Tom Mutton, der Fintechleiter der Bank von England, hat kürzlich auf einer Veranstaltung erklärt, dass Privatsphäre und Anonymität bei CBDCs nicht verwechselt werden dürfen.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Tom Mutton, der Fintechleiter der Bank von England, hat kürzlich auf einer Veranstaltung erklärt, dass Privatsphäre und Anonymität bei CBDCs nicht verwechselt werden dürfen.

Two of the leading cryptocurrencies are Bitcoin and Ethereum. The direct correlation between the two is so strong that one cannot move up or down without the other one to follow.

Bitcoin is supposed to lead, but that has not always happened. In any case, in 2023, Bitcoin gained 67.05% YTD, while Ethereum 53.95% YTD. Hence, Bitcoin leads, but for those believing in Ethereum, it means that there is more room to catch up.

The best way to speculate on the difference between the two is to focus on the ETH/BTC price. The cross tracks the differences between the two leading cryptocurrencies; the higher it gets, the closer the two move.

For example, if the cross moves to parity, it means that 1 Ethereum equals 1 Bitcoin. But that is a long road to such a level. As for now, the cross trades at 0.066, moving in a tight consolidation in 2023.

The ETH/BTC cross more than doubled in April 2021, moving from 0.03 to above 0.06. Since then, it moved into a range with the highest point 0.08 and the lowest 0.05.

But a bullish flag pattern keeps the focus on Ethereum. On a daily close above 0.07, bulls might want to invest in Ethereum instead of Bitcoin because the cross has room for more upside until the flag’s measured move is reached.

The post ETH/BTC price has upside potential, according to this bullish pattern appeared first on CoinJournal.

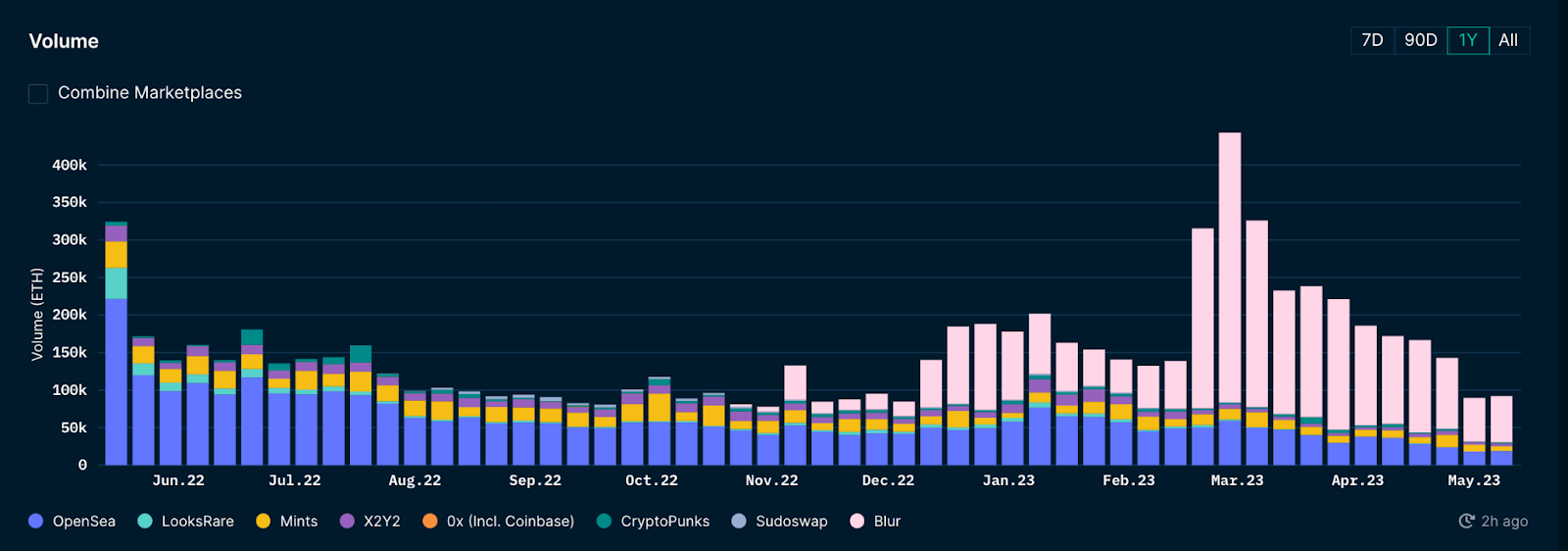

An analysis of the NFT market by Nansen, a leading blockchain analytics firm, has hinted at a resurgence in the sector in the first three months of the year. Data comparing market performance in terms of trading volumes shows sales surged over 230% in Q1, 2023 vs. Q4 2022.

According to Martin Lee, a Data Journalist at Nansen, the significant increase is observable in both ETH and USD metrics. A new player in the NFT marketplace ecosystem accounted for a large share of the trading volume, the analysis reveals.

