Cyber-Kriminelle haben verschiedene Methoden verwendet und so im Jahr 2022 mehrere Milliarden in Krypto stehlen können.

Finanzmittel Info + Krypto + Geld + Gold

Krypto minen, NFT minten, Gold schürfen und Geld drucken

Cyber-Kriminelle haben verschiedene Methoden verwendet und so im Jahr 2022 mehrere Milliarden in Krypto stehlen können.

FTM price rose modestly ahead of the upcoming US inflation data.

It has also done well as traders wait for the upcoming fUSD stablecoin launch.

Fantom (FTM) price made a small comeback on Tuesday as investors waited for the upcoming American consumer inflation data. It rose to a high of $0.4780, which was a few points above this week’s low $0.4138. This price is about 30% below its highest point in 2023.

The main catalyst for FTM will be the upcoming American consumer inflation numbers scheduled for Tuesday. Economists expect the data to show that the country’s inflation inched downwards in January as goods prices retreated.

According to Reuters, the median estimate among economists is that the headline consumer price index (CPI) declined from 6.5% in December to 6.2% in January. This will be the seventh straight months that inflation has moved downwards.

Core inflation, which is an important number that excludes the volatile food and energy prices, is expected to have dropped from 5.7% in December to 5.6%. These inflation numbers will have an important role for Fantom and other cryptocurrency prices like Bitcoin and Ethereum.

They will also have an important role for other financial assets like stocks and commodities. Their impact is that they will have an impact on the Federal Reserve. Higher-than-expected inflation numbers, coming a week after the US published strong jobs numbers, will mean that the Fed will be more combative.

On the other hand, if inflation softens, there is a likelihood that the Fed will be a bit dovish in its bid to prevent a hard landing. Besides, the yield curve has inverted to the lowest point since the 1980s, signaling that a recession could be coming.

Meanwhile, Fantom price is reacting to news that the developers are working to rebuild the network after the challenges we wrote about here. One of the projects the developers are working on is a stablecoin known as fUSD that will power its ecosystem. The news was recently confirmed by Andre Cronje, an influential figure in the ecosystem.

On the 4H chart, we see that the FTM price has crawled back in the past few days. It has moved from a low of $0.4172 to a high of $0.4827. Still, the coin remains below the 50-period moving average. It has also moved slightly below the 38.2% Fibonacci Retracement level.

A closer look shows that it is forming a bearish flag pattern. Therefore, the coin will likely have a bearish breakout, with the next key level to watch being at $0.40. A move above the resistance point at $0.50 will invalidate the bearish view.

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in. It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest. eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600. Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

The post Fantom (FTM) price rebounds ahead of US inflation data appeared first on CoinJournal.

The US CPI data is the main economic event of the trading week. Inflation has been the main driver of monetary policy for more than a year now; thus, every market participant is on standby until the data comes out.

