Tether hat seine Compliance-Bemühungen hervorgehoben, nachdem der CEO von Ripple sagte, dass die US-Regierung hinter USDT her sei.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Tether hat seine Compliance-Bemühungen hervorgehoben, nachdem der CEO von Ripple sagte, dass die US-Regierung hinter USDT her sei.

El Salvador war das erste Land, das Bitcoin im Jahr 2021 als gesetzliches Zahlungsmittel einführte und besitzt nun über 5.700 BTC.

Die Kryptobörse Coinbase erlitt einen „systemweiten“ Ausfall und man kann nicht mehr darauf zugreifen.

In a significant leadership transition within the crypto space, Antonio Juliano, the founder and long-time CEO of dYdX, has announced his decision to step down from his role.

After seven years of steering the decentralized exchange, Juliano is pivoting to the position of Chairman & President, handing over the reins to Ivo Crnkovic-Rubsamen, the former chief strategy officer of the exchange.

Juliano’s departure from the CEO position was revealed through a post on May 13, where he shared his intentions to shift his focus towards broader strategic initiatives within the company.

In his statement on X, Juliano expressed confidence in Crnkovic-Rubsamen’s capabilities, emphasizing his preparedness to lead dYdX into its next phase of growth.

Crnkovic-Rubsamen, a seasoned trader with a background in finance, has been an integral part of dYdX since 2022, bringing a wealth of experience to his new role.

Reflecting on his decision, Juliano highlighted his belief in nurturing leadership within the organization, stating, “As I realized I did not need to be CEO, I worked to shepherd other leaders at the company on their own leadership journeys, until one of them was ready to run the company himself.” This move underscores Juliano’s commitment to fostering talent within dYdX and ensuring a smooth transition of leadership.

Despite stepping down as CEO, Juliano’s future plans remain uncertain. He hinted at exploring new opportunities but admitted to having no concrete plans for his next career move.

Before founding dYdX, Juliano held positions as a software engineer at notable tech companies such as Coinbase, Uber, and MongoDB, indicating a diverse background that could lead him in various directions.

The leadership transition comes at a pivotal moment for dYdX, as the decentralized exchange experiences a surge in activity amid a broader rebound in the crypto markets.

Data from DefiLlama reveals impressive metrics for dYdX, with a market capitalization exceeding $1.1 billion and over $465 million in total value locked. Furthermore, the exchange’s annualized revenue stands at $35.4 million, underscoring its financial viability and market relevance.

Recent developments within the dYdX ecosystem, including the launch of its layer-1 blockchain in October 2023 and the v4 upgrade in January, have fueled heightened trading activity. These advancements, coupled with the innovative use of the DYDX token for network transactions, have positioned dYdX as a leading player in the decentralized finance (DeFi) space.

As Ivo Crnkovic-Rubsamen assumes the role of CEO, he inherits a thriving platform poised for further expansion and innovation.

With Juliano’s continued involvement as Chairman & President, dYdX remains well-positioned to navigate the evolving landscape of decentralized finance and capitalize on emerging opportunities in the crypto space.

The post dYdX founder Antonio Juliano steps down as CEO appeared first on CoinJournal.

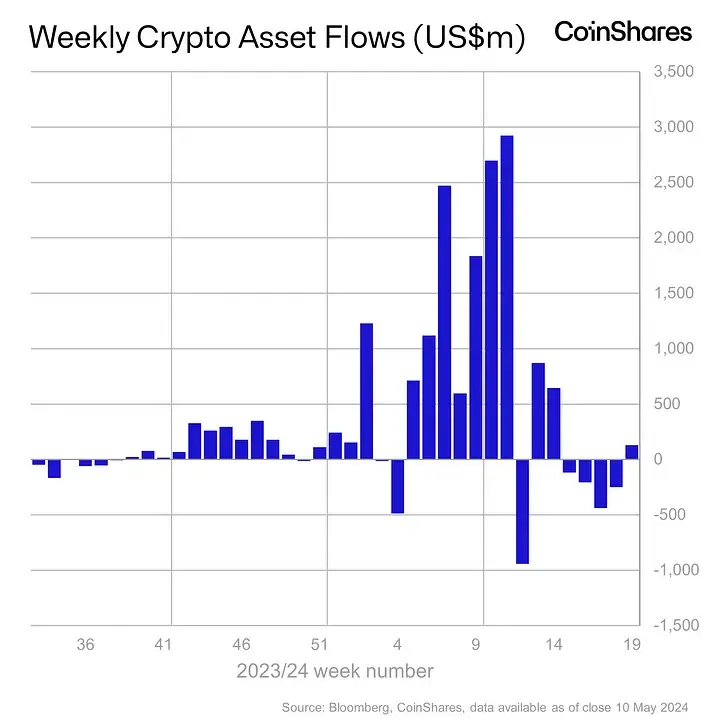

As Bitcoin shows fresh resilience above $62,000, latest market data reveals that digital asset investment products recorded inflows for the first time in over a month last week.

On Monday, digital assets manager CoinShares published its weekly report on crypto investment products.

The details showed the industry saw $130 million in inflows for the week ending May 10. It’s the first time the metric reads positive since the first week of April – a run of four weeks of outflows.

Notably, Bitcoin saw inflows of $144 million, while short-Bitcoin ETPs recorded outflows of $5.1 million.

The majority of the inflows were seen in the US, with $135 million. Hong Kong saw $19 million in inflows. Elsewhere, Canada and Germany recorded outflows of $20 million and $15 million respectively.

While the week saw inflows overall, CoinShares’s head of research James Butterfill wrote in the company blog that ETP volumes have continued to decline.

For instance, the market saw ETP volumes of $8 billion last week, while it averaged $17 billion in April.

“These volumes highlight ETP investors are participating less in the crypto ecosystem at present, representing 22% of total volumes on global trusted exchanges relative to 31% last month,” Butterfill noted.

The post Crypto investment products see first inflows in over a month appeared first on CoinJournal.