Die Staatsanwälte im Strafverfahren von Sam Bankman-Fried sehen keinen Grund, dass die Geschworenen bei ihrer Auswahl Fragen zu dessen ADHS-Erkrankung oder moralischen Einstellung beantworten sollten.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Staatsanwälte im Strafverfahren von Sam Bankman-Fried sehen keinen Grund, dass die Geschworenen bei ihrer Auswahl Fragen zu dessen ADHS-Erkrankung oder moralischen Einstellung beantworten sollten.

The Hong Kong Monetary Authority (HKMA) has warned crypto firms that it’s against the law for any unauthorised company or platform to refer themselves as a “bank”, or deposit-taking businesses.

Hong Kong regulation prohibits this, HKMA noted.

HKMA’s warning noted that firms taking such an approach to their marketing to the public are contravening the Banking Ordinance. The regulator notified the public to be aware of this fact, while crypto firms were reminded that only HKMA-licensed providers can use the term bank or take deposits from the public.

“Under the Banking Ordinance, only licensed banks, restricted licence banks and deposit-taking companies (collectively known as “authorised institutions”), which have been granted a licence by the HKMA can carry out banking or deposit-taking business in Hong Kong,” the regulator warned via a press release published on Friday.

Among terms the Hong Kong financial markets watchdog cautioned crypto firms not to use or describe themselves include digital bank, crypto bank, crypto asset bank, digital trading bank and digital asset bank. Unlicenced firms should also not claim to offer banking accounts or banking services, as well as describing funds sent to accounts with the companies as “deposits.”

Such terms as “savings plans” or “low risk” and “high return” are also not allowed under the law for such unauthorised platforms.

“These descriptions may mislead members of the public into believing that those crypto firms are banks authorised in Hong Kong, to which they can entrust their savings,” HKMA noted.

According to the regulatory authority, crypto firms are not approved and regulated as banks in Hong Kong. HKMA does not also supervise these platforms, which means funds that people place with these entities do not benefit from the Hong Kong Deposit Protection Scheme.

Hong Kong is one of the fastest-growing crypto hubs in the world and many crypto companies, including exchanges, have looked to secure regulatory approval to offer products and services there.

The Hong Kong government’s recent unveiling of a crypto framework aimed at transforming the crypto sector has been lauded by many crypto industry players.

But while the jurisdiction opens up the financial hub to crypto, Hong Kong’s Securities and Futures Commission (SFC) recently warned exchanges and other providers against misrepresenting their regulatory status. The regulator also asked exchanges not to offer services and products to investors before completing the process, or extending services not allowed under the law.

The post Hong Kong warns crypto firms against referring to themselves as “banks” appeared first on CoinJournal.

Cryptocurrency prices had a good performance this week as Bitcoin rose to $26,000.

tomiNet was one of the best-performing tokens as it jumped to a record high.

VeChain price soared after being listed by Coinbase.

Cryptocurrency prices had a relatively good week as Bitcoin bounced back above $26,000 after falling below $25,000 on Monday. Some of the most important news were Franklin Templeton’s decision to apply for a Bitcoin ETF and Deutsche Bank’s move to offer crypto custody solutions.

There were other important news. Hedera Hashgraphg launched Stablecoin Studio, a product that empowers institutions to build stablecoins. Telegram, the giant messaging company integrated Toncoin while Coinbase added VeChain in its platform. This article looks at some of the top cryptocurrencies, including tomiNet, XDC Network, and VeChain.

tomiNet was one of the top breakout stars in the crypto industry this week as it surged to the highest level on record. As it jumped, the token moved to the top 100 of the biggest cryptocurrencies in the world, with its market cap surging to over $268 million.

For starters, tomiNet is a blockchain project that seeks to build quality applications. It has a browser, a DNS service, and a multichain digital wallet for tokens and NFTs. Its goal is to combine the best of Web2 and Web3 technologies to create a more private ecosystem.

It is unclear why the tomiNet price surged. A likely reason is that traders are just pumping the token since there was no major news in the ecosystem. On the two-hour chart, the token rose above the key resistance level at $3.60, the highest level on 11th September.

