ARK Invest hat etwa 23 Prozent der COIN-Aktien verkauft, die die Firma im März gekauft hatte.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

ARK Invest hat etwa 23 Prozent der COIN-Aktien verkauft, die die Firma im März gekauft hatte.

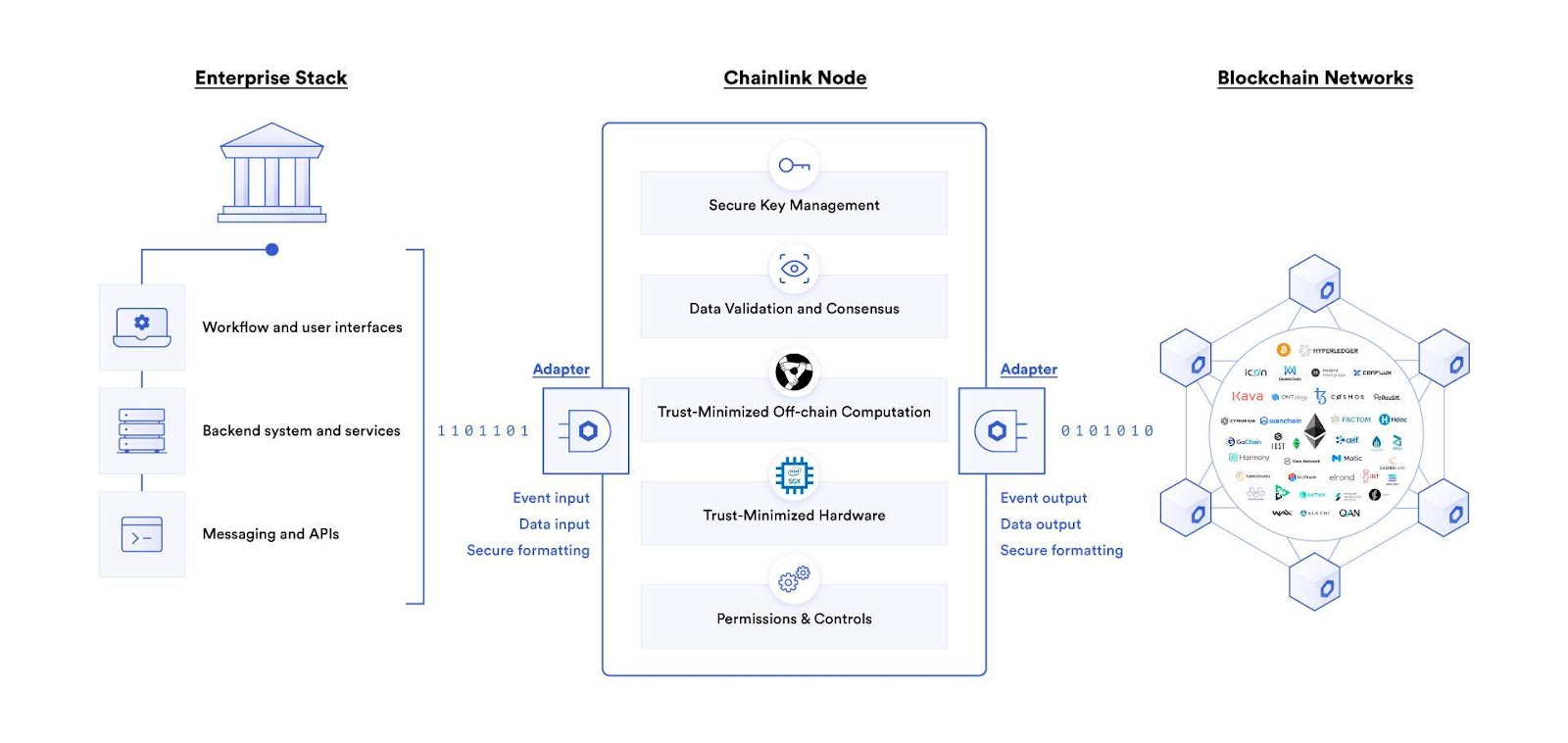

Chainlink developer Chainlink Labs and PwC Germany have announced a strategic partnership aimed at accelerating the adoption of enterprise blockchain.

The joint business relationship will see Chainlink Labs provide support to mainstream companies that currently work with PwC Germany but are yet to integrate with the blockchain economy.

According to details in a press release sent to CoinJournal, Chainlink Labs will help empower these companies in relation to development of smart contracts and node infrastructure deployment. On the other hand, PwC will offer “strong technical expertise” and help ensure the onboarding is fully compliant with applicable regulatory laws.

