- BlackRock’s spot Bitcoin ETF (IBIT) is near $20 billion in assets, currently in top 3% among all ETFs.

- IBIT and FBTC have recorded 59 days of inflows – a streak that puts the two among top 20 ETFs.

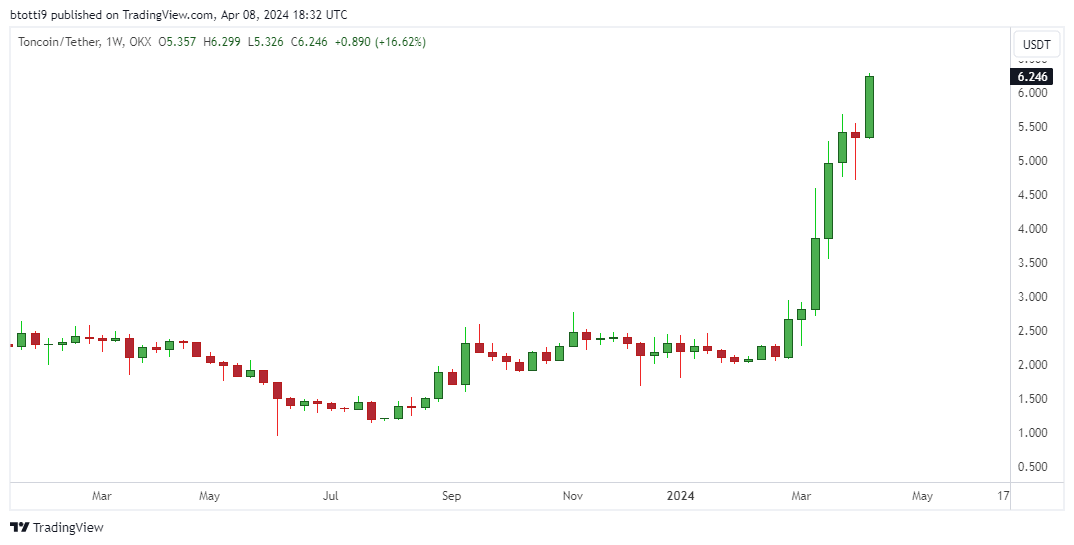

- Meanwhile, Bitcoin price could hit a new all-time high amid spot ETF and halving sentiment.

BlackRock’s spot Bitcoin ETF (IBIT) continues to outshine peers as inflows surge.

Data also shows that IBIT is not just in the top 20 in terms of longest consecutive streak of inflows, but its also climbing the ranks for total assets.

Bloomberg ETF analyst Eric Balchunas shared these details on Monday. He noted that BlackRock’s spot Bitcoin ETF has inched to within the top 3% among all ETFs for total assets held.

According to the analyst, IBIT is closer to hitting the $20 billion mark in assets, a feat that could coincide with a new all-time high for Bitcoin.

BlackRock’s IBIT leads peers

BlackRock, the world’s leading asset manager recently updated its list of Authorised Participants (APs) to include banking and investment giants Goldman Sachs, Citigroup, Citadel and UBS among others.

As at the time of his post on X, IBIT assets under management totaled $18.96 billion and ranked 88th overall.

It means the new spot Bitcoin ETF currently sits above some of the oldest ETFs in the market. Those IBIT has surpassed include the iShares MSCI Emerging Markets ETF (EEM), the VanEck Semiconductor ETF (SMH), the iShares MSCI Japan ETF (EWJ), and the iShares TIPS Bond ETF (TIP).

$IBIT is nearing $20b in assets, curr 88th spot among all ETFs, which puts it in Top 3%. It just passed a bunch of veterans incl $EEM, $EWJ, $SMH and $TIP pic.twitter.com/IgmuHpFlKb

— Eric Balchunas (@EricBalchunas) April 8, 2024

Earlier in the day, Balchunas had noted that BlackRock’s IBIT and Fidelity’s FBTC ETFs “have now taken cash for 59 straight days.”

That means the two ETFs are trending in the top 20 all-time charts, the hot streak putting these ETFs in a league of their own compared to other newly launched ETFs or those on an active streak.

MOVIN ON UP: $IBIT and $FBTC have now taken cash for 59 straight days and are now in the Top 20 all-time. (That said they in league of own when it comes to active streaks or streaks for newborns) via @thetrinianalyst pic.twitter.com/3cdYorXjOT

— Eric Balchunas (@EricBalchunas) April 8, 2024

Bitcoin price eyeing new all-time high

The ongoing pace for spot Bitcoin ETFs, which the US Securities and Exchange Commission (SEC) approved in January this year, has helped push Bitcoin price higher.

On Monday, BTC rose to above $72,600. Although its trading around $71,900 at the time of writing, bullish sentiment could see the benchmark crypto hit a new all-time above the peak reached in mid-March.

According to data from CoinGecko, Bitcoin’s current all-time high of $73,737 was reached on March 14, 2024. Analysts predict a post-halving explosion for Bitcoin price.

The post BlackRock’s IBIT nears $20 billion in assets as Bitcoin eyes new ATH appeared first on CoinJournal.