Das neue britische Gesetz für Onlinesicherheit bringt beträchtliche Auflagen für Social-Media-Dienste mit sich, von denen auch verschlüsselte Messenger wie Signal nicht ausgenommen bleiben.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Das neue britische Gesetz für Onlinesicherheit bringt beträchtliche Auflagen für Social-Media-Dienste mit sich, von denen auch verschlüsselte Messenger wie Signal nicht ausgenommen bleiben.

The Australian Securities and Investments Commission (ASIC) has initiated legal proceedings against Bit Trade, the operator of the Kraken cryptocurrency exchange in Australia. The action stems from Bit Trade’s failure to adhere to design and distribution requirements for one of its trading products.

As per ASIC’s statement released on September 21st, the financial regulator in Australia alleges that Bit Trade neglected to establish a target market determination before offering its margin trading product to Australian clients. These design and distribution obligations represent a legal mandate for financial product providers operating in Australia. They entail specific guidelines for designing financial products tailored to meet predetermined customer needs and subsequently distributing them through targeted strategies.

We are suing Bit Trade, provider of the Kraken crypto exchange in Australia, for allegedly failing to comply with the design and distribution obligations (DDO) for its margin trading product. Since October 2021, customers have lost about $12.95 million https://t.co/MCRYqah0dP pic.twitter.com/zURQ2xDw7M

— ASIC Media (@asicmedia) September 20, 2023

ASIC contends that since the implementation of these design and distribution obligations in October 2021, Bit Trade’s margin trading product has been used by at least 1160 Australian customers for losing a collective $8.35 million (12.95 million Australian dollars).

According to ASIC, Bit Trade received notification of its non-compliance with these obligations in June 2022 but continued offering the product without fulfilling the necessary determinations.

Bit Trade’s margin trading product functions as a “margin extension” service, granting customers credit extensions of up to five times the value of the assets they employ as collateral. The regulatory authority asserts that this product effectively qualifies as a “credit facility,” offering customers credit for trading certain cryptocurrencies on the Kraken exchange.

ASIC’s deputy chair, Sarah Court, emphasized that these proceedings should serve as a stark reminder to the crypto industry that financial products will continue to undergo scrutiny by regulators to ensure compliance with consumer protection laws in Australia. She stated, “ASIC’s actions underscore the importance of complying with design and distribution obligations to ensure that financial products are distributed to consumers in a responsible manner.”

The post Bit Trade, the Kraken subsidiary operating in Australia, sued by the ASIC appeared first on CoinJournal.

Bitcoin – the world’s largest cryptocurrency is a “bargain” today, says Robert Kiyosaki – the renowned author of Rich Dad Poor Dad.

The so-called digital gold has not been a lucrative investment over the past two months.

But the Founder of Rich Global LLC recommends seeing the recent weakness as an opportunity to build a position in the “future” at a discount. His recent tweet reads:

Gold, silver, bitcoin are bargains today … but not tomorrow. America is broke. Buy GSBC today before stocks, bond, real estate.

Robert Kiyosaki even called fiat currencies “fake money” this past weekend. Also on Wednesday, Santiment – a crypto analytics platform reported an increase in Bitcoin’s on-chain activity to levels not seen since April.

Note that there’s a bunch of tailwinds that could catalyse the price of a Bitcoin in the near to medium term – the pending approval of an exchange-traded fund for example.

And then of course, there’s the halving event scheduled or April or May of 2024. In fact, PlanB – a pseudonymous crypto analyst who also goes by 100trillionUSD reiterated today that BTC could hit $100,000 in about two years.

He even left the prospect for it to eventually be worth $1.0 million much like what Cathie Wood has forecast multiple times this year.

Bitcoin is currently trading at $26,900 versus its year-to-date high of $31,500 in mid-July.

The post Robert Kiyosaki says Bitcoin is a ‘bargain today … but not tomorrow’ appeared first on CoinJournal.

Top gambling tokens by market cap including the Rollbit Coin have taken a hit even as the crypto gambling market expands. Notably, a new decentralized betting platform, Chancer, is causing waves with its futuristic decentralized betting platform. As a result, its native token, CHANCER, has attracted the attention of crypto investors in droves.

Interested buyers are flocking to the ongoing CHANCER presale, with the token currently selling at $0.012 but expected to rise to $0.013 in the next presale stage.