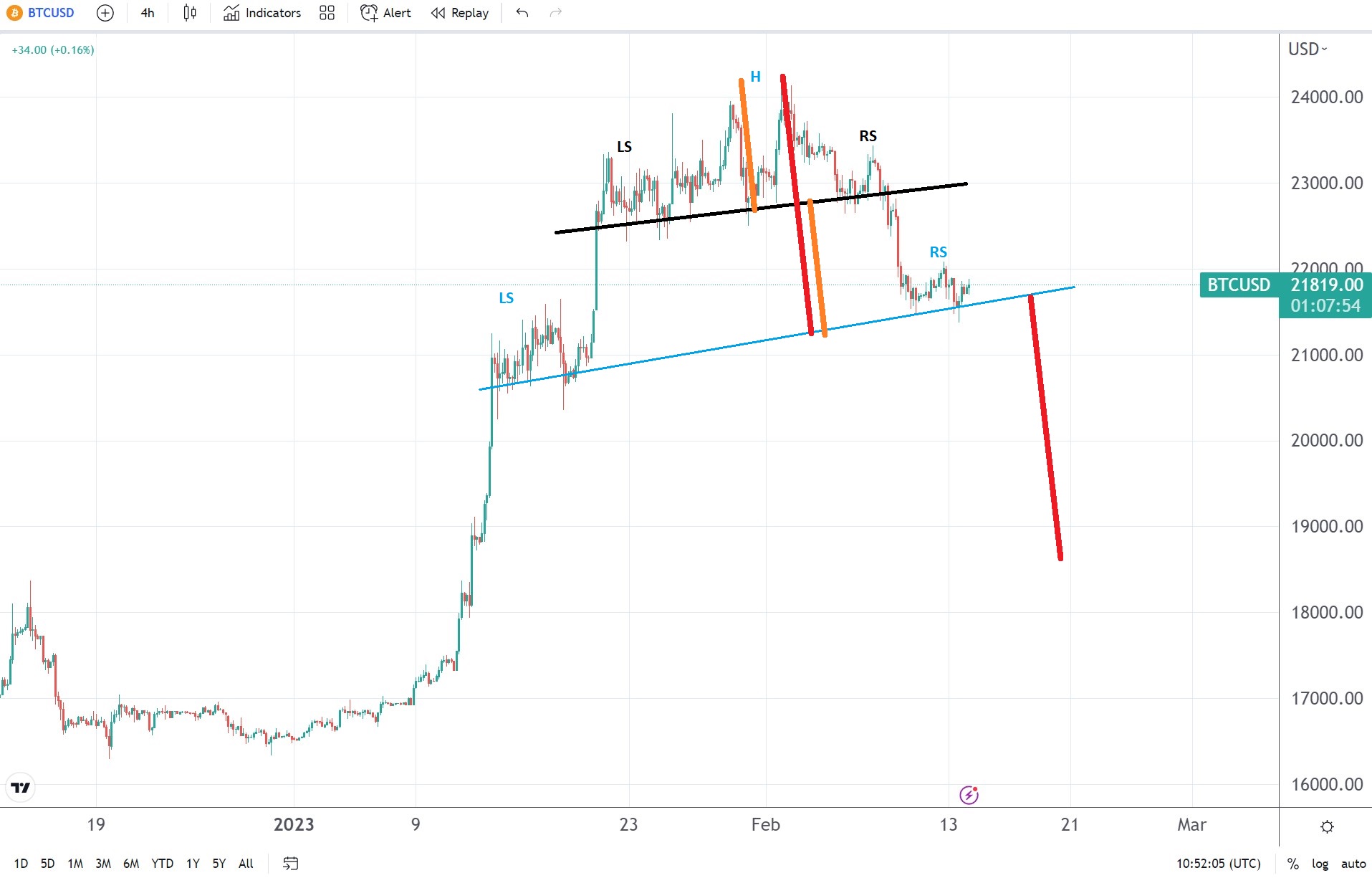

Crypto traders enjoyed a nice rebound of the entire market at the start of 2023. Bitcoin, for example, rallied close to $24k, where it met resistance.

Bitcoin’s adoption by many institutional investors made it sensible to US economic data. In other words, the US dollar’s volatility moves Bitcoin too. Therefore, today’s inflation data is a key driver not only for the fiat currencies but also for the cryptocurrency market because of Bitcoin’s influence on the overall crypto market.

Crypto enthusiasts cheered the strong start to the trading year as Bitcoin rallied aggressively. But in doing so, Bitcoin only followed the overall US dollar’s weakness seen across the FX dashboard.

If the US CPI report for January shows renewed inflationary pressures, the US dollar should surge across the dashboard.

On such a release, the market should buy the dollar in anticipation of further tightening from the Fed. Hence, the dollar should pressure Bitcoin.

From a technical perspective, there is one head and shoulders pattern that should keep bulls at bay. The market currently consolidates above the neckline, and if the dollar gets stronger after the CPI report, then the pattern’s measured move points to a drop below $19k.

The market should not climb above the highest point in the previous head and shoulders pattern for the pattern to work. More precisely, it should remain below $23,500 for the bearish pattern to remain valid.

The post Bitcoin awaits US CPI data; head and shoulders paints a bearish picture appeared first on CoinJournal.

Magic Eden has announced a strategic partnership with MoonPay.

The two entities will work together to offer new payment options for purchasing digital collectibles.

MoonPay raised $555 million in November 2021.

Web3 payment platform MoonPay has partnered with Magic Eden, one of the leading non-fungible token (NFT) marketplaces in the world. The partnership will see MoonPay offer new payment options for purchasing digital collectibles on Magic Eden.

Thanks to this latest cryptocurrency news, Magic Eden users can now buy NFTs across various blockchains using a credit or debit card, Apple Pay and Google Pay. The partnership is designed to make it easier to onboard new users into the web3 ecosystem.

While commenting on this latest development, Magic Eden chief operating officer Zhuoxun Yin said;

“Our goal is to make NFTs accessible to everyone, enabling individuals to own and control their digital assets.”

The partnership with Magic Eden comes after MoonPay partnered with the NFT marketplace LooksRare. The partnership will see MooPay allow LooksRare users to buy and sell cryptocurrencies using various payment options. Users of the platform can also purchase NFTs via credit card.

In October 2022, Uplift DAO, the cross-chain crypto launchpad offering crowdfunded support for disruptive web3 projects, partnered with MoonPay. This collaboration is designed to make it easier for users to invest in new and exciting web3 initiatives using traditional payment methods.

MoonPay has been onboarding web3 projects to its platform over the past two years. In November 2021, the company raised $555 million. The investment allowed it to continue building strategic partnerships within the web3 ecosystem.

In December, the web3 payment processing platform secured registration with the U.K.’s Financial Conduct Authority (FCA). by acquiring a licence with the FCA, MoonPay has ensured that it complies with local money laundering regulations in the United Kingdom.

The post NFT marketplace Magic Eden and MoonPay partner on credit card payments appeared first on CoinJournal.

Crypto exchange Binance has seen increased withdrawals over the past 24 hours as investors act on the recent allegation by the US SEC that Binance USD (BUSD) stablecoin is a security. Data obtained from the blockchain intelligence platform Nansen indicate that net outflows from the exchange had hit $788 million in the past 24 hours.

This is the largest net outflow from Binance since December 17 when the exchange’s proof of reserves audit was pulled down from the website of Mazars auditor.

Binance has however come out to array fears saying that funds are safe and that it can handle any amount of withdrawals. The exchange said:

“We run a very simple business model — hold assets in custody and generate revenue from transaction fees.”

It all started with the US SEC issuing a wells notice to Paxos Trust Company stating that it was violating investor protection laws by issuing an unregistered security, the BUSD. Following the SEC’s action, the New York Department of Financial Services (NYDFS) ordered Paxos to halt the issuance of BUSD and Paxos immediately obeyed the orders.

As investors rush to withdraw their funds from Binance, the BUSD token redemptions have also surged. Data from Peckshield shows that over 342 million BUSD tokens have been burned in the past 24 hours.

Investors seem to be cashing out of the BUSD stablecoin as fears of the SEC escalating the issue and filing a lawsuit as is the case with Ripple’s XRP token gain traction.

The post Binance withdrawals surge post SEC’s Paxos clampdown appeared first on CoinJournal.