Key Takeaways

- The Federal Reserve increased interest rates 0.25% Wednesday, but the market is anticipating the hiking cycle is coming to a close

- Optimism is flowing in crypto markets, which saw crushing losses in 2022 as rates rose swiftly

- While the Fed has said it no longer forecasts a recession, this could be a double-edged sword for crypto

- Fed may be reluctant to cut rates, instead electing to for the higher for longer approach, something which could restrain crypto

- Employment is at half-century lows, wage pressure remains and core inflation has been stickier than the headline number

- Overall, macro environment is far brighter than nine months ago, but caution may be prudent for crypto investors despite market-wide sentiment spiking rapidly

Following the latest 25 bps increase to the federal funds rate Wednesday, which was widely anticipated ahead of time by the market, the most important interest rate in the economy is now a remarkable 525 bps above where it was prior to March 2022, when the Fed first hiked rates.

Finally, after a relentless liquidity squeeze, the market is anticipating that the end of the road may be nigh. For Bitcoin investors, this is music to their ears. Or at least that is what many in the sector are currently proclaiming. The only thing is, the true story may be a bit more convoluted.

Bitcoin has moved with yield expectations

Firstly, it is unquestioned that the transition to a higher yield environment has been a death wish for crypto. As inflation became rampant last year and we transitioned to a new paradigm of tight monetary policy after a decade of essentially-free money, digital assets were crushed. Liquidity was sucked out of the entire system, hurting assets which reside on the long end of the risk spectrum the most. And that is certainly where crypto has set up shop in its brief existence thus far.

The below chart shows this as well as any. Plotting the two-year treasury yield, which moves with rate expectations, on an inverted axis against the Bitcoin price shows how much the latter has dipped in line with the rise in yields. And we know that where Bitcoin goes, crypto tends to follow.

The optimism being spouted about now is centred on the hope that much-coveted rate cuts are imminent. Yet there is reason to believe that this may still be premature, for a number of reasons. The bulk of Powell’s comments from Wednesday’s meeting can be dismissed as diplomatic answers structured to leave the Fed with as much optionality as possible going forward, but one admission was notable: the revelation that the Fed is no longer forecasting a recession.

“So the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession,” Powell said.

While this may sound like good news – and it is! – this also means that, perhaps counter-intuitively, Bitcoin may not have quite the boost behind it that it may have otherwise hoped for. The reason is that, if we go back to Economics 101, the Fed utilises rate cuts to stimulate a sluggish economy. If a recession is no longer anticipated, it is less likely these cuts will come.

The Federal Reserve has been extremely reluctant to cut rates in the last few decades unless explicitly forced to, such as when the economy went into a tailspin as the COVID pandemic suddenly emerged in March 2020. If we view the below chart, showing the fed rate all the way back to 1990, we see that without a recession, the administration has been cautious for the most part. And with inflation remaining higher than its 2% target, it feels ambitious to assume it will change that approach anytime soon.

While rate hikes may be coming to an end, rate cuts don’t feel like they will transpire anytime soon.

This thought is reinforced when digging into the numbers underlying this unique current macro situation. While the headline figure of 3% inflation is drawing all the attention, the core number is perhaps the better gauge; this strips out the volatile effects of food and energy and can be more relevant for the Fed’s policy decisions. Looking at this core number, it has dropped only 110 bps in the last year and remains at a stout 4.8%. This contrasts with a fall of 690 bps in the headline figure over the same period.

Not to mention that with the way the CPI is structured as a YoY number, we are into the stage of the year where inflation was always going to fall. This is because there were such hot readings landing at this time last year, when energy prices were sky-high and inflation came within 10 bps of hitting double digits. These readings dropping out of the index creates a more dramatic reduction in the YoY number.

While 3% may sound close to 2%, this difference also remains a chasm, should the Fed remain determined to get back to its original target. Jim Bianco, speaking to the On the Margin podcast this week, had a good way of explaining why this matters.

