Weniger als zwei Jahre nach dem Start des Staking-Dienstes durchbricht dieser eine wichtige Schallmauer trotz schwächelndem Ethereum-Kurs.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Weniger als zwei Jahre nach dem Start des Staking-Dienstes durchbricht dieser eine wichtige Schallmauer trotz schwächelndem Ethereum-Kurs.

Cryptocurrency prices had a mixed week amid elevated risks. Bitcoin price plunged to a low of $21,820, the lowest level since January 20. AI coins like SingularityDAO, Fetch.ai, and Ocean Protocol soared and then plunged. This decline was also in line with that of American stocks, including the Dow Jones and Nasdaq 100 indices. Here are the top crypto price predictions for some of the top coins like Hedera Hashgraph, Vibrate (VIB), and Oasis Network (ROSE).

Hedera Hashgraph price has been in a strong bullish trend in the past few days. HBAR price has formed an ascending channel shown in blue. The coin is slightly below the upper side of this rising channel. It is approaching the lower side of the Andrews Pitchfork tool. Also, the coin has moved above the 23.6% Fibonacci Retracement level.

HBAR price has moved above the 25-period and 50-period exponential moving averages. At the same time, the Relative Strength Index (RSI) and the MACD have continued rising. Therefore, Hedera has room for more upside as buyers target the upper side of the channel at $0.0803, which is a few points above the current level.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Bitstamp is a leading cryptocurrency exchange which offers trading in fiat currencies or popular cryptocurrencies. Bitstamp is a fully regulated company which offers users an intuitive interface, a high degree of security for your digital assets, excellent customer support and multiple withdrawal methods.

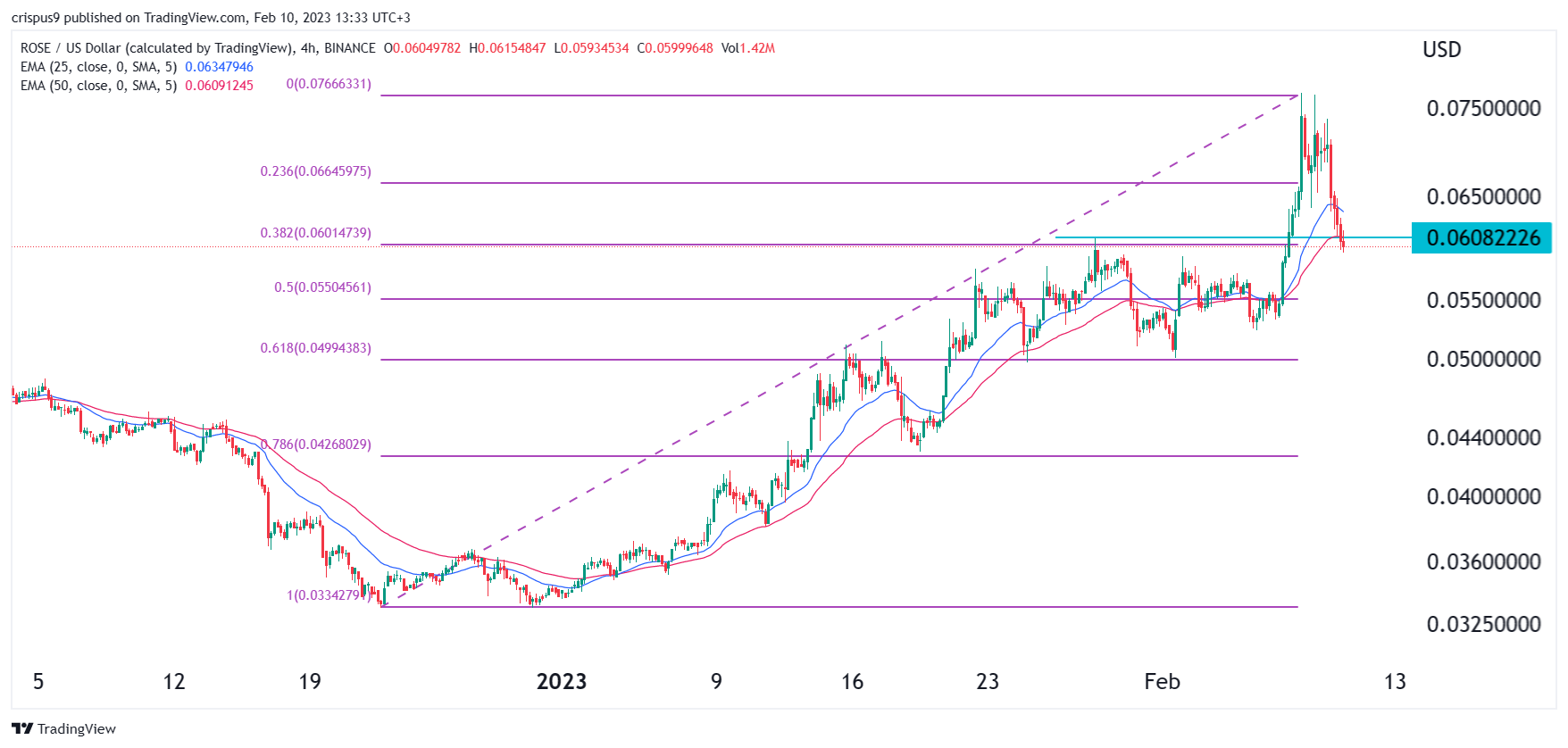

Oasis Network is a leading smart contract platform that makes it possible for developers to create dApps. Some of the top dApps built in the network are Geniish, Covalent, and MetaMirror among others. ROSE price had a strong comeback this week, pushing it to a multi-month high of $0.076. On the 4H chart, Oasis Network price has moved below the 23.6% and 38.6% Fibonacci Retracement level.

