Ripple lobt die bessere Regulierung in Europa als Grund für das eigene Wachstum im Ausland.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Ripple lobt die bessere Regulierung in Europa als Grund für das eigene Wachstum im Ausland.

Key takeaways

Binance users interested in Bitcoin mining can now subscribe to Binance’s cloud mining services starting today.

The new service comes despite Binance currently facing regulatory pressure in the United States.

The world’s largest cryptocurrency exchange by daily trading volume, Binance, has launched new Bitcoin subscription-based cloud mining products.

#Binance is launching a new batch of Cloud Mining products for #BTC mining.

Complete your subscription to Cloud Mining products and start accumulating rewards!

Find out more 👇https://t.co/lH2jTwOxKs

— Binance (@binance) June 15, 2023

Starting today, June 15, Binance users interested in Bitcoin mining but who don’t have the hardware can subscribe to the cryptocurrency exchange’s cloud mining services and purchase hashrates.

At the moment, the cryptocurrency exchange is selling 1 Terahash per second (Th/s) at $10.7280. As a user purchases more hashrate. The probability of higher income in terms of the Bitcoin earned through mining increases.

Binance revealed that its BTC mining subscription service would be active for six months. For each TH/s purchased, users stand a chance to earn 0.0004338 BTC during the 180-day period.

The product is currently available on the Binance global website, which means that it is not available to its users in the United States.

This latest development comes at a time when Binance is facing regulatory pressure in the United States.

The United States Securities and Exchange Commission (SEC) sued Binance earlier this month for allegedly breaking securities laws. The regulatory agency has also filed for a temporary restraining order to freeze Binance.US’s assets.

Binance.US has already hired former SEC enforcement co-director George Canellos as part of its legal team as it defends itself against the regulatory agency’s allegations.

Last week, Binance.US announced the suspension of USD deposits on its platform as it transitions into an all-crypto exchange.

The SEC also sued rival cryptocurrency exchange Coinbase for failing to register as a broker, national securities exchange or clearing agency.

The post Binance introduces Bitcoin mining cloud services amid regulatory pressure appeared first on CoinJournal.

After ten consecutive interest rate hikes, the US Federal Reserve this week paused its rate hiking policy. The move was nearly unanimously anticipated by the market and movement after the meeting was relatively minimal.

However, over the past month, markets have been flying. The S&P 500 is up 6% in the last 30 days, now only 8.8% off an all-time high, despite being 27% below the mark in October. The Nasdaq is up 10% over the same timeframe – that is 15% below its all-time high from November 2021 but a tremendous resurgence considering it shed a third of its value in 2022.

And yet, something is being left behind: Bitcoin.

Bitcoin is now trading below $25,000 for the first time in three months. I put together a deep dive in March analysing the its underlying price movement to show how tightly it trades with the stock market. This was at a time when Bitcoin was rallying and banks were wobbling amid the Silicon Valley Bank fiasco. Suddenly, it was fashionable to declare Bitcoin as decoupling from the stock market. Ultimately, that wasn’t true. However, something very interesting has happened in the last month.

First, take a look at the path of the Nasdaq and Bitcoin since the start of 2022, which roughly coincides with the start of the bear market:

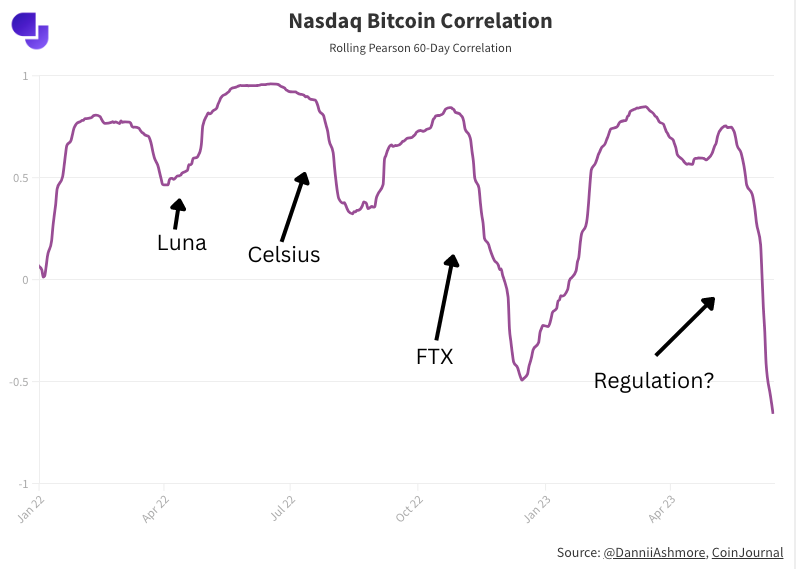

Clearly, the two have moved in lockstep. But two episodes jump out: the first is November 2022, when Bitcoin fell and the Nasdaq surged. The second is this past month. We discussed the 10% jump in the Nasdaq over the last month. However, Bitcoin has fallen 9% in the same timeframe. This marks a clear departure from what we would expect. Plotting the correlation (using 60-Day Pearson) shows this more directly:

I touched on November 2022 above, and the swift fall in correlation can be seen on the chart. This was when FTX collapsed, sending the crypto market into a tailspin. At the same time, however, stocks raced upwards as softer inflation numbers were met by lower expectations around the future path of interest rates.

There were also less dramatic (but equally temporary) decouplings between Bitcoin and stocks in April/May 2022 and June/July 2022. On the chart below, I have pencilled in incidents which occurred during these periods:

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).

Indeed, what is different about November (FTX) and today is that we see a Bitcoin fall happening at the same time as a Nasdaq surge. While the Luna and Celsius incidents hurt crypto immensely, they came as stocks were also struggling and so the effect is not as dramatic in terms of correlation breaks (although is still tangible on the chart).

But today, we are seeing the biggest break in the correlation trend over the last couple of years – surpassing even FTX. The 60-Day Pearson currently sits at -0.66, whereas the lowest it hit during the FTX crisis was -0.49.

The reason is obvious. The great regulatory crackdown in the US is freaking the market out, and for very good reason. The two biggest crypto companies on the planet, Binance and Coinbase, were both sued last week.

Crypto.com has suspended its institutional exchange, citing weak demand amid the regulatory woes. eToro and Robinhood pulled a bunch of tokens from their platforms following confirmation from the SEC that it viewed them as securities. Liquidity is dropping like a stone.

I wrote in-depth about the concern following the announcement of the Coinbase lawsuit last week, so I won’t rehash it here (that analysis is here). While I believe Bitcoin should be able to weather the storm long-term, the picture appears far murkier for other cryptocurrencies.

Make no mistake about it, the crypto industry faces a massive problem as long as lawmakers continue to turn the screw. The crisis very much feels existential for a lot of the crypto market.

Regarding Bitcoin, enthusiasts dream of a day when it can decouple and claim that title of uncorrelated hedge asset, or a store-of-value, akin to gold. I’ve done a lot of work around what that hypothetical future could look like, or what could lead the market to that point. But for now this remains just that: hypothetical. Because while the correlation is at its lowest point in five years, it is not being driven by fundamentals and thus will inevitably spike back up. This is nothing more than the market reacting to what is a very bearish development around regulation in the US.

It’s not how investors hoped a decoupling would come. But if anyone doubted the market’s fear over the regulatory woes, or questioned why Bitcoin had not fallen more, looking at the break in correlation paints a very clear picture of how detrimental Gary Gensler’s games have been to the cryptocurrency industry.

In truth, it is not hyperbole to say that this is the most out of whack Bitcoin’s correlation has ever been whilst trading as a mainstream financial asset. Because back when it last happened in 2018, Bitcoin traded with such thin liquidity that its price action is largely irrelevant to draw conclusions from going forward.

The post Bitcoin correlation with stocks at 5-year low as regulatory crackdown takes toll appeared first on CoinJournal.

Cryptocurrencies plunged hard after the latest Federal Reserve decision.

Bitcoin dropped below the key support levels at $25,300 and $25,000.