“The Fed would tell us that the neutral funds rate is half a percent above inflation…so if the long-run (inflation) rate is 3% (as opposed to 2%), the neutral rate is 3.5%, so they are 200 bps above that (at the current fed rate). When the yield curve normalises out again, it should be positive 150 bps – that is historically where it has been.

With a 150bps spread on the yield curve, he concludes that the 10-year yield must be at 5% to be neutral. Currently, the 10-year yield is at 3.9%, meaning via Bianco’s summation, rates would need to come up 110 bps to hit the Fed’s notion of neutrality under a 3% inflation target regime. This illustrates how the journey to 2% remains important, should that still be the Fed’s target (which Powell has adamantly repeated it is).

Lagged effects of monetary policy

In addition to the inflation number, there is no getting around the fact that wage pressure remains high and unemployment is at 3.6%, hanging around the lowest mark in half a century. This, again, is great news for the overall economy, but will also spell concern in the Fed that inflationary pressure remains and the fight is not yet over. Cutting into this environment feels like a risk that Powell and co. are not in a position to take, and perhaps won’t be for longer than some anticipate.

With monetary policy operating with such a notorious lag, and the fact this hiking cycle has been among the swiftest in modern history, it needs to be caveated that, while the Fed is determined to keep all options open, there genuinely is a lot of uncertainty.

