- Bitcoin (BTC) and Ether (ETH) broke higher today, trading above $26,650 and $1,620.

- Maker (MKR) hit a yearly high near $1,470 amid fresh buy pressure.

- Meanwhile, Shiba Memu has raised over $3.3 million in its presale as SHMU price jumps to $0.030025.

Cryptocurrency’s total market cap was up 1.3% on Wednesday morning, with the top coins Bitcoin (BTC) and Ether (ETH) breaking above $26,650 and $1,620 respectively.

The uptick in crypto prices came as the industry looked past SEC’s latest delay of a spot Bitcoin ETF and Chase Bank’s ban on crypto payments for its UK customers. Digital asset prices were also ticking higher as US futures rose after Tuesday’s brutal sell-off that saw the Dow Jones Industrial Average book its biggest single-day loss since March.

Here is the price prediction for Bitcoin (BTC) and Maker (MKR), and an overview of the new crypto project Shiba Memu (SHMU).

What is Shiba Memu?

Shiba Memu is the new kid on the block in the meme coin neighbourhood. Its a new project that sits at the intersection of crypto and artificial intelligence (AI), bringing a novel approach to market traction that’s so crucial to meme coin adoption.

Unlike most meme tokens that gain traction in the community thanks to human effort, Shiba Memu looks to leverage the power of AI to create a marketing powerhouse. AI will do all the heavy duty work needed to sustain interest in the coin, and reward holders of the native token SHMU for their input and feedback.

Learn more here.

Bitcoin price prediction

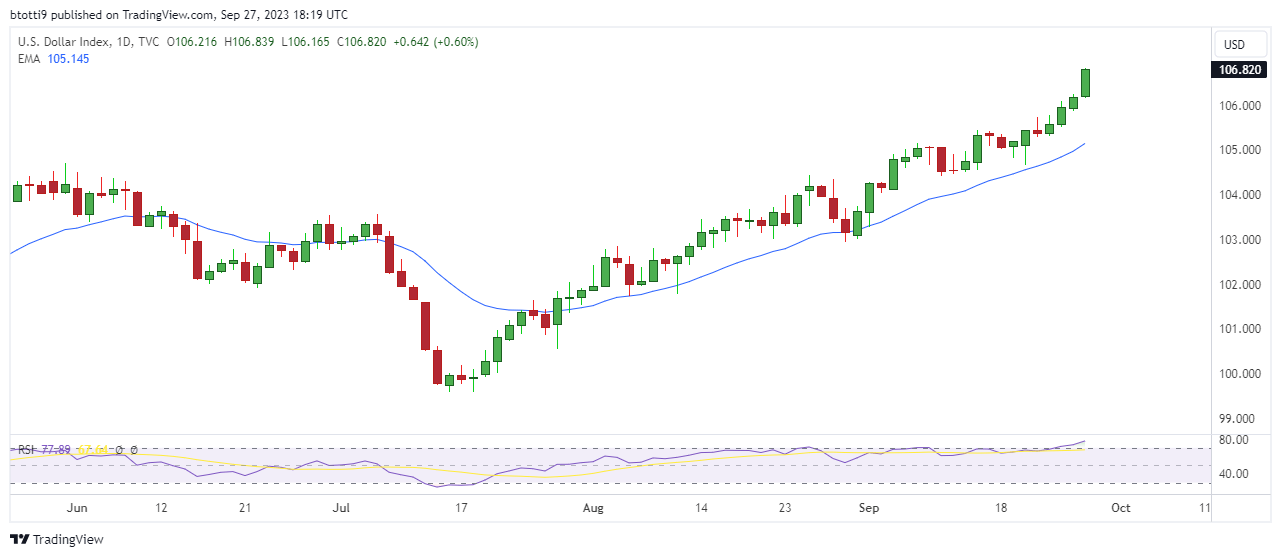

Bitcoin has not moved much in the past week, down 1.6% as of writing as investor jitters suppressed buyers amid the uncertainty that gripped the market after Fed’s recent “higher for longer” interest rates outlook.

With regulation still a big talking point, analysts have predicted a potential setback for bulls before prices steadily climb with a new bull cycle. In the short term, the upcoming $3 billion options expiry on September 29 could provide fresh fuel for downward pressure. At $26,770 at the time of writing, BTC suggests new attempts at the key $28,300 zone are possible. However, a flip in sentiment in the risk asset market could mean a retest of support around $25k. The $20k area is a target for the bears.

Maker price prediction

Maker has outperformed most top altcoins in the past week, with MKR up nearly 10% in the past 24 hours. The cryptocurrency is trading above $1,450, the highest price level in a year that came after a breakout above the key horizontal resistance line of $1,250.

Bullish indicators strewn all over the MKR charts suggest an upside to above $1,600 is possible. However, an unexpected turn of events resulting in downside momentum could mean retreat to support around $1,350.

Shiba Memu price prediction: Will SHMU reach $1 in 2024?

Shiba Memu does not trade in the secondary market yet, given the token is still in presale. However, with interest in this meme coin rocketing amid a broader optimism for the AI space, it is possible the price of SHMU could skyrocket when trading goes live on major exchanges.

At the moment, investors who bought Shiba Memu at the first stage presale price of $0.011125 have watched the value rise more than 169%. This is because of SHMU token price having jumped to $0.030025 as investors have poured over $3.3 million into this promising project.

What price factors could help Shiba Memu?

Shiba Memu’s roadmap highlights Q1, 2024 for the launch of its revolutionary AI dashboard, while strategic partnerships and ecosystem development will continue in the second quarter.

In Q3, 2024, Shiba Memu will explode on global exchanges, bringing demand for SHMU to a whole new level. If the coin lives to the hype that currently surrounds it, and mirrors explosive entries into the market such as seen with Pepe (PEPE) and other coins, the fourth quarter could be a great period for SHMU holders.

A final presale price of $0.0379 suggests upside momentum amid FOMO buying ahead of crypto’s expected bull market could quickly push SHMU to the $0.05 and then $0.1 levels. That could see targets at 50 cents and the $1 come into view.

The post Crypto price outlook: Bitcoin, Maker, Shiba Memu appeared first on CoinJournal.