- Chromia Appnet welcomes first ever decentralised token bridge with My Neighbor Alice collaboration.

- ALICE tokens can now be bridged from the Binance Smart Chain (BSC).

- Chromia token (CHR) was slightly lower on Tuesday afternoon, but was 12% higher in the past week.

Chromia, a standalone public blockchain developed by Swedish company Chromaway AB, has hit a new milestone after blockchain-based game My Neighbor Alice Alpha Season 3 went live on the Appnet.

Decentralised token bridge on Chromia

My Neighbor Alice Alpha Season 3 launched on the first ever Chromia Appnet, a collaboration that is set to see the public have access to MNA’s unique multiplayer game. There is a ‘free trial’ where players can tap into the benefits of land ownership as well as use the native MNA token ALICE.

Another milestone is the bridging of ALICE from Binance Smart Chain, the first bridged asset use on the Chromia Appnet.

🌸 My Neighbor Alice Alpha Season 3 is now LIVE!

Join us and explore an array of exciting new features, like:

🛠 Crafting System

🆓 FREE TRIAL for non-landowners

🖼 Plot-sharing by landowners through FREE-RENTING

👗 ELLE branded Quests and #NFTs

🪙 $ALICE token utilization… pic.twitter.com/rmTNLs5rHP— Alice (@MyNeighborAlice) June 27, 2023

Alpha Season 3 comes with all the popular game features, including fishing, farming and land decoration. However, there are also new exciting experiences such as sharing of land plots, staking ALICE and customising in-game avatars.

“Today, with the release of My Neighbor Alice Alpha Season 3, is a big milestone for both us and Chromia. We are the first app on Chromia appnet and the first project to utilise the decentralised token bridge in order to give in-game utility for $ALICE,” Viktor Plane, Technical Director at My Neighbor Alice said when commenting on the development.

Chromia’s open source blockchain offers EVM compatibility for Ethereum and the Binance Smart Chain. It provides for the development of next-generation decentralised applications through enhanced scalability, data and storage capabilities and customizable fees.

The applications include DeFi options trading protocol Hedget that launched in 2020 and the increasingly popular MNA. Chromia also enables supply chains, with Chromia’s technology used to trace product origins and integration of NFTs.

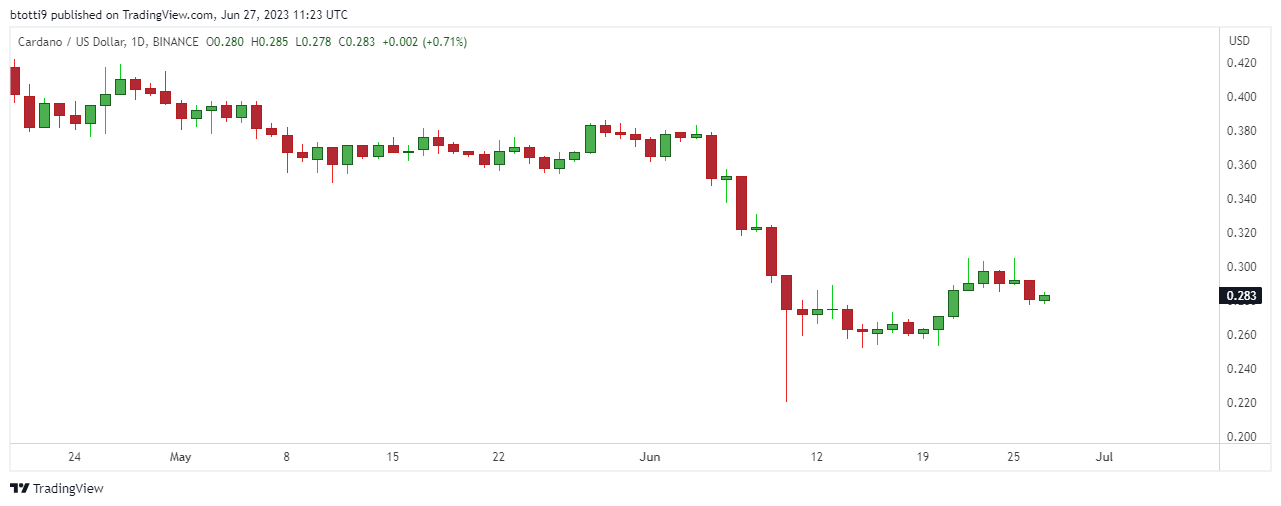

Chromia (CHR) price

The Chroma token (CHR), the native token of the Layer-1 blockchain network, hovered above $0.13, about 2.8% down in the past 24 hours at the time of writing. CHR however traded nearly 12% higher over the past week.

ALICE price hovered at $1.06, just in the green over the past 24 hours and more than 20% up in the past seven days.

The post Chromia (CHR) hits milestone as My Neighbor Alice Alpha Season 3 goes live appeared first on CoinJournal.