„Die US-Kapitalmärkte müssen vor einem tyrannischen Vorsitzenden geschützt werden, auch vor dem derzeitigen“, so der Abgeordnete Warren Davidson über den SEC-Leiter Gary Gensler.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

„Die US-Kapitalmärkte müssen vor einem tyrannischen Vorsitzenden geschützt werden, auch vor dem derzeitigen“, so der Abgeordnete Warren Davidson über den SEC-Leiter Gary Gensler.

The current market outlook for Bitcoin and crypto continues to suffer from the flurry of activities around the actions of the US Securities and Exchange Commission (SEC) after it sued Binance and Coinbase.

While June started off with wild volatility that has pegged prices below key levels, a new report suggests the market headwinds in May did little to slow down network revenue generation for the world’s two largest blockchains by market cap over the month.

The report by German-based ETP (exchange-traded products) issuer ETC Group highlights a significant jump in network revenue for both Bitcoin and Ethereum over the past month.

ETC Group Research team’s Tom Rodgers (Head of Research) and Hanut Singh (a Research Analyst at ETC Group and formely with CoinJournal), shared the outlook via an overview of the biggest trends and events in crypto over the month – from regulation to macroeconomics and adoption as signaled by on-chain data.

Writing in the Digital Assets and Metaverse Monthly Review: May 2023, Rodgers and Hanut noted that although continued headwinds saw the total crypto market cap flatline near $1.1 trillion.

On the macro level, the uncertainty around the US debt ceiling debate weighed on crypto markets. Elsewhere, the regulatory front saw the non-friendly approach by the US SEC and UK’s Financial Conduct Authority (FCA) continue to impact sentiment.

However, despite these factors, there was noteworthy growth in terms of network revenue for the leading blockchains.

“…revenues generated by the two largest blockchains by market cap rose substantially in May due to increasing user bases and new technological developments, most notably Ordinals for Bitcoin, and increasing adoption for Ethereum enterprise solutions,” the ETC Group research team wrote.

According to the ETC Group report, the weekly revenue on the Bitcoin network increased by 249% year over year in May. This was largely driven by the spike in Ordinals, which as CoinJournal reported here, saw BTC miners record multi-year highs in transaction revenue.

The demand for the Bitcoin Ordinals meant transaction fees amounted to 29.57% of monthly revenue for miners – the last time it was that high was during the 2017 bull market that had seen the first real foray into crypto by institutional investors.

For Ethereum, renewed interest in staking was visible in May despite the fears of a major withdrawal rout after the Shapella upgrade. Indeed, as the ETC Group report highlights, the supply of staked ETH on the mainnet rose from 14% to almost 20% at the end of the month. About $46 billion worth of ETH was staked, representing a 200% jump in the percentage of supply locked on the network.

This has happened even as ETH supply has declined since the Merge. Meanwhile, monthly fees rose by 53.7% in the month – from $241 million in April to $448 million in May. Increased demand for Ethereum blockspace is behind the jump in total network fees, the researchers noted.

While US presidential candidates Ron DeSantis (R) and Robert F. Kennedy Jr. (D) have indicated support for Bitcoin, the overall outlook on US crypto regulation remains largely hostile even with bipartisan engagements.

The SEC recently ramped up its crackdown with the lawsuits against Binance and Coinbase, even as the crypto community highly anticipates the outcome of another high profile case between the SEC and Ripple Labs over the XRP token.

This even as Asia emerged as a strong destination for crypto, led by Hong Kong’s recent regulatory guidelines that have seen OKX, Huobi and other exchanges apply for licenses. The adoption of the MiCA rules by Europe was also a notable event that could make the bloc attractive to more US-based crypto businesses.

May also witnessed increased institutional interest in blockchain amid further growth in tokenisation.

Interest peaked after State Street, the second-oldest US bank, hinted at a move likely to help bring $1.4 trillion worth of assets onto the blockchain via tokenisation of ETFs. The issue of tokenisation and its benefits had also previously been highlighted by the Bank of New York Mellon.