It has moved slightly above the 25-period moving average while the Relative Strength Index (RSI) has moved above the overbought level. Therefore, the token will likely retreat as sellers target the key support at $3.6 as the momentum fades.

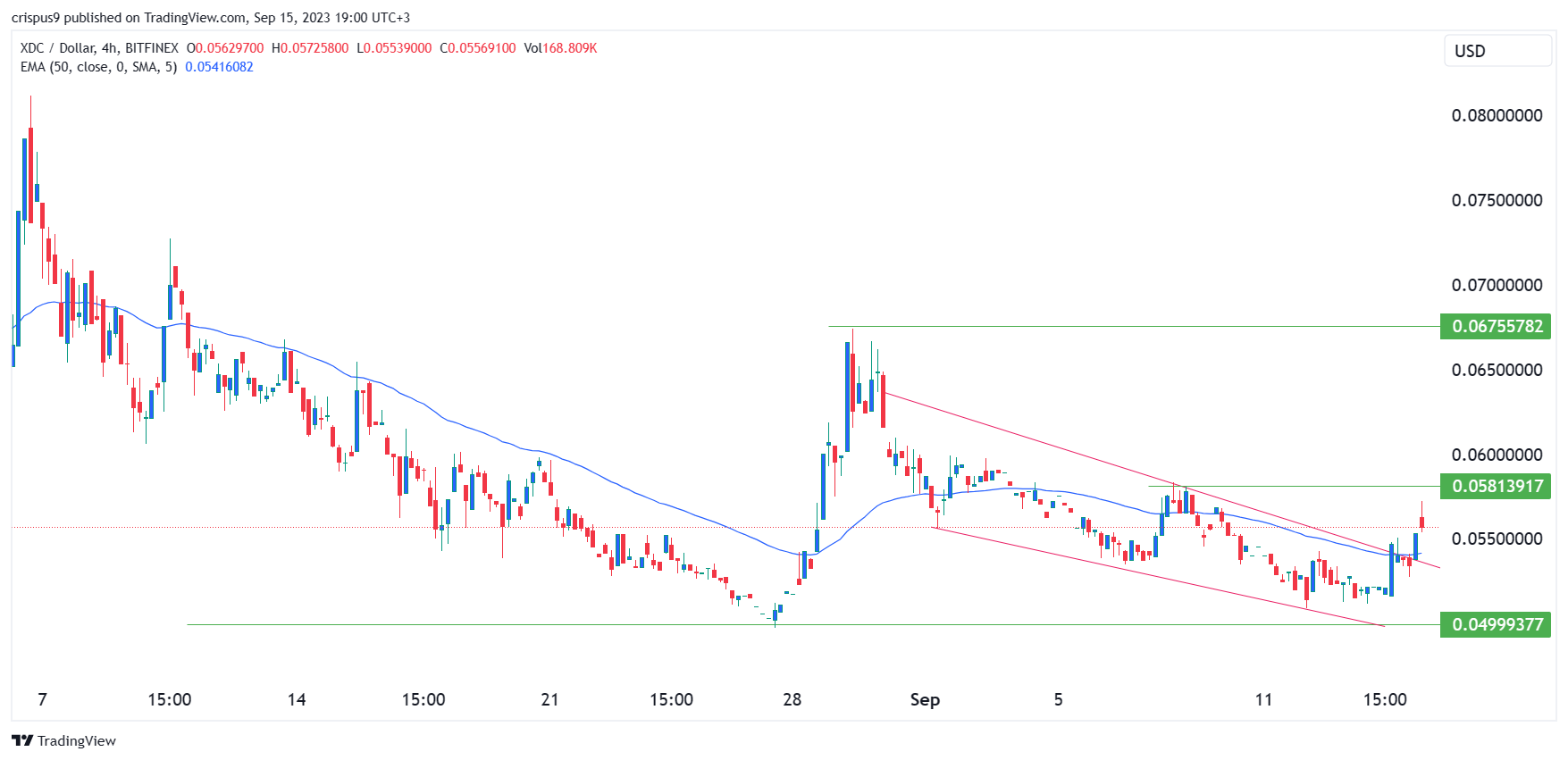

XDC Network token price made a strong bullish comeback after falling to a low of $0.050 on Monday. On the four-hour chart, the pair managed to cross the upper side of the falling wedge pattern shown in red. In price action analysis, this pattern is one of the most popular bullish signs.