The goal is to help organizations and enterprises develop and deploy bespoke blockchain solutions that leverage Chainlink’s technology for productivity and profitability.

Companies can leverage Chainlink technology to develop and run smart contracts and nodes. Source. Chainlink Labs

Companies can leverage Chainlink technology to develop and run smart contracts and nodes. Source. Chainlink Labs

Dimitri Gross, the head of Technology Interest Group for Digital Assets and Crypto at PwC Germany, said.

“PwC Germany and Chainlink Labs aim to help accelerate enterprise adoption of blockchain technology in key enterprise sectors such as capital markets, ushering in a new era of transactional security, transparency, and efficiency.”

PwC Germany’s footprint in the blockchain space encompasses multiple in-house solutions, including Blockchain Explorer and Transaction Analyzer (BETA), Tokenization Framework, Smart Contract Formal Verification Framework, and Digital Asset Valuation Model.

The platform also provides several blockchain-focused services, including technology assessment, ecosystem management, and blockchain consulting.

The post Chainlink Labs and PwC Germany partner to accelerate enterprise blockchain adoption appeared first on CoinJournal.

The Ethereum Shanghai upgrade is slated to occur in mid-April. While not as seismic a shift as the Merge event which took place last September, it is nonetheless an important moment for the world’s second-largest cryptocurrency.

The most impactful consequence will be around Ethereum stakers. For the first time, those with staked ETH will be allowed to unstake their holdings.

And that is a lot of ETH. Currently, there is 17.7 million Ether locked up in staking contracts, equivalent to 14.8% of the total supply.

Once the upgrade goes live, this ETH will finally be eligible to hit the market. That may sound like a scary proposition, but in reality, there have been many liquid staking alternatives available throughout the staking period, which kicked off in late November.

In such a way, stakers have received back liquid “tokens” which can be traded in place of ETH. These tokens can then be redeemed for actual ETH once the upgrade goes live – which we now know is imminent.

Nonetheless, there may be some elevated selling pressure in the immediate aftermath of the event. The liquid tokens have traded for (usually small) discounts compared to ETH, while it will also now be more intuitive and simpler for people to sell.

Despite all this, concluding that this will dent ETH’s price would be naive. The market knows this is coming and that same old concept of “priced in” is gain relevant. Remember, many hypothesised that the Merge would drive a massive price increase, but it came and went with only minor volatility.

If the Shanghai upgrade goes smoothly, it would not be a surprise to see the same happen here.

One thing I have wondered about is what the yield on staked ETH will look like going forward.

One theory is that, if Ethereum continues to act as the base layer for decentralised finance, the staking yield could look like some sort of risk-free yield in the space. In such a way, it could be used as a benchmark to value investments in the space, much like the risk-free rate in traditional finance is used.

Then again, with the way DeFi has gone over the last couple of years, maybe it won’t. The space has seen a flood of capital flee the space as the bear market has ravaged cryptocurrency as a whole.

With 15% of the ETH supply locked up in staking contracts, and the number steadily rising from when staking opened up in late 2020, the balance on exchanges has done the opposite.

There is currently 18.3 million ETH on exchanges, equivalent to 15.2% of the supply, slightly above the 14.8% that is staked.

The 18.3 million ETH on exchanges represents the lowest figure since June 2018, at the depths of the previous crypto winter.

The chart shows that the balance has been falling steadily since ETH staking came online.

Of course, the above charts are in native units. When flipping the denominated unit to the dollar value of ETH instead, you get a much wackier pattern. Nonetheless, the dollar value on exchanges is still above what it was until the first quarter of 2021.

As cryptocurrency markets as a whole rally off the back of renewed hope that the Federal Reserve will pivot off high interest rate policy sooner than previously anticipated, Ethereum has followed, trading at $1,800, its highest price since last September – right when the Merge occurred.

Macro will continue to drive the price going forward, but the Shanghai upgrade is nonetheless an important moment as Ethereum solidifies its long process of switching from a proof-of-work blockchain to proof-of stake.

The post 15% of the Ethereum supply is about to be released: Ethereum Shanghai upgrade imminent appeared first on CoinJournal.

Cross-chain NFT platform Magic Eden has added to the impetus around NFT Ordinals on Bitcoin by launching a fully audited Bitcoin NFT marketplace. The digital artifacts marketplace will feature everything from images and audio clips.

Magic Eden’s move means traders within the ecosystem are set to benefit from being able to buy and sell Bitcoin-based inscriptions tied to satoshi – the smallest unit of measuring value for BTC.