“The increase has largely been driven by the rise of Blur,” Lee noted in an analysis shared with CoinJournal.

In Q4, 2022, over 1.5 million ETH, or more than $1.97 billion worth of NFTs was transacted. This amounted to NFT sales volume of 9,036,778 during the period. In comparison, the NFT market recorded a significant increase in transacted volume in Q1, 2023 with market volume hitting over 2.83 million ETH, or $4.54 billion.

The total transacted in the quarter was 11,498,022 NFTs, with the volume increasing 230% in Q1, 2023 compared to Q4, 2022.

Although Q1, 2023 showed significant increase in sales volume compared to Q4, 2022, Nansen data shows there was a lull in April. While $1.7 billion was transacted in March, the next 30 days saw a dip in volume with approximately $1.2 billion generated. The trend is also being observed in May as shown below.

Data shows a decline in NFT volumes in April and May. Source:Nansen

Data shows a decline in NFT volumes in April and May. Source:Nansen

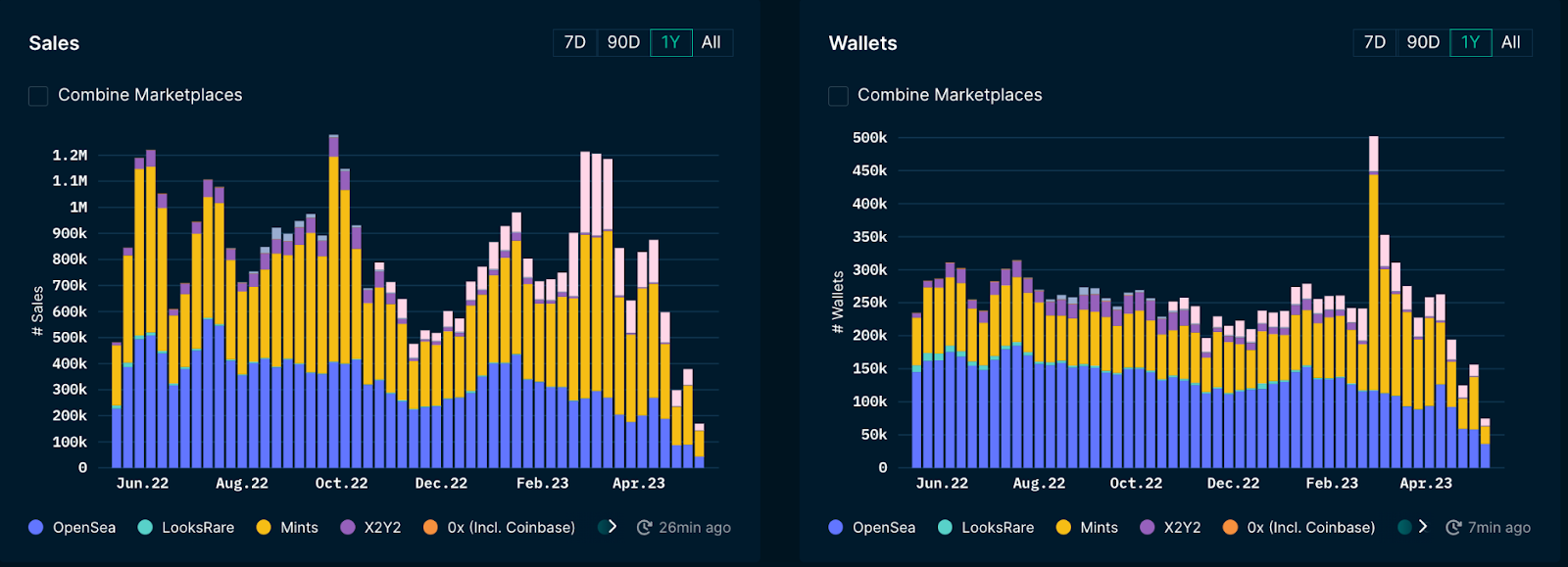

There’s also a slight decline in the number of users, with data for the past few weeks lower than what was recorded in the past year. Notably though, Q1 saw 13,999,528 in users, compared to 11,233,872 in Q4, 2022.

A visualization of NFT sales and wallets between January,2022 and April, 2023. Source: NansenThe decline comes amid a surge in interest in meme coins, with the likes of Pepe (PEPE) and Floki Inu (FLOKI) top performers in the last month.

A visualization of NFT sales and wallets between January,2022 and April, 2023. Source: NansenThe decline comes amid a surge in interest in meme coins, with the likes of Pepe (PEPE) and Floki Inu (FLOKI) top performers in the last month.In the last quarter of 2022, the NFT market observed noteworthy sales figures, particularly for OpenSea. The platform accounted for 219,992.50 ETH in volume, equivalent to $272,415,866.4. The total NFT sales across the platform during the quarter was 1,413,780 NFTs.

During this period, other platforms that recorded significant volumes were LooksRare, Mint, CryptoPunks, and X2Y2.

