Vor dem Hintergrund neuer Strafmaßnahmen gegen die Kryptobörse Kraken beantragt Coinbase erneut, dass die US-Börsenaufsicht eine klare Regulierung von Kryptowährungen vornimmt.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Vor dem Hintergrund neuer Strafmaßnahmen gegen die Kryptobörse Kraken beantragt Coinbase erneut, dass die US-Börsenaufsicht eine klare Regulierung von Kryptowährungen vornimmt.

Crypto exchange OKX has announced the listing of two artificial intelligence (AI) related crypto tokens on its spot market.

The two tokens, Fetch.ai (FET) and SingularityNET (AGIX) will be added to the exchange’s spot market at 10:00 am UTC on Friday, November 24.

Deposits for FET/USDT and AGIX/USDT are open, enabled at 6:00 am UTC ahead of trading, OKX said in a post on X. OKX will enable FET and AGIX withdrawals on November 27, at 10:00 am UTC.

Fetch.AI is an Ethereum-based token that is powered by artificial intelligence to support a decentralised internet economy. The total supply of FET is 1,152,997,575.

After OKX’s announcement, the price of OKX surged more than 10% to break above $0.55, with cumulative gains over the past 30 days at 99%.

Meanwhile, the price of SingularityNET (AGIX) was up 9% in the past 24 hours as bulls looked to extend gains above $0.30. AGIX/USD has soared nearly 50% in the past month and is more than 600% up since its low in November 2022.

The SingularityNET network also uses artificial intelligence to power its decentralised AI marketplace.

Fetch.ai and SingularityNET prices have rallied alongside the growing positive narrative around AI, with mainstream forecasts by companies such as Nvidia, Meta and Microsoft adding to the bullish outlook.

Listing on OKX adds to the tokens’ visibility and could see further upside momentum as crypto eyes the next bull market.

Another token to rally higher this week has been Pyth Network (PYTH), which went live on OKX’s spot and perpetual markets on November 20. PYTH is up 25% in the past 24 hours.

The post OKX to list Fetch.ai (FET), SingularityNET (AGIX) for spot trading appeared first on CoinJournal.

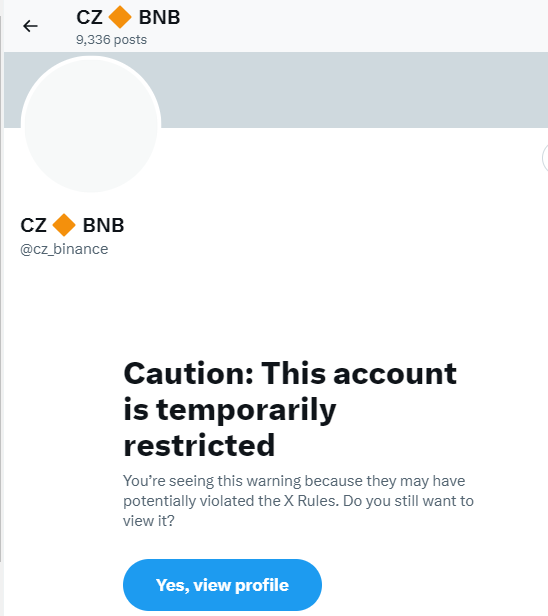

Binance founder and former CEO Changpeng ‘CZ’ Zhao’s X account has been restricted. While its not clear why the ex-Binance chief’s X (formely Twitter) is restricted, the move comes as a surprise to many.

On Thursday, US prosecutors wanted CZ prevented from leaving the US for the UAE, with allegations that he was a flight risk. This is after he pleaded guilty to money laundering charges and was released on a $175 million bond.

On Thursday, US prosecutors wanted CZ prevented from leaving the US for the UAE, with allegations that he was a flight risk. This is after he pleaded guilty to money laundering charges and was released on a $175 million bond.

Binance will also pay a $4.3 billion penalty as settlement with the US Department of Justice (DOJ).

After he stepped down, CZ was replaced by Richard Teng, the former head of Abu Dhabi Global Market, UAE.

CZ’s account restriction was due to several name changes, which is what he noted in a comment as he urged against FUD.

