Die Marktkapitalisierung von BTC ist auf Platz 11 unter den Top-Vermögenswerten nach Marktkapitalisierung geklettert und liegt nun hinter dem Autohersteller Tesla.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Die Marktkapitalisierung von BTC ist auf Platz 11 unter den Top-Vermögenswerten nach Marktkapitalisierung geklettert und liegt nun hinter dem Autohersteller Tesla.

Key takeaways

Meta is ending support for NFTs on Instagram and Facebook.

The company introduced the NFT feature roughly a year ago.

Meta said it would focus on other ways to support businesses and creators.

Stephane Kasriel, Meta’s head of commerce and financial services, announced on Monday that the social media giant is ending its support for nonfungible tokens (NFTs) on its social media platforms.

Some product news: across the company, we’re looking closely at what we prioritize to increase our focus. We’re winding down digital collectibles (NFTs) for now to focus on other ways to support creators, people, and businesses. 🧵[1/5]

— Stephane Kasriel (@skasriel) March 13, 2023

According to Kasriel, the decision was prompted by Meta’s desire to focus on other ways to support creators, people, and businesses. He said;

“A big Thank You to the partners who joined us on this journey and who are doing great work in a dynamic space. Proud of the relationships we built. And look forward to supporting the many NFT creators who continue using Instagram and Facebook to amplify their work. We learned a ton that we’ll be able to apply to products we’re continuing to build to support creators, people, and businesses on our apps, both today and in the metaverse.”

Meta introduced its NFT feature on May 10, 2022. By August, the social media giant had expanded the NFT feature to capture 100 countries in the Americas, Asia-Pacific, Middle-East, and Africa.

By September, Meta introduced a new feature that allowed users on both Facebook and Instagram apps to share and cross-post their digital collectibles.

Despite winding down support for NFTs, Kasriel said Meta continues to pursue various ways it can help creators connect with their fans. The social media giant will focus on other products, including Reels, for messaging and monetisation.

Meta added that it would continue to work with NFT and web3 content creators who take advantage of its various tools to help them grow their community. Kasriel wrote;

“And we’ll continue investing in fintech tools that people and businesses will need for the future. We’re streamlining payments w/ Meta Pay, making checkout & payouts easier, and investing in messaging payments across Meta.”

Despite the initial traction, the social media giant is shifting its strategy in a bid to explore other areas.

The post Meta to end support for NFTs on Facebook and Instagram appeared first on CoinJournal.

Filecoin, a decentralised storage network that allows users to access efficient blockchain-based file storage at low, is hours away from a major network upgrade. The excitement around the new features that come with the upgrade, alongside broader market exuberance, has helped push the value of the native FIL token higher.

FIL was trading around $6.36 at 2:00 pm ET on Monday, up more than 24% in the past 24 hours. According to data from TradingView, the cryptocurrency’s price had touched an intraday high of $6.44 on major crypto exchange Coinbase.

Per the market data from CoinGecko, the file storage platform’s native token has jumped more than 32% over the past month.

Filecoin price chart showing FIL jumped to $6.50 on Coinbase on Monday. Source: TradingView

Filecoin price chart showing FIL jumped to $6.50 on Coinbase on Monday. Source: TradingView

The broader cryptocurrency market has rallied hard in the past 24 hours, with massive buying pressure on Monday as the markets reacted to news of the US government working to backstop failed banks.

As CoinJournal reported, the sentiment flip saw Bitcoin add over $4,000 in 24 hours as bulls rallied to prices above $24,000. Most altcoins also soared, with the total cryptocurrency market cap rising nearly 15% to over $1.16 trillion.

But for Filecoin, as noted above, the upside momentum also included buyside pressure catalysed by an upcoming network upgrade. In February, the Filecoin developer team announced that the Filecoin Virtual Machine (FVM) would go live in March.

The price of FIL tokens jumped more than 26% on the day after the Filecoin news reached the market. Just like then, the latest price surge comes as the developer team confirmed that FVM would go live on Tuesday, 14 March 2023.

This is because the upgrade is set to introduce smart contracts, allowing for the creation and deployment of decentralised applications (dApps) on Filecoin. The FVM upgrade also unlocks features such as collateral lending and liquid staking.

“Basically – if you regard the Filecoin storage network as a massive decentralized data warehouse whose state is being constantly proven to the public, you can think of the FVM as a programmable controller for it,” the Filecoin team noted last week.