During the first quarter of 2023, Blur emerged as a prominent player in the NFT market. While OpenSea sales volume was 661,547.79 ETH, or approximately $1.02 billion from 3,727,299 NFTs sold, Blur’s volume was nearly three times higher.

According to the Nansen analysis, Blur saw its remarkable growth translate to over 1.8 million ETH, or $2.93 billion worth of NFT sales. The platform accounted for 1,999,688 of the quarterly NFT sales.

Blur, launched in October 2022, is now one of the leading NFT marketplaces. The Ethereum-based platform looks to offer traders and collectors a top marketplace that highlights a community-driven ecosystem.

Blur’s growth in terms of sales volume demonstrates the continued expansion of the NFT market, with traders and collectors keen to explore the best of both established and emerging platforms.

The post NFT trading volume rose 230% in Q1, Nansen finds appeared first on CoinJournal.

Microsoft is among several global tech and finance companies looking to advance interoperabiloty in the financial markets via a new privacy-enabled blockchain network.

The institutional-focused blockchain is dubbed the Canton Network and will offer access to a decentralised infrastructure targeted at unlocking the potential of synchronised financial markets, according to details shared in a press release on Tuesday.

The Canton Network consortium includes crypto platform Digital Asset, investment banking providers BNP Paribas and Goldman Sachs and auditing giant Deloitte. Other partners are Cboe Global Markets, Cumberland, Deutsche Börse Group, EquiLend, Moody’s, and Paxos among others.

Created as a ‘network of networks’, Canton will see previously siloed systems within the financial markets ecosystem interoperate – with industry players benefiting from aspects such as proper governance, privacy, and permissioning applicable to the highly regulated sector.

Apart from harnessing the power of blockchain, the project will also look to advance integration of Web3 and AI in the financial industry.

Rashmi Misra, the General Manager AI & Emerging Technologies, Business Development at Microsoft, said:

“We are excited to be a supporting partner of the Canton Network. We look forward to helping the financial community build and scale cloud enabled Web3 applications on Azure while harnessing the power of AI to improve the user experience and drive developer adoption.”

Canton Network participants are set to test the interoperability capabilities of the platform starting in July. Users will be able to execute atomic transactions across multiple smart contracts, with rapid cross-chain settlement, privacy and security.

Adoption of blockchain technology and digital assets among financial institutions and payments providers has picked up again after a lull that came with the turmoil of the crypto winter and regulatory uncertainty.

Recent moves in this direction have been made by companies like Visa and Mastercard.

The post Microsoft joins BNP Paribas, Goldman Sachs and others on new blockchain network appeared first on CoinJournal.

Dogecoin (DOGE) became arguably the most famous meme coin buoyed by social media hype over the past few years. Millionaires were created out of nowhere, and thousands of other meme coins sprung up to try and capitalize on increased demand for the “next big thing” in the crypto world.

However, only some of these meme coins have succeeded. This, combined with wider economic pressures and a general slowdown in the entire crypto market, has led some investors to look elsewhere.

But the meme coin boom isn’t over. It’s just getting started following the launch of new trending meme crypto projects like DigiToads (TOADS).

Savvy investors think that DigiToads (TOADS) is a win-win proposition. Unlike many other meme coin success stories, it’s actually got a ton of solid fundamentals built-in to an incredibly innovative ecosystem that’s rewarding, fun, and primed for growth. Memecoin hype can only get you so far, but TOADs has both the fun marketing appeal and the long-term profit potential investors have been crying out for.

DigiToads leads the charge as one of the hottest P2E cryptos in the crypto space, thanks to its extremely enjoyable swamp battle arena that lets users train and battle with a range of TOAD companions. The best-placed competitors will receive regular rewards in the form of TOADS tokens, which can then be used to buy food, train, and customize your companions to take them to the next level.

The TOADS ecosystem has been built from the ground up with a community-focused ethos at the core of everything it does. It is currently conducting its presale which provides early investors with long-term gains thanks to heavily discounted prices and sustainable passive income potential thanks to top NFT staking capabilities. You can participate in the DigiToads presale here.

With prices already soaring during TOADS’ presale phase, the token price is locked in to go even higher before its official launch thanks to staggered increases. With the increased popularity and number of investors flocking to purchase the new TOADS token, DigiToads could surpass well-known meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB).

Dogecoin hype and price performance over the years have certainly shown what sort of gains are possible in the meme coin world. It also showed other crypto projects how much marketing power a few tweets from famous followers can get you.

However, DOGE could not solidify those huge gains, and its long-term journey has been slightly less appealing to investors. Analysts have suggested that this comes down to fundamentals: social media hype can only get you so far, and credible investors need credible crypto options.

While DOGE remains a viable option for your crypto portfolio since it could still surge back to its former highs, experts think that TOADS also has everything needed to become the next meme coin.

The post In the year of the meme coins will DOGEs growth be eclipsed by TOADS? appeared first on CoinJournal.