Key takeaways

-

USDT’s total market cap is close to its all-time high of $84.1 billion.

-

Tether’s recovery could see the broader crypto market embark on a rally again.

-

Metacade could be one of the biggest winners thanks to the project’s huge potential.

The cryptocurrency market has been in a bearish cycle since 2021, with the prices of most coins and tokens down by more than 50% from their all-time highs.

However, the market sentiment has improved this year, with Bitcoin and other major cryptocurrencies up by over 40% year-to-date.

One of the biggest positives this year is the recovery of USDT, the stablecoin issued by Tether. USDT remains the largest stablecoin in the world in terms of market cap, and its recovery could spell excellent times ahead for the cryptocurrency market.

Does USDT’s recovery signal an upcoming bull cycle, and should investors take the opportunity to purchase cryptocurrencies like Metacade?

USDT’s total market cap crosses $83 billion

USDT, the world’s leading stablecoin by market cap, has almost recovered from the bear market jitters.

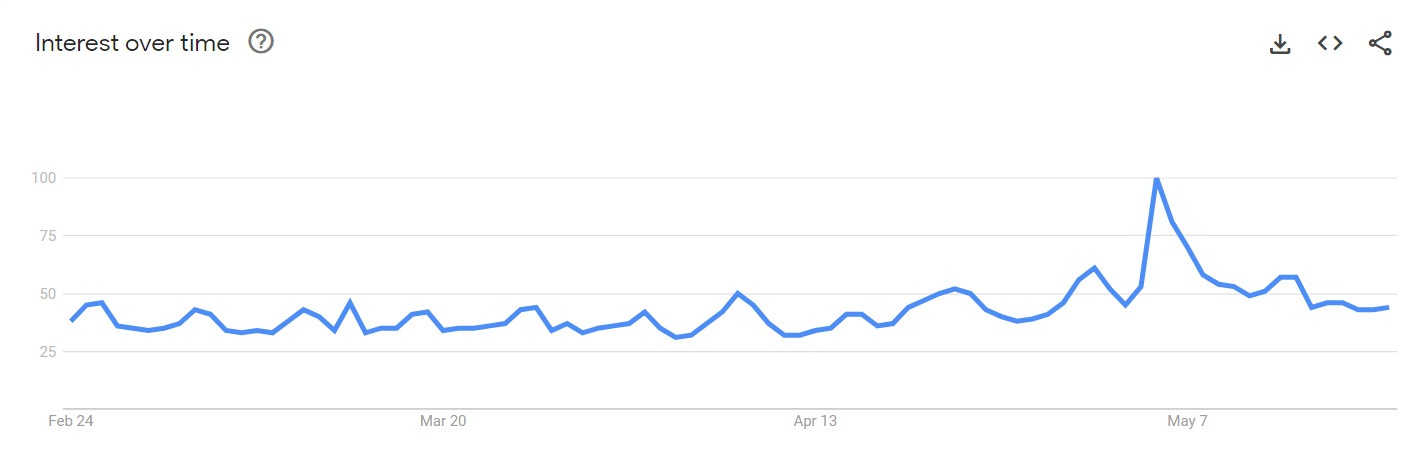

The total market cap of USDT recently crossed $83 billion, which is just below the all-time high of $84.1 billion reached on May 10, 2022. According to the data obtained from Coinmarketcap, USDT’s total market cap crossed the $83.5 billion mark earlier today, indicating that the stablecoin is doing as well as it did during the most recent bull cycle.

What does Tether’s recovery mean for the cryptocurrency market?

Tether’s recovery is an excellent development for the broader cryptocurrency market. It comes following numerous regulatory uncertainties and the banking crisis in the United States.

The collapse of the Silicon Valley Bank severely affected the market cap of USDT’s nearest competitor, Circle’s USDC. Due to the crisis in the US, the supply of rival USDC has declined from nearly $47 billion to $27.8 billion

With USDT now close to its all-time high, a liquidity crisis in the cryptocurrency space might not be something investors worry about.

Data provider Kaiko revealed that the rising USDT isn’t tied to an increase in trading volumes. The firm stated that;

“The data doesn’t show any notable increase in USDT market share (as measured by trade volume) relative to other stablecoins over the past few months, in large part due to Binance’s promotion of TUSD as an alternative to BUSD.”

The firm further stated that the increase in USDT could be because of offshore trading among market-making firms and whales.

How does this affect projects like Metacade?

USDT’s recovery will be a boost for the broader cryptocurrency market. Historically, Bitcoin has performed well when there is an increase in the total USDT supply.

With USDT now close to its all-time high again, it could benefit Bitcoin and other cryptocurrencies.

MCADE, the native token of the Metacade ecosystem, could be one of the biggest winners if the market rallies.

Metacade has performed well over the past seven days despite the broader crypto market recording slight losses. At press time, the price of Metacade stands at $0.02111, down by 1% over the last 24 hours. The token is up by more than 5% from the low of $0.01954 recorded over the weekend.

Despite its recent positive performance, MCADE is down by 53% from its all-time high price of $0.04569. This could represent an excellent buying opportunity for investors.

Metacade has huge potential in the GameFi ecosystem, making it one of the tokens investors could consider. It is a web3 project on the Ethereum blockchain, with the team currently working on launching a play-to-earn ecosystem that allows users to enjoy new web3 experiences.

What Metacade hopes to achieve is to allow players to be able to play, connect, build, and earn seamlessly. The team is working to also turn Metacade into a decentralised autonomous organisation (DAO) by next year, ensuring that the project is truly decentralised.

Should you buy Metacade now?

Metacade is a relatively new project, and its token price is down by more than 50% from its all-time high. This implies that MCADE could be trading at a discount.

However, the major investment decision regarding MCADE should be based on the potential of the project. As stated above, Metacade hopes to change the way the P2E model works by introducing new web3 experiences for the users.

The development team is already working on its P2E ecosystem after raising $16 million in the recently concluded presale event. The token has also launched on Uniswap, MEXC, and BitMart, and the team is working to get it listed on other leading cryptocurrency exchanges.

The post USDT’s total supply nears all-time high: will cryptos like Metacade rally higher? appeared first on CoinJournal.