In a press release published on Tuesday, Magic Eden noted the infrastructure supporting Bitcoin inscriptions is growing, even as the network counts over 400,000 such digital artifacts so far.

At the moment, the Bitcoin NFT marketplace has integrated two non-custodial wallets – Hiro and Xverse – with support for features such as listing, delisting and buying and selling. The marketplace already offers access to more than 70 collections.

3/ Why Bitcoin? Ordinal digital artifacts exist on-chain, never off-chain, and are totally immutable, meaning they cannot be altered in any way.

Add the security aspect of BTC & the decentralization of its nodes, and you get the ultimate home for true digital collectibles.

— Magic Eden 🪄 (@MagicEden) March 21, 2023

Commenting on the development, Magic Eden co-founder and CEO Jack Lu, noted:

“Adding a Bitcoin marketplace is really exciting for our team, considering it is the grandfather of all blockchains and we are all passionate about blockchain. Bitcoin Ordinals bring a whole new dimension into the universe of NFTs.”

Part of the early efforts aimed at accelerating adoption include Magic Eden’s partnership with 13 top collections, including Inscribed Pepes, Taproot Wizards and Bitcoin Bandits. Digital artfacts on the platform will be subject to top quality filtering, with collectors having access to details such as Ordinal rarity, name, inscription number, age and so forth.

“On Bitcoin, all media that is uploaded onto the chain cannot be changed or removed,” Lu said in a statement. “This simplicity is embraced by many creators who want to create true collectibles that are inscribed onto the chain. We’re excited to bring our winning marketplace user experience we’ve developed over the last year and a half to Bitcoin.”

Magic Eden’s release of a Bitcoin NFFT marketplace builds on the company’s solid foundation as a top provider of blockchain and Web3 solutions. While it remains the leading NFT marketplace for Solana, this latest move adds to recent expansions to Ethereum and Polygon.

The post Magic Eden launches Bitcoin NFT marketplace appeared first on CoinJournal.

The Federal Open Market Committee will conclude its two-day meeting on Wednesday.

This decision will likely have implications for Litecoin and other crypto prices.

Economists expect a more balanced Fed as it battles inflation and financial stability.

Litecoin price moved sideways on Wednesday as investors waited for the upcoming interest rate decision by the Federal Reserve. LTC was trading at $80, where it has been in the past few days. Other cryptocurrencies are also wavering, with Bitcoin trading at $28,255 and Ethereum stuck at $1,800. XRP and ADA are two of the best-performing big-cap coins.

The main catalyst for Litecoin price will be the upcoming interest rate decision by the Fed. Economists polled by Reuters expect the Fed will maintain a relatively balanced tone as it combats some of the top challenges in the economy.

The biggest challenge the Fed is facing is the stability of the financial system following the collapse of several banks, including Credit Suisse and Silicon Valley Bank. And now, several researchers believe that about 190 banks could fail because of their large unrealized losses.

A lack of confidence in the financial market could lead to chaos as people rush to get their money out. That would put the American economy at risk.

The other big risk is that America’s inflation seems to be sticky. Data published last week showed that America’s consumer price index (CPI) remained at 6% in February, much higher than the Fed’s target of 2%. As such, the bank will need to show its commitment for fighting inflation in the country. As such, the most balanced way will be for the bank to hike by 25 basis points. In a note, analysts at ING wrote:

“It’s a close call, but we expect a 25bp hike by the Fed today. Ultimately, Powell’s primary goal is to restore investor confidence and a hold might signal a lack of trust in the financial system. The dot plots may also be revised slightly higher, and the dollar could recover a bit.”

A hawkish tone by the Fed could dent the recent rally in cryptocurrencies. Most coins have jumped by double digits in the past few days as investors price in a more dovish tone by the bank.

The four-hour chart shows that the LTC price has moved sideways in the past few days. In this period, it has formed a symmetrical triangle pattern that is shown in red. The coin has moved slightly below the 50-period exponential moving average (EMA).

Litecoin is also below the important resistance level at $88.36, the lowest point on February 13. The MACD has moved slightly below the neutral point. Therefore, there is a possibility that Litecoin’s price will have a bearish breakdown after the Fed decision. If this happens, the next reference level to watch will be at $70.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Bitstamp is a leading cryptocurrency exchange which offers trading in fiat currencies or popular cryptocurrencies. Bitstamp is a fully regulated company which offers users an intuitive interface, a high degree of security for your digital assets, excellent customer support and multiple withdrawal methods.

The post Litecoin price prediction: LTC outlook ahead of Fed decision appeared first on CoinJournal.