Margrethe Vestager, die geschäftsführende Vizepräsidenten der europäischen Kommission, hat betont, wie wichtig es sei, Veränderungen bei technologischen Entwicklungen zu antizipieren und Pläne dafür zu entwickeln.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Margrethe Vestager, die geschäftsführende Vizepräsidenten der europäischen Kommission, hat betont, wie wichtig es sei, Veränderungen bei technologischen Entwicklungen zu antizipieren und Pläne dafür zu entwickeln.

nealthy, an Ethereum-based Web3 startup that provides diversified exposure to NFTs and cryptocurrency investing, secured $1.3 million in a pre-seed funding round backed by several top investors across the investment space.

The funding round closed in November 2022, the startup said in a press release sent to CoinJournal on Tuesday. Per the announcement, prominent Web3 investors that backed it include celebrity crypto investor ‘DonGeraldo.’

The Dubai incorporated platform says it will use the capital injection to grow its team, hire new talent and seek greater adoption.

The interest in Web3 continues to gather pace and nealthy is looking to tap into this ecosystem by removing the barriers to the market. The startup achieves this via index tokens, which are investment assets that replicate traditional exchange-traded funds (ETFs).

Investors can leverage the index tokens to invest across the Web3 space – easily and quickly – as the product allows for on-chain storage of digital assets, with the portfolio seamlessly diversified in the event of sudden market shifts.

An example of an index token is nealthy’s $NFTS, which like other offerings, has value that is pegged nearly 1:1 to given blue-chip NFTs.

Ludwig Schroedl, the CEO of nealthy noted in a statement that interest in diversification within the crypto sector is rising, especially with the massive growth witnessed in the NFT trading markets.

“That’s even more true for first-time investors,” he said, adding “A blue-chip index token, like $NFTS, can provide superior investment opportunities at a reduced level of risk. And if we can do it with NFTs, we can do it with every asset on the blockchain.”

The startup is looking to expand its reach with the release of multiple products ahead of its alpha launch.

The post Web3 startup nealthy raises $1.3M in pre-seed backed by top industry investors appeared first on CoinJournal.

Cryptocurrencies fell early Tuesday, with Bitcoin trading towards support around $22,100 on broader market reaction to comments from Federal Reserve Chair Jerome Powell.

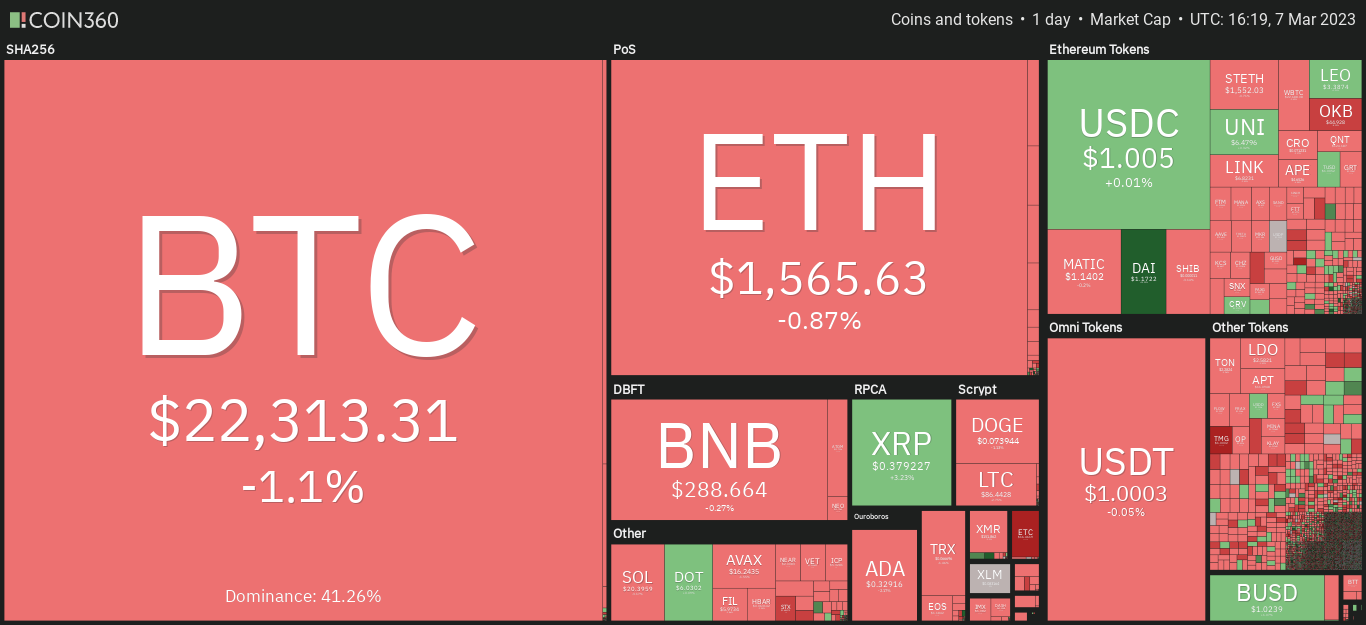

Coin360 crypto map showing price dump after Powell’s remarks. Source: Coin360

Coin360 crypto map showing price dump after Powell’s remarks. Source: Coin360

The reaction also saw US stocks slip after Monday’s gains, with investors appearing to have been spooked by Powell’s remarks on interest rates.

