- The crypto market cap was down 3.2% in the past 24 hours to $1.2 trillion as Binance halted BTC withdrawals.

- The exchange’s action followed massive network congestion for Bitcoin amid increase in fees as tokens with inscriptions and ordinals pumped.

- Meanwhile, Bitcoin (BTC) saw its market cap drop to $540 billion for a 45% market dominance.

The total cryptocurrency market cap is down 3.2% to $1.2 trillion in the past 24 hours as of writing. The top two digital assets by market capitalization Bitcoin (BTC) and Ethereum (ETH) are both down more than 3% in the same period and -5.4% and -2.2% respectively over the past seven days.

As a result, BTC price is below $28,000 while Ether is trading near $1,850 amid broader selling pressure for crypto.

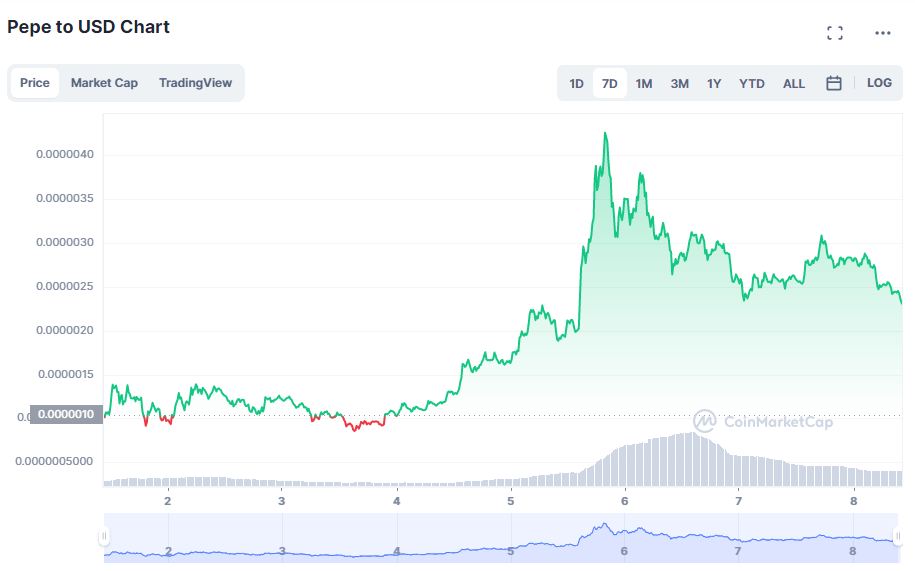

While most big cap tokens are down about 3 to 6%, Pepe (PEPE) and Sui (SUI) are the biggest losers in the top 100 coins with about -12% performance in the past 24 hours.

Why crypto market is down today – look at Bitcoin

The traditional markets continue to see some negativity as traders place new bets on regional banks plummeting again following last week’s bounce. The outlook isn’t the same for crypto and Bitcoin indeed rallied as multiple US bank stocks dumped.

But why is the crypto market cap down? Notably, crypto remains volatile and BTC is finding it difficult to break higher following the rejections near $30,000. However, panic selling could be behind this latest down leg, particularly with such data as the one showing enormous BTC outflows from the Binance exchange.

BREAKING: #Binance outflow data confirms largest withdrawal in it’s history, over 162,000 $BTC has left the exchange, valued at over $4.6 Billion.

Are Whales/Insiders jumping ship? 👀 pic.twitter.com/QSXYAEvHkt

— WhaleWire (@WhaleWire) May 7, 2023

Binance addressed the “outflows” funds movement between its hot and cold wallets amid the adjustments in BTC address. This comes after the exchange suspending Bitcoin transactions as the flagship network experienced massive congestion. It’s a scenario that saw transaction fees spike significantly.

For instance, on Sunday, transaction fees in BTC block 788695 was 6.7 BTC, higher than the block subsidy of 6.25 BTC. On-chain data shows Bitcoin experienced a spike in blockspace demand, pushing transactions fees higher.

According to on-chain analytics platform Glassnode, the high demand for blockspace is being driven by BRC-20 tokens. The tokens that use inscriptions and ordinals have been up as shown by the 9% gains for Stacks (STX) amid BTC price decline.

#Bitcoin is experiencing extremely high demand for blockspace, driven by BRC-20 tokens, utilizing text based inscriptions, and ordinals

This is a revenue boost for Miners, as the average fee paid per block has reached 2.905 $BTC, near past bull peaks

📊https://t.co/DyVjODagG9 pic.twitter.com/8ZV0i4DNzm

— glassnode (@glassnode) May 8, 2023

As such, the Bitcoin market cap is down to $540 billion today, representing about 45% of market dominance. Ethereum‘s market dominance currently stands around 18.6%

Bitcoin price prediction

The announcement that Binance had suspended BTC withdrawals – on two occasions – looks to have spooked a few traders into action. But the crypto market cap could recoup some of the losses ahead of a crucial week with economic news. Binance is also reportedly eyeing Bitcoin Lightning Network transactions.

Crypto analyst Michael van de Poppe highlights Bitcoin price levels at $27.4k or even $26.8k could provide the bounce area.

“Mentioned before that $29.2K was the key level to break for #Bitcoin. We did have a bounce towards it, but no break. Additionally some FUD regarding #Binance doesn’t help. Looking at $27.4K or $26.8K for potential longs towards the CME gap at $29.6K,” the analyst tweeted on Monday morning.

The post Why is the crypto market down today? appeared first on CoinJournal.