Key Takeaways

- Dogecoin’s price surged 30% off the back of Elon Musk changing the Twitter logo to the Dogecoin dog

- Meme season may be over, however, our Analyst writes

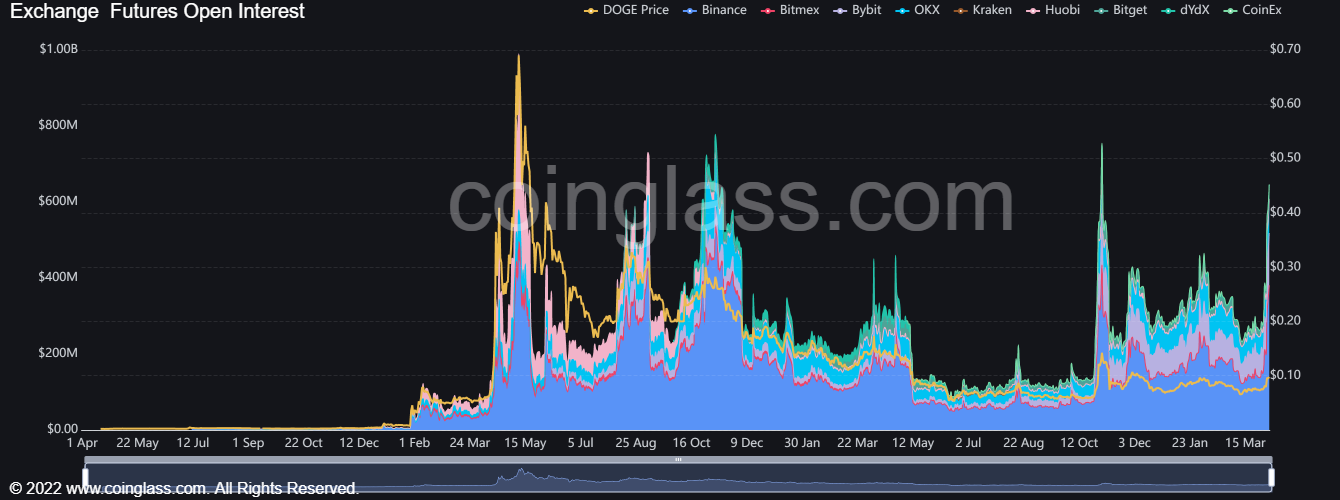

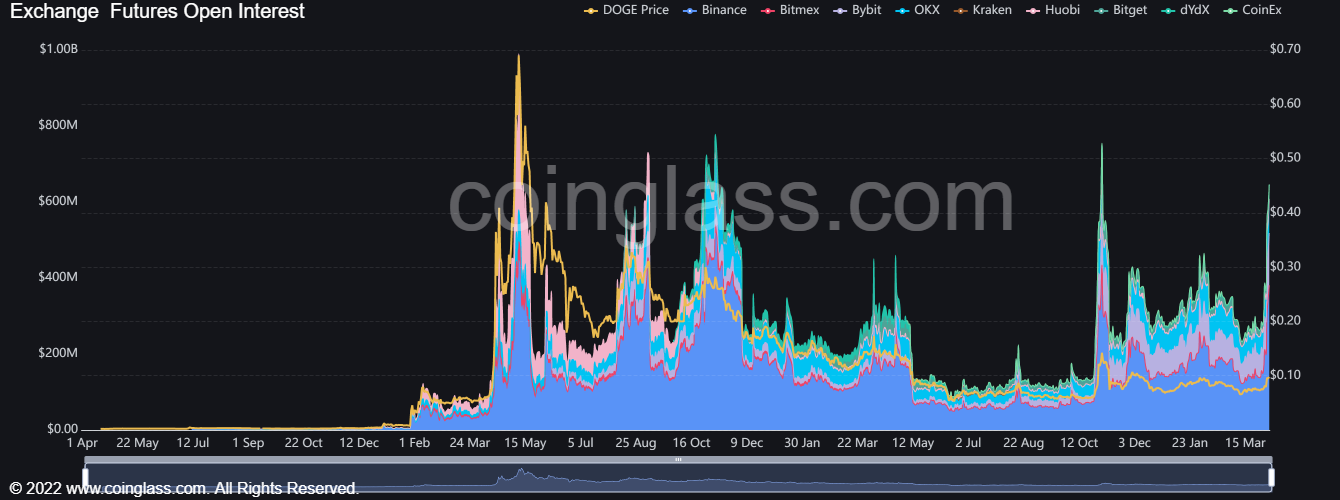

- Open interest surged to its highest level since November

- Musk is unfazed by a $258 million lawsuit accusing him of racketeering by pumping and dumping the Dogecoin price

It’s beginning to feel like 2021 again.

A year that was filled with facemasks and restrictions on how close you could stand to somebody may be banished to the depths of our memories for many, but for Dogecoin investors, that was a happy time.

The meme coin exploded onto the scene, returning over 3500% for investors as it surged from $0.004 as high as $0.73.

The only problem is that meme coins don’t exactly offer a lot of value. Predictably, Dogecoin therefore collapsed as the bear market ravaged the crypto world in 2022.

The days of Robinhood investors blindly punting obscure tokens with doggy logos were over, and Dogecoin careened down, the party over as soon as it began.

Elon revives Dogecoin

But it’s 2023 now. And after just over a quarter of price action, Dogecoin has printed a 39% gain.

This was aided, by Elon Musk rolling back the clock with a good old-fashioned Dogecoin joke. He changed the logo of Twitter to the Dogecoin dog Monday, of course announcing it on the platform itself.

Immediately, the price jumped 30%. Prior to the endorsement, Dogecoin had been lagging the rest of the market badly. While its price was up 13% on the year, Bitcoin and other coins have printed enormous gains off the back of expectations around interest rates shifting to a more dovish forecast.

Looking at derivatives markets, the Elon effect was tangible here too. Open interest soared to its highest level since the FTX collapse last November, according to data from Coinglass. Open interest measures the amount of open contracts that traders have opened on the underlying asset.

What happens next?

Trying to predict the short-term value of any meme coin is a fool’s endeavour, but I do wonder whether the meme craze is over.