Powell was on Tuesday making his first of two appearances before US Congress – first at the Senate Banking Committee and on the second day, at the House Financial Services Committee. The central bank’s monetary policy, particularly on inflation, is a key element of the Fed Chair’s prepared testimony.

Notably, Powell told lawmakers that it is possible the Fed will look to raise interest rates further given recent economic data that came in hotter than expected. According to the Fed, these sets of economic metrics suggest interest rates could still go up. This, he noted, will be warranted if outlook indicated there’s need for faster tightening.

Following the news, crypto, stocks and bonds reacted lower as the dollar index rose. Bitcoin touched 24-hour lows of $22,120, while Ethereum fell to support near $1,540. Across the stock market, the S&P 500 dropped by 1%, while the Dow Jones Industrial Average and the Nasdaq Composite shed 0.6% and 0.9% respectively.

Economist Mohamed El-Erian pointed out the market’s reaction and what Powell’s testimony projects.

So much for the repeated dovish mentions of disinflation at the last press conference#Fed Chair Powell’s prepared comments now tilt to the hawkish side, including the quote below that will go viral#Stocks and #bonds sell off as they wait for his responses to Senators‘ questions pic.twitter.com/xOozIXczam

— Mohamed A. El-Erian (@elerianm) March 7, 2023

While markets might see a swift bounce from the losses, investors are likely to remain jittery ahead of the Fed’s next policy announcement expected on 22 March, 2023.

The post Crypto turns red as Fed Chair Jerome Powell hints at higher rates appeared first on CoinJournal.

Binance has added 11 additional tokens to its proof-of-reserves (PoR) report.

The world’s leading cryptocurrency exchange said it has over $63 billion across 24 assets.

The results have not been audited by any external accounting firm at the moment.

Binance, the world’s leading cryptocurrency exchange, published its latest PoR report on Tuesday, March 7th.

According to the company’s announcement, it has added 11 tokens to its PoR report. The tokens include MASK, ENJ, WRX, GRT, CHR, CRV, 1INCH, CVP, HFT, SSV, and DOGE.

This latest cryptocurrency news means that Binance now holds over $63 billion across 24 assets in its proof of reserves system. Bitcoin, Ether, and Tether (USDT) are the top three assets on the exchange, accounting for $12.7 billion, $7.1 billion, and $16.3 billion in net customer balance.

Binance wrote that;

“With the addition of 11 assets to its PoR system, Binance, the world’s largest exchange by trading volume, now shows over 63B USD in reserves.”

Cryptocurrency exchanges, including Binance, OKX, and Bybit, adopted the PoR system following FTX’s collapse late last year. The PoR system is designed to promote greater transparency amongst cryptocurrency exchanges and assures users that their funds are safe.

Following Binance’s PoR report on January 26, 2023, the cryptocurrency exchange implemented zk-SNARKs, zero-knowledge protocols that increase the privacy and security of user data during the verification process.

According to Binance, its PoR leverages Merkle trees to add up on-chain data so that users can rest easy knowing that their assets are held for them 1:1 in our custody.

In December last year, South African auditor Mazars removed Binance’s PoR audit from its website. The auditing firm also ceased providing services to Binance and other cryptocurrency exchanges.

Binance remains the world’s largest cryptocurrency exchange. The crypto exchange accounts for over $12 billion in daily trading volume, higher than the $1.1 billion recorded by its closest rival, Coinbase.

The post Binance’s latest PoR shows it has over $63 billion across 24 assets appeared first on CoinJournal.

Thailand’s government will offer tax breaks for companies issuing investment tokens.

The government expects over $3 billion worth of investment token offerings over the next two years.

The move could attract more cryptocurrency companies to Thailand.

Thailand’s cabinet agreed earlier today that they would waive corporate income tax and value-added tax for companies that issue digital tokens for investment.

According to a Reuters report, a government spokesperson said companies operating in the country would have the opportunity to access alternative ways of raising capital through investment.

This latest cryptocurrency news gives companies more fundraising options in addition to traditional methods like debentures, Rachada Dhnadirek revealed.

The Thai government expects that there will be around 128 billion baht ($3.71 billion) worth of investment token offerings over the next two years. However, the government would lose tax revenue worth 35 billion baht ($1 billion), Rachada added.

The move to give companies issuing investment tokens tax breaks could attract more cryptocurrency-focused companies to Thailand.

Cryptocurrencies have become quite popular in Thailand in recent years after the country’s Securities Exchange Commission started regulating digital currencies.

In 2022, the government relaxed tax rules in the cryptocurrency trading industry in a move to promote further development.

Despite that, Thailand’s apex bank and other regulators have banned the use of cryptocurrencies as a means of payment for goods and services. According to the central bank, using cryptocurrencies as means of payment could impact Thailand’s financial stability and the overall economy.

In January, the Thai SEC launched a probe into the Zipmex cryptocurrency exchange for allegedly breaching local rules. The SEC was investigating activities that they believed could have violated the business rules for digital asset providers in the country.

The regulatory agency had asked Zipmex to clarify whether it has been operating as a digital asset fund manager in the country without proper licences.

The post Thailand offers tax breaks for companies issuing investment tokens: Reuters appeared first on CoinJournal.