Michael Saylor wird für sein Festhalten an Bitcoin über den Krypto-Winter von 2022 belohnt, denn durch die jüngste Kletterpartie ist die Investition von MicroStrategy schon wieder gewinnbringend.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Michael Saylor wird für sein Festhalten an Bitcoin über den Krypto-Winter von 2022 belohnt, denn durch die jüngste Kletterpartie ist die Investition von MicroStrategy schon wieder gewinnbringend.

The price of REN (REN) fell sharply on Wednesday morning after Ren Protocol announced it would be transferring all of its assets to the FTX debtor’s wallet.

As the broader market traded cautiously amid wider anticipation of economic data later in the day, REN holders were spooked into heavy selling. REN price nosedived from above $0.10 to lows of $0.94, shedding nearly 12% of its value against the US dollar.

The sharp declines were accompanied by huge sellside volume, with data from CoinGecko showing daily trading volume had spiked by more than 45%.

Ren Protocol is a cross-chain bridge that FTX, through its subsidiary Alameda Research, acquired in February 2022. Following the collapse of the Sam Bankman-Fried led crypto exchange last November, the platform’s assets moved to the debtors’ amid the ongoing bankruptcy proceedings.

Now the Ren Protocol team says the FTX “Debtor” has asked them to transfer all crypto assets it holds to cold storage wallets controlled by the debtors. The platform noted that the transfers are meant to help secure the cryptocurrencies ahead of any possible shutdowns of infrastructure and systems related to FTX.

— Ren (@renprotocol) April 12, 2023

Ren will send the cryptocurrency to segregated wallets, with assets moved from bridge protocol stored separately from other assets secured by the Debtor.

In December, Ren announced that its v.1.0 remained operational after the FTX/Alameda debacle. However, the team recognised the network could go offline and urged holders of Ren assets to bridge back to the native chains.

2) Due to this not being in our control, it is advised for anyone still holding Ren assets to bridge those assets back to their respective native chains.

This can be done here: https://t.co/5rq7H5zuV1

— Ren (@renprotocol) December 20, 2022

While the REN/USD pair has clawed back a little, the token remains vulnerable to further downside. However, buyers are battling to keep the support zone near $0.98. Some REN holders are also looking at the dip as an opportunity to buy low, pointing to the promise of Ren v.2.0.

The post REN price dips after major Ren Protocol announcement appeared first on CoinJournal.

2022 has been a terrible bear market for cryptocurrency investors since November 2021. Bitcoin, the leading cryptocurrency, dropped from $69k to $15.5k in a matter of months.

Other cryptocurrencies followed.

Over the last year, the industry was hit by a wave of negative news. Just think of the FTX collapse, which turns out to be the largest fraud in recent history.

Also, the $2 trillion bear market was the largest in the (relatively short) cryptocurrency market’s history. Moreover, multiple crypto lender bankruptcies have been announced.

Finally, over 300 lawsuits and regulation cases scared investors away.

Yet, the market bounced. It is incredibly resilient, rewarding investors believing in it. For instance, Bitcoin trades above $30k, up +80% YTD.