The post FIL jumps 24% as Filecoin community eyes major network upgrade appeared first on CoinJournal.

For once, it’s not crypto doing the collapsing. Trad-fi was feeling left out of the party, evidently, as the banking sector wobbled in a big way this weekend.

Silicon Valley Bank (SVB) is no more, in what amounts to the largest collapse of a US bank since 2008, when Lehman Brothers pulled its best Satoshi Nakamoto impression and disappeared into the ether (pun not intended).

While the drama may have centred in trad-fi, crypto bounced around aggressively over the weekend as a variety of knock-on effects rumbled. SVB was a crypto-friendly bank, as was Silvergate, which was announced to also be winding down last night.

This, as well as the fact that the entire financial markets wobbled, meant crypto faced a storm. We have dug into some of the movements here at https://coinjournal.net/ to sum up the carnage.

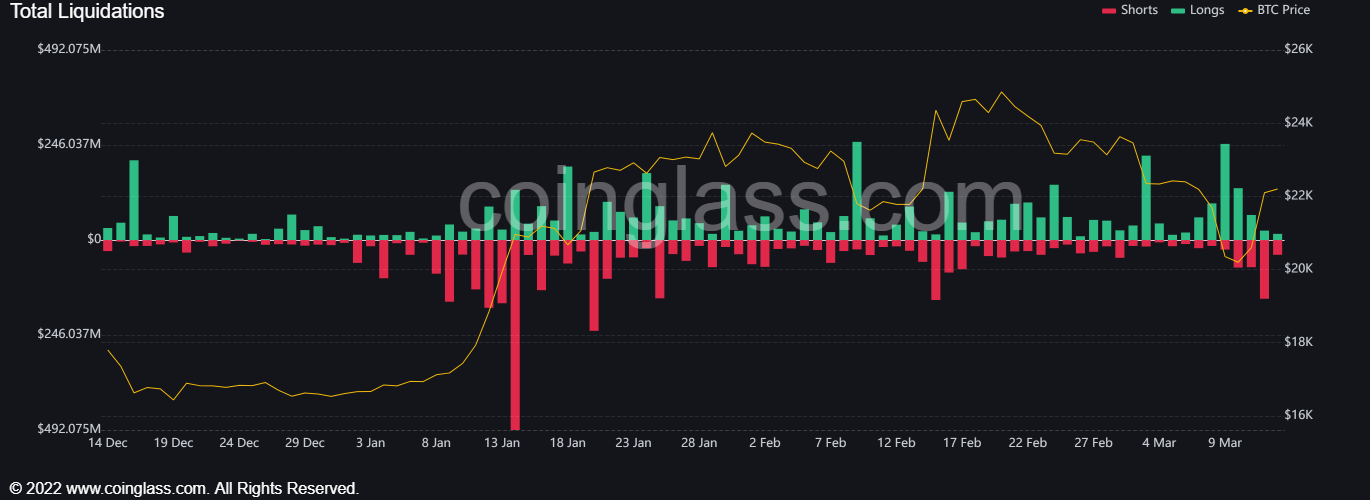

With violent price swings, liquidations were inevitable. Longs got caught out badly on Thursday and Friday, as the Bitcoin price fell south of $20,000.

There were $249 million of long liquidations across exchanges on Thursday, with Friday bringing an additional $134 million. The $383 million of long liquidations was the most in any 48 hour period this year.

