- At press time, Bitcoin trades at $67,260 marking a 3.57% rise over the past day.

- Bitcoin transaction volumes remain subdued despite the resurging BTC value.

- Bitcoin Dogs await token claiming and exchange listing with bated breath.

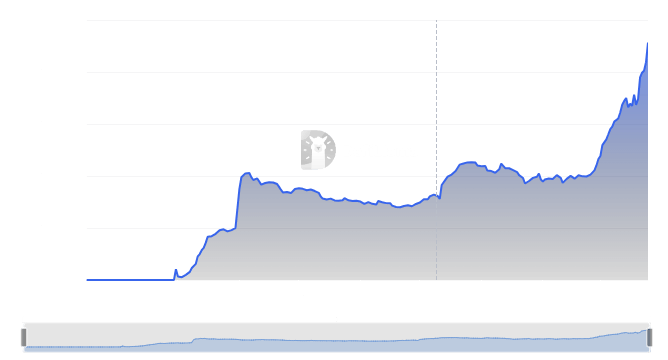

Bitcoin (BTC) has surged back into the spotlight, with its price hitting a high of $67,744 in the past 24 hours.

This surge in value comes just in time for the much-anticipated exchange listing of 0DOG, the native token of Bitcoin Dogs.

BTC price moves out of consolidation

The recent Bitcoin price surge comes after a period of consolidation and uncertainty in the cryptocurrency markets that followed Bitcoin’s ascent to its new ATH of $73,750.07 11 days ago.

Analysts attribute Bitcoin’s recent price surge to several key factors. One significant factor is the growing interest from institutional investors and Wall Street in spot Bitcoin ETFs listed on Nasdaq. This influx of institutional capital into the cryptocurrency markets has contributed to the upward momentum of Bitcoin’s price.

Furthermore, the concentration of trading volume within these ETFs has led to a surge in Bitcoin’s value.

However, despite the soaring price, on-chain transaction volumes in terms of US dollars remain subdued compared to the levels witnessed during the bull market of 2021. This discrepancy suggests a prevailing sentiment among investors to hold onto their Bitcoin, anticipating further price appreciation.

In addition, even with Bitcoin hitting a record high of $73,750, there is a noticeable decline in economic transactions on its blockchain.

Analysts from Blockware Solutions highlight a discrepancy between the soaring price and the muted on-chain dollar volume. Current data shows average transfer volumes to be under $200,000, a stark contrast to the 2021 bull market where figures exceeded $1 million.

However, Blockware Solutions analysts further speculate that a significant Bitcoin price movement will precipitate an increase in on-chain volume as seasoned Bitcoin holders may begin moving assets to exchanges for sale.

The data also shows a growing portion of Bitcoin that has remained inactive for 3 to 4 years, reflecting the confidence of long-term investors. Projections from experts suggest that Bitcoin’s price could ascend to six figures in the near term. For instance, Standard Chartered projects that it will breach $150,000 in 2024.

Bitcoin Dogs: investors await exchange listings

As Bitcoin jumps back into the limelight, Bitcoin Dogs, a Bitcoin-based dog-themed project, has garnered significant attention in the recent past with its unique platform where dog lovers and crypto enthusiasts come together to trade, collect, and engage in various activities within the Dogeverse.

Central to the Bitcoin Dogs ecosystem is its native token, 0DOG. This token serves as a utility and governance token within the platform, allowing users to participate in various activities such as trading, staking, and governance decisions.

Additionally, Bitcoin Dogs features Non-Fungible Tokens (NFTs) representing digital collectibles of virtual dogs, adding a layer of gamification and collectibility to the platform.

The recent conclusion of the 0DOG token presale marks a significant milestone for the Bitcoin Dogs project. The presale, which lasted for a record 30 days, witnessed overwhelming participation from the cryptocurrency community, resulting in a successful fundraising effort.

Following the presale, participants will soon be able to claim their 0DOG tokens and engage in trading activities on the platform.

The success of the presale underscores the growing interest and confidence in the Bitcoin Dogs project, highlighting its potential for future growth and adoption.

Investment outlook: Bitcoin vs Bitcoin Dogs

As Bitcoin continues to regain momentum and reach new highs, investors are faced with the question of whether now is a good time to invest in Bitcoin or Bitcoin Dogs.

Well, while past performance is not indicative of future results, the bullish sentiment surrounding Bitcoin’s price trajectory and the promising prospects of projects like Bitcoin Dogs may present attractive investment opportunities for those looking to diversify their portfolios in the cryptocurrency space.

However, as investors navigate these exciting developments, careful consideration of market trends and project fundamentals will be essential in making informed investment decisions in the ever-changing landscape of digital assets.

The post Bitcoin (BTC) regains momentum just in time for the upcoming 0DOG exchange listing appeared first on CoinJournal.