Chancer is on the verge of pioneering the world’s inaugural decentralized social betting platform. With this groundbreaking innovation, Chancer token holders will gain the ability to craft and partake in wagers tailored to their interests, expertise, and social connections.

The overarching objective of this project is to disrupt the global gambling and betting landscape by eliminating the traditional “house” and claiming a portion of the market share. Chancer is set to challenge the established bookmaking and betting business model as it gains widespread attention.

Chancer’s betting mechanisms encompass two distinct approaches: conventional Betting which involves wagers on well-known events such as NBA games or global occurrences like elections, and social Betting (P2P Betting) which allows individuals to engage in friendly competitions, whether it’s two tennis players facing off or a weightlifting contest at the local gym.

Social betting, one of Chancer’s standout features, permits people to bet on any verifiable event, opening up an array of possibilities for everyday scenarios.

The initial development phase has prioritized private bets, confined to the bettor and any additional participants, while public betting, which can be live-streamed, is the next focus for the development team. Furthermore, the product team is actively working on data validation using nodes, enabling individuals to place bets on global events like the aforementioned NBA game, ensuring transparent and actionable outcomes for payouts.

To accommodate a wide spectrum of use cases, ranging from social betting to globally broadcasted wagers, the Leaderboard User Interface is well into development. This feature empowers bettors to share their winnings within their social circles and cultivate a reputation within the broader Chancer community.

In conjunction with the Leaderboard, the User Interface team has completed work on user profiles, providing bettors with the means to engage in private and public contests seamlessly. Additionally, the Social Sharing feature, powered by Google’s WebRTC technology, enables Chancers to broadcast their bets and spark viral trends. Participation is open to anyone who meets the minimum liquidity requirement to match their odds.

To commemorate the achievement of the initial UI and UX milestones, the team is showcasing their progress on the website product page and has announced a series of upcoming updates, including Ask Me Anything (AMA) sessions with the community throughout September. The team also recently unveiled a product teaser, generating anticipation for the exciting developments ahead.

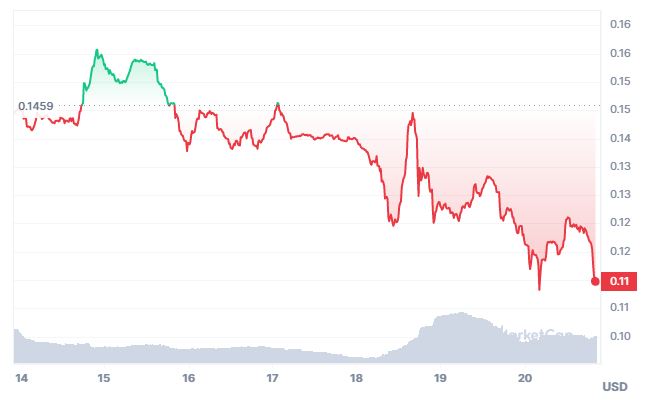

According to spotonchain, a whale today swapped 2.56M RLB tokens for 191.6 $ETH at $0.12 ($313K) after the RLB price dropped by 10% in 24 hours. The whale then swapped 193.31 $WETH and 192.4 $ETH for 493.14 $MKR at $1,278 on average ($630K).

Rollbit Coin price chart

Rollbit Coin price chart

However, despite the recent RLB token price drop, analysts still see a possible upward movement owing to Rollbit’s robust performance, notably in its casino revenue segment, as indicated by the insights of the prominent Twitter analyst, Miles Deutscher. There is also the record-breaking token burn rate and untapped potential in futures and sports-related revenue.

$RLB has generated $1.35m in casino revenue in the last 24h. 🤯

Impressive how sticky casino rev has been.

More than making up for low crypto volatility.

RLB burn is now at monthly highs ($5.6m burnt over the last 30 days).

Futures rev + sports both still have upside. pic.twitter.com/JdlVhCRGG0

— Miles Deutscher (@milesdeutscher) September 19, 2023

The Rollbit has recently witnessed remarkable growth, amassing an impressive $1.35 million in casino revenue within the past 24 hours, as reported by the reputable crypto and finance analyst, Miles Deutscher, on his Twitter account. This extraordinary revenue generation bodes well for the future of RLB, as it gains increasing traction in the marketplace.