That’s also the view of Citibank, which has suggested tokenisation could see up to $4 trillion of liquid and illiquid assets brought on-chain.

The post Bitcoin and Ethereum network revenues spiked in May despite significant headwinds: ETC Group report appeared first on CoinJournal.

With Bitcoin price struggling below $26,000, and the wider crypto market impacted by recent regulatory events, there’s has been very little to cheer Bitcoiners.

But for a solo BTC miner, a lucky break had them strike gold with the winning of a block reward. According to on-chain data, the miner beat staggering odds to mine block 793607 and earn the 6.25 BTC block reward.

The solo miner reportedly achieved the once-in-a-life-time feat using a single Antminer S9 and accounted for only 17 terahashes (TH). Their “lottery” win was worth about $160,000 at the time of block reward.

“Congratulations to miner 151XTfHBfaDqoNWGGeYobNX2YzFFWuB5YD with only ~17TH for solving the 275th block at http://solo.ckpool.org! That is likely a single S9 miner. A miner of this size would only solve a block once every ~450 years on average,” tweeted Con Kolivas, a CGMiner software engineer and the admin of Solo CKPool.

It’s not the first time a solo miner has hit such a jackpot, with CKPool apparently seeing seven such instances since January. However, the feat is increasingly difficult as the Bitcoin hashrate and mining difficulty have increased.

According to data from Blockchain.com, the current Bitcoin mining difficulty is 51.23 trillion hashes. Mining difficulty looks at how difficult it is to mine the next block, that is how many hashes a miner must generate to find and solve a valid block. The current difficulty is at all-time highs and has most blocks solved by major mining pools and companies.

The difficulty adjusts every 2016 blocks (about two weeks’ time) and can go up or down. The next adjustment expected on June 14 will see the difficulty jump by about 2.92% to 52.73 T.

The post Solo Bitcoin miner beats the odds to win 6.25 BTC block reward appeared first on CoinJournal.

Many speculate the regulatory crackdown in the US will push crypto two ways: offshore and/or into the decentralised realm. For the former, that doesn’t need much explanation. Tightening the noose on crypto companies in the US will force those same companies to move abroad if they want to continue their operations at the same capacity (or at all).