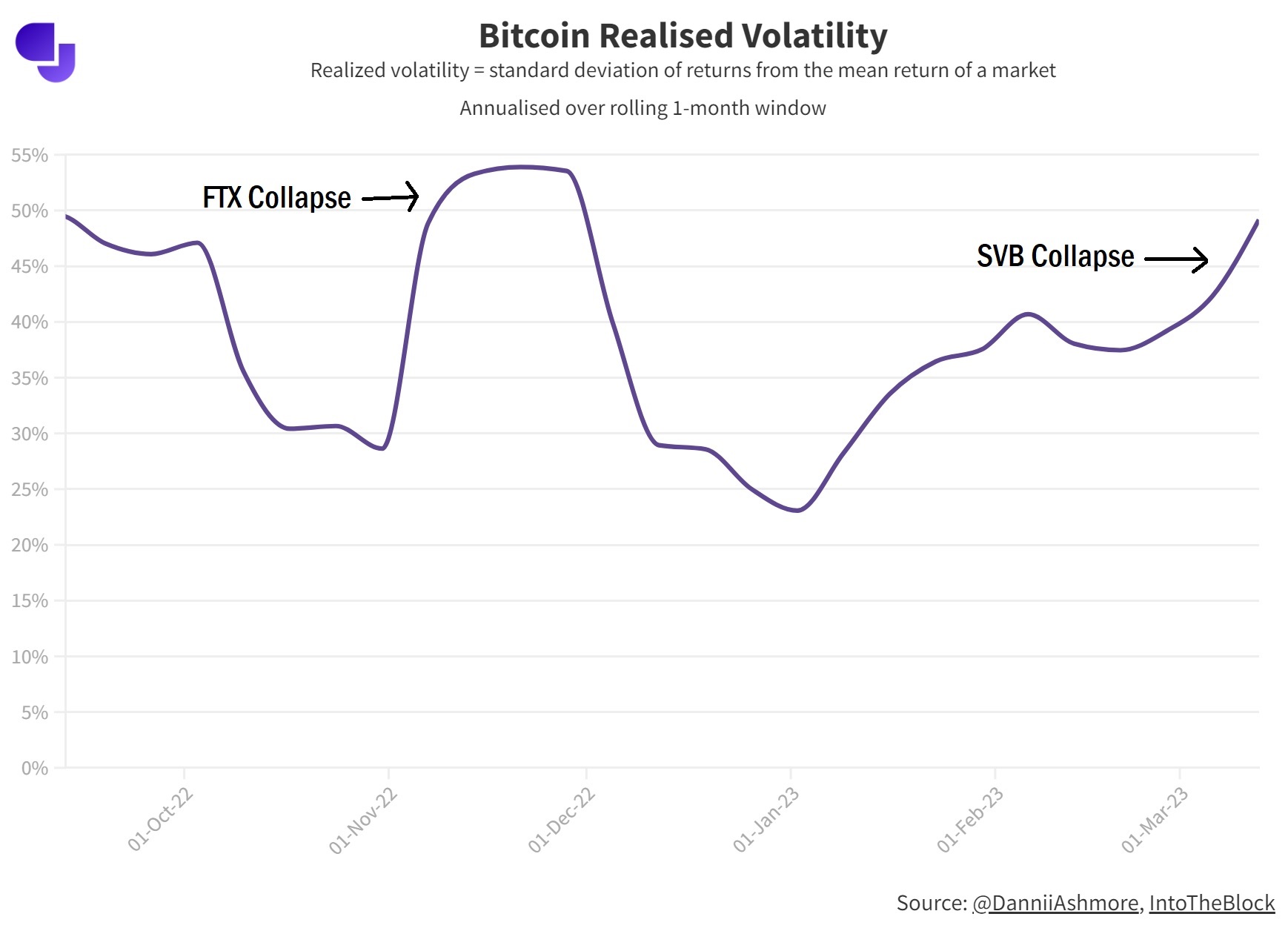

Obviously, liquidations stem from volatility. Looking at Bitcoin to dissect the extent of the movements, the volatility is now back up to levels last seen when FTX collapsed in November.

The chart below shows that the metric had been rising steadily, before SVB going poof kicked it back up to a mark 3-Day volatility mark of 50%, last seen when Sam Bankman-Fried’s fun and games were revealed to the public.

“We have been seeing relatively muted action in the crypto markets since the FTX collapse last November” said Max Coupland, Director of CoinJournal. “The SVB event served to kick volatility back up to levels we last saw amid all the crypto scandals of last year – not only FTX, but Celsius, LUNA etc. The difference with this event is that the crash was sparked in trad-fi for a change”.

But all is well that ends well. Or something along those lines, as despite SVB going under, the Fed announced last night, after a weekend of chaos, that all deposits at SVB would be made whole.

The bail-out (if you can call it that, as SVB is still going under) quelled up fear in the markets that the issue could become systemic. Crypto roared back, with Bitcoin spiking back up to $22,000 at time of writing. And this time, it was shorts who got caught offside, with $150 million liquidated across the market Sunday.

Perhaps the biggest winner of all was the world’s second-biggest stablecoin, USDC. 25% of the stablecoin’s reserves are backed by cash. Crucially, 8.25% ($3.3 billion) of reserves were (are) trapped in SVB, with the stablecoin dipping below 90 cents on several major exchanges over the weekend.

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

At press time, the peg has been largely restored as the crypto market bounces upward, with Bitcoin north of $24,000.

And so, the immediate storm appears to have been weathered in cryptoland.