Despite events of the last couple of days, this is a very different market climate than the hysteria of the stimmy-cheque-Robinhood era of 2020 and 2021. Interest rates have been hiked faster than any point in history, tech and crypto have been pillaged, and inflation is spiralling while recession fears abound.

It’s a different world. Not only that, but the novelty of memes, and crypto in general, has worn off. The Dogecoin story is not a new one, the pumps and dumps now familiar to all, perhaps inciting less FOMO while certainly attracting less mainstream attention than years past.

Numerous scandals have rocked Crypto over the last year and its reputation has undoubtedly taken a hit. With the scale of the bear market so fresh in investors’ minds, it is hard to envision a scenario whereby Dogecoin ramps up as it previously did.

Then again, this is a meme, and memes don’t obey rhyme or reason. I have never “invested” in memes, something which my wallet did not appreciate in 2020 and 2021, but perhaps I just don’t get it.

Who knows with Elon anyway? Perhaps he really does have plans to incorporate Dogecoin into Twitter properly. Or maybe he’s just trolling, and Dogecoin is getting a quick day in the sun before yet another inevitable crash.

Either way, the latest Dogecoin pump by Musk shows the billionaire is not fazed by a $258 million lawsuit currently levelled at him.

A Dogecoin investor accused him of running a pyramid scheme to support the Dogecoin price. Musk has been accused of racketeering to pump up the Dogecoin price before letting it crash.

Musk’s lawyers seem confident the case will be thrown out, however.

The term market manipulation is thrown around a lot in crypto. It seems hard to conclude that what is happening here is not in that bracket, regardless of that lawsuit, as frivolous as it may be.

I wonder how close we are to seeing a tweet saying “taking considering taking Dogecoin private at $1 a token. Funding secured” from the big man myself?

The post Dogecoin surge rolls back the years, but it won’t last long appeared first on CoinJournal.