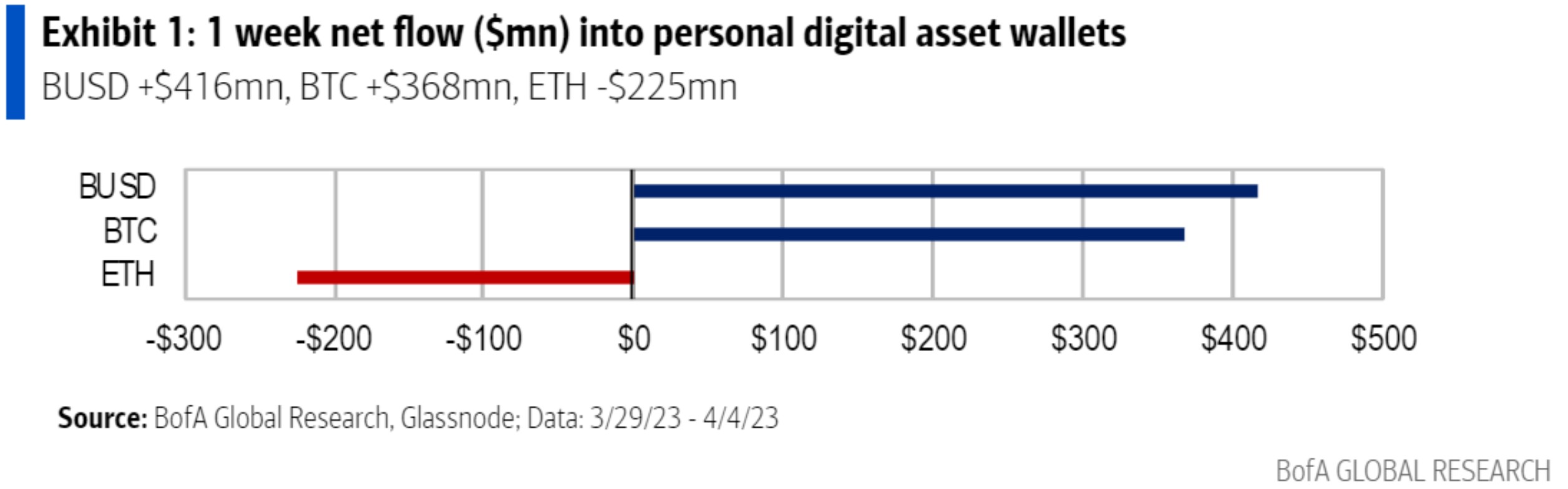

Recent research from the Bank of America shows positive developments for the cryptocurrency industry. HODL seems to be the secret of Bitcoin’s success. According to the research, hoarding in personal digital asset wallets increased after Bitcoin’s price jumped above $30k.

This is nothing short of impressive, considering that Bitcoin was released less than two decades ago. To put it into context, one Bitcoin was priced at 5 cents in 2010.

It tells much about the cryptocurrency market’s volatility and that booms, busts, mania, and despair are the norm.

The post Should you invest in cryptocurrencies as they bounced from the 2022 lows? appeared first on CoinJournal.

Der Handel mit digitalen Vermögenswerten ist oft mit Risiken verbunden, die die Vertrauenswürdigkeit deutscher Kryptobörsen beeinträchtigen können.

Key takeaways

A Hong Kong regulator has revealed that DeFi projects could be subject to regulatory requirements.

The SFC said DeFi activities fall within the scope of the Securities and Futures Ordinance.

Hong Kong’s new licensing regime for digital asset trading platforms takes effect in June 2023

Keith Choy, interim head of intermediaries at Hong Kong’s Securities and Futures Commission (SFC), revealed on Wednesday, April 12th, that decentralised finance (DeFi) projects could face licencing requirements and regulation in the country.

According to the SFC, DeFi activities fall within the scope of the Securities and Futures Ordinance and will be subject to the same regulatory requirements as traditional finance (TradFi).

Choy mentioned this while speaking at the Web3 Festival in Hong Kong. This latest cryptocurrency news comes after the United States and France recently published reports on DeFi regulation.

Choy’s speech doesn’t come as a surprise, as the SFC has previously pointed out that the DeFi ecosystem is in need of regulation. However, the regulatory agency is yet to lay out its plans on how to properly regulate the ecosystem. Choy said;

“Providing automated trading services is a regulated activity under the SFO. If a decentralized platform allows trading in virtual assets, which constitutes securities or futures as defined under the SFO, the platform and operators are required to have a Type 7 license.”

The SFC pointed out that authorisation requirements are also necessary when companies wish to offer a collective investment scheme to the public in Hong Kong

According to Choy, DeFi presents regulatory agencies with issues, including financial stability and limited transparency, resulting from a lack of data and unregulated firms and activities.

He also discussed market integrity issues like price oracle manipulation, front-running transactions and investor protection concerns.

Hong Kong is one of the leading crypto hubs in the world. In February, Interactive Brokers launched its crypto trading services in Hong Kong.

Hong Kong’s new licensing regime for digital asset trading platforms is set to come into effect in June 2023.

The post DeFi projects could face regulatory requirements, says Hong Kong regulator appeared first on CoinJournal.