ROSE has moved below the 25-period and 50-period moving averages. It has moved below the key support level at $0.060, the highest point on January 28. Therefore, the outlook for the coin is bearish, with the next key level to watch being at $0.055, which is ~10% below the current level.

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600. Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

Kucoin is a cryptocurrency exchange which offers over 200 cryptocurrencies. Kucoin has a wide range of services, such as; a built-in peer-to-peer exchange, spot and margin trading, bank level security and a wide range of accepted payment methods. Users can benefit from a beginner-friendly interface and relatively low fees.

Viberate, the music-focused blockchain project, has done well in the past few days. VIB crypto price soared to a high of $0.148, which is about 130% above the lowest point in December. The coin rose above the key resistance point at $0.1127, the highest point on January 23rd. It has jumped above all moving averages.

The Relative Strength Index (RSI) has moved above the overbought level. Therefore, the coin will likely resume the downward trend and retest the key support level at $0.10. A move above the key resistance point at $0.13 will invalidate the bearish view.

The post Crypto price predictions: Hedera (HBAR), Oasis (ROSE), Viberate appeared first on CoinJournal.

Whatever you think of Bitcoin as an asset, the public ledger that is the blockchain makes it a lot of fun to get a bit nerdy and look into the analytics behind the asset. Love it or hate it, we have a wealth of information via on-chain analytics that we simply don’t have for most other assets.

Today, let’s do a quick little piece assessing Bitcoin’s unrealised profit. In simple terms, what would the profit or loss be if all Bitcoins were sold right now? Obviously, this would tank the market, and everybody’s net worth would go poof. But hey, don’t ruin the party. It’s still a reasonably indicative metric.

After all, if Bitcoin is ever to perform as a store-of-value, it has to satisfy the definition of that term – that is, protect one’s wealth.

First step is simple. Let’s look at how much of the Bitcoin supply is profit and supply. The below chart plots this, as the total supply of Bitcoin climbs mechanically via its pre-determined schedule towards its final supply cap of 21 million coins.

The merciless effects of the bear market are clear to see. That’s a whole lot of red appearing on the right side of the chart, with over 10 million bitcoins in loss in November 2022. Thanks, Sam.

The little renaissance that 2023 is has kicked that number back down, with 6.6 million bitcoins currently at a loss.

The next chart shows this in a different way – tracking the percentage of the total supply in profit.

We can see that with two-thirds of the total supply in profit, it is likely that Bitcoin’s total unrealised profit is a positive number, i..e if everybody sold at the current price, the difference between that current price and the price at which the bitcoins were purchased would be positive.

And it is. A profit of 0.114 BTC, or about $2,500 at current prices.

The profit number flipped positive on January 13th of this year, having been negative for most of the second half of 2022, as Bitcoin found out the hard way how much tougher things are when the money printer is turned down and interest rates are no longer zero.

So, what does this all mean? Well, nothing. Sort of.

On-chain metrics are fun to play around with, and certainly some can be nice indicators. But the above charts are just a fancy way of looking at price, really. Price go up, profit go up. Price go down, profit go down.

Not to mention, the market right now is clearly following macro news, essentially a leveraged bet that the words of Fed chairman Jerome Powell will be kind.

I did have a play around with layering the price over various charts, trying to ascertain whether there was an impact. But, nah.

Nevertheless, despite the lack of predictive power here, it is an interesting way to view the dynamics of Bitcoin and gauge the overall sentiment of the market.

The uptick in profit metrics is clear since the start of the year, even if prices are still a magnitude below bull market levels. Whether the market continues to bet on the Federal Reserve loosening rates, or if inflation and employment numbers give it a reason to hesitate and pull back, remains to be seen.

It’s a macro world, and Bitcoin is just living in it. Stay tuned for more on-chain pieces, and we will try nail down into this relationship a bit more.

The post If all Bitcoin was sold today, the profit would be $2,500: An on-chain analysis appeared first on CoinJournal.

Im Zentrum der Ermittlungen stehen Investitionsangebote an amerikanische Kunden, die vermeintliche Verstöße gegen das US-Wertpapierrecht darstellen sollen.

Kraken – the U.S. based crypto exchange was in focus today on reports that it’s bringing down the curtain on its crypto-staking operations.

Kraken was facing an investigation from the U.S. Securities and Exchange Commission over selling unregistered securities.

The Kraken staking programme is offered and sold as a security. Staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.

On Thursday, the crypto exchange agreed to end the said operations to settle those charges. Kraken will pay $30 million in penalties as well even though it refrained from admitting to or denying the allegations.

The development marks the first regulatory crackdown on staking; a service that’s been quite popular with the crypto exchanges.

Kraken offered a whopping 20% annual percentage yield on staking with payments sent to clients twice per week. On Twitter, Gary Gensler – Chair of the U.S. SEC said in a video message today:

When a company or platform offers you these kinds of returns, whether they call their services lending, earn, rewards, APY or staking – that relationship should come with protections of the federal securities laws.

The crypto exchange did confirm, however, that its staking services will remain available to clients outside of the Unites States through a different subsidiary.

Today’s settlement also casts doubt upon Coinbase Global Inc that offers staking services in the United States as well. Its shares closed the regular session down nearly 15% on Thursday.

The post Kraken to end its crypto-staking services in the U.S. – here’s why appeared first on CoinJournal.