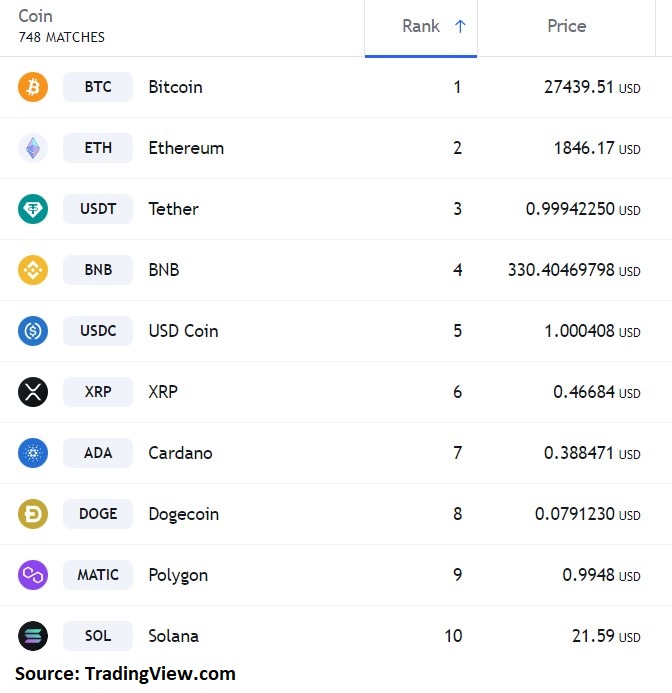

- Ethereum (ETH) ICO price was $0.31 when the address received coins on 30 July 2015.

- The addresses’ wealth has jumped from $733 to over $4.4 million at the time of the single transaction on 23 April 2023.

- Last week a Satoshi era wallet woke up after over 10 years.

An Ethereum wallet that participated in the coin’s initial coin offering (ICO) has transacted for the first time, on-chain data shows.

The address received 2,365 ETH on 30 July 2015 and remained dormant until Sunday, 23 April 2023 when it transferred 1 ETH. The address received the ETH at block 0 and transferred the single ETH at prices of $1,868 at block 17110898.

With the ICO price having been $0.31 in 2015, the wallet‘s wealth has grown from around $733 to over $4.4 million.

“An Ethereum ICO participant woke up after 7.7 years of dormancy and transferred 1 $ETH to a new address. He received 2,365 $ETH ($4.42M currently) at Ethereum Genesis, the ETH ICO price [was] ~$0.31,” on-chain data tracker Lookonchain tweeted.

An Ethereum ICO participant woke up after 7.7 years of dormancy and transferred 1 $ETH to a new address.

He received 2,365 $ETH($4.42M currently) at Ethereum Genesis, the ETH ICO price is ~$0.31.https://t.co/hOfBSyml19 pic.twitter.com/yoMoB6vE9n

— Lookonchain (@lookonchain) April 24, 2023

Ethereum price traded at an all-time above $4,800 in 2021 and hit year-to-date highs above $2,100 this month after the Shapella upgrade.

Bitcoin wallet woke up after 10 years

Last week another mega-dormant wallet address woke up, this time a Satoshi era Bitcoin wallet address that remained inactive for over 10 years.

As highlighted by CoinJournal, the wallet was created in 2012 and held 1,128 BTC for over 10 years. On 21 April 2023, the wallet transferred 279 BTC worth about $7.8 million to three new addresses.

Bitcoin price at the time of the wallet’s creation 10+years ago was between $12 and $95.

The post Ethereum ICO account that bought ETH at $0.31 wakes up after 7 years appeared first on CoinJournal.