- Ether.Fi price rose 10% as altcoins looked to rebound, hitting highs of $5.35 amid latest upside momentum.

- ETHFI could target $10 if bullish sentiment prevails.

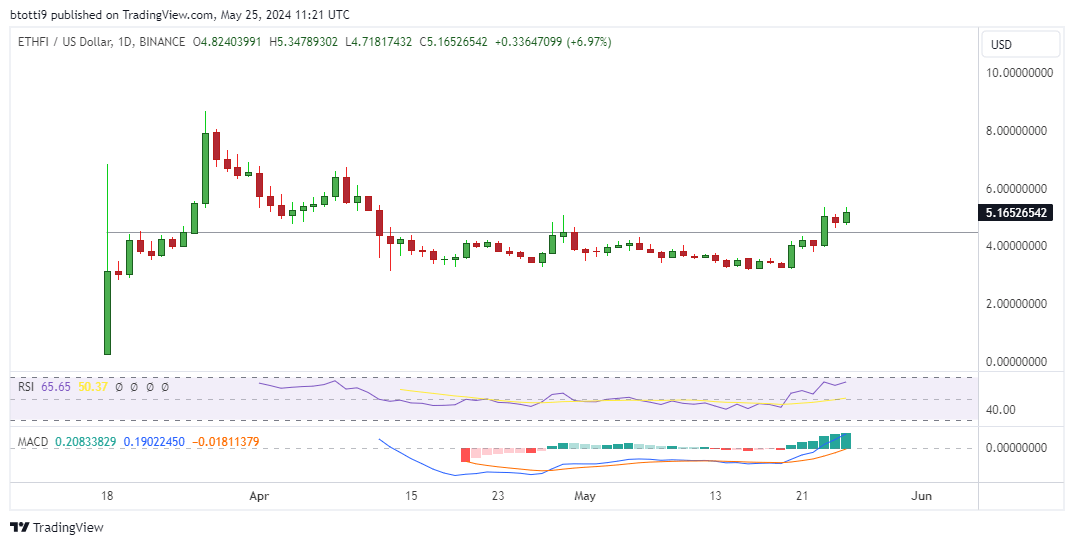

Ether.Fi price rose 10% to reach highs of $5.35, a seven-week peak for the Ethereum liquid restaking platform’s native token ETHFI.

Importantly, Ether.Fi price at current levels sees it trade above a crucial support-turned resistance area.

With prices up 47% this past week, can bulls strengthen to push to $10? The last breakout above $5 saw ETHFI rally to its all-time high of $8.53 on March 27.

Ether.Fi introduces ether.fi Cash

On May 24, the Ether.Fi team announced the launch of ether.fi Cash, a mobile wallet and Visa credit card that allows users to save, spend or invest with their ether.fi assets.

Cash allows users to borrow or settle everyday transactions with USDC. Users can also pay off balances using their stake and liquid rewards.

“Cash is the third in our Trilogy of products — ether.fi Stake, ether.fi Liquid, and ether.fi Cash. Combined these integrated products help users save, invest and spend their crypto, making it so that users never have to offramp again,” the protocol noted in an announcement.

ETHFI price surges past $5

Data from CoinGecko shows that ETHFI price soared alongside major altcoins as Ethereum spiked earlier in the week. The ETH price reacted sharply to news of an impending spot ETF approval, reaching highs of $3,900.

The upside momentum also impacted ecosystem tokens, with ETHFI bouncing from lows of $3.23.

Read more: Ether.Fi (ETHFI) token dumps after trading debut

Although price faced an initial rejection at the horizontal resistance line, a retest of the area saw bulls break higher to hit $5.35 on May 23.

The Relative Strength Index (RSI) on the daily chart is at 66 to suggest the upper hand is with the buyers. Also, the MACD indicator is strengthening above the signal line to reflect an overall bullish outlook for ETHFI.

If bulls flip the key resistance zone into a robust support area, a surge to $6.14 could see them aim for the ATH.

The post Ether.Fi price breaks above key resistance, is $10 next? appeared first on CoinJournal.