Nonetheless, the past few days present as yet another crushing blow. Three of the big crypto banks – SVB, Silvergate and Signature – are now no more. These banks allowed crypto firms to offer on-ramping from fiat into crypto 24/7 through their settlement services, in contrast to the regular banking hours of the banking sector.

Liquidity and volume thus may dip even further in the crypto market, after a year that has already seen volumes, prices and interest in the space freefall.

Despite the Fed stepping in to shore up deposits and hence stabilising the stablecoin market and wider crypto prices, the long-term future of the cryptocurrency industry in the US has taken another heavy body blow this weekend. And with the US being the biggest financial market in the world, that is very bad news.

Coupled with the regulatory clampdown by the SEC in the last few months, 2023 has followed 2022 in creating a more hostile and bearish environment for the sector at large.

So crypto investors may have seen a bounceback in prices in the last few months, but this appears to be largely macro-driven correlation with the stock market, as the underlying events in the industry – regulation, more bankruptcies, and crypto-friendly banks shuttering – have not been positive.

If you use our data, then we would appreciate a link back to https://coinjournal.net. Crediting our work with a link helps us to keep providing you with data analysis research.

The post Crypto volatility back to FTX levels, with $791 million of liquidations in 4 days as SVB collapse rocks market appeared first on CoinJournal.

Bitcoin broke above the $24,000 level, soaring a massive $4,000 candle in just over 24-hours to leave bulls targeting a new breakout above $25,000.

In our Bitcoin price prediction article this morning, we highlighted an analysis by popular crypto analyst Rekt Capital. In it, the analyst simply pointed to Bitcoin price having invalidated a double top formation when it rallied from under $20,000 to a weekly close above $21,770.

According to the analyst’s technical outlook for BTC, a break higher was likely given the retest of range lows on the daily chart.

While he suggested a continued range consolidation, he pointed to the potential for bulls to break higher. That came sooner as BTC forced its way above $24,000 amid a spectacular bounce for cryptocurrencies after last week’s sharp declines. But can Bitcoin maintain this upside momentum? Here are what some analysts are saying:

At current prices, Bitcoin is about $500 “from challenging the macro downtrend,” Rekt Capital has noted. If this happens, BTC could be poised for a huge breakout – possibly with a new macro uptrend in the picture on the monthly chart.

“BTC Monthly RSI looks like it has successfully retested the 2015 & 2018 Bear Market Bottom area as new support,” he added in another tweet.

According to the analyst, Bitcoin still needs to break the macro downtrend line at $25k for a technical breakout in March. Maintaining the positive outlook could see BTC break the macro downtrend in April with breakout price point around $23,400.

The Macro Downtrend #BTC breakout price for the month of March is ~$25000

But in April, the $BTC Macro Downtrend breakout price will be ~$23400

If BTC keeps this up heading into April, it will register a technical breakout just by maintaining the highs#Crypto #Bitcoin pic.twitter.com/9VWI54oql4

— Rekt Capital (@rektcapital) March 13, 2023

Like Rekt Capital, crypto analyst Altcoin Sherpa suggests bulls aren’t completely out of the woods yet. For him, the price needs to break above and hold support at $25,000. If not, BTC remains in “a danger zone.”

“BTC: Some high time frame resistance areas, I view this current area as a danger zone. 1W 200 EMA + S/R level that price couldn’t break over a few weeks. If we flip $25k soundly, I think we blitz to 30kish areas.”

$BTC: Some high time frame resistance areas, I view this current area as a danger zone. 1W 200 EMA + S/R level that price couldn’t break over a few weeks. If we flip $25k soundly, I think we blitz to 30kish areas. #Bitcoin #BTC pic.twitter.com/dpcRWPf0M1

— Altcoin Sherpa (@AltcoinSherpa) March 13, 2023

According to IntoTheBlock, Bitcoin faced a significant hurdle in the $22,650- $23,325 region after bulls’ strong bounce in the $19,000 area. This supply zone coincided with a zone where 1.14million addresses had acquired BTC, with the average price around $23,022.

But after the swift bounce above this level, on-chain data suggests the next major target is $30,000.

It looks like everyone took this as a challenge. $BTC ran past $23k and all eyes are slowly focussing on $30k https://t.co/CnwF5p8pDW

— IntoTheBlock (@intotheblock) March 13, 2023

The post Bitcoin breaks above $24K as analysts predict what next for BTC appeared first on CoinJournal.