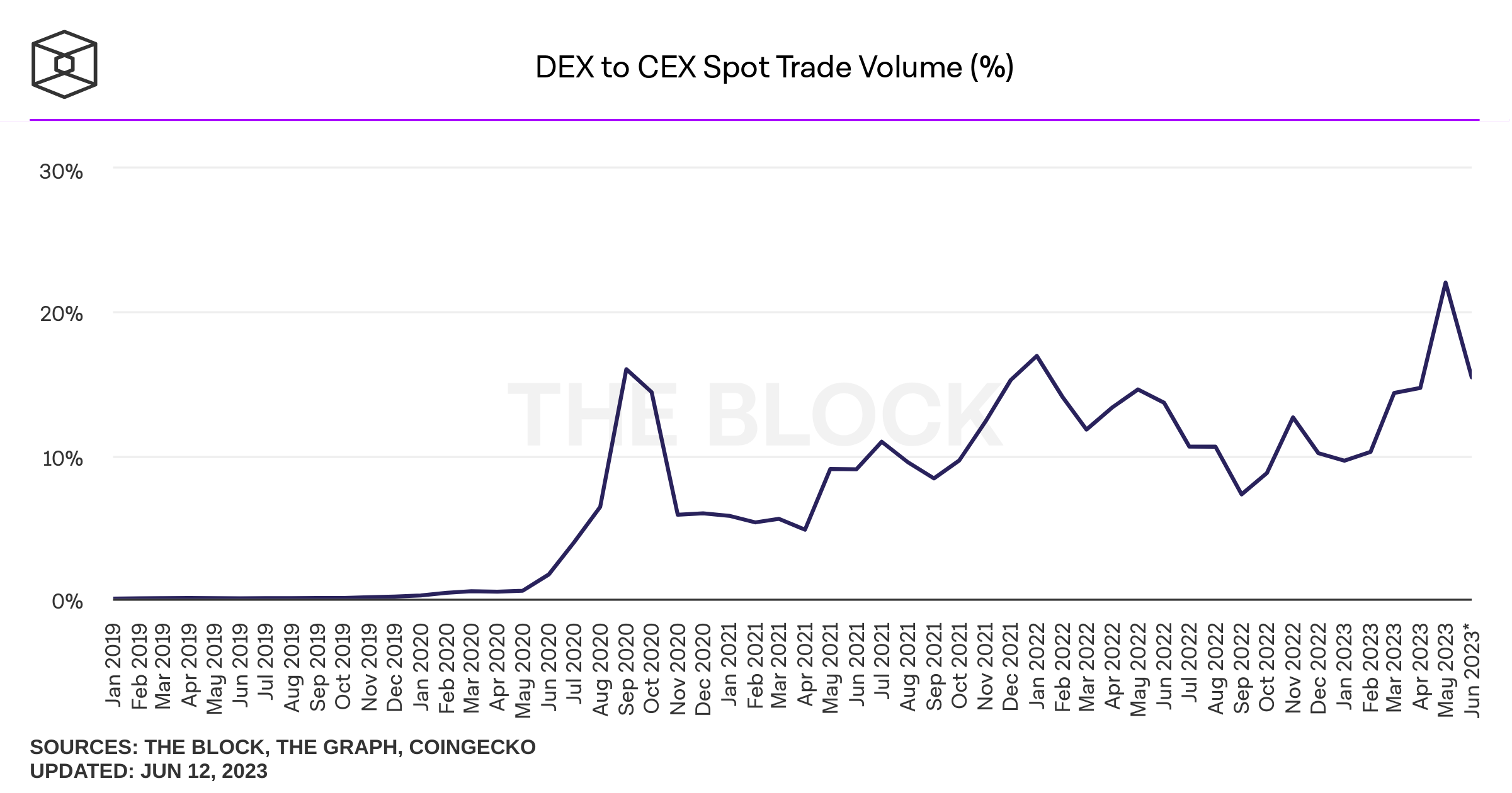

But whether this will push activity on-chain presents as a more interesting debate. Decentralised exchanges took off during the pandemic hysteria, however their volumes fell drastically throughout 2022. While volume also fell for centralised exchanges (CEXs), the ratio of the volume of DEX trading to CEX volume fell from 16.9% at the start of 2022 to 9.6% twelve months later, showing DEXs fell further than their more conventional counterparts.

Could the regulatory travails of Coinbase, Binance and other centralised exchanges reverse this trend? The below chart shows that there was indeed an increased portion of activity accounted for by DEXs in May, with DEX trading capturing 22.1% of volume, compared to 14.7% the prior month. However, the share has dropped back down to 15.4% through the first twelve days of June.

Binance was sued on June 5th and Coinbase on June 6th, which is curious when looking at the above trend as the DEX share has dropped since. Then again, these lawsuits may have been largely priced in. Coinbase was served with a Wells notice a few months ago, while Binance was (and still is) facing numerous investigations from different lawmakers. The price of Bitcoin will tell you all you need to know – it fell only 5% on news Binance had been formally sued, while the Coinbase news didn’t budge it much at all.

Binance was sued on June 5th and Coinbase on June 6th, which is curious when looking at the above trend as the DEX share has dropped since. Then again, these lawsuits may have been largely priced in. Coinbase was served with a Wells notice a few months ago, while Binance was (and still is) facing numerous investigations from different lawmakers. The price of Bitcoin will tell you all you need to know – it fell only 5% on news Binance had been formally sued, while the Coinbase news didn’t budge it much at all.

