Der Coinbase-CEO Brian Armstrong erklärte, die Börse habe bereits darüber nachgedacht, Funktionen einzuführen, wodurch sie zu einer Art Neobank werden würde.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Der Coinbase-CEO Brian Armstrong erklärte, die Börse habe bereits darüber nachgedacht, Funktionen einzuführen, wodurch sie zu einer Art Neobank werden würde.

Synthetix has seen the volume of its perpetual futures jump.

The network is gearing towards the launch of Synthetix V3.

Synthetix (SNX/USD) price has staged a strong comeback in the past few days as investors cheer the upgrade to V3. It rose to a high of $3, which is much higher than the lowest level during the weekend at $2. Like other coins, SNX has soared by over 100% from its lowest point this year.

Synthetix, a leading player in the blockchain industry, is doing well. The SNX token is one of the best-performing coins in the world, according to data compiled by Binance. It has jumped by over 32% in the past 24 hours.

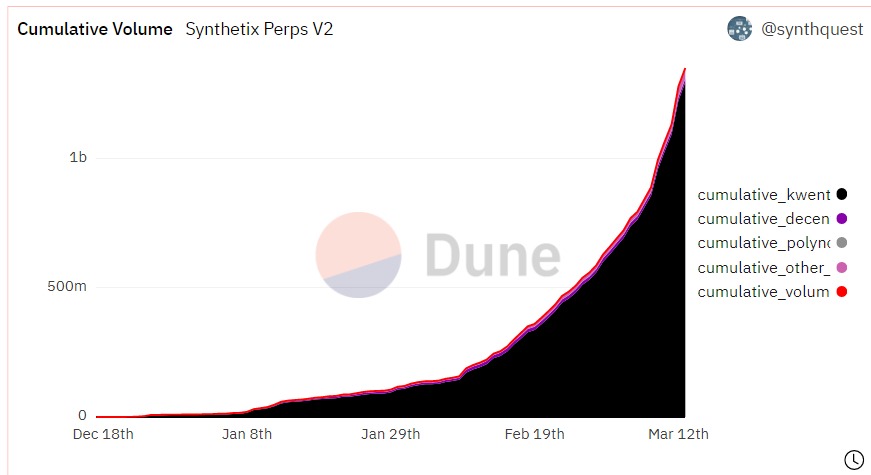

There are several reasons why SNX is doing well. First, the on-chain volume shows that perpetual futures in the ecosystem is doing well. Its daily volume surged to more than $100 million. Daily fees in the Perps futures has jumped to over $67k in the past seven days.

And as shown below, the cumulative perps volume has been in a strong bullish trend. Therefore, investors believe that Synthetix’s ecosystem is doing well even as challenges continued.

Second, Synthetix is doing well is because of its upgrade to V3. The V3 is a big upgrade that will be much different from the existing platform. It will provide a permissionless derivatives liquidity platform to power on-chain financial products. It will transform the network into a layer of liquidity that all derivatives can be built upon.

In a statement, the developers said that Synthetix will release these upgrades to the upcoming months. The initial release has already happened and will be followed by the collateral agnostic system and V3 spot market. The order types in V3 will be atomic orders, asynchronous orders, and wrapping.

Like other cryptocurrencies, SNX price is reacting to the developments in the banking sector. Silicon Valley Bank and Signature Bank closed last week. Circle’s funds at Silicon Valley Bank will be released.

The daily chart shows that the Synthetix price has made a strong comeback in the past few days. It has managed to move above the 50-day exponential moving average. However, it has formed what looks like a shooting star pattern, which is usually a bearish sign. It sits at an important level since this price was the highest point on November 5.

Therefore, there is a likelihood that Synthetix will pull back in the coming days because of the shooting star pattern. If this happens, the next key level to watch will be at $2.50, which is the 50-day moving average

The post Synthetix’s SNX price soars as Synth perps volume spikes appeared first on CoinJournal.

Der Bankenriese HSBC hat bekannt gegeben, dass er den britischen Zweig von der Silicon Valley Bank übernommen habe.

Key takeaways

Crypto-friendly bank Signature Bank has been shut down by New York Banking authorities.

The Federal Reserve said the decision was made to protect the US economy and strengthen public confidence in the banking system.

Signature Bank’s closure comes days after the collapse of the Silvergate Bank and the Silicon Valley Bank.

The Federal Reserve announced on Sunday that the New York-based Signature Bank had been closed down by its state charter authority.

This latest cryptocurrency news means that Signature Bank is the third major bank to shut down operations within the space of a week.

In a statement issued on March 12, the Federal Reserve said the decision to shut down Signature Bank was made with the United States Federal Deposit Insurance Corporation (FDIC) to protect the U.S. economy and strengthen public confidence in the banking system.

The United States apex bank added that they would backstop all depositors of Signature Bank. The Federal Reserve wrote;

“We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

The Federal Reserve pointed out that the move is designed to ensure that the United States continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

The Fed said shareholders and certain unsecured debtholders would not be protected.

Signature Bank’s shutdown makes it the third major bank to close operations within the space of a week. On March 9th, crypto-friendly bank Silvergate shut down its operations and voluntarily liquidated its assets. The bank said it made the decision in light of recent industry and regulatory developments.

Silicon Valley Bank, a major bank for some crypto and tech startups, also collapsed last week. However, the crypto market has remained resilient.

Bitcoin rose by nearly 10% on Sunday to trade above $22k after dropping below the $19k level last week. The total cryptocurrency market cap also stands above the $1 trillion level despite the ongoing FUD in the market.

The post New York banking authorities shut down crypto-friendly Signature Bank appeared first on CoinJournal.

Schon ab Montag soll der Wechsel von USDC in US-Dollar im Verhältnis 1:1 wieder möglich sein, und die fehlende Liquidität nach dem Kollaps der SVB zunächst aus eigenen Geldern finanziert werden.