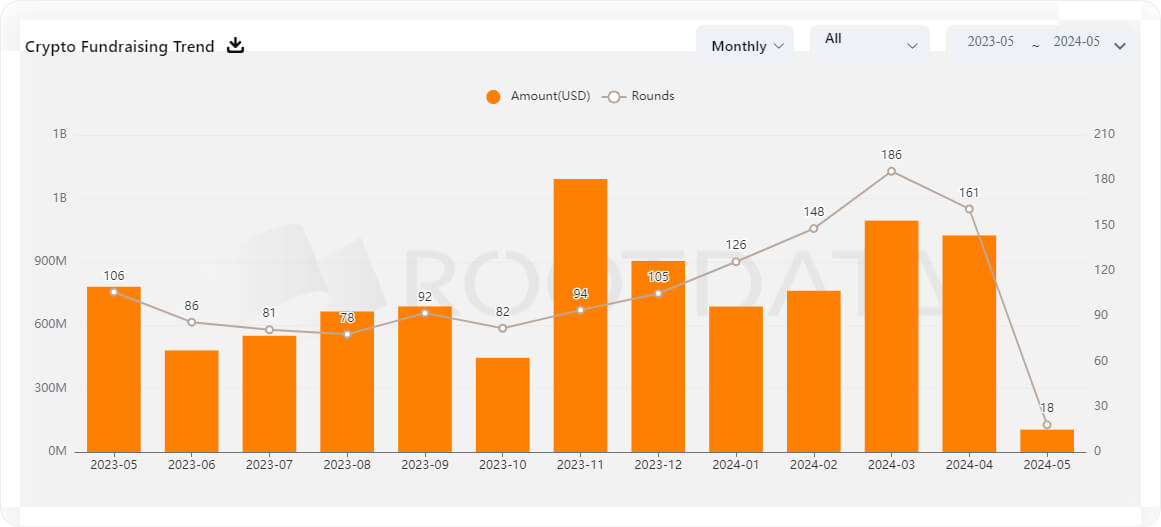

Venture capital funding across the cryptocurrency space surpassed the $1 billion mark in April, a feat that means the industry has now hit this milestone for two consecutive months.

According to details on Web3 asset data platform RootData, VC funding in April reached $1.02 billion. This represented amounts raised across 161 rounds.

While April’s total amount raised from venture capital investors did not match the $1.09 billion raised in March, it represents the third-highest mark in the past year. March saw 186 investment rounds, up from 148 in February when VC firms injected over $762 million into crypto projects.

Crypto VC funding year-to-date has seen over $3.67 billion, capturing investments across 639 rounds so far.

The details suggest this year could see VC participation in the crypto space surpass the previous year’s figures in both the amount invested and the total number of crypto projects. In 2023, crypto projects across infrastructure, DeFi, gaming and DAOs recorded over $9.3 billion.

Already, hitting the billion dollar mark for a second consecutive month suggests continued broader optimism from the investment community.

Animoca Brands, Polychain Capital, Paradigm, Coinbase Ventures, Pantera, Binance Labs, Dragonfly and NGC Ventures have been some of the most active players in the space so far this year. a16z also remains a top player in the space.

Among notable fundraises in April was the $47 million investment in real-world asset tokenization platform Securitize. Asset management giant BlackRock led the investment round. Coinbase Ventures and Pardigm backed layer-1 blockchain Monad’s $225 million round.

In terms of funding scale, the vast majority of projects (over 82%) have secured investments of between $1 million and $10 million. However, a total of 74 fundraising rounds have seen investments of more than $10 million.

Of these, nine Web3 startups have attracted more than $50 million each from top VC firms.

The post Crypto VC funding tops $1B for second consecutive month appeared first on CoinJournal.

Paolo Ardoino, Chief Technology Officer bei Bitfinex, erklärte, dass die Hackergruppe ein Lösegeld gefordert hätte, aber er „konnte keine Anfrage finden“.

Das umgekehrte Kopf-Schulter-Muster, das sich bildet, „würde Sinn machen“, wenn Bitcoin nicht „direkt durch“ 67.500 US-Dollar bricht, so ein Krypto-Händler.

Arthur Hayes ist überzeugt, dass es für Bitcoin in den kommenden Wochen und Monaten langsam zurück nach oben geht.