Happy Thanksgiving! 🦃

No need to FUD. All good now. 🙏 pic.twitter.com/IhkSTNwFvi

— CZ 🔶 BNB (@cz_binance) November 23, 2023

The post Ex-Binance CEO CZ’s X account restricted appeared first on CoinJournal.

The Ripple token, the fifth-largest by market cap with over $33 billion, was trading near $0.61 at the time of writing. Meanwhile, Dogecoin (DOGE) has surged to highs of $0.075 and could break higher as on-chain activity swells.

Both XRP and DOGE saw a negative flip this week as cryptocurrencies dumped after news that former Binance CEO Changpeng Zhao was stepping down.

While XRP failed to break the psychological barrier at $1 in July, crypto analyst Ali says a breakout from a descending parallel channel could see XRP/USD push to the $0.65 – $0.66 region.

#Ripple | $XRP appears to be breaking out from a descending parallel channel, which may result in an upswing to $0.65 – $0.66 for #XRP. pic.twitter.com/gvfeEMKIDX

— Ali (@ali_charts) November 23, 2023

Recent lawsuits by the SEC have listed several altcoins as securities – but not XRP has not been. In as much as there’s a likely battle over a settlement with the SEC in April next year, the previous wins against the regulator has the community buzzing on what next when the case that started in December 2020 finally recedes into the rear mirror.

As for DOGE, the analyst looks at a spike in large transactions amid institutional interest as pointers to a potential price spike.

#Dogecoin | There’s a notable surge in $DOGE transactions exceeding $100,000 in the past month, consistently hitting new highs.

This uptick suggests increased interest in #DOGE from institutional players and whales, potentially gearing up for a significant price spike. pic.twitter.com/UpxVkfu9hW

— Ali (@ali_charts) November 23, 2023

The intraday gains stand at 3.5%, while the 24-hour trading volume is currently over $1.1 billion. It’s the fourth biggest volume in the period among non-stables, with Bitcoin, Ethereum and Solana – which has been flying in the market – ranking higher.

Dogecoin has seen a 24-hour trading volume of nearly $452 million. While the top meme coin lags some tokens in the $16 billion dog-meme market, its gains over the past month have cut yearly losses to just 5.5%.

Positive moves in the market could see DOGE/USD break above $0.1 going into next year. However, DOGE bulls have a steep hill to climb if they are to reclaim the all-time high of $0.73 reached in May 2021.

The post XRP and DOGE poised for significant upswings: analyst appeared first on CoinJournal.

InfStones, a blockchain infrastructure provider and one of the key node operators for liquid staking protocol Lido Finance, will look to address a recent vulnerability issue by rotating its validator keys.

The platform is expected to take the security step by temporarily withdrawing its Ethereum validators from Lido.

InfStones’ move follows the discovery of a security threat connected to the open-source library Tailon in July, and which was disclosed by researchers at blockchain security platform dWallet Labs.

That chain of vulnerabilities at InfStones that put over $1 billion worth of assets at risk. The dWallet Labs team disclosed this to the Lido node operator to allow for remediation, Elad Ernst, cybersecurity researcher at dWallet Labs wrote on X.

1/ Our team at @dWalletLabs discovered a chain of vulnerabilities that could result in a loss of more than $1B in crypto assets. The full article here: https://t.co/cUUfevvUQ9 Let’s take a closer look

— Elad Ernst (@EladErnst) November 21, 2023

Lido Finance acknowledged the vulnerability, noting the potential for an impact on 25 of InfStones servers.

“Lido contributors are now actively working with the Node Operator on investigating the incident to understand its full scope and potential impact,” the platform said in an update.

However, the protocol’s security team clarified that there had been no indication that keys had leaked or been compromised. The vulnerability was also unlikely to have impacted Lido Finance validators.

To clarify: There is currently no indication of key leakage or compromise, and the vulnerability may not affect validators related the Lido protocol.

— Lido (@LidoFinance) November 22, 2023

While InfStones notes that its keys have not been compromised, it has decided to transition to new keys. To continue with operations and to ensure stability of the liquid staking protocol, InfStone will redirect staked Ether (ETH) to Lido for re-staking.

Lido is the largest liquid staking platform on Ethereum, with more than $18 billion in total value locked (TVL) as of November 23

The post Lido node operator to rotate keys after security firm flags vulnerability appeared first on CoinJournal.