Key Takeaways

- Number of addresses containing one Bitcoin or more crosses one million

- Bitcoin relatively subdued despite trading at 2-month low

- Two prominent market markers are scaling back activity in the space

- Active addresses show notable decline in last week

We wrote last week that nearly one million addresses on the Bitcoin network now contain at least one Bitcoin. That mark has now been passed, as the below chart shows.

As dramatic as that sounds, it doesn’t equate to one million people, as aggregate wallets exist (such as exchange wallets), not to mention the fact that one person often has more than one address.

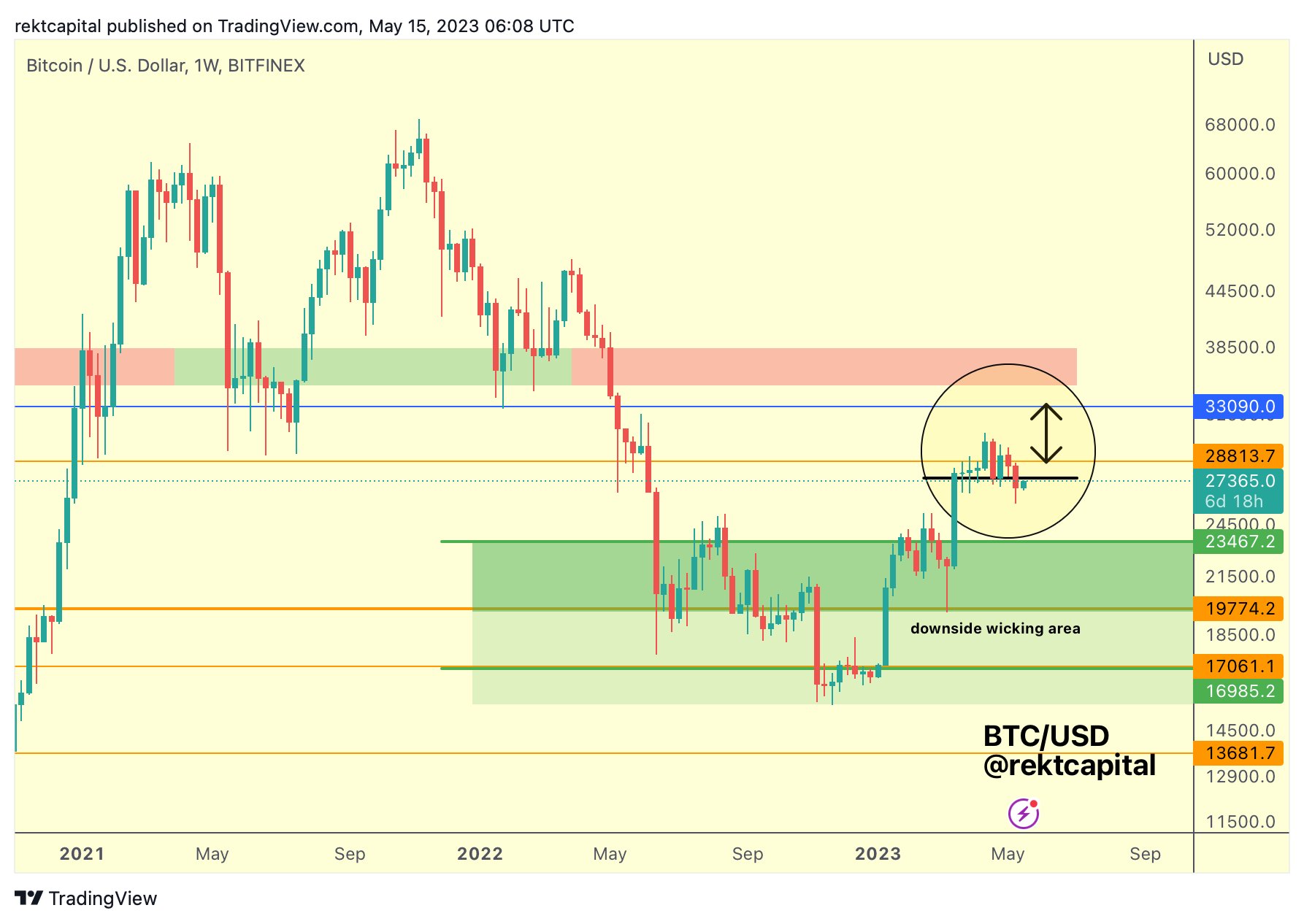

Looking beyond this quirky threshold, there has not been too much of note occurring in the markets in recent weeks. The market has been somewhat soft, Bitcoin trading at $27,300 as I write this, a two-month low. It is down 7% over the past ten days, but that is not exactly a dramatic decline by Bitcoin’s standards.

Looking at activity on the network does show more notable developments, however. The below chart shows a perceptible break downwards when analysing the 7-day exponential moving average (EMA) of active addresses on the network.

It is the biggest decline in activity over the last year. It is not immediately obvious what is causing it, but with the 7-day EMA running roughly between 800,000 and 1,000,000 addresses, the fall towards 600,000 does stand out.

Regarding possible catalysts, there has not been much beyond the continued big story of the year: the regulatory crackdown from the US. Coinbase CEO Brian Armstrong said the exchange would consider the UAE as an international hub, as the company reels from the punitive measures levelled against the industry in recent times – including a Wells notice served to Coinbase in March.

Congressman Brad Sherman was the latest lawmaker to slam the industry, making some startling comparisons that haven’t exactly gone down well in the industry:

“Peru is way ahead of us (the US) in cocaine production. China is way ahead of us in organ harvesting. We don’t need to keep up on those things and we don’t need to keep up on crypto”.

Regardless of whether you agree or not, the industry is feeling the pinch of this hostile stance in the US. Last week, two prominent crypto market makers, Jane Street and Jump Crypto, announced they were scaling back their market making activity.

This amounts to a blow to markets that are already very thin. Indeed, we have written multiple times what role the thin liquidy has played in Bitcoin’s run-up this year. In April, crypto profits, prices all hit their highest marks since June 2022. But so did volatility, as there has been a dearth of capital in the space ever since Alameda, one of the largest market makers, evaporated amid the FTX crash in November. And that liquidity is only going to get thinner again with the news out of Jane Street and Jump Crypto.

With thin liquidity comes high volatility, as it takes less capital to move prices. The below chart shows that volatility has fallen off since March, but is still trading above 40% on an annualised basis and up markedly since the start of the year.

While Bitcoin’s price fall from close to $30,000 to where it currently sits at $27,200 is nothing to write home about, the shallow nature of the markets hint that more volatility could be on the way.

The post Bitcoin roundup: active addresses fall, market makers scale back, price softens appeared first on CoinJournal.