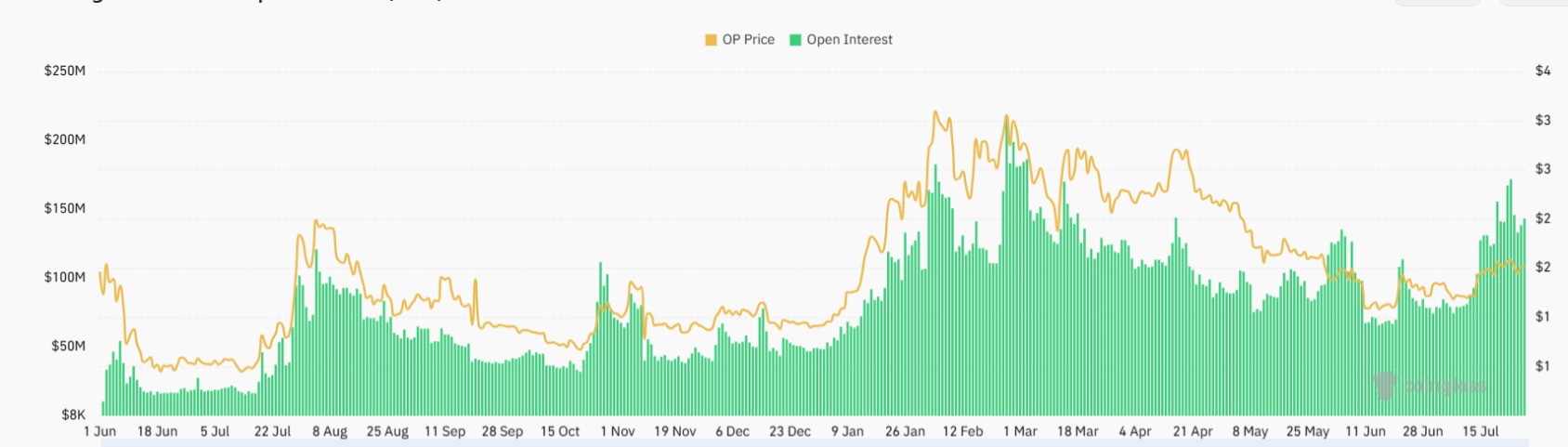

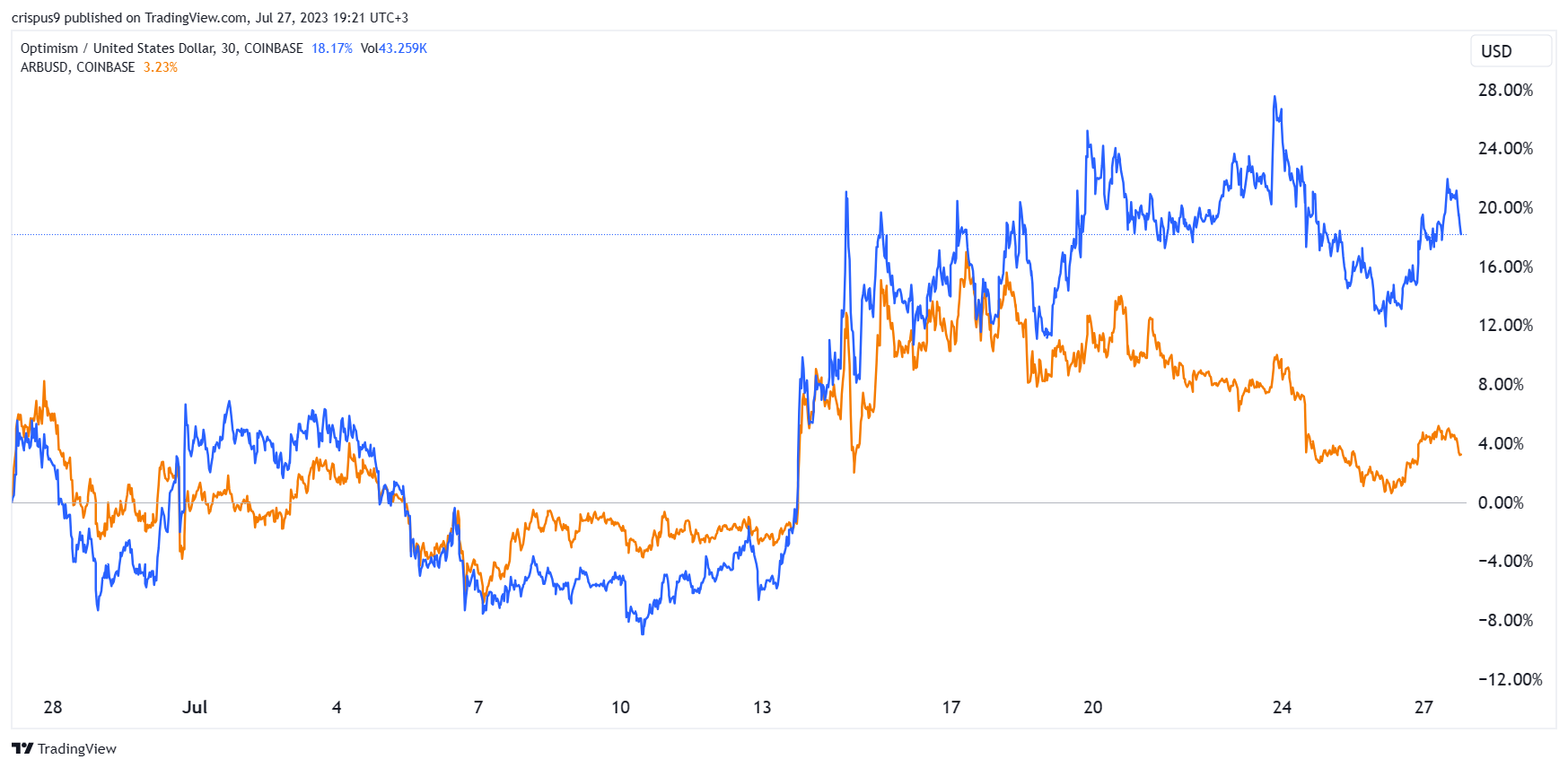

For crypto, this bears consideration amid the tangible excitement that has begun flowing through certain circles. Undoubtedly, this has been a tremendous run and the industry would have snapped your hand off if you offered them this position nine months ago, when FTX circled the drain and threatened to pull a chunk of the entire asset class down with it. But the battle has not quite been won yet, even if the tide has begun to turn.

The post A temperature check on crypto as market eyes end of rate hiking cycle appeared first on CoinJournal.