XRP has formed a double-top pattern on the daily chart.

Cryptocurrency prices dipped sharply this week amid significant monetary policy and regulatory concerns. Bitcoin crashed below the important support at $25,000 while most altcoins erased their 2023 gains. This sell-off accelerated after the Federal Reserve pointed to two more rate hikes later this year. In this article, we will explain what to expect in XRP, Hedera Hashgraph, and Stacks.

The XRP price drifted downwards this week after it jumped to a high of $0.5624. Its highest point was an important level since it was also the year-to-date high. This means that the coin has formed a double-top pattern, which is usually a bearish signal. The neckline of this price is at $0.4075, the lowest level on May 11.

At the same time, Ripple price managed to cross the 25-day and 50-day exponential moving averages, signaling that bears are gaining traction. The Relative Strength Index (RSI) crossed the key level st 50 while one line of the Stochastic Oscillator indicator dropped below the oversold level. XRP price also formed a small shooting star pattern.

Therefore, the outlook of Ripple is bearish, with the next level to watch being at the neckline of the double-bottom pattern at $0.4075.

inv-news-table coins=”XRP” limit=”2″]

Hedera Hashgraph is a major blockchain project that seeks to become a good and faster alternative to Ethereum. It is faster, cheaper, and governed by leading companies like Google, IBM, and LG. Like other cryptocurrencies, the HBAR price has been in a strong downward trend in the past few months. It has erased about 40% from its highest level this year.

HBAR price has dropped below the important support level at $0.0542, the lowest level on March 10th. The token has moved below the 25-period and 50-period moving averages. At the same time, the Relative Strength Index (RSI) has continued falling. Therefore, there is a likelihood that the coin will continue falling as sellers target the next key support level at $0.035, which is about 18.5% below the current level.

inv-news-table coins=”HBAR” limit=”2″]

Stacks price has been in a strong bearish trend despite the rising interest of Bitcoin development. STX managed to move below the lower side of the descending channel shown in orange. At the same time, the coin has dropped below the 25-day and 50-day EMA. On the daily chart, it has moved below the 61.8% Fibonacci Retracement level.

Stacks has also moved below the psychological level of $0.50. Therefore, there is a likelihood that the coin will continue falling as sellers target the next level at $0.35.

inv-news-table coins=”STX” limit=”2″]

The post Crypto price prediction: XRP, Hedera Hashgraph, Stacks appeared first on CoinJournal.

Due to increased market volatility, Delio, a Korea-owned cryptocurrency lending and savings company, has temporarily suspended fund withdrawals.

Founded in 2018, Delio offers its customers an annual percentage rate (APR) of up to 10.7% on their Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) holdings.

The company said in a statement that it made the decision to halt deposits and withdrawals to protect its customers, who are currently perplexed as a result of the sharp decline in the price of Bitcoin and other cryptocurrencies. The translated version of the statement read:

“In the aftermath of the recent suspension of deposit and withdrawal of digital assets at Haru Invest., situations such as a sharp increase in market volatility and increased confusion among investors are causing. In this situation, in order to safely protect the assets of customers currently in custody, Delio will inevitably suspend withdrawals temporarily as of June 14, 2023, 18:30, until the above situation and its aftermath are resolved.”

Since reaching an all-time high (ATH) of $69,000 in 2021, the price of Bitcoin has significantly decreased. The price of the leading cryptocurrency has decreased by more than 5% this week, and most altcoin prices have also undergone significant declines.

Without strong capital controls and reserves, the protracted bear market has made it inevitable for centralized cryptocurrency businesses to cease fund withdrawals or go out of business. Only a few of the numerous crypto lending platforms have managed to continue their regular business operations.

The bear market has seen industry heavyweights like Celsius, Voyager, BlockFi, Vauld, and a host of others go under.

One of the very few digital asset lenders that have not suspended fund withdrawal services during these difficult times is Nexo, which reached a $45 million settlement with the US SEC last January.

The post Crypto lending platform Delio temporarily suspends withdrawals appeared first on CoinJournal.