- SEC sued Binance for violating securities laws on Monday.

- Here’s what Binance said in its response to the regulator.

- Coinbase Global ended 10% down on today’s development.

Binance is in focus on Monday after the U.S. Securities and Exchange Commission (SEC) sued the world’s leading crypto exchange.

Here’s what Binance said in its response to SEC

In its lawsuit, the regulator accused Binance as well as its CEO Changpeng Zhao for failing to comply with the U.S. securities laws. The CFTC had previously filed such charges against the crypto company as well.

SEC also alleged that Binance commingled user funds worth billions of dollars with Merit Peak Limited – a CZ-controlled European company. Only hours later, though, Binance declined claims of wrongdoing and said in its official response to the regulator:

Any allegations that user assets on the Binance.US platform have ever been at risk are simply wrong. We will vigorously defend against any allegations to the contrary.

Crypto community stood with Binance on Twitter

On Twitter, the crypto community demonstrated support for Binance and CEO Changpeng Zhao. Many found the SEC unfair in the way it was dealing with crypto assets in the United States.

In its response, Binance also said that the regulator’s overreach was hurting the U.S. reputation as a global hub for financial innovation. Still, it added:

We’ll continue to cooperate with regulators and policymakers across the globe. We remain committed to productive engagement to ensure next-gen of crypto regulation fosters innovation.

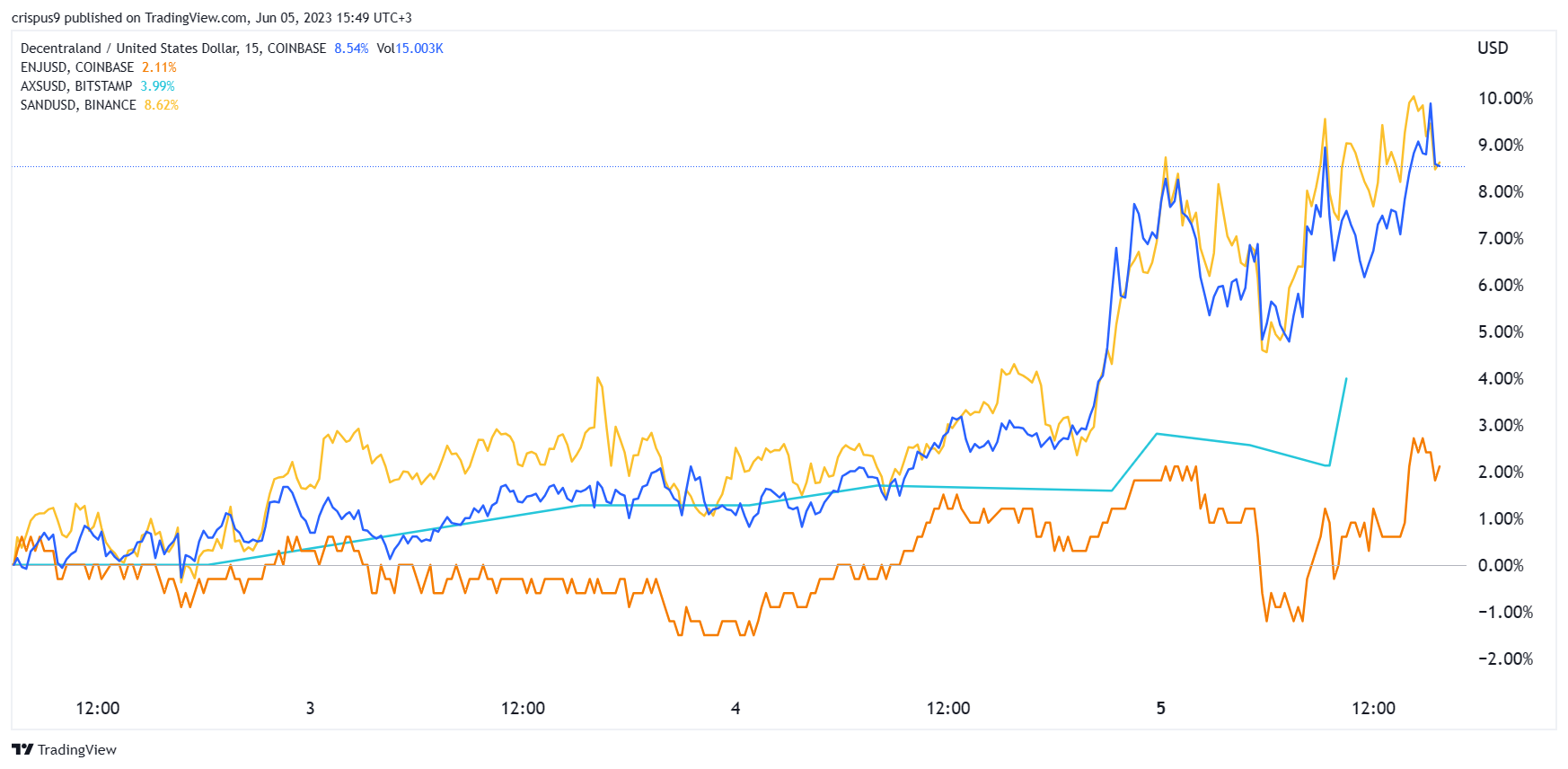

SEC’s lawsuit against Binance saw shares of peer Coinbase Global Inc lose about 10% today.

The post Binance on SEC’s lawsuit on Monday: ‘we will vigorously defend’ appeared first on CoinJournal.