In truth, whatever the reasons, it is hard to draw conclusions from the above data. Volume remains incredibly thin, as I have discussed in-depth previously. In fact, on-chain activity and fees have actually fallen for the fourth consecutive week for Bitcoin, the immense spike in activity caused by the Ordinals protocol and BRC-20 tokens fading into the rear window. Despite this fall, however, it should be noted that fees are still significantly higher than the start of the year.

It is not just Bitcoin. Fees and activity are dwindling across the crypto space. The below is the same chart but for Ethereum, which has also seen four straight weeks of declining fees. In contrast to Bitcoin, the activity is inching down closer to where it was in January, however.

All in all, volume in the cryptocurrency space remains incredibly thin. This is due to a variety of factors. The first is the collapse in prices. When prices fall, people invariably trade crypto less. And with Bitcoin still 60% off its peak from late 2021, the hysteria and jammed order books feel a long way off.

But regulation is also a key factor. This has suppressed enthusiasm for the space immeasurably, with particular implications for institutions. We saw a telltale sign of that over the weekend, with Crypto.com suspending its US institutional exchange. While its retail platform will remain operational, the company cited limited demand from institutions as the reason behind the decision.

A cocktail of freefalling prices and an increasingly punitive regulatory regime is the worst possible scenario for the industry, and it is not hard to see why institutions have pulled back from the space.

The jump in DEX volume portrayed by the above on-chain data may seem promising at first glance, but that trend seems to have reversed. Additionally, for institutional capital to flow significantly into the space, centralised exchanges provide a vital function. So many were optimistic of these institutions pouring in only a couple of years ago, when companies like Tesla were stashing Bitcoin on balance sheets, but that feels a long way off now.

The post Crypto volumes continue to lag, Bitcoin & Ether fees down for fourth consecutive week appeared first on CoinJournal.

Litecoin has formed a triple-top pattern on the daily chart.

The main news is the recent lawsuits against Coinbase and Binance.

The Federal Reserve will deliver its next interest rate decision.

Litecoin price has come under intense pressure in the past few days as investors focus on the recent SEC lawsuits against Coinbase and Binance. LTC token retreated to a low of $73.98, lower than the year-to-date high of $105.70.

Litecoin, like other cryptocurrencies, is going through a rough patch as investors focus on last week’s lawsuit by the SEC. The lawsuits alleged that the companies provided unregulated securities in the United States. The agency also sued Binance’s Chief Executive, Changpeng Zhao, as we wrote here.

It is stil too early to predict the next outcome of these lawsuits. As we have seen with the ongoing SEC vs Rippple case, the process can last for several years. The most likely outcome will be a settlement between either Binance or Coinbase with the SEC. Alternatively, the two companies could lose the suits, leading to major implications foe the crypto industry.

For example, if Coinbase loses, it means that the company will be forced to delist thousands of cryptocurrencies. Popular coins like Bitcoin and Litecoin will be safe since they are seen as commodities.

The next key catalyst for the LTC price will be the upcoming interest rate decision by the Federal Reserve scheduled for Wednesday. Analysts believe that the bank will leave interest rates unchanged at between 5% and 5.25%.

A pause in interest rate hikes will be a positive thing for Litecoin, stocks, and other financial assets. For one, it will be the first time in 10 meetings that the Fed has not hiked interest rates.

The decision will come a day after the US publishes consumer price index (CPI) data. Analysts believe that the headline consumer price index (CPI) dropped to 4.1% in May from the previous 4.9%.

Turning to the daily chart, we see that the LTC price has formed a triple-top pattern at $105.70, where it struggled moving above this year. The neckline of this pattern is at about $65.60. The coin has moved below the 50-day and 100-day moving averages.

The Relative Strength Index (RSI) has moved below the neutral point at 30. Therefore, I suspect that the LTC price will continue falling as sellers target the key support at $65.60. A move below that level will open the possibility of the coin dropping to $60.

The post Litecoin price analysis ahead of the FOMC decision, US inflation data appeared first on CoinJournal.