Deutscher astutely pointed out the remarkable resilience of RLB’s casino revenue, which has not only compensated for the low volatility seen in the crypto markets but also proved to be consistently lucrative. This observation is of significant import, suggesting that RLB has secured a stable and prosperous revenue stream, independent of the frequently unpredictable conditions within the crypto realm.

Deutscher also shed light on the fact that the rate of token burning for RLB has reached unprecedented levels, with a staggering $5.6 million worth of tokens incinerated over the past month. Token burning, a strategic mechanism employed by crypto projects, serves to diminish the total supply of tokens, thereby increasing scarcity and potentially boosting their value. This high burn rate could be indicative of robust demand and a thriving ecosystem for RLB.

The post CHANCER presale price set to hit $0.013 as Rollbit Coin drops 21% in a week appeared first on CoinJournal.

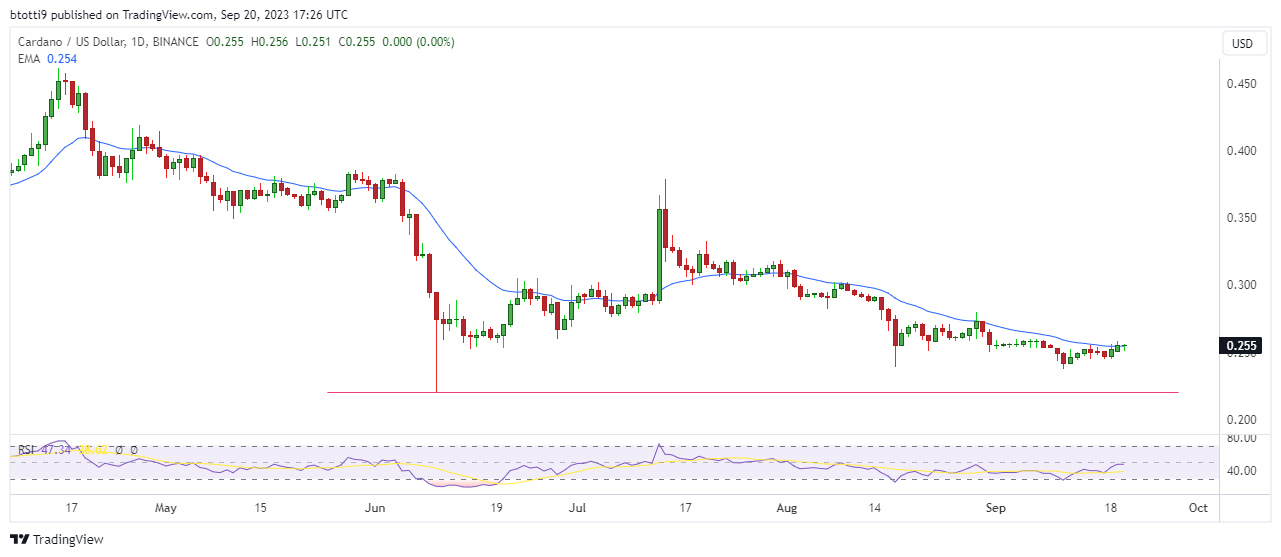

Cardano (ADA) is struggling for an upside push with the past week only seeing a 2.2% uptick as per data from CoinGecko at the time of writing. Indeed, ADA is down 43% since sliding lower amid the crypto winter. ADA/USD traded just above $0.25 on Wednesday afternoon.

With the cryptocurrency largely negative, the market outlook amid the historically slow September doesn’t look particularly promising for bulls. Data on DeFiLlama shows Total Value Locked (TVL) in assets on the chain has declined 8% in the past month to $152 million.

However, as Bitcoin is poised above $27k and altcoins are showing signs of waking up, a spike in volatility could help ADA buyers. But will bears give up territory?

A look at Cardano’s performance over the past week we see sellers have largely shown resilience around the $0.25 level. The daily chart has Cardano facing rejection at the 20-day EMA, and this moving average remains critical to bullish plans.

The daily RSI also gives sellers a slight advantage as it hovers below the 50 mark. This leaves bulls facing a daunting task of pushing for the $0.28 level for a breather and potential upside joy.

On the flipside, a breakdown beyond 40.24 will open a path for a bearish retest of support in the $0.22-$0.20 region.

The post Cardano price: ADA poised as bears stay put appeared first on CoinJournal.