XDC price has jumped above the 50-period moving average and is approaching the crucial resistance level at $0.058, the highest level on September 8th. Therefore, because of the falling wedge pattern, there is a likelihood that the token will continue rising as buyers target the key level at $0.60.

VeChain price jumped sharply after the coin was listed by Coinbase, one of the biggest exchanges in the world. It rose by more than 17% from its lowest level on Monday. As it jumped, the coin flipped the important resistance level at $0.016 (August 29th) into support.

VeChain has moved above the 25-day and 50-day moving average while the MACD has jumped above the neutral point. The price is also above the Ichimoku cloud.

I suspect that VeChain price will likely retreat in the coming days as the bullish momentum fades. If this happens, the coin will likely retest the support at $0.01680. The alternative scenario is where the price jumps as buyers target the resistance at $0.018 (August 14th high).

The Bitvavo platform was launched in 2018, with the goal to bridge the gap between traditional currencies and digital assets. Bitvavo is making digital assets accessible to everyone, by offering transparent fees, a wide range of assets and an easy to use platform.

CoinGate is a Lithuanian-based fintech company founded in 2014. The payment gateway offers cryptocurrency payment processing services for businesses of any sizes. Permission-based account management, fiat payouts to the bank account and brand new email billing feature are just a few reasons why CoinGate has become a go-to payment processor for many.

The post Crypto price prediction: tomiNet, VeChain, XDC Network appeared first on CoinJournal.

Die Deutsche Bank hat sich als Partner für die Umsetzung ihre Pläne zur Verwahrung von Kryptowährungen das Krypto-Unternehmen Taurus an Bord geholt.

Key takeaways

BitGo and Swan will work together to launch a new trust company.

The Bitcoin-only trust company will offer custody without exposure to the other cryptocurrencies.

Crypto custodian BitGo and bitcoin financial services firm Swan have announced plans to launch a Bitcoin-only trust company.

According to the press release published on Thursday, the Bitcoin-only trust company will offer custody without exposure to other digital currencies. The trust, which will be launched following regulatory approval, will combine BitGo’s custody capabilities with Swan’s expertise in fraud prevention and onboarding.

The companies said it would be the first Bitcoin-only trust company in the United States. BitGo CEO Mike Belshe said,

“We believe the best model for the Bitcoin industry is the same battle-tested model that has been part of the US financial industry for over a century: the separation of exchange and custody. Our teams have worked closely together for nearly a year on stronger qualified custody models. Early in 2023, we recognized the opportunity to establish a Bitcoin-only custodian, combining the unique capabilities of each company and supporting the innovators that will be at the forefront of pushing Bitcoin adoption.”

This latest cryptocurrency news comes as BitGo continues to expand its presence in the cryptocurrency space despite the ongoing bear market. BitGo is one of the custodians Swan hired for its Bitcoin storage needs.

Cory Klippsten, Swan’s CEO, also commented that;

“We immediately saw the vision,” said Cory Klippsten, Swan’s CEO. “For years, we’ve heard from major clients, partners, and other Bitcoin companies that they would prefer a Bitcoin-only software and services stack that is focused strictly on the best custody that leverages Bitcoin’s unique features. It’s important to us to build a custodian without the risks of securing many altcoins within the same trust company as Bitcoin. We want to do our part to build a dedicated ecosystem for Bitcoin, separate from industry speculators, to allow for innovation in custodial offerings.”

This latest development comes a few days after South Korean Hana Bank and BitGo announced a partnership to launch a joint crypto custody venture. The joint venture will combine Hana Bank’s knowledge of financial services and compliance with BitGo’s crypto custodial solutions.

The post BitGo and Swan partner to launch a Bitcoin-only trust company appeared first on CoinJournal.