Der Gründer von Terraform Labs wurde in Montenegro zu vier Monaten Haft veruteilt, weil er einen gefälschten Pass verwendet haben soll.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der Gründer von Terraform Labs wurde in Montenegro zu vier Monaten Haft veruteilt, weil er einen gefälschten Pass verwendet haben soll.

Binance’s war with the SEC goes on. As does Coinbase’s. As does, well, the entire cryptocurrency space, which suddenly faces a regulatory threat that feels existential for the crypto industry in the US.

The market has responded, unsurprisingly, by selling. Bitcoin dipped below $25,000 for the first time in three months last week, before bouncing back to where it currently trades at $26,500.

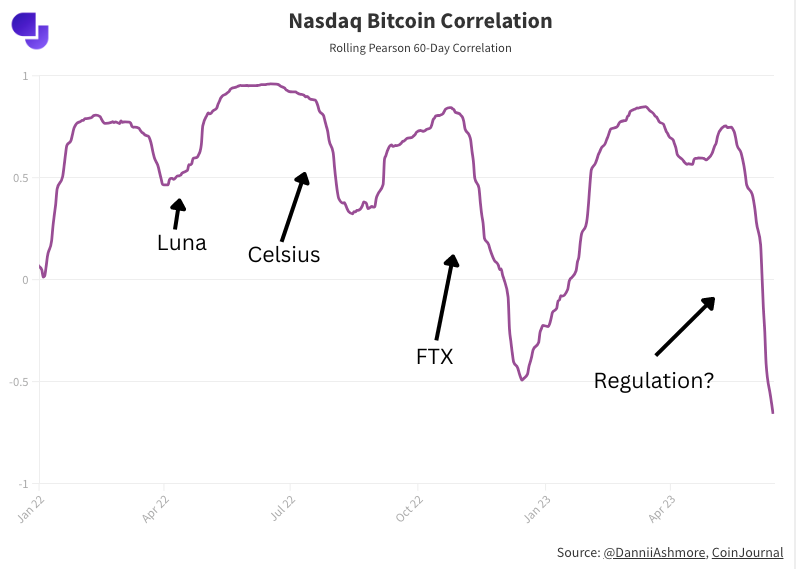

More notable, however, was that this came amid a time when the stock market is soaring. As I detailed in depth last week, the correlation between stocks and Bitcoin is now at a 5-year low. This is similar to the dip in correlation we saw in November when FTX collapsed while the stock market surged off softer-than-expected inflation numbers.

In such a way, while Bitcoin’s price decline seems minor on the face of things, it is underperforming relatively as the rest of the market is red hot.

In such a way, while Bitcoin’s price decline seems minor on the face of things, it is underperforming relatively as the rest of the market is red hot.

But beyond price, how are markets reacting? Are people again concerned about storing their assets with these centralised exchanges?

Well, looking at the total amount of Bitcoin sitting in these exchanges, there has been net outflows for 33 days in a row. That is the longest streak since November 2022 amid the FTX scandal.

The scale of withdrawals is not the same, however. Back in November, the last time we saw a consistent stream of net withdrawals, FTX was exposed as insolvent (and fraudulent) with $8 billion of customer assets gone. Fear was extreme and the entire market panicked, concerned that other exchanges could follow. Bitcoin ran for the exit doors, much of it sent straight to cold storage (or sold for cash).

While the current developments are concerning for crypto in their own way, there appears to be no fear that customer assets are in danger. This is not a repeat of FTX, and the market reaction is also significantly more muted.

Indeed, if we look at the total balance of Bitcoin across exchanges, we can see that the recent dip does not stand out in the context of the steep downtrend we have seen since the start of 2020.

But what about Binance? Accusations levelled at the world’s biggest crypto exchange are certainly more sordid than merely securities violations. Binance and CEO Changpeng Zhao have been accused of trading against customers, manipulating trade volume, failing to implement adequate money laundering procedures, encouraging US customers and VIPs to circumvent location-based restrictions, and commingling customer funds.

It is the latter accusation which is the headline one and throws up painful memories of FTX. While I have been critical of Binance for operating in an incredibly opaque manner (they have always refused to reveal their liabilities), there has been no evidence to date that customer funds have been misappropriated as they were in the FTX case. Again, this really has little in common with the FTX situation.

On Saturday, a US court even approved an agreement between Binance and the SEC that would dismiss a temporary restraining order to freeze all Binance.US assets.

“We are pleased to inform you that the Court did not grant the SEC’s request for a TRO and freeze of assets on our platform which was clearly unjustified by both the facts and the law,” Binance.US said on Twitter.

This appears to have assuaged the doomsday scenario, whatever chance there was of that to begin with. In looking at the flows on Binance specifically, however, it has seen more outflows than any other major exchange. 7.3% of its Bitcoin balance was withdrawn in the two weeks since the lawsuit was announced on June 5th. That equates to 52,000 Bitcoin, or about 0.3% of the total circulating supply.

For context, when Binance came under fire for its lack of transparency around reserves after FTX collapsed, 13.3% of its Bitcoin balance was withdrawn in a similar two-week period – evidently bigger as seen on the above chart, nearly double the flows of what have been seen thus far amid this SEC case.

What does this all mean? Not very much, really. Binance has long operated in the shadows, and as I wrote here upon the SEC’s case being announced, it was a day that had long been coming. But there should not be a sudden uptick in concern around the safety of customer funds, and that is reflected in the relatively small flow of funds out of the platform.

Nonetheless, the allegations against Binance are far more than merely selling unregistered securities, which is the main sticking point across the industry (and what Coinbase is being sued for). It is for this reason that funds have moved out of Binance at a faster pace than other exchanges, even if the size of these is no reason for alarm.

All in all, the reaction is not surprising. Nor were the news of these lawsuits, really.

The post Report: 33 straight days of net withdrawals from crypto exchanges appeared first on CoinJournal.

As Bitcoin bulls face rejection from above $26k, a top analyst has pointed out the benchmark cryptocurrency’s price faces fresh downside pressure.

BTC price is currently 2.4% up in the past week, but has failed to break past key resistance around $26,600. The breakdown to lows of $24,800 last week amid negative regulatory headlines appears to have only emboldened bears further.

According to crypto analyst Rekt Capital, the technical outlook for BTC suggests more weakness is likely. This is after a new weekly close below the 200-week moving average, which signals a “double confirmation of [a] breakdown,” the analyst noted.

Last week, Bitcoin price recovered from lows of $24.8k after the market reacted sharply to the SEC’s lawsuits against crypto exchanges Binance and Coinbase. Commenting after the upside, Rekt Capital suggested that Bitcoin had “run straight into the 200-week MA”

He noted that if bears managed to turn this zone into new resistance, there was likelihood BTC could see a “two-step breakdown confirmation.” Such a price scenario was likely to result in further downside pressure.

“Technically, BTC is positioned for downside. Why? Because it has produced another, new Weekly Close below the 200-week MA. As a result, $BTC has shown double-confirmation of breakdown from the 200-week MA. Continued rejection here could send price lower,” he tweeted on Monday, pointing to last week’s prediction.

Here’s a chart the analyst shared, showing Bitcoin’s rejection at both a downtrend line and the 200-week MA.

If Bitcoin gives up the $26k level again, a run to June lows could open up room for more losses. However, as BitMEX founder and former CEO Arthur Hayes pointed out last week, its likely crypto will hit the pain of an extended sideways action before a new trigger sets up an “autumn rally.”

As CoinJournal reported, the BitMEX founder believes the trigger will be retail trading, and a big possibility is this next bull market is led by the Chinese trader. BlackRock filing for a spot Bitcoin ETF could also be a significant tailwind in coming months.

The post Bitcoin signals potential breakdown, top analyst says about BTC price appeared first on CoinJournal.

Ethereum Foundation researcher Michael Neuder has proposed that Ethereum’s validator balance cap be increased from the current 32 ETH.

The proposal is under consideration by core developers and if approved could see those looking to be validators on the world’s largest proof-of-stake network required to have 2,048 ETH, a balance that would be 64 times higher than the current limit.

According to Neuder, while the 32 ETH limit works towards more decentralisation of the Ethereum network, increasing it not only helps lower the size of the validator set, but will also ultimately bring more efficiency to the leading altcoin.

Large validators, such exchanges and institutions will find it easy to manage their operations given the reduction such an increase from 32 ETH to 2,048 ETH would occasion.

With the 32 ETH limit, entities that run as validators had to increase the number of validator nodes they operate for them to have sufficient stake. But with more people eyeing the staking rewards, the number of Ethereum validators has remained high even after the Shapella upgrade.

Currently, Ethereum has over 700,000 validators, and a further 90,000 are looking to join the set.

Also part of the proposal is the idea of having staking rewards auto-compounded. This means instead of requiring any ETH above the current cap moved to another account, the rewards could be compounded to have validators earn higher staking income.

While core Ethereum developers debated the likely pitfalls of implementing such a change, the agreement was for continued discussions. Notably, the proposal seeks to increase the limit, but the minimum stake will remain 32 ETH.

The post Ethereum proposal seeks to increase validator limit from 32 ETH to 2,048 ETH appeared first on CoinJournal.

The cryptocurrency market is in consolidation following the strong rally since the start of the year. For example, Ripple (XRP) rallied against the US dollar in the first four months of the year as it jumped from $0.3 to almost $0.6 following the overall bullish cryptocurrency market trend.

But then, a consolidation followed. Since trading close to the $0.6 level, XRP/USD failed to make a new high for the year. In fact, it was constantly rejected by horizontal resistance.

However, this rejection, while bearish short term, also tells something different. As long as the price action keeps the series of higher lows intact, it builds energy before another try at the resistance level.

In other words, the bias remains bullish for the XRP/USD if the price is above $0.4. If the level holds, XRP/USD may be close to finishing a bullish reversal triangle with a measured move pointing to much higher levels.

The cryptocurrency market’s bearish trend ended in the last part of 2022. In the case of XRP/USD, one can see a double bottom pattern at the $0.3 level – a bullish reversal pattern.

But that is not the only bullish sign. The fact that the market formed a series of higher highs while failing at horizontal resistance tells us that it is building energy to break higher.

More precisely, the price action resembles a bullish triangle. On a close above $0.6, the market should keep advancing toward the $0.8 area because such a triangle has a measured move equal to the length of its longest segment.

The post XRP/USD price prediction: bullish triangle favors a move to $0.8 appeared first on CoinJournal.