- RAY token surges 17% in 24 hours, eyes $0.240 resistance as technical indicators turn bullish.

- Memeinator’s presale exceeds $500,000 in less than 48 hours, aiming to reshape the meme coin landscape.

- Raydium’s momentum and Memeinator’s success captivate the cryptocurrency community.

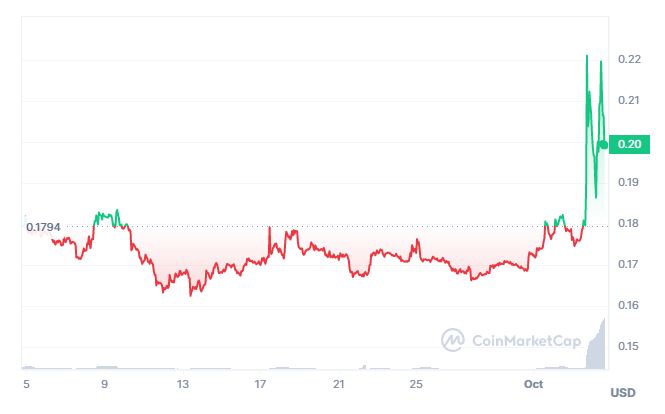

Raydium’s native utility token, RAY, has been making waves in the crypto market, exhibiting a remarkable surge in its price. Over the past 24 hours, the price of RAY increased by 17%, catapulting it to the forefront of top-performing cryptocurrencies.

At the time of writing, RAY was trading at approximately $0.2019, marking a noteworthy climb from its intraday low of $0.1754. This surge in price has garnered significant attention and optimism among crypto investors.

Raydium price chart

Raydium price chart

Why is the price of Raydium (RAY) rising?

The recent surge in RAY’s price can be attributed to a combination of factors, including a building bullish momentum and positive market sentiments partly due to the recent Ripple Labs win against the US SEC.

The Ripple Labs win is seen as a great catalyst for the cryptocurrency market, which has recently been targeted by the US authorities who have tried to argue that some cryptocurrencies are securities and not cryptocurrencies.

Raydium price prediction

Analysts have pointed to a symmetrical triangle pattern that had been forming, indicating the potential for a breakout. The clean break above the triangle’s resistance level has ignited further optimism, suggesting the potential for continued upside in RAY’s price.

With Raydium’s RAY token showing bullish momentum, traders and investors are closely watching key resistance levels. The next significant hurdle appears to be at $0.240, a level that has historically acted as strong resistance.

However, as with any price movement, there are factors to consider. Technical indicators, such as the widening Keltner Channel bands, suggest the potential for price swings and breakout opportunities. Yet, the overbought conditions in the top range of the bands may introduce the possibility of a temporary dip.

Influx of capital and volatility

The Chaikin Money Flow (CMF) indicates a modest influx of capital into the RAY market, signifying some buying pressure. A rising CMF rating could signal increased purchasing pressure and a potential market breakout.

Meanwhile, the Relative Volatility Index (RVI) suggests that the RAY market is currently volatile, opening the door to significant price volatility and trading opportunities. However, extreme volatility also brings increased risk.

The TRIX indicator reflects favourable price momentum, indicating high purchasing pressure. Nevertheless, a declining TRIX rating could hint at a potential reversal in RAY’s price trend.

Memeinator presale success

In a world inundated with meme coins promising the moon and stars, Memeinator has emerged as a beacon of change. In less than 48 hours, Memeinator’s presale has surged past the $500,000 mark, signalling its unwavering commitment to reshaping the meme coin landscape.

The genesis of this ambitious endeavour was born out of frustration with the deluge of meme coins that often failed to deliver on their promises. Memeinator sought to bring back the fun and magic that once defined meme coins.

Memeinator’s unique features

What sets Memeinator apart is its innovative approach. It introduces an AI-driven game inspired by classic ’90s action movies, a burgeoning community, and enticing prizes, including the chance to journey into space with Virgin Galactic.

The Memeinator ‘resistance’ has already gained significant traction, with over 20,000 individuals joining the journey on Twitter and actively engaging in vibrant discussions within Telegram and Discord communities.

Solid-proof audit and utility

To ensure credibility and security, Memeinator underwent a meticulous audit by Solid Proof, a respected German-based company specializing in evaluating crypto project protocols, smart contracts, and KYC assessments. This audit places Memeinator in an esteemed company alongside reputable projects like UNCX, Shopping.io, and ZyberSwap.

Memeinator’s utility extends beyond its presale success. Its MMTR Tokenomics boasts a total supply of 1 billion tokens, with allocations for community engagement, marketing pools, and exchange liquidity provision. A deflationary mechanism will be employed, with the team executing a burn strategy as needed to maintain the token’s price.

Conclusion

Raydium’s bullish momentum and Memeinator’s presale success are currently making waves in the cryptocurrency space. While RAY’s price surge sparks optimism among traders, it’s crucial to consider the technical indicators and potential market swings.

On the other hand, Memeinator’s journey to reshape the meme coin landscape has garnered significant community support and validation through a Solid Proof audit. With innovative features and a committed community, Memeinator seeks to redefine the meme coin space.

The post Raydium price prediction as momentum builds and Memeinator presale surge